Why accurate, timely, and independent analysis is key to meeting front office demands

How the front office can drive performance with automated data and efficient systems.

More Data and More Frequently Than Ever… Why Form N-PORT Oversight is a Must

More Data and More Frequently Than Ever… Why Form N-PORT Oversight is a Must

Global Risk Outlook: Measuring the impact when market volatility returns

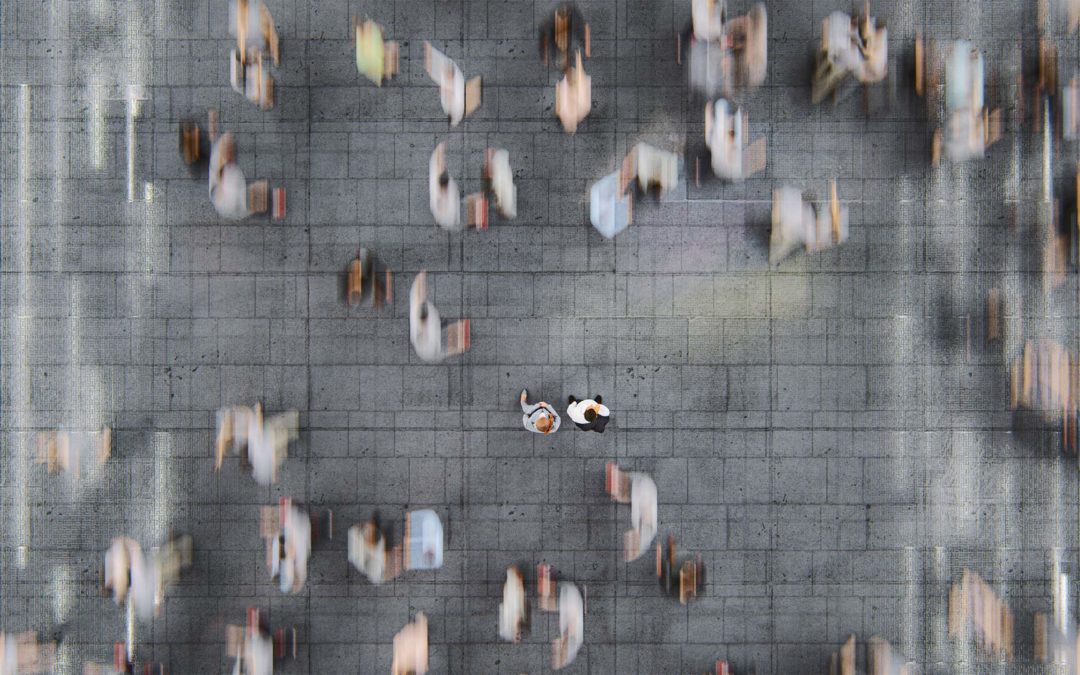

With the role of asset managers becoming increasingly important to the global financial services industry, it is important to look at the currently market tre…

StatPro Workflow Issue Six: Q4 2017 (Global_WorkflowMag_2018)

Review the latest insights into the challenges facing the middle office in boutique and large asset management firms today.

Buy-Side Risk Trends Heading into 2018 (Global Hosted Risk Events 2018)

Asset managers are playing an increasingly important role in global financial services; with AUM closing in on that of global banking balance sheets, they ar…

Best of 2017 — The Year of Change

Whether it’s shaking up old habits, adopting new technology or moving offices, this year, the mantra seemed to have been out with the old, in with the new.

StatPro Workflow Issue Six: Q4 2017

Review the latest insights into the challenges facing the middle office in boutique and large asset management firms today.

Fiat news and the connection between political risk and market risk

Among the key note speakers at the Risk Hedge USA 2017 conference in New York City this fall was Dr. Ben Hunt, Chief Risk Officer of Salient Partners. In his speech, Dr. Hunt discussed the relationship between political volatility and market volatility (Hunt 2017).

Dr. Hunt argued that the connection between political risk and market risk is broken because of the “fiat news” phenomenon. “Fiat news” is named in reference to “fiat money,” which derives its value from the faith and credit of an economy – and not the value of some physical commodity. Then “fiat news” is an artful term implying that the value of information is derived from the credence we grant to it, or the strength of marketing, and not by the value of truth (statements of fact). News agencies, or in general those parties communicating news of political events, are therefore managing market expectations rather than imparting factual information as such.

Artificial Intelligence in the Fund Industry:

Artificial Intelligence in the Fund Industry:

SEC puts Liquidity Estimation Back in Focus

As part of the SEC investment company reporting modernization rules published in October 2016, all open-ended US mutual funds and ETFs will be required to im…

Buy-Side Risk Trends Heading into 2018

Asset managers are playing an increasingly important role in global financial services; with AUM closing in on that of global banking balance sheets, they ar…

Getting 30e-3 Wrong Again

Is Rule 30e-3 back? Could we, in the mutual fund industry, actually be poised to move to a (mostly) paperless distribution of shareholder reports?