Attribution

Performance & Analytics

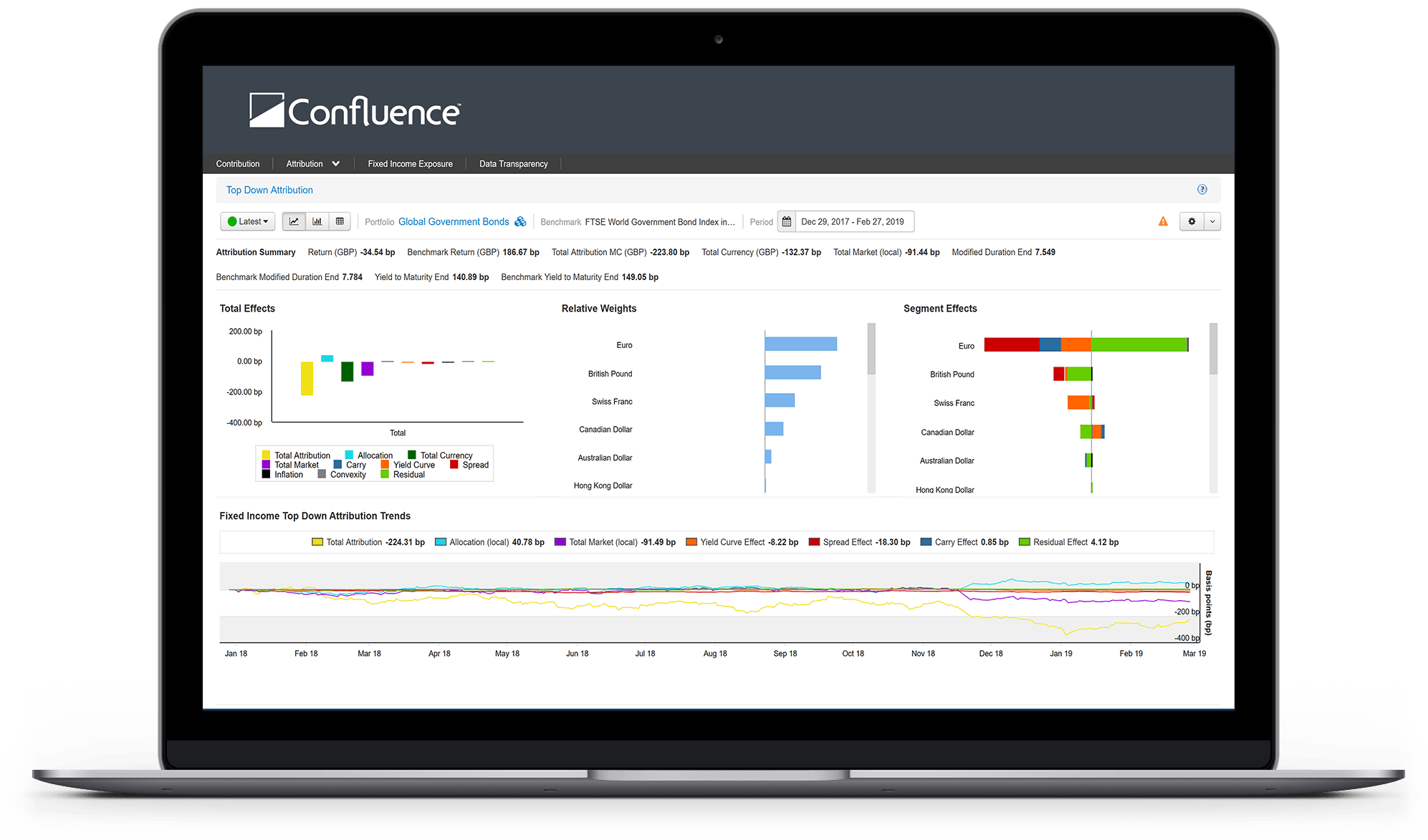

Enhanced workflow for assessing the impact of investment decisions across multi-asset classes and investment strategies.

Make informed decisions and close the feedback loop

Easily quantify the relationship between a portfolio’s excess return and the active decisions of the portfolio manager. Understand the sources of performance through advanced hybrid attribution models, in absolute or relative terms and enhance your performance workflow by quantifying the impact of investment decisions across multi-asset classes and investment strategies.

Comprehensive multi-asset analysis

Flexible and in-depth analysis

Easily identify the key sources of returns using a hybrid approach designed to pinpoint all the underlying drivers and factors of your performance attribution, in line with your investment strategies.

Streamline and increase the transparency of your performance reports with a dedicated workflow functionality to validate, sign off and report the trend returns.

Slice and dice your sources of returns at any level, with full drill down and access to the underlying analytics helping you make informed decisions that will ultimately improve your investment strategy by articulating PnL factor decomposition and/or attribution effects.

ESG Attribution of products and mandates

ESG Analytics

Better understand and interpret your ESG exposures and help answer the question of traditional allocation vs selection breakdown to determine if your ESG strategies outperform broad indices. Slice and dice the performance attribution of your investments versus ESG ratings and risk signals.

Decompose your ESG scores and split out your active ESG bets into ESG allocation and ESG selection effects, meaning greater oversight over your ESG security selection empowering you to make more informed ESG allocation decisions.

Produce advanced fixed income performance reports by calibrating the performance analysis and defining the underlying drivers to match the portfolio strategies.

Flexible, scalable and transparent fixed income attribution

Rely on a robust data set and best-of-breed fixed income analytical libraries to run precise performance decomposition, in addition to fully integrated index vendors risk numbers (subject to entitlement) and the possibility to define custom hierarchies in the risk numbers application. This will mean you will be able to provide accurate and fully transparent fixed income results with additional possibility to customize the assignment of each effect.

Leverage the flexible framework to understand the sources of performance through the lenses of proprietary factors and hybrid attribution models: choose how to decompose the curve positioning, decide which factors to separate out from selection/allocation effects or granularly explain the drivers of spread changes.

Attribution

Find out more

Attribution

Find Out More

Contact

Confluence

Request

a Demo

Download

Factsheet

Complete the form to get started

Request a

Demo

Complete the form to get started

For enquiries

Contact Confluence

Complete the form to get started

What We Do

Data-Driven Solutions

We are a global leader in data-driven investment management solutions, partnering with our clients to deliver products and services designed to optimize efficiency and control.