ESG Solutions

Automate the management and analysis of your ESG data

ESG data and reporting enables institutional investors and asset managers to manage environmental, social and governance (ESG) standards and restrictions reliably and efficiently, to comply with client investment guidelines, to implement client mandates, and to monitor ESG portfolio risks.

Best-of-breed data from multiple sources

Accessing multiple datasets from different sources globally, allows for better monitoring and improves operational efficiencies

Monitor investment process

With our vast and comprehensive dataset, we allow the management of ESG data throughout the investment process and improve the monitoring of sustainable policies

Automation of regulatory reporting

PAI Monitoring, TCFD assessment, SFDR disclosures, European ESG Template, etc

Import

ESG Risk Monitoring

ESG Portfolio Assessment

Regulatory Reporting Service

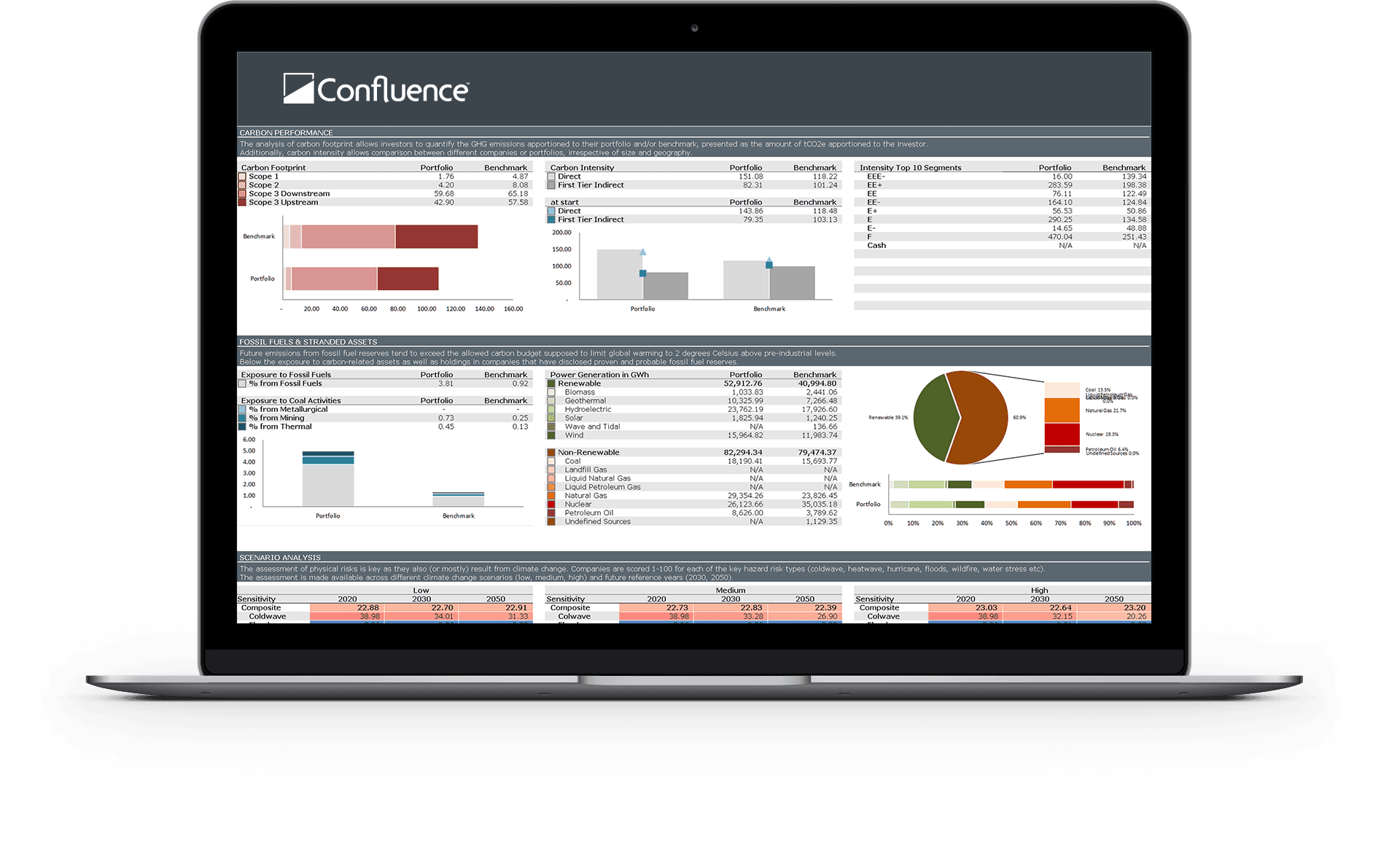

- Rating and scores across portfolio and benchmarks, also in relative terms

- Single Issuer rating and scoring at security level

- Controversial activities monitoring

- Carbon and Climate Risk Monitoring

- Exclusion lists Monitoring

- TCFD Monitoring

- Paris Agreement alignment Monitoring

- Principle Adverse Indicators (PAI) Monitoring

- SFDR 2 Disclosures

- Taxonomy Outputs (including the Luxembourg “Tax d’Abonnement”

- European ESG Template

Import

ESG Risk Monitoring

- Rating and scores across portfolio and benchmarks, also in relative terms

- Single Issuer rating and scoring at security level

- Controversial activities monitoring

- Carbon and Climate Risk Monitoring

Regulatory Reporting Service

- Principle Adverse Indicators (PAI) Monitoring

- SFDR 2 Disclosures

- Taxonomy Outputs (including the Luxembourg “Tax d’Abonnement”

- European ESG Template

ESG Portfolio Assessment

- Exclusion lists Monitoring

- TCFD Monitoring

- Paris Agreement alignment Monitoring

Features

Multi-source platform covering all asset classes

(equities, fixed income – both govt and corp –, funds, etfs, derivatives…)

- ECPI – proprietary research model, more than 6,600 mother companies (90-95% global market caps)

- S&P Global Trucost – leader in carbon and environmental data and risk analysis

- Morningstar Sustainalytics – largest independent provider of ESG research and ratings

ESG screening spanning across all analytics

(including and not limited to allocation, performance, risk, fixed income attribution) across portfolios and benchmarks, as well as in relative terms

- Rating and Scores across the E-S-G pillars and all sub-components

- Custom Controversial Activities Monitoring (adult content, alcohol, biotechnology and genetically modified organisms, coal, fossil fuels, fracking/shale gas producers, gambling, military, nuclear and biological weapons, tobacco, etc)

- Risks Monitoring (environment, human rights, child/labour rights, etc) + monitoring severity according to UN GC

- Climate Change Monitoring across different physical risks, forecast and severity scenarios

- ESG indices both total and constituent level (we are registered benchmark administrator and are also regulated by FCA in UK)

Monitoring and reporting

- User and Workflow Management / Customizable dashboards and reporting capabilities

- Embedded Dashboards inclusive of heatmaps and specific decompositions

- Pre-canned Reporting (single portfolio, multi portfolios overview, issuer level and peer group analysis etc)

- Regulatory Reporting (PAI Monitoring, TCFD assessment, SFDR disclosures, European ESG Template, etc)

Request a

Demo

Download

ESG Factsheets

ESG Data & Reporting