Treasuries should benefit from highly probable September cuts

Prepared by:

Interest Rates Expected to Drop

In the past, there has been a strong association between changes in Federal Reserve rates and the yield on 10-year Treasury bonds, which is the opposite of bond prices. This is so because the economy determines the long end of the yield curve, while the Fed controls the short end. Consequently, as the Fed lowers rates in reaction to a disinflationary event, longer-term yields react to the reality of the economy. With the yield gap at negative 22 basis points (bps), the extensively followed two-year/10-year yield curve has been inverted for the longest period of time in history—two years. According to Tony Farren, managing director of rates sales and trading at Mischler Financial Group, “the market is starting to think the Fed is too late in cutting rates.”

The current 2.9 % inflation, which the government said is the smallest 12-month increase since March 2021, is for sure good news. However, the actual numbers might be much higher. Shelter, services, and electricity prices are up 5%, transportation is up 9%, and car insurance premiums are up 26% (2023-2024). Rent, housing, and grocery prices have been the biggest drivers of inflation in the past year. The consumer price index revealed a surprising decrease in inflation in June, which was primarily caused by lower gas, airline tickets, and used car and truck prices. Everything else is up, and everyone is paying more.

Is the Fed ignoring the actual inflation numbers?

Two more important datasets will be examined before the meeting on September 17-18th in Washington, D.C.: the PCE index (Personal Consumption Expenditure) on August 30th, and the second is the jobs report from the Bureau of Labor Statistics on September 6th. The jobs data will likely determine the percentage cut. The markets are pricing a September cut. Therefore, we assume the Fed will cut the rates in order to avoid a market crash. 10-year Treasuries are back below 4% as markets are pricing 95bps of Fed rate cuts across the remaining three meetings this year and 200bps of easing by next October. At Capital Economics, Paul Ashworth said recent rata “should support a quarter-point cut in interest rates” but, “at the same time, doesn’t suggest price pressures are collapsing in a way that could warrant a bigger 50 bsp reduction”.

There were concerns earlier this month that the economy might be slowing down faster than previously thought after last month’s jobs report.

Bond yields and mortgage-backed securities

Mortgage-backed securities are also a favorite of Janney Montgomery Scott’s top fixed-income strategist, Guy LeBas. While they might not be “a free lunch, they are at least a cheap snack,” he told Barron’s that their risks are similar to those of Treasuries and that bond investors could expect “more income and some price appreciation.” Bond yields would decline in response to lower interest rates, increasing the value of existing bonds acquired at a higher rate of return. For those interested, duration opportunities can be found in investment-grade credit, municipal, and government bonds.

Money Market funds

Mirroring the US, the Bank of Canada is expected to cut its rates at the next meeting. Inflation decelerated in June to 2.7 percent annually, with the drop attributed to a slowdown in gasoline prices.

Bond investors are speculating that the U.S. Treasury yield curve will become less inverted and eventually return to a normal positive slope. As the first Fed rate cut in September draws near, it could be appropriate to consider lowering equities risk and raising exposure to Treasury bonds. Those purchasing longer-term bonds, like 30-year bonds, should keep in mind that a lot can happen during that time, including changes in interest rates, inflation, economic growth, exchange rates, geopolitics, and even the president.

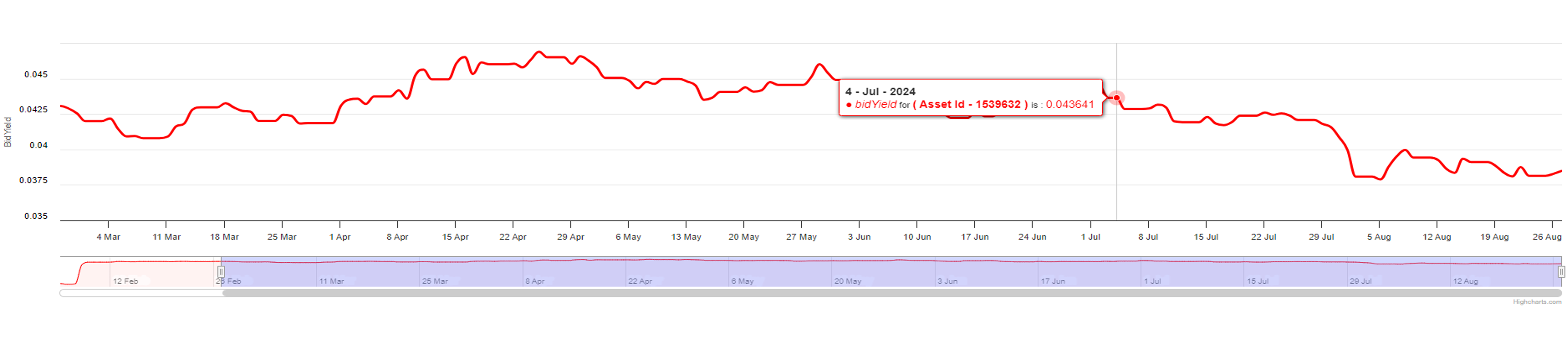

10-year US treasury rates

Source: Confluence Data Services: STL

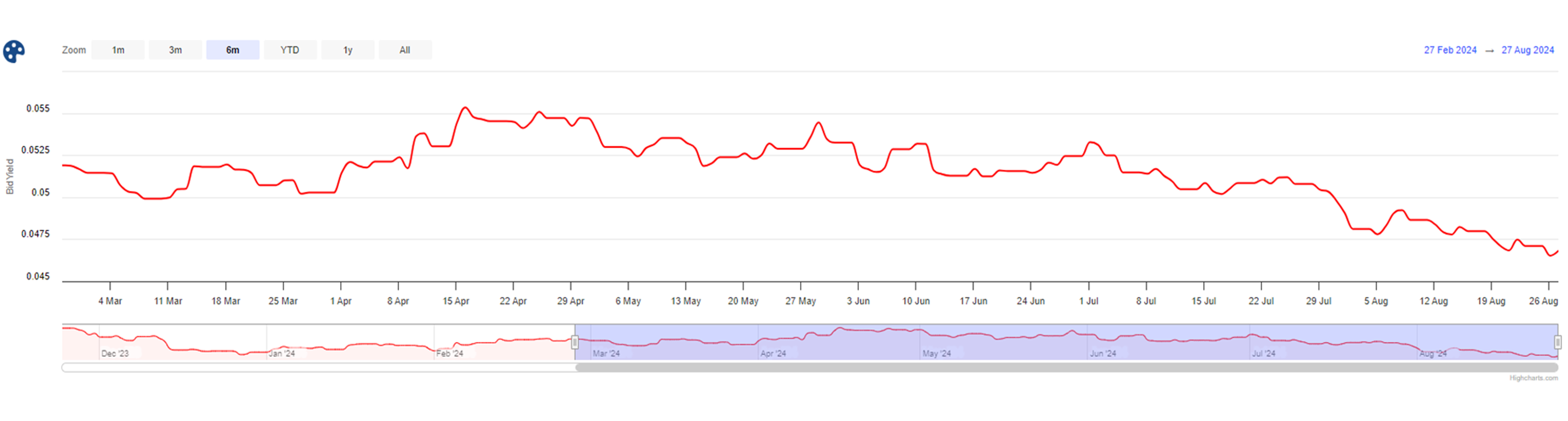

US Corporate bond 6-month bid yield

Source: Confluence Data Services: STL

Disclaimer

About Confluence

We resolve complex data challenges

As the investment management industry deals with ever-present data challenges along with increasing demands from clients and regulators to provide more detailed data and granular analysis, we help our clients transform their raw data into meaningful insights, providing solutions to complex data challenges.