January 2024

Value & Yield factors drive active managers to outperform in Emerging Markets Equity

by:

Emerging Markets Equity Performance

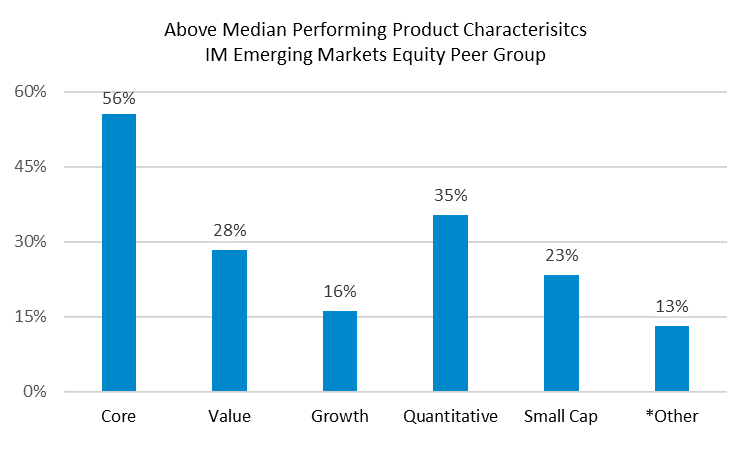

Figure 1 below is a percentage breakdown by characteristics of the 99 products with above median performance for the year. From a style perspective, core and value dominated growth, accounting for 84% of these products. Within growth, products either excluded China completely or were well underweight. Also of note is that quantitative products made up 35%, while small cap products accounted for 23%.

Other: Ex China, Frontier & Low Volatility.

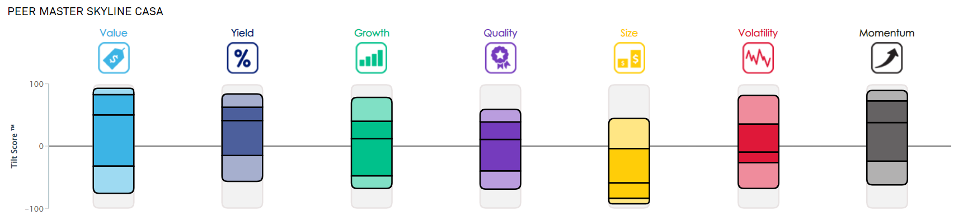

Comparing the factors that drove the markets to the factors that drop active manager performance, Momentum stands out, especially within the quantitative and small cap focused products.

Disclaimer

The information contained in this communication is for informational purposes only. Investment Metrics, a Confluence company, is not providing legal, financial, accounting, compliance or other similar services or advice through this communication. Recipients of this communication are responsible for understanding the regulatory and legal requirements applicable to their business.

About Confluence

For more information, visit confluence.com

In this article: