Disclosure use cases

SDR regulation overview

Best practice data sets for ESG disclosure use cases

UK TCFD Reporting

Best practices and lessons learned from the EU

To help UK firms prepare for the recently announced SDR and current TCFD annual/monthly requirements, we share recommendations gathered from working with firms across the EU and UK to streamline their ESG disclosure and reporting processes.

Discover the articles in this series:

Disclosure use cases

Best practice data sets

ESG data points and models

Managing changing vendor data and complex modelling requirements

Operations

Incorporating climate/ESG disclosures into your investment operations

In previous articles in this series, we shared lessons learned from working with firms in the EU to incorporate climate/ESG disclosures into their investment operations. We also looked at how firms can manage evolving vendor data, plus how to navigate complex modelling requirements, with a deep dive into TCFD reporting and an additional climate value at risk (VaR) example.

In this article we give an overview of the new UK SDR regulations and the timeline firms need to adhere to. We also recommend the best practice data sets for each regulatory disclosure use case and deep dive into a TCFD case study, leveraging our Confluence Revolution ESG solution.

In the news Final UK SDR regulations

Timeline for firms’ staggered obligations

SDR investment labels

SDR requirements summary

Best practice Multi-vendor data approach

During SFDR regulations rollout we noticed most firms use multiple, sometimes overlapping data vendors and many systematically override vendor data with their own assessments, as they don’t trust or agree with the data provided by the vendors.

We recommend working with a specialised ESG reporting technology and risk modelling vendor to remove the manual processes of finding the latest data sets to comply with regulation updates, and to simplify data modelling into a ready-to-use, compliant report. The templated report needs to cover the totality of the portfolio across multiple asset classes, from equities to fixed income, and from mutual funds to derivatives if needed.

Our end-to-end ESG monitoring and reporting tool, Confluence Revolution ESG solution, simplifies the identification, management and integration of climate and sustainability risks into a firm’s overall risk management and ESG disclosure processes.

Use case data sets

We recommend the following ESG data sets for ESG risk management and reporting, TCFS/CAD compliance, EET/PAI/SFDR/SDR compliance use cases:

| Use case | Disclosure frequency | ESG risk monitoring calculation frequency | Recommended ESG data set |

|---|---|---|---|

| ESG risk management and monitoring Includes ESG assessment and peer group analysis | Annual or according to internal compliance needs | Any frequency from daily | ECPI + S&P Trucost or M*Sustainalytics |

| TCFD/CAD compliant Confluence format | Monthly, quarterly, annual Through Confluence Revolution ESG solution TCFD Rev-I report | On demand report as of date | ECPI + S&P Trucost |

| EET/PAI/SFDR/SDR compliant Standardised regulatory format | Monthly, quarterly, annual Through Confluence Revolution ESG solution PAI/SFDR/SDR Rev-I reports or bulk exports | On demand report as of date | ECPI + S&P Trucost or M*Sustainalytics or MSCI |

Data standardisation across providers

Using dedicated data managers Confluence simplifies and streamlines data from each vendor we work with to ensure standardisation across markets and full coverage to help firms meet their ongoing regulatory needs through:

- Standardised integration

- Mapping, cleansing and transformation across asset classes

- Modelling new sets of analytics to meet the ever-evolving regulatory requirements and ongoing data updates provided by vendors

- Data extractions and reporting tools to define and generate reports and disclosure templates for internal and external audiences.

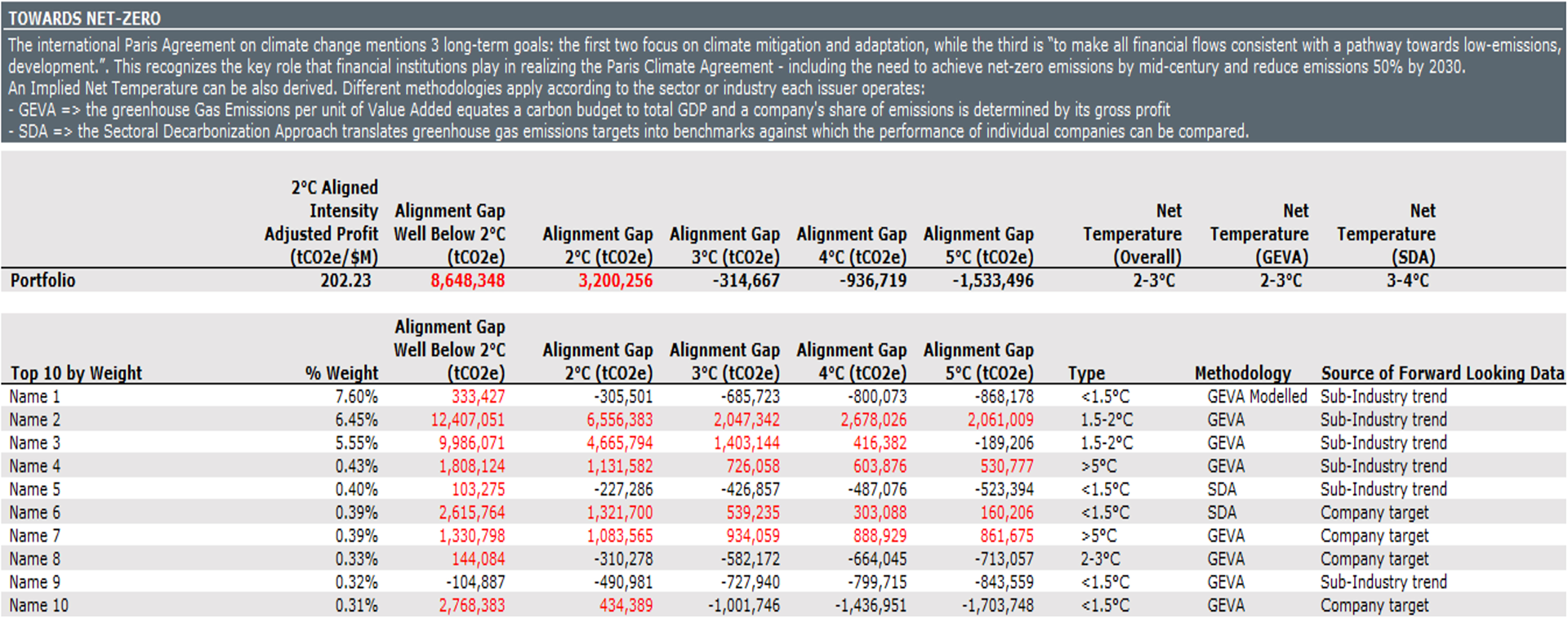

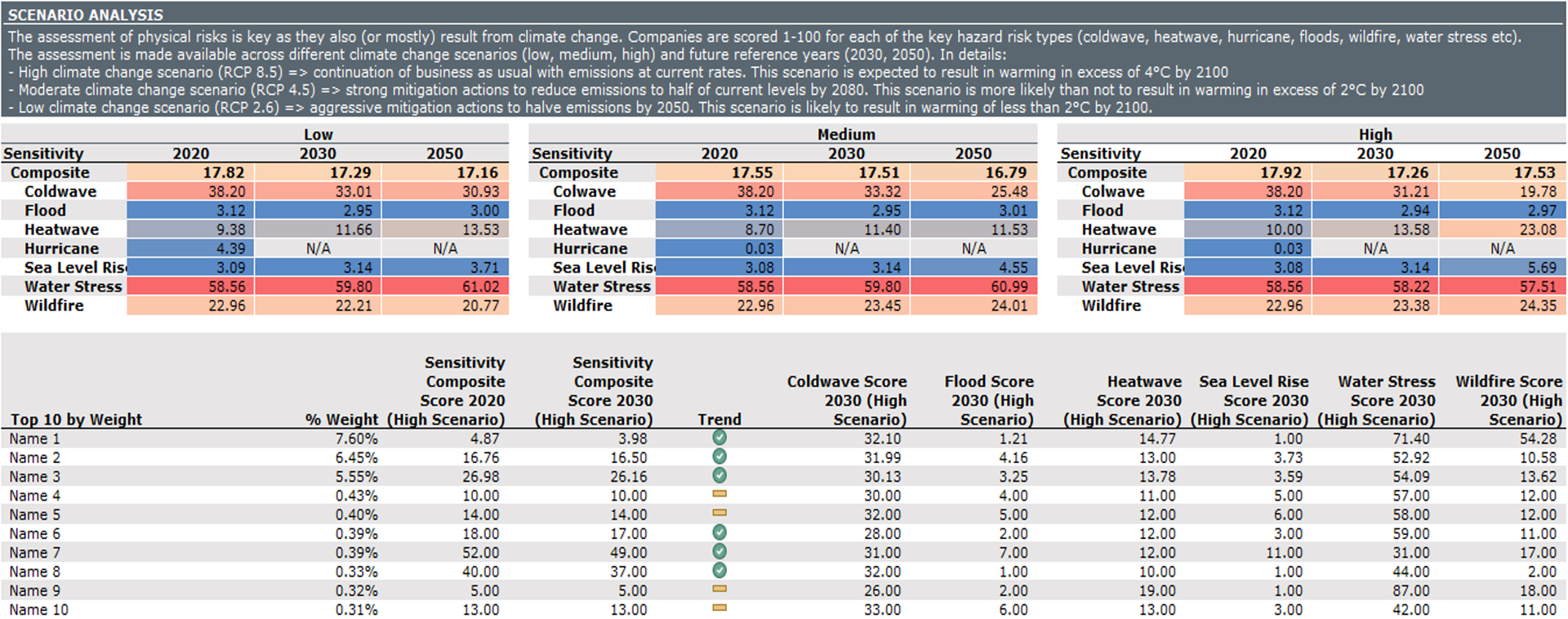

Use case example Using S&P Trucost for TCFD disclosures

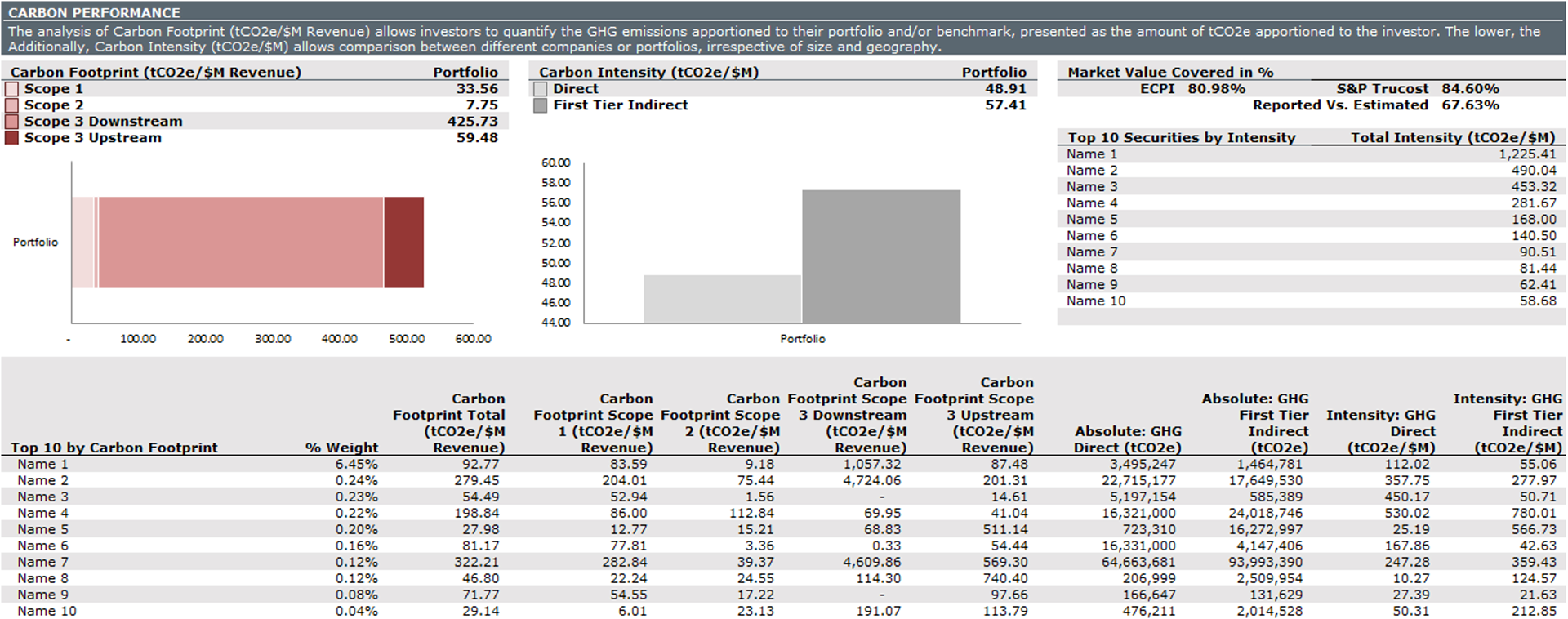

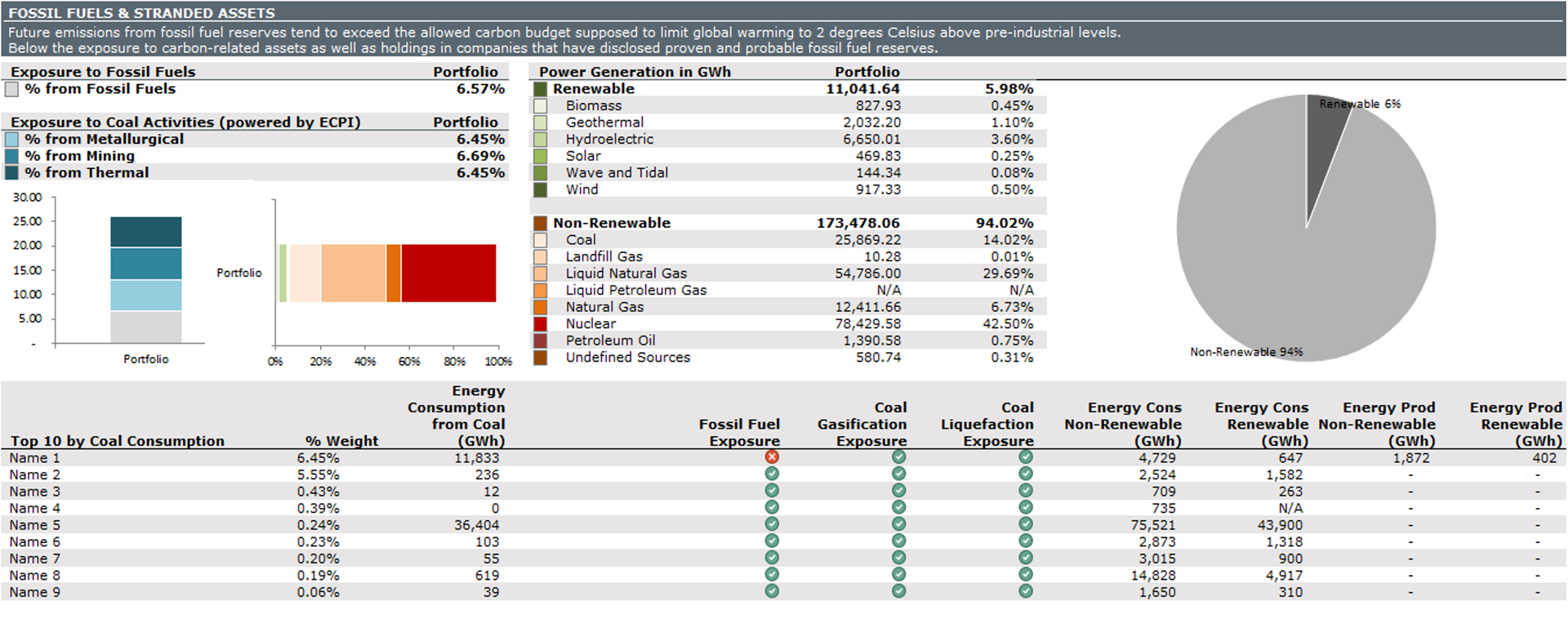

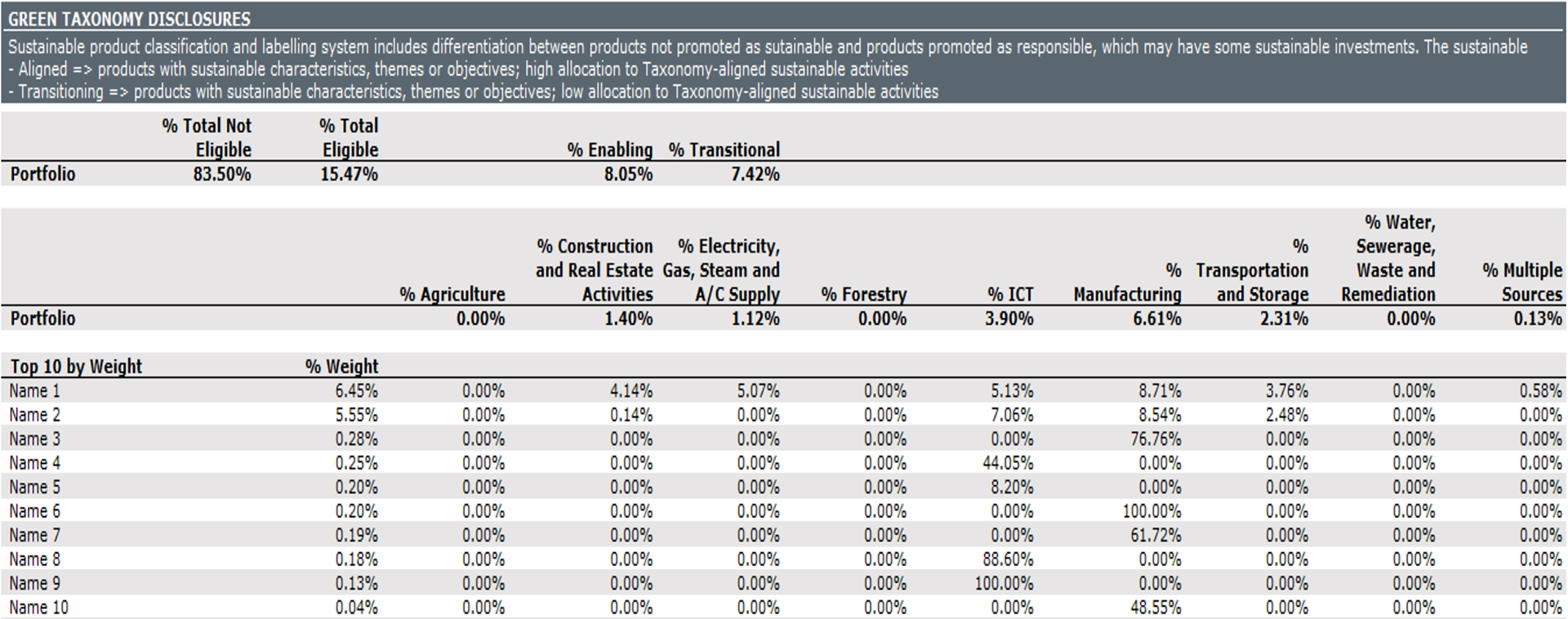

Confluence partners with S&P Trucost to map and maintain data to support all core metrics categories defined within the TCFD framework. Core TCFD metrics and categories are in-built for ESG risk assessment and reporting templates into the Confluence Revolution ESG solution. Using this end-to-end ESG monitoring and reporting tool, firms can access carbon performance, exposure to fossil fuels, power generation across renewable and non-renewable sources, green taxonomy disclosures, net-zero alignment according to various temperature pathways, scenario analysis based on physical risks monitoring across different severities, among other variables.

The screenshots below demonstrate the key categories:

Carbon performance, including Scope 1-3 Greenhouse Gas (GHG) emissions, carbon footprint and carbon intensity

Exposure to fossil fuels and breakdown of power generation across renewable and non-renewable sources

Green taxonomy disclosures

Net-zero alignment, according to various temperature pathways

Scenario analysis based on physical risks monitoring across different severities

Getting ready for SDR and TCFD

Working with a specialised ESG reporting technology and risk modelling vendor like Confluence, firms can simplify their ESG disclosure processes, leveraging integrated multi-vendor data sets and in-built complex modelling to meet their ever-evolving regulatory requirements.