Resources

Sign up for Resource updates

Blog

Beyond the hype: Why 2026 is the year of “boring” AI and radical practicality

For the last two years, the investment management industry has been stuck in a cycle of anticipation regarding artificial intelligence.

Regulatory fines and the rising burden of compliance: How investment managers can stay ahead

In today’s global investment landscape, compliance is no longer just a checkbox exercise — it’s a critical factor in protecting firms from financial and reputational risk.

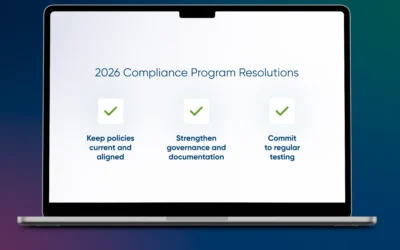

Translating SEC Exam Priorities into Action: How Compliance Leaders Will Refocus Their Programs in 2026

Going forward into 2026, the compliance landscape will be shaped less by brand-new rules and more by heightened expectations around program effectiveness, governance, and execution.

Reports

Q4 2025 Sector Insights Dashboard

This report introduces the Sector Insights Dashboard, a new quarterly analysis that provides a clear, factor-based view of U.S. equity sector performance.

Q4 2025 Factor Performance Analysis

In 2025, global equity markets were supported by easing inflation, stabilization, and a shift toward more accommodative monetary policy, which improved risk sentiment and valuations.

January 2026: Transparency, Enforcement, and What’s Ahead

As the industry enters 2026, regulators across major jurisdictions are moving from rulemaking to closer supervision, validation, and enforcement.

Case Studies

Identifying Complementary Funds Through Style Differentiation

Fund of Funds managers and multi-manager investors are under pressure to deliver diversified portfolios that maintain performance consistency while reducing unintended style concentration and risk.

Automating the Monitoring of Market, Liquidity, and Sustainability Risk

A Luxembourg regulated Super ManCo automates the monitoring of market, liquidity and sustainability risk using Confluence Revolution.

Institutional Defined Benefit Plan Targeting

Confluence helped an Asset Management firm define a debt distribution strategy based on client types and sizes, moving to LDI with the Prism Analytics platform.

White Papers

Co-Sourcing with Confidence: A Smarter Model for Regulatory Resilience

Why leading investment managers are blending control and capacity to meet today’s regulatory reporting demands.

Why Asset Managers Are Embracing Managed Services for Regulatory Reporting

Asset managers face mounting challenges in regulatory reporting and compliance. These complexities demand precise data management, ongoing awareness of regulatory updates, and accurate submission timing.

Investment monitoring and shareholder disclosures

In this overview we examine an important and taxing set of regulatory regimes, imposed by more than 100 countries around the worldand applying generally to firms wherever domiciled.

Videos

After the Alert – January 2026

Welcome to the January 2026 edition of After the Alert

After the Alert – December 2025

Welcome to the December 2025 edition of After the Alert

After the Alert – November 2025

Welcome to the November 2025 edition of After the Alert