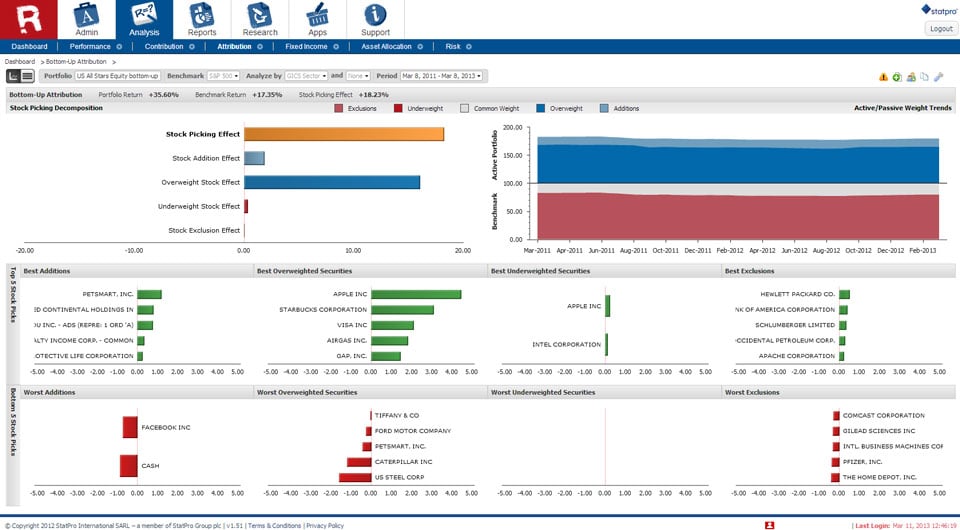

Stock- or security-level attribution is clearly required for “bottom-up” portfolio managers that are taking investment decisions at an individual security level.

Performance analysts learn early in their careers that the attribution analysis must replicate the investment decision process. It seems awkward to use the traditional Brinson & Fachler allocation formulae to measure the impact of individual stock decisions, but this does replicate the investment decisions taken by the “bottom-up” style portfolio manager. The manager is making investment decisions at stock-level, choosing to be underweight or overweight individual securities, which the traditional allocation formulae measures precisely.

In the context of stock-level analysis the traditional Brinson & Fachler selection formulae actually measures the impact of the security return within the portfolio differing from the return of that same security within the benchmark. This of course could be the result of an alternative pricing source or corporate action factor used in the portfolio compared to the benchmark, but is most likely caused by a transaction during the period. Transactions, purchase or sells are likely to result in a negative impact, suffering bid/offer spread, stamp duty, broker’s commission and other transactions costs. In addition to transaction costs the stock-level selection effect also includes timing effects trading at intra-day prices not necessarily the same as the end of day price used in the benchmark. Very occasionally the intra-day trades are at such advantageous prices that the bid/offer and transaction costs are covered and overall the timing/transaction effect is positive, but this will be rare indeed.

Read: New Insights for Asset Managers: How Technology Can Drive the Most Effective Middle Offices

But, stock-level attribution is not only of use for “bottom-up” stock pickers, it’s also valuable to “top-down” managers, and other stakeholders in the investment decision process. Attribution analysis of all forms is useful to portfolio managers particularly when performance is poor. Client meetings can be difficult enough at the best of times but if the portfolio manager can’t articulate why they’ve under-performed and crucially why the prospects for future out-performance are better, then there is a good chance the client will be lost. Stock-level analysis provides the possibility of fully explaining performance and in desperation the prospect of clutching a few straws and pointing out isolated good decisions, or perhaps highlighting a single bad decision that is unlikely to be repeated.

In the middle office for the performance analysts and risk controllers, stock-level attribution helps ensure the actual performance return is accurate, an old fashioned view I know but from my perspective the first responsibility of the performance analyst and allows a complete analysis of performance. In the context of the back office daily stock-level attribution analysis can be used as a diagnostic tool to identify pricing and other operational errors.

Stock-level attribution is the vital cog in the asset manager’s toolkit providing quality control of the investment decision process, allowing effective communication with clients, understanding the behavior of the portfolio, ensuring the return is accurately calculated and identifying errors.

Watch my latest video for more.