Why Factors Matter

How understanding factor exposures helps investors evaluate manager skill, risk alignment, and portfolio performance.

Author:

Confluence’s Style Analytics’ foundation was built on a simple but powerful idea: investment factors matter. They help explain how and why portfolios generate returns, offering a lens into the underlying drivers of performance. For institutional investors, understanding factor exposures is crucial for evaluating a manager's skill, portfolio construction, and market alignment.

What Are Investment Factors?

Factors like value, momentum, size, quality, and volatility are the building blocks of modern portfolio theory and quantitative investing. They represent systematic characteristics that influence stock returns and can be used to assess portfolio behavior relative to benchmarks.

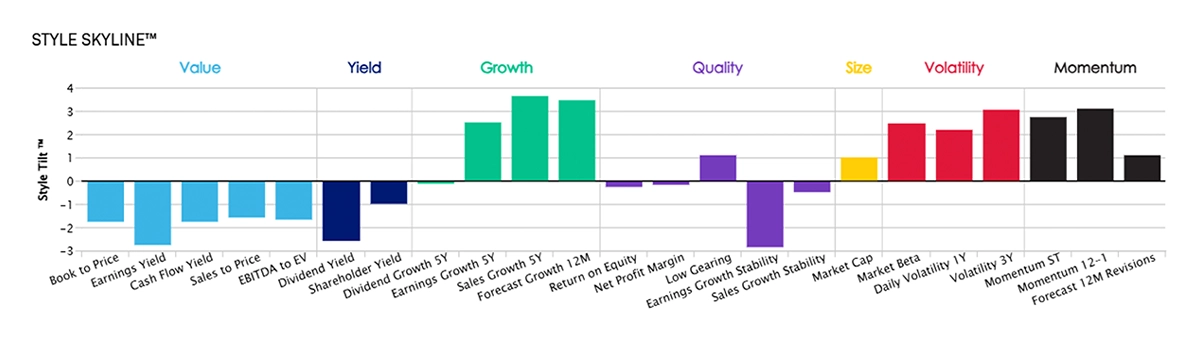

The Style Analytics SkylineTM displays easily readable key insights into benchmark-relative style exposures, also known as Portfolio Style Tilts. When displayed together, they show a complete factor picture of the portfolio’s style.

Key Factors:

Value - stocks that are cheap vs. expensive

Momentum - stocks with strong earnings/price trends

Size - small companies vs. large companies

Quality - financially strong vs. weak companies

Volatility - stable vs. high-risk companies

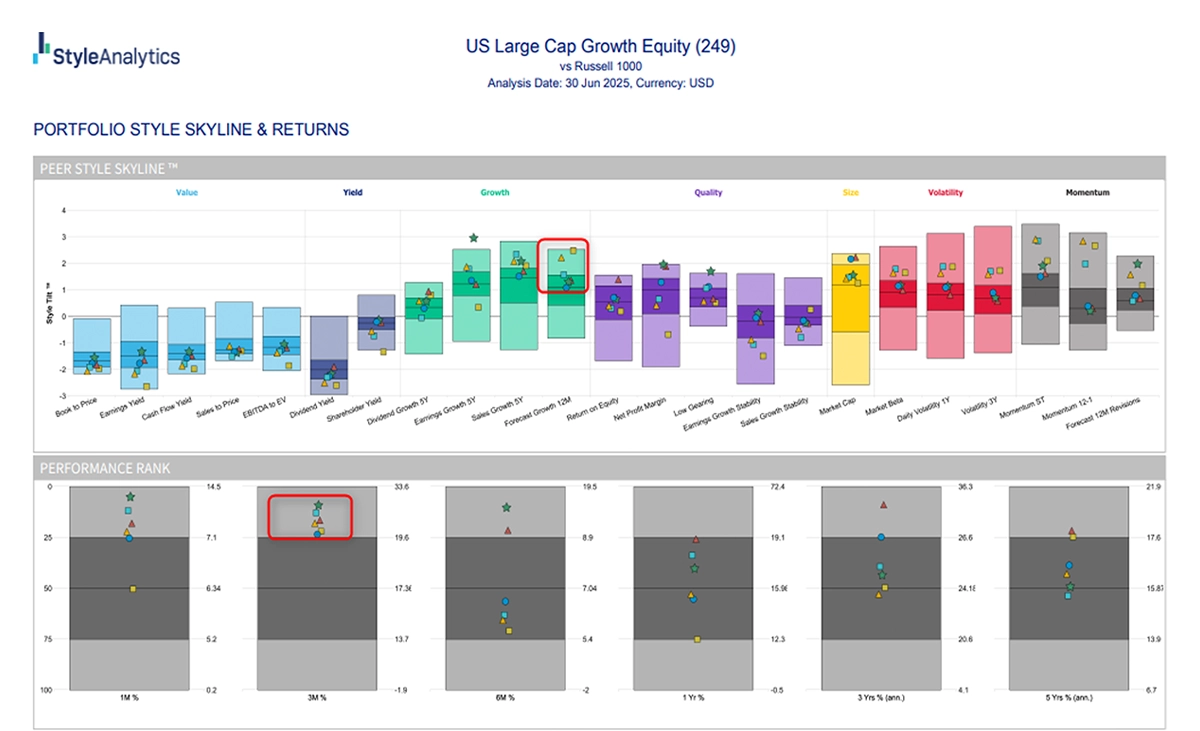

Figure 1: Style Tilts displayed on a Style SkylineTM for a US Large Cap Growth manager relative to a core US Large cap benchmark.

Figure 1 shows Style Tilts displayed on a Style Skyline for a US Large Cap Growth manager relative to a core US Large Cap benchmark. Figure 1 illustrates that the manager is investing in stocks that are more expensive than the benchmark but support superior Growth attributes, higher Volatility, and stocks that exhibit strong earnings and price Momentum.

Why Factor Exposure Matters

Understanding a portfolio’s style tilts is just the beginning. The real value comes from linking these exposures to performance outcomes. Attribution analysis allows users to break down returns into allocation effects and selection effects. Attribution analysis is an extremely valuable tool to evaluate managers’ active returns across a wide swath of categories or segments, such as asset classes, sectors, countries, and fundamental investment factors.

Attribution analysis enables users to reconcile relative performance by allocating investments to various investment styles versus stock selection within style groupings. This helps users understand historical performance relative to a benchmark. Style Analytics employs a widely recognized industry standard methodology, known as the Brinson-Fachler model.

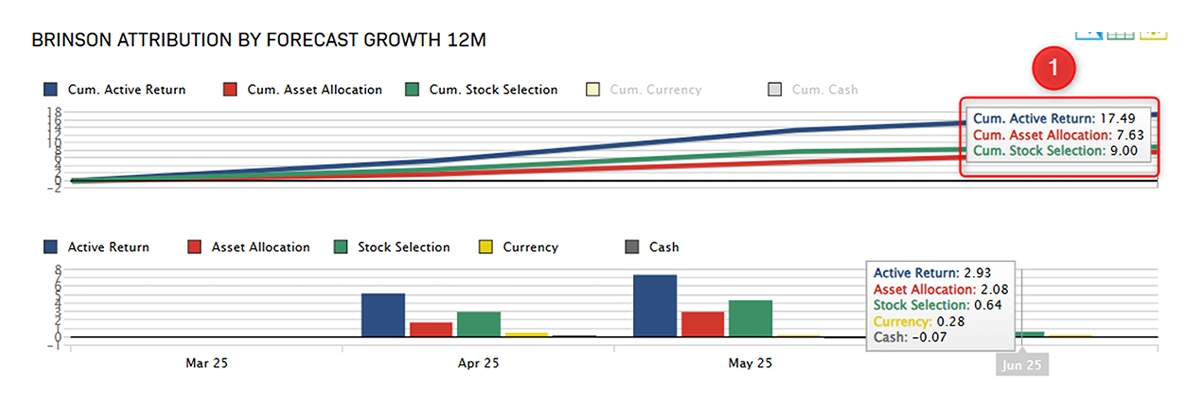

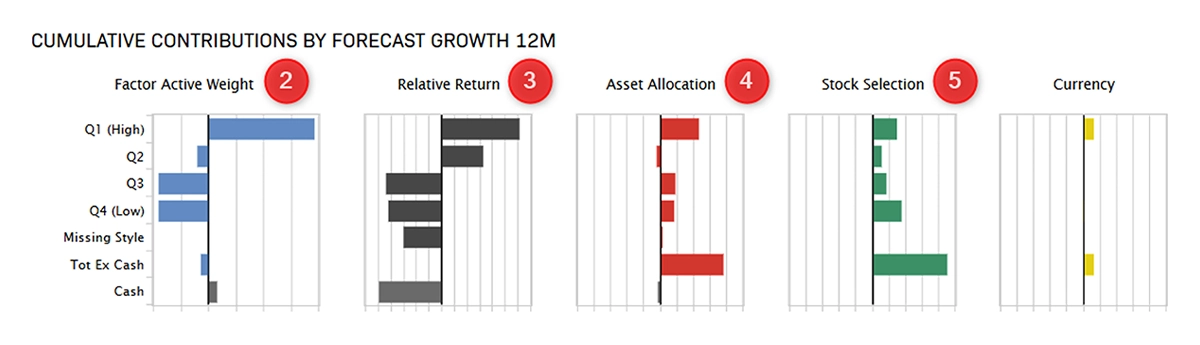

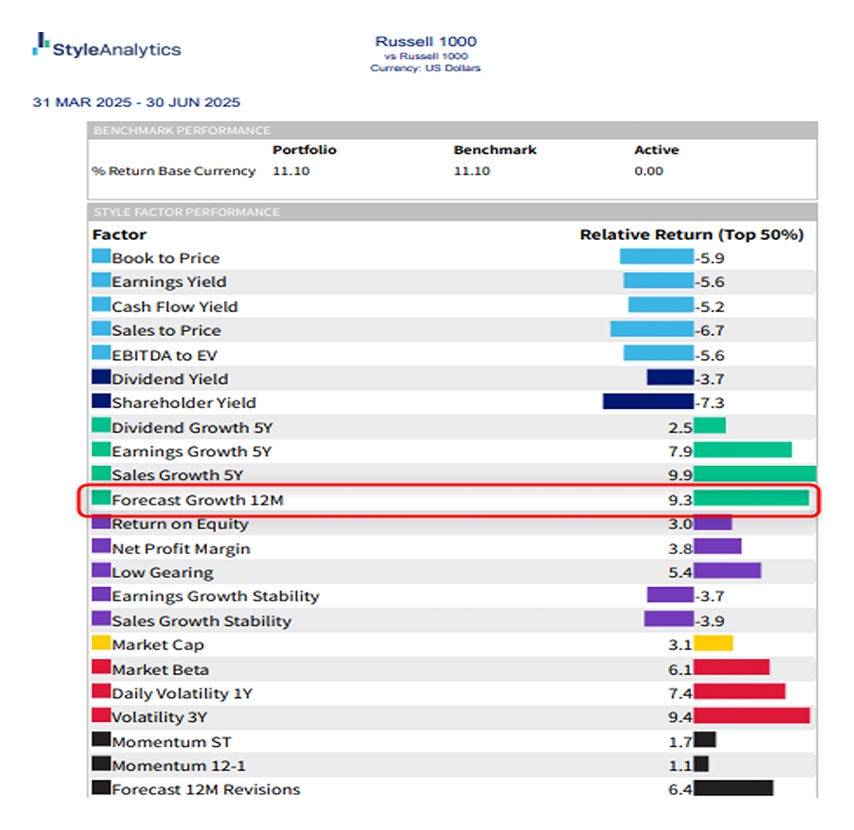

Figure 2a and b: demonstrate how Style Analytics can attribute recent performance results.

Figure 2 shows that the same manager depicted in Figure 1 can attribute recent performance results to their allocation to a particular investment factor: Forecast 12 Month Growth, a measure of the expected earnings growth for a stock or portfolio over the next 12 months.

Figure 2 shows that this same manager generated strong results (+17.49%), driven by a combination of favorable allocation (+7.63%) (overweighting high-growth quartiles, underweighting slow-growth ones). +9.00% selection effect (superior stock choices within those quartiles).

It is evident that the fund was overweight in the fastest-growing group () e.g., Q1 (High)) and underweight in the slower expected growth segments. And there was a monotonic relationship between how the fund was positioned and what the market was rewarding over the 3-month period. The market consistently rewarded higher growth: Q1 > Q2 > Q3 > Q4, which reinforced the manager’s positioning () and collectively contributed positively across all segments by approximately 800 basis points (). Lastly, within all the various segments, the fund consistently added value from stock selection, generating benchmark-beating results in each of the four segments, which collectively added 900 basis points () to performance within the analysis period.

Statistical Analysis: Correlation Matters Too

Beyond attribution, we use statistical analysis to uncover deeper relationships between factor returns and manager performance. Attribution analysis and statistical analysis are both analytical tools, but they serve distinct purposes and are applied in different contexts, particularly in finance and investing. The purpose of statistical analysis is to uncover patterns and relationships in data using mathematical techniques. One such approach is to examine the statistical relationship between factor returns and manager returns, specifically market relative returns for both datasets.

Attribution shows "what happened." Correlation shows "how closely linked" a manager is to a factor.

For each of our primary investment factors in our default Portfolio Style Skyline, as shown in Figures 1 and 2 for our US Large Cap Growth Manager, we conducted a correlation analysis to examine the statistical relationship between the manager's active returns and the factor's relative returns. To define factor returns, we created and rebalanced factor portfolios on a monthly sector-adjusted basis by sorting in descending order by factor value. We proceeded down the list until we reached a cumulative weight of 50% on a free-float market capitalization basis. This list of stocks per factor is a proxy for that particular factor, and we calculate a market-cap-weighted return for that group of stocks using beginning-of-period weights. For both data sets, we strip off the relevant broad market return and calculate weighted correlation coefficients over the trailing three years, with more weight given to more recent periods compared to longer-dated periods. Correlation coefficients measure the strength and direction of the linear relationship between two variables. The most common type is the Pearson correlation coefficient, which ranges between -1 and +1, with both extremes signifying perfect negative or positive correlations, respectively, and zero indicating no linear relation.

Managers highly correlated with a style tend to move with factor trends

Putting It All Together

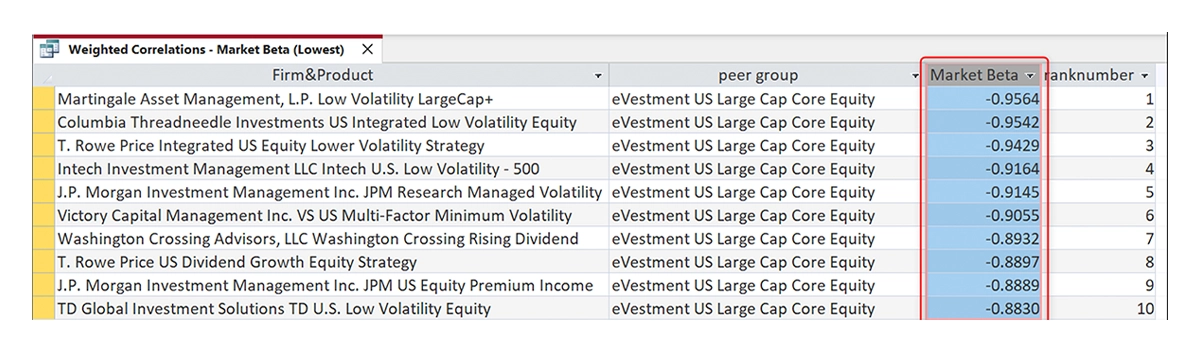

We focused our research on domestically oriented managers in the US market and rank-ordered managers with the highest positive correlations across the major broad eVestment peer groups. For a select few factors, where it made intuitive sense, we highlighted managers with the lowest, or rather highly negative, correlations to these factors. Examples of the latter include the Volatility factors, such as Market Beta or 1 Year Volatility, which are specific investment mandates that focus on a low-volatility approach. This was all done in the spirit of helping institutional investors understand style alignment, evaluate performance drivers, and anticipate market sensitivity.

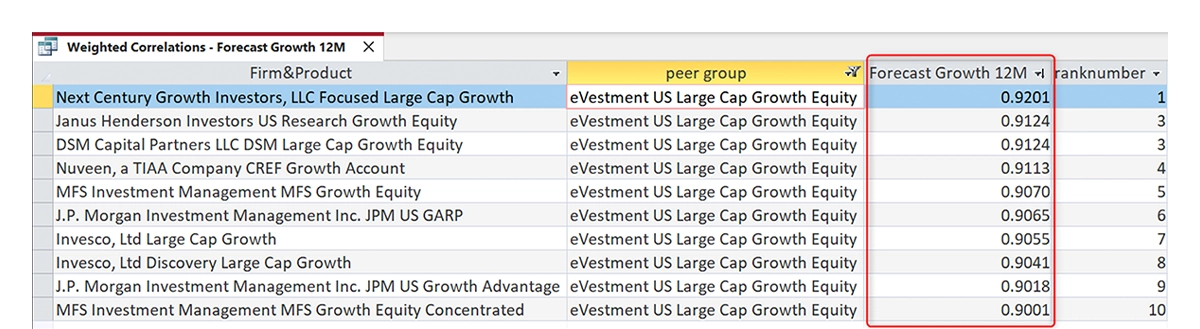

Figure 3: eVestment Large Cap Growth group for data through July 31, 2025

Figure 3 displays the eVestment Large Cap Growth group data, which incorporates active manager returns and market relative factor returns, for the three years ending July 31, 2025. It represents the funds within the eVestment US Large Cap Growth Category that have the highest positive (weighted) correlation to Style’s Forecast Growth 12 Month Factor. All of these managers had a correlation coefficient hovering around 1.0, indicating a robust statistical relationship between their monthly active returns and the 12 Month Forecast growth’s market-relative active returns.

Why does this matter? It is essential to put positioning into context. If a manager’s returns are heavily correlated with an investment style, it is not too much of a stretch to believe that its return patterns will move in line with broader factor trends in the current market environment.

Figure 4: shows the performance of the top half of each factor relative to the overall benchmark

Managers highly correlated with a style tend to move with factor trends

Figure 5: a subset of these same managers from a Skyline and performance perspective:

Figure 4 shows the performance of the top half of each factor relative to the overall benchmark using the Confluence Style Portfolio Analyzer. For the three-month period ending in June 2025, using the benchmark as the focal point, there is a clear and strong relative performance of growth factors, marked by notable strength from the 12 Month Forecast Growth Factor (e.g., 9.3%).

It is reasonable to expect that a manager whose returns are highly correlated with a factor that has been richly rewarded in the market would have benefited from the relatively strong performance of the factor. Figure 5 shows the plotted subset of these same managers from a Skyline and performance perspective.

Without linking Portfolio Skyline Tilts to performance in our coefficient analysis, it is reasonable to expect that all these managers will have positive exposures to the 12 Month Forecast Growth Tilt (Figure 5). All six managers rank squarely above the median relative to peers and comfortably above the Russell 1000 Index, as shown in Figure 5, with the 0 line on the Y-axis for the June quarter. Please note that this analysis window spans 3 years, and we are only showing the June Skyline here for illustrative purposes. The bottom part of Figure 5 shows that these managers are placed squarely in the top quartile of our 3-month performance table, which aligns with our factor performance horizontal bar chart above, where the 12 Month Forecast Growth performed strongly during the June quarter.

Let’s examine one of the low-Volatility factors mentioned above. However, this time, we will focus on those products with the highest negative correlation, which implies that they are most closely aligned with the inverse of high volatility (e.g., low volatility). For this example, we are using Market Beta, which is one of Style’s default volatility factors on our standard Portfolio Style Skyline, within the eVestment US Large Cap Core Universe:

Figure 6: using Market Beta, one of Style's default volatility factors on our standard Portfolio Style Skyline

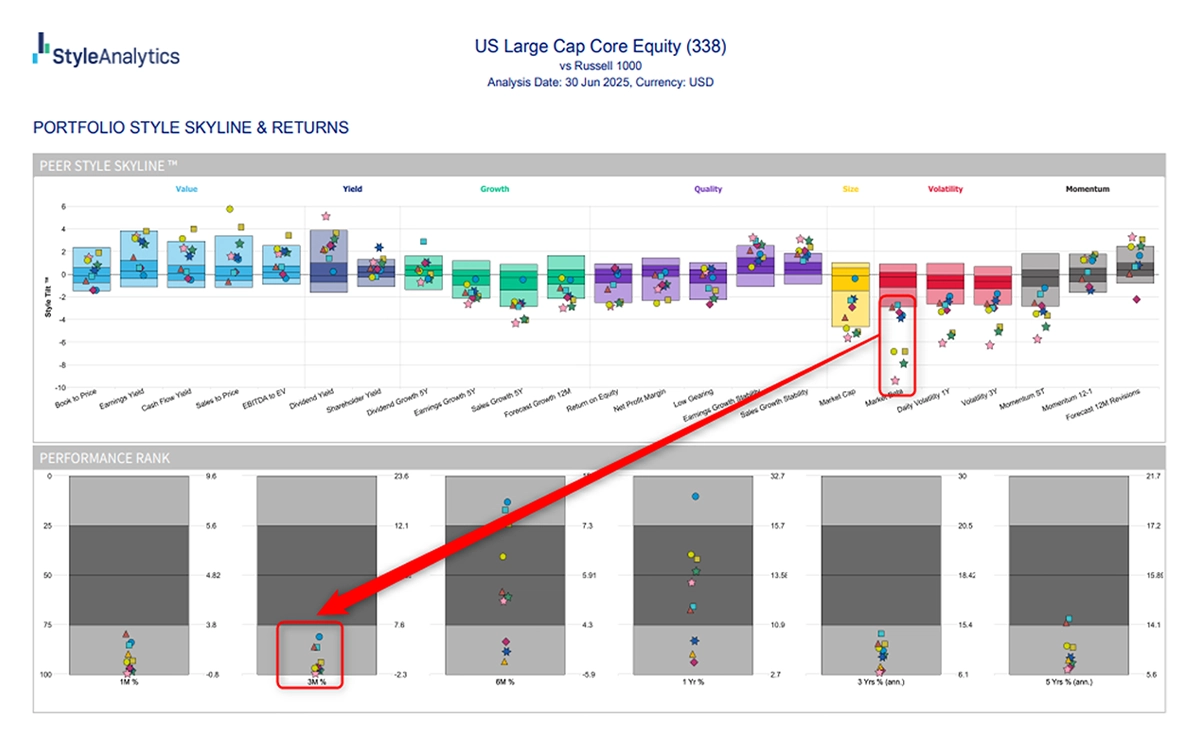

Figure 7: eVestment Large Cap Core Portfolio Style Skyline and Performance as of June 30, 2025

All these products exhibit extremely high negative correlations with the market beta factor, which makes intuitive sense given that seven out of the ten strategies have “low Volatility” or similar terms in their product names. Knowing Large cap market performance, as shown in the horizontal bar chart in Figure 4, products that were on the opposite side of the “risk on” trade during the June quarter likely struggled as high volatility factors were among the strongest performing factors. Market Beta as a factor outperformed the overall Russell 1000 Index by roughly 600 basis points during the second quarter, so it is reasonable to expect that “risk off” type managers would have struggled in this market dynamic given the strong headwinds.

All ten products rank at or near the bottom 5% of the Market Beta factor distribution (e.g., floating below the distribution) as shown in the top section of Figure 7. Performance ranks squarely in the bottom quartile for both June and the second quarter of the year. This insight helps contextualize performance and anticipate how managers may fare in different market regimes.

As one can imagine, some of the factors lent themselves to stronger links than others either positively or negatively to manager performance but nevertheless, we calculated Pearson’s correlation coefficients across all products with full performance history across the three-year window to identify products that had the highest exposure within peer groups across a range of Portfolio Skyline Factors.

Why This Matters

Factor analysis is more than academic-it's a practical tool for manager due diligence, portfolio diagnostics and risk

For institutional investors, factor analysis is more than academic—it’s a practical tool for manager due diligence, portfolio diagnostics, risk management, and strategic allocation.

If a manager’s returns are consistently correlated with a specific factor, it’s reasonable to expect their performance will track that factor’s behavior in the market. This insight enables investors to make informed decisions about a manager's fit, diversification, and market exposure.

While it is hard to pinpoint precisely why a stock or, for that matter, a portfolio performs in absolute or relative terms, given the complexity of the market and all its crosscurrents, it is crystal clear that factors matter. Through statistical and fundamental analysis, we can conclude how investment styles impact stock and portfolio returns. We can both measure style exposures and link their performance to manager returns, as evidenced by our correlation analysis as explained above.

If you would like further information regarding the methodology behind this research or want additional product-specific analysis, please reach out, and we would be happy to share insights on either.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with 700+ employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com

You may also like: