The Smart Way to Compliance

Why Asset Managers Are Embracing Managed Services for Regulatory Reporting

Author:

Introduction

Asset managers face mounting challenges in regulatory reporting and compliance. These complexities demand precise data management, ongoing awareness of regulatory updates, and accurate submission timing. Balancing these requirements with core business functions can strain resources, hinder growth, and compromise profitability. Fund and asset managers increasingly rely on external partners for compliance, data management, and regulatory reporting.

According to a study by Carne Group, 99% of fund managers believe it will become much harder to navigate regulatory complexities over the next two years. This will fuel greater levels of outsourcing and a stronger focus on innovation.1 In addition, 94% of wealth managers and institutional investors said the ability to manage the regulatory environment will become much harder between now and 2026.1 Moreover, 36% of bank chief risk officers (CROs) ranked “implementation of regulatory rules or supervisory expectations” as a top risk management issue over the next 12 months—second only to cybersecurity risk.2

This whitepaper explores the intricacies of regulatory compliance, especially within investment management, and advocates for managed services outsourcing as a sustainable, strategic solution. By outsourcing compliance functions, asset managers may achieve significant cost savings, operational efficiencies, and scalability, potentially enabling them to focus on core business objectives.

The Complexity of Regulatory Reporting, Data Management, and Compliance

The regulatory landscape for asset managers has become increasingly complex in recent years due to evolving rules, heightened scrutiny, and global regulatory developments. In lockstep, regulatory reporting for asset managers has become increasingly complex, with mounting requirements and the need for advanced technological solutions to meet tighter compliance windows. Regulations like Form PF (under the Dodd-Frank Act) require private fund managers to report complex leverage, exposure, and liquidity data. Recent amendments have increased both the frequency of filings and the granularity of information required.

In addition, asset managers operating internationally must comply with overlapping, and sometimes conflicting, regulations like the SEC’s rules, the EU’s AIFMD/MiFID II, and the UK’s FCA framework.

This has led to several critical challenges for asset managers, including:

Complex Data Requirements: Regulations now demand a large volume of real-time data, such as portfolio composition, risk exposures, and derivative positions. The challenge lies not only in gathering this data but also in increasing accuracy and timeliness. The key culprit is data complexity, with 24% of asset managers and owners saying it is their top barrier.3 Requirements like the EU’s Securities Financing Transactions Regulation (SFTR) and MiFID II force asset managers to report granular trade data, placing additional pressure on data systems.

Constantly Changing Regulations: Rules are continuously changing, driven by political shifts, technological innovation, and economic disruptions, making it difficult for in-house teams to stay current. For example, anti-Money Laundering (AML) regulations also have intensified globally, leading to additional burdens around adverse media screening, due diligence, and reporting obligations.

Timing Issues: Regulatory bodies often provide short windows for compliance, leaving managers scrambling to meet requirements with limited time. Reports such as Tailored Shareholder Reports and Form PF come with tight deadlines, requiring precise coordination of data collection, validation, and submission.

Cost and Resource Drain: Maintaining an in-house compliance team capable of meeting these demands is expensive, with additional costs for training and technology upgrades. Building in-house compliance functions and regulatory technology solutions requires significant investment. Asset managers must balance these rising costs with maintaining profitability. More aggressive regulatory enforcement, with larger fines and more violations, increases the need for proactive compliance strategies. While AI can enhance productivity, efficiency, and accuracy, it requires ongoing oversight and training by skilled professionals to ensure it's effectiveness and compliance with regulatory standards.

Data Management Challenges Pervade the Industry

Data management, including accurate collection, security, and consistency across platforms, is a significant challenge. In a recent EY survey, 75% of asset and wealth managers cited data as a barrier to innovation amid siloed assets and legacy systems. Not a single participant was positive about all aspects of their data management, as 79% percent cited poor quality data as a specific pain point.4 As a result, 37% of asset managers expect to outsource in the next two years.4

In terms of data accuracy, forms such as Form PF, MiFID II reports, and ESG disclosures require highly accurate data. Errors can result in compliance breaches, fines, and reputational damage. Asset managers collect data from various sources (e.g., custodians, third-party administrators, and brokers), which increases the likelihood of discrepancies. Manual data entry and reconciliation can introduce human error, compromising data quality and accuracy. In addition, asset managers often use multiple platforms (e.g., portfolio management, trading, and compliance systems) that do not always communicate seamlessly, leading to inconsistencies in data. Asset managers handle sensitive personal and financial data, making them targets for cyberattacks, ransomware, and phishing campaigns. Compliance with regulations like the SEC’s proposed cybersecurity rules adds pressure to implement robust controls.

Citing cost (73%), disparate technology systems (62%), and regulatory oversight (52%) as operating challenges, asset managers seek to deploy solutions that enable scale and efficiency, according to Cerulli Associates, including managed services: 33% of asset managers outsource the full back-office function, while 20% outsource middle-office operations.5

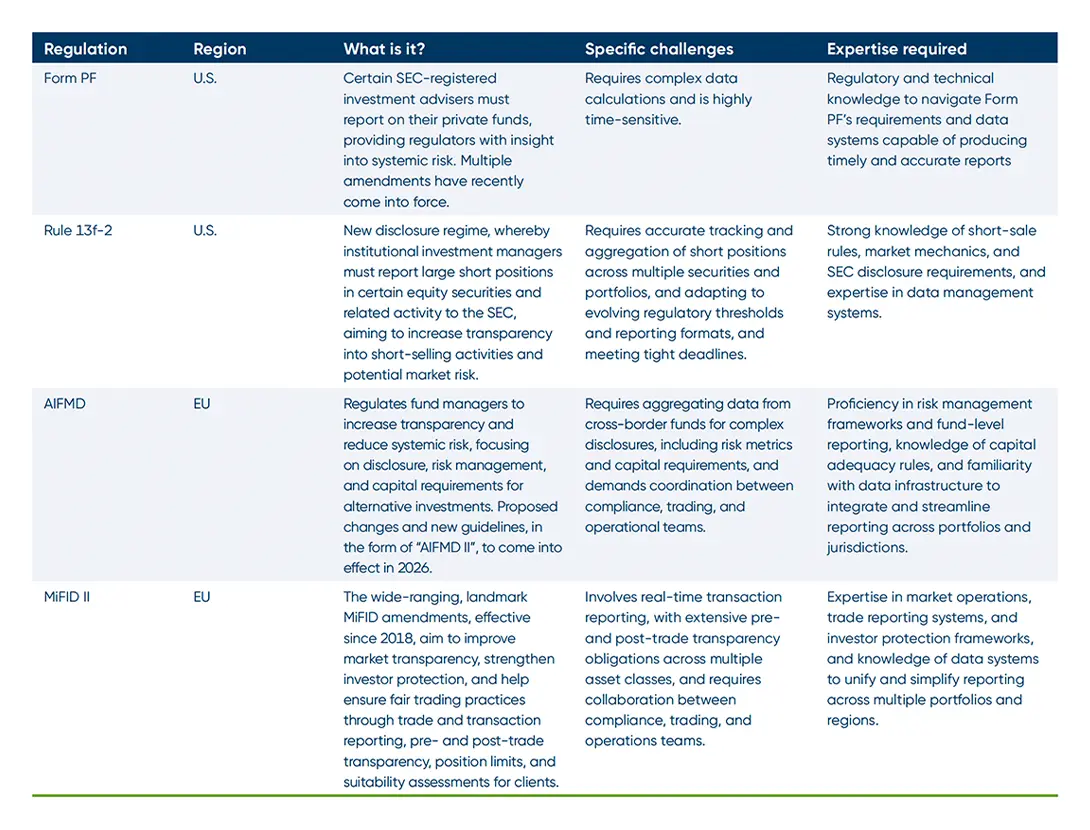

Challenges of Regulatory Reporting: Four Use Cases

The following are examples of the regulatory complexities asset managers face.

Future-Proofing Compliance: The Case for Managed Services in Regulatory Reporting

Managed services offer more than just outsourced labor; it can provide a comprehensive platform and process for handling regulatory reporting efficiently. Outsourcing provides asset managers with access to specialized compliance expertise and cutting-edge technology. It’s no wonder that 44% of asset managers are assessing the need for additional outsourcing in their operations, and more than 90% plan to begin or increase their outsourcing of data-related activities.3

Unlike one-off solutions, managed services offer ongoing support, preparing firms for future regulatory changes as they arise, driving value through:

A Continuous, Integrated Process for Reporting Compliance: Managed services platforms are designed to streamline data management, calculations, and reporting. With centralized systems, firms can more efficiently extract accurate information for regulatory filings—reducing the need for ad-hoc data collection and reconciliation.

Prepared for New Regulations: Rather than treating compliance as a series of individual events (like filing Form PF or preparing for ECB statistical reporting requirements), managed services adopt a “perpetual readiness” approach.

Value in Data, Calculations, and Dissemination: With managed services, data, calculations, and dissemination processes are already built and aligned to regulatory standards. Firms additionally benefit from reduced delays and errors in reporting, allowing them to focus on business growth rather than compliance bottlenecks.

Proactivity, Adaptability, and Flexibility: Managed service providers are well-positioned to quickly adapt to new rules and integrate them into existing systems and processes. Whether it’s new ECB reporting changes or evolving requirements in the private markets, the right provider can offer the flexibility to scale and meet compliance requirements without major disruptions.

AI Roadmap Built In: Al is increasingly being integrated into risk management and compliance functions to enhance productivity, efficiency, and accuracy. According to a survey, 68% of financial services firms consider AI in these functions a top priority.6 As table stakes, top tier managed services offerings will have AI-powered applications integrated within workflow optimization.

Streamline Your Back Office: The Benefits of Performance Reporting as a Service

Managing performance reporting in-house is becoming increasingly complex for many firms. Between aging teams and rising demands on data accuracy and timeliness, the challenges are mounting. Firms that choose to keep it internal often face high costs and key-person risk. Although some companies hold on due to legacy contracts or a desire for control, many firms have already moved to outsourced solutions.

The benefits are clear: outsourcing helps mitigate risk, reduce cost, and lets your team focus on higher-value tasks. Some firms like Confluence offer performance reporting solutions designed to handle data and calculations efficiently, reducing the burden of operational upkeep compared to in-house setups.

The Crucial Role of Technology and Specialized Knowledge

Asset managers need specialized tools and expertise to manage these processes effectively. Regulatory technology tools can automate compliance processes, such as regulatory reporting, trade surveillance, and client onboarding. Managing large datasets requires expertise in data governance frameworks to foster data accuracy, accessibility, and alignment with regulatory standards.

In addition, asset managers must engage cybersecurity professionals to design and maintain secure environments that meet compliance mandates and protect sensitive information. They also need skilled professionals to evaluate and monitor third-party service providers to strengthen their adherence to security and data management protocols.

While technology plays a crucial role in streamlining operations and reducing errors, it must be complemented by specialized human oversight. This blend contributes to:

- Data that remains accurate and consistent across systems through ongoing reconciliation and monitoring.

- Security controls that are proactively updated in response to evolving cyber threats and compliance mandates.

- Technology investments that yield results, as knowledgeable professionals can optimize systems and processes to align with the firm’s regulatory and operational objectives.

Managed services are designed to adapt to new regulations, potentially helping firms comply with upcoming changes. Managed services platforms integrate data collection, calculations, and dissemination, aiming to simplify the reporting process. By partnering with external compliance experts, firms can reduce the risk of non-compliance and work towards keeping their systems up to date. According to Cerulli’s research, 65% of asset managers cited “improving internal employee productivity” as a driver for outsourcing, followed by “incorporating efficiencies” (58%).5

Managed services are also designed to address the complexities outlined earlier by offering scalable solutions that evolve alongside regulatory requirements. Asset managers may reduce the costs and risks associated with in-house compliance efforts while gaining access to technology and expertise that could be difficult or expensive to maintain internally

Transforming Compliance with Managed Services

Outsourcing compliance functions through managed services can offer asset managers a strategic advantage. By shifting the burden of regulatory tasks to specialized providers, firms may unlock cost savings, enhance operational efficiency, and mitigate risks. This approach can enable asset managers to redirect focus toward their core business activities—such as investment strategy and client service—while potentially benefiting from the expertise, technology, and adaptability managed services offer.

Key Considerations for Outsourcing Regulatory Reporting and Compliance

Here’s a checklist to help you evaluate whether outsourcing is the right strategic move for your firm by identifying gaps, assessing potential benefits, and ensuring alignment with the right service providers.

Evaluate Current Compliance Strategy: Determine whether your current in-house team is struggling to keep up with regulatory demands.

- Is your in-house compliance staff struggling to meet reporting deadlines or regulatory updates?

- How often do errors, missed filings, or last-minute scrambles occur in your compliance processes?

- Are your compliance functions diverting significant time and resources from core business activities?

Assess Technology Gaps: Consider whether your firm’s technology is robust enough to handle evolving compliance requirements.

- Does your current technology infrastructure support automated reporting and real-time compliance tracking?

- Are your systems integrated, or do you rely on manual processes that create inefficiencies and errors?

- How quickly can your current technology adapt to new regulatory requirements or changes?

Understand the Scope of Regulations: Stay informed about new regulations that may impact your firm.

- Are you aware of emerging regulations, such as the EU’s AFIMD, that could impact your operations?

- Do you have the resources and expertise to interpret and implement new regulations as they arise?

- How often do you conduct internal audits or mock exams to assess your compliance readiness?

Cost-Benefit Analysis: Analyze the potential savings and efficiencies gained from outsourcing versus maintaining an in-house team.

- What are the current costs (staff, technology, training) associated with maintaining in-house compliance functions?

- How much time and money could be saved by outsourcing routine compliance tasks?

- Would outsourcing free up resources to invest in other growth areas, such as portfolio management or client services?

Evaluate Providers: Look for managed services providers with expertise in the asset management sector, scalable solutions, and a track record of compliance success.

- Does the provider specialize in compliance management for asset managers and understand industry-specific regulations?

- Can the provider scale its services to match your firm’s growth and evolving regulatory needs?

- What is the provider’s track record in meeting deadlines, avoiding compliance errors, and ensuring regulatory readiness?

Meeting the Moment: Outsourcing for Success

As the regulatory landscape for asset managers becomes more complex, the need for accurate, timely, and cost effective compliance management has never been greater. Outsourcing to managed services providers can offer a strategic solution, potentially allowing firms to navigate the complexities of regulatory reporting while minimizing costs, improving efficiency, and reducing risk. By outsourcing, asset managers may be able to refocus their efforts on core business activities, possibly driving growth and profitability in an increasingly competitive marketplace.

Asset managers should evaluate their current compliance strategies and consider whether outsourcing managed services could help them streamline operations, reduce risk, and enhance overall business performance. Managed services outsourcing can offer a sustainable solution for navigating the growing complexities of regulatory compliance.

Sources:

1 The Carne Group, Change2024 Report—The measure of a moving industry.

2 EY, Managing through persistent volatility: the evolving role of the CRO and the need for organizational agility—13th annual EY/IIF global bank risk management survey, 2024.

3 BNY Mellon, The Future of Asset Management—A Trends Report, 2024.

4 EY, Frictionless data sharing through the wealth and asset management ecosystem.

5 Cerulli Associates, The Cerulli Report—U.S. Vendor Management & Operations Outsourcing 2022: The Evolution of the Asset Manager Operating Models.

6 KPMG, The generative AI advantage in financial services, August 2023.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in the content of this blog post, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

Confluence is a leading global technology solutions provider committed to helping the investment management industry solve complex data challenges across the front, middle, and back offices. From data-driven portfolio analytics to compliance and regulatory solutions, including investment insights and research, Confluence invests in the latest technology to meet the evolving needs of asset managers, asset owners, asset servicers, and asset allocators to provide best-of-breed solutions that deliver maximum scalability, speed, and flexibility, while reducing risk and increasing efficiency. Headquartered in Pittsburgh, PA, with ~700+ employees in 15 offices across the United Kingdom, Europe, North America, South Africa, and Australia, Confluence services over 1000 clients in more than 40 countries. For more information, visit confluence.com