Use Case

Wealth Management Firms Use Case

Clients rely on you to navigate the complex financial market and deliver unique, continuous value to meet their investment objectives. You have the expertise, however it’s challenging to stay ahead of ever-changing market conditions, with research often time-consuming and costly.

Delivering unique insights for fund research and portfolio construction

Keeping ahead with the latest data and insights across the portfolio management lifecycle is critical, to ensure fast and informed decisions.

Our Wealth Manager Use Case demonstrates how the modular Style Analytics tools can quickly provide you with the insights you need to build, visualize and communicate differentiated strategies.

Our insights are derived from analyzing over 28,000 funds, 130+ factors and ESG metrics on each to illustrate factor exposures.

Featuring the 3 key phases in the portfolio management lifecycle, we demonstrate how to:

- Undertake manager due diligence to meet a client’s objectives

- Research and select managers

- Aggregate individual manager characteristics into a total portfolio view

- Identify the key drivers of style, risk, performance and more.

Portfolio Management Lifecycle Phases

Portfolio Management Lifecycle Phase

Manager Search and Select

How and where do I research suitable managers?

How do I know if the manager is a good substitute or complement?

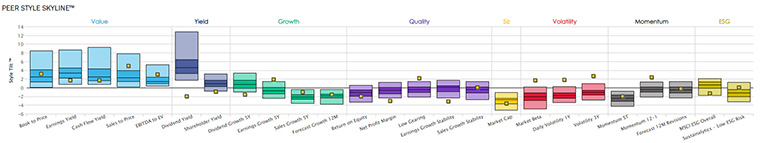

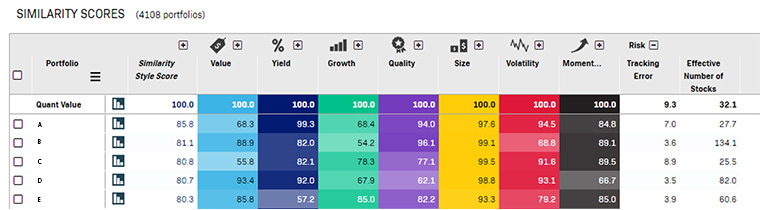

Given the Value manager is a Volatility outlier, you may want to find a replacement fund. Using the Style Analytics Similyzer™ module allows you to identify funds with similar or different investment styles across thousands of managers. To maintain Value exposure and reduce Volatility exposure, Similyzer™ calculates the factor exposures of all funds, showing how similar or different the investment styles are comparing to your manager’s fund. By filtering the results grid in just a few clicks, you can find a manager below with similar or different factor exposures.

Portfolio Management Lifecycle Phase

Multi-Manager Analysis

How can I aggregate individual manager characteristics into a total portfolio view?

The Fund of Fund Studio module enables you to analyze a multi-manager client portfolio seamlessly in a few clicks.

You can add managers from the workbench (an easy to access buy-list), and quickly change allocations to existing and prospective managers over time, as seen in the top-right grid in this example.

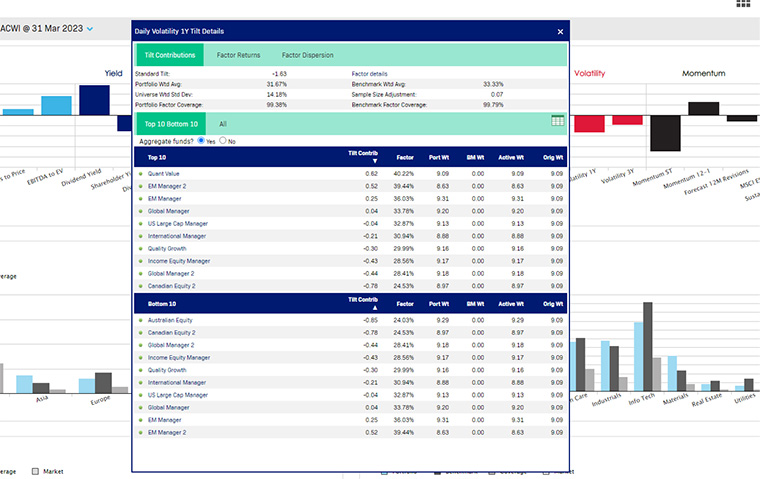

In the Fund of Fund Studio report you can drill into the manager’s contribution to the overall style exposure of the client’s portfolio. In this example, the Value manager is shown as the highest contributor to the Daily Volatility of the overall portfolio and therefore increasing your total funds risk. A replacement candidate needs to be considered.

In the previous phase (Manager Search and Select), you used the Similyzer™ module to find a potential replacement manager. In Fund of Fund Studio, you now can create scenarios to see how well this manager, or other candidates, fit into the overall client portfolio with just a few clicks.

In the example below, one Value manager has been substituted for your current manager, demonstrating how you’ll maintain and increase your Value exposure, whilst decreasing Volatility exposure.

Portfolio Management Lifecycle Phase

Manager Evaluation and Monitoring

How can I perform due diligence on the managers I hire?

Analyze and monitor both current and potential managers from your buy list, using the Style Analytics Portfolio Analyzer module.

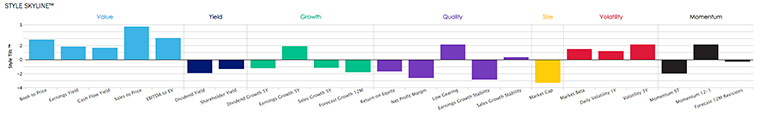

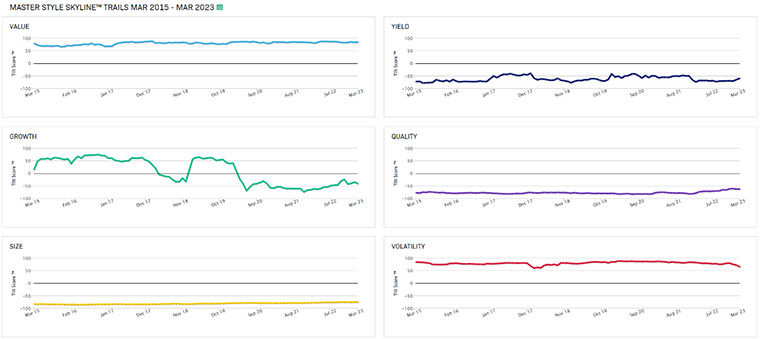

Using our best-in-breed Style Skyline™ you can identify the fund manager’s style exposure by selecting from a list of 130+ individual factors, including ESG.

In this example using the latest set of holdings, you see the manager is currently biased toward Value and Volatility factors. You can identify if the manager is adhering to their stated investment style and meets your client’s mandate.

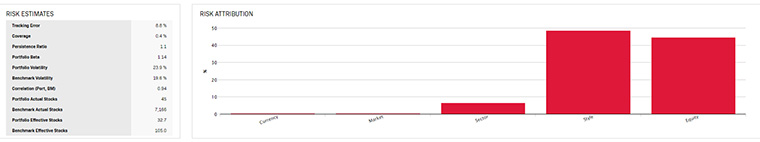

Using the latest holdings, you can then understand Fund risk by using the Style Analytics ex-ante risk model. You can identify traditional risk measures including tracking error, portfolio volatility and beta, etc.

This example breaks down tracking error to show the key sources of risk. The manager demonstrated has a near-even split from both style bets and stock-specific bets.

How do I know if they’re sticking to their investment strategy?

You can assess the historical Style exposure trends to uncover the manager’s consistency, or lack thereof, against category or individual factors. The Master Skyline methodology, aggregates factors into a simpler category score and measure changes over time.

In the example below, the manager’s bias towards Value and Risk has held relatively constant for over eight years, whereas exposures to Growth tended to be more positive in the past.

How do I know if the manager is adding value?

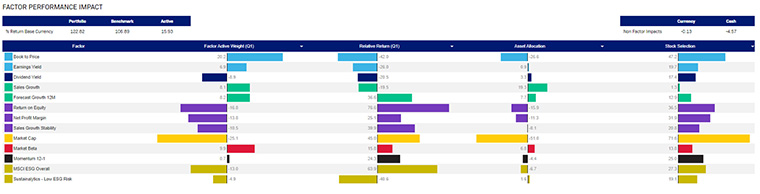

Style Analytics offers a suite of performance attribution methodologies including market, sector, style and factor.

In this example, the featured Style Mine module enables factors to be used as a framework for understanding the source of active returns.

The manager’s bet on the book-to-price factor has negatively impacted returns from an allocation perspective, however they’ve selected winning stocks.

Delivering unique insights for fund research and portfolio construction

We can help you deliver unique value across the portfolio management lifecycle and grow your competitive advantage.

Style Analytics

Part of Confluence

About Style Analytics

Style Analytics, part of Confluence, provides industry-leading style factor and ESG analysis to help Wealth Management firms identify drivers of return to improve portfolio outcomes, diversification and differentiation:

- Differentiate strategies

- Identify fund risk and exposure to ESG alongside style factors

- Compare fund factor exposures to peers

- See which factors outperformed or underperformed in individual markets.

About Confluence

Confluence is a leading global technology solutions provider committed to helping the investment management industry solve complex data challenges across the front, middle and back offices. From data-driven portfolio analytics to compliance and regulatory solutions, including investment insights and research, Confluence invests in the latest technology to meet the evolving needs of asset managers, asset owners, asset servicers, and asset allocators to provide best-of-breed solutions that deliver maximum scalability, speed and flexibility, while reducing risk and increasing efficiency. Headquartered in Pittsburgh, PA, with 750+ employees in 15 offices spanning across the United Kingdom, Europe, North America, South Africa, and Australia, Confluence services over 1000 clients in more than 40 countries. For more information, visit: confluence.com