“We’ll postpone the vote if, there’s a little confusion here, so we’ll postpone the vote”. With those words from Chairman Richard Shelby way back on April 7, 2016, the U.S. Senate Committee on Banking, Housing & Urban Affairs delayed consideration of President Obama’s nomination of Lisa Fairfax and Hester Peirce for membership in the SEC.

In the four months since, the Senate Banking Committee has made no further move to consider them. Ordinarily there would be nothing odd about a Senate committee blocking the President’s nominations, but in this case it is the Democrats holding up the nominations. That would be strange enough, but their reason for doing so – in response to the 2010 Citizens United Supreme Court decision – is both strange and oh so political.

The Citizens United decision removed restrictions on corporate political donations, a decision that did not go over well with Democrats. Overturning that Supreme Court decision is not realistic, so Senate Democrats are going for the next best thing – requiring companies to disclose political donations to their shareholders. In true political fashion, it appears the real goal is to reduce corporate political donations through the shame of public exposure, similar to what was done with conflict minerals. The SEC does not have the authority to say whether or not you can trade in conflict minerals, but they do have the authority to say whether you need to publicly disclose any trading in conflict minerals. The idea is that if you force companies to publicly say they trade in conflict minerals, they will not trade in conflict minerals. Likewise, the SEC cannot say whether companies can make political donations, but they can compel companies to publicly disclose the details of their political donations, which is expected to lead to fewer corporate political donations. There is a bit more to it than that, for there is some question as to whether such a disclosure rule would stand up in court, but that is the strategy.

The Republican controlled Senate certainly won’t compel the SEC to pass a political donations disclosure rule, so the Democrats need SEC members who already want to pass such a rule. The three current SEC members and all of the President’s nominees to date, including Fairfax and Peirce, have not provided a level of confidence that they will do so, and have given some indication that they won’t. So Democratic Senators are rejecting nominees for the SEC proposed by a Democratic president in an effort to enact campaign finance reform.

So what does all this have to do with the asset management industry? The SEC is down from the full five members to only three members. Due to the Citizens United political dispute, there is little chance of any additions in the foreseeable future. With the commission down two members, what will happen to the big three proposals of SEC Modernization, Liquidity, and Use of Derivatives? Enacted? Delayed? Forgotten? What if another member resigns? What if two more members resign and the SEC is down to just one sitting member?

Section 17 200.41 of the Code of Federal Regulations (CFR) sets the SEC’s quorum. It states that the quorum is three unless there are fewer than three members, in which case the quorum is the actual number of members. The wording of the rule implies that the number of members is not an issue, a position that was stated more explicitly in the text of the 1995 final rule that modified 200.14: “The Commission also believes that it would be appropriate to preserve the flexibility necessary to take effective action in the event, however unlikely, that there would be a period with only one commissioner in office”. So unless all three current members depart and there are no members whatsoever, the SEC has the authority to act.

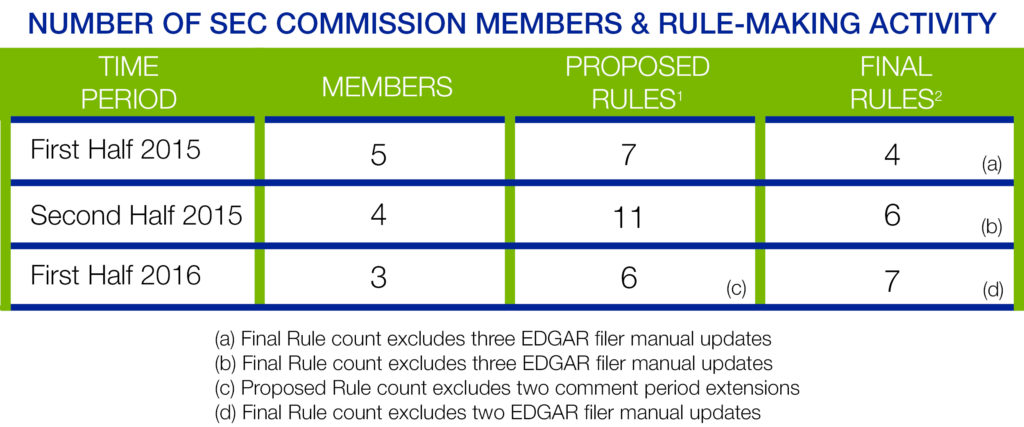

That is the theory, but how have things happened in practice? We have a pretty good comparison of how commission size has affected rule making since the Commission was at full strength in the first half of 2015, down to four in the second half, and down to three in the first half of 2016. Even adjusting for certain technical events like EDGAR Filer Manual updates and the extension of comment periods, there appears to be no let down in rule-making activity. As well, the rules proposed and finalized have significance. The four and three member Commission made such notable proposals as Liquidity Risk Management, Use of Derivatives and Advisor BCP, and finalized such notable rules as Crowdfunding and Titles V and VI of the JOBS Act.

Despite a merely passing interest in politics, when I dig into an issue like this, I always find the political maneuvering interesting and funny – in a gallows humor type of way perhaps, but funny nonetheless. But while interesting, it looks like the asset management industry should expect and prepare for SEC regulation to proceed regardless of commission vacancies. The strange twists and turns of the political process that made campaign finance a capital markets issue and resulted in Democrats saying “No” to President Obama do not appear to have any overall impact on the asset management industry or on any of the 2015 proposals that will occupy the bulk of the industry’s attention over the next couple of years.