From Spotify to Amazon, and Google to Apple, we’ve all heard of the cloud – repeatedly.

While adopting the cloud to deliver new features may have become the standard for many consumer-facing industries, we’ve heard time and again that the financial industry has been slow to catch up and has serious concerns regarding cloud deployment.

This trend is now changing and rightly so. In this blog post, I will lay out why a move to the cloud can bring huge benefits for asset managers particularly hedge funds and how by moving into the cloud they can free up costs and resources and reduce complexities in order to concentrate on generating alpha.

More computing power – Recent trends in the hedge fund industry are driving the need for more computing power. Chief among them is regulation. For instance, Form PF requires private funds to regularly report their AUM to the Financial Stability Oversight Council, which necessitates more frequent valuation of assets. A resurgence in structured products which have more sophisticated models has also led to a demand for more computing power. At the same time, IT budgets are either remaining same or shrinking. Moreover, the additional computing power may not be needed constantly, meaning a large investment in infrastructure could often stand idle.

Need more computing power on a smaller budget and with elasticity? Cloud is the obvious answer.

Read: New Insights for Asset Managers: How Technology Can Drive the Most Effective Middle Offices

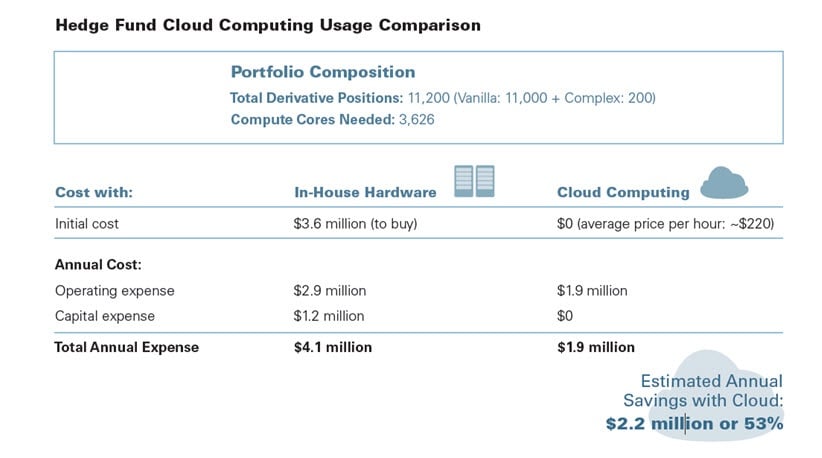

Cost – Cost reduction is perhaps the most compelling argument for a move to the cloud. Cloud computing saves cost by doing away with onsite IT infrastructure, large servers, maintenance, upgrades and training costs. So how much money are we talking about? A recent study by Greenwich Associates attempted to put a dollar amount to these savings. According to their estimates, hedge funds could get cost savings of more than 50% with cloud deployment. Here’s an illustration from the study:

Source: ‘Cloud computing for the buy-side: moving beyond the myths’ by Greenwich Associates

Source: ‘Cloud computing for the buy-side: moving beyond the myths’ by Greenwich Associates

Flexibility and scalability – Hedge fund managers work in a dynamic environment where they utilize different tools to analyze markets, execute orders, conduct performance and risk analysis and perform other functions. The ability to connect all these tools in one platform on the cloud offers them real-time access and flexibility and boosts productivity.

Cloud computing also gives them scale to enter new markets, adapt to new business processes and grow their company through utilizing opportunities in a timely manner.

Speed – Cloud computing can provide real-time access to portfolio analytics, risk intelligence and client information, thereby making response to market changes speedy and profitable.

Security – Having read thus far, you are likely thinking to yourself, this is all well and good but the cloud is not as secure as my files residing in my own servers, right? Wrong. The cloud is actually more secure than the old legacy systems as security is built into the cloud from the ground up and not added as an afterthought. Moreover, disaster recovery, physical security and business continuity processes are served much better with the cloud than with legacy systems. In a survey examining cloud usage within the investment management industry conducted by Eze Castle Integration, 54% of respondents said improved disaster recovery and business continuity process was an important driver to cloud utilization.

It is important though to distinguish between pure cloud providers and what we call ‘cloudwash systems’ – those who hastily migrate by pushing existing legacy software into the cloud. (This infographic gives 5 ways to spot the different between pure cloud and cloudwash)

Cloud adoption is not a one-size-fits-all. Most firms pace adoption to the cloud depending on their size and maturity. For a hedge fund start-up with low capital and no existing infrastructure baggage, it makes sense to run almost all business operations in the cloud. For most others, it is more realistic to adopt it for functions that require more elasticity and real-time access. Top of that list is non-core activities such as analytics, reporting, and compliance.

StatPro Revolution is a pure cloud-based portfolio analytics service built from the ground up with security at the forefront. There are no IT costs, and no maintenance or upgrade charges. The service comes complete with multi-asset class market data covering millions of securities and a wide range of index families, further reducing complexity and data management costs.

In conclusion, cloud computing is here to stay and grow exponentially. In fact, in a survey by Hedgeweek, 87% of hedge fund managers are utilizing the cloud in some form or the other. The benefits of a cloud-based service over a legacy system are many and compelling. With the right cloud-based service provider, hedge funds can gain a clear and differentiated edge in a highly competitive industry.

Sources:

1. Greenwich Associates Report: Cloud computing for the buy side: moving beyond the myths

2. Eze Castle Integration Report: Examining cloud usage within the investment management industry

3. HedgeWeek

4. CEB TowerGroup

Read more blog posts on our Hedge Fund Technology Resource Page.