Hedge funds have never looked so good! Global hedge funds under management now stand at an all-time high of $2.66 trillion with 2013 accounting for over $360 billion in capital inflow.

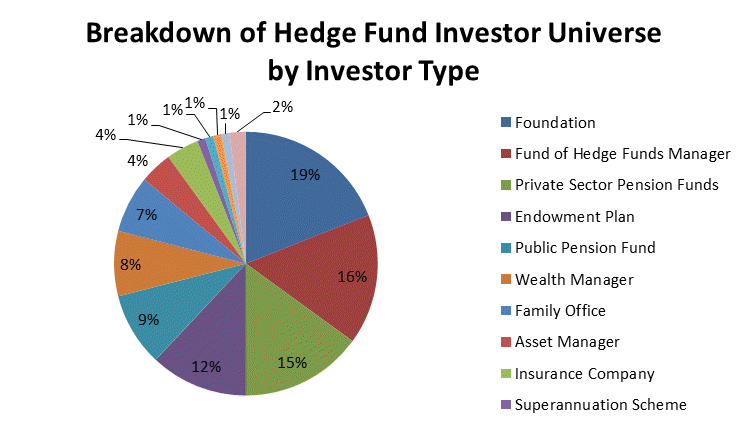

Institutional investors are flocking to hedge funds in ever greater numbers.

Source: Preqin Hedge Fund Investor Profiles

Source: Preqin Hedge Fund Investor Profiles

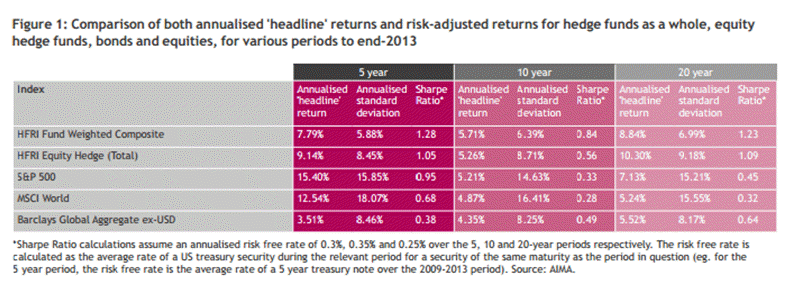

Institutional investors have grown more confident in hedge funds following positive performance in 2012 and 2013. The attractiveness of hedge funds mainly lies in the fact that on a risk-adjusted basis they historically outperform equities and bonds in the long term*. Institutional investors now look at hedge funds as a good way of diversifying their portfolio and reducing volatility.

At the same time, hedge fund managers are adjusting to their new life under increased regulatory oversight. While there are certainly concerns around increased cost and complexity due to regulations, hedge funds are beginning to appreciate the level playing field and increased investor confidence which these regulations provide – be it the AIFMD in Europe or the Dodd-Frank Act, FATCA and JOBS Act in the U.S. As per a July 2014 survey by Preqin, nearly 60% of European hedge fund managers are either already compliant or expect to be by the deadline. That number is expectedly lower in other parts of the world.

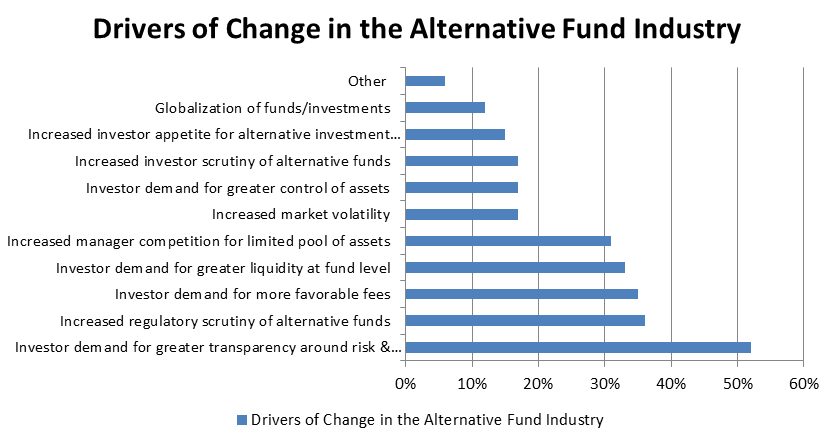

Together, the institutional investors and increased regulations are bringing about a wave of change in the industry. Institutional investors are demanding more transparency than ever before and regarding it as a prerequisite for building trust. When evaluating new funds and existing funds in their portfolios, investors are looking to get a good handle on the fund’s investment strategy, the risks, the exposure and the expected returns. In short, they want more transparency. While performance (returns) remains by far the most important criteria for assessing a hedge fund, a number of investors say that a good way for a fund manager to stand out is by offering a high level of transparency.

This clamor for transparency has not gone unnoticed. In a 2013 survey by State Street and Preqin, ‘Investor demand for greater transparency around risk and performance’ was cited as the top driver of change in the alternative fund industry.

Source: State Street 2013 Alternative Fund Manager Survey

Source: State Street 2013 Alternative Fund Manager Survey

Transparency to the investors simply means more frequent and more granular reporting, so they can get a view of what is generating the returns, exactly where the risks lie and whether the mandates are being fulfilled or not.

This has challenged the hedge fund industry which has for long held a shadowy, secretive reputation. Many hedge fund managers are reluctant to provide more reporting as they don’t want to give up their ‘secret sauce.’ Their proprietary strategy which is their key value-add and which they rightly fear losing. So is there a way to meet the demand for more reporting without losing control?

Read: New Insights for Asset Managers: How Technology Can Drive the Most Effective Middle Offices

At the same time, these managers also question to what extent the investors are prepared to pay for this increased transparency. After all, increased reporting means hiring more people and incurring significant costs in technology and processes, right?

As it turns out, there are smart, secure and user-friendly ways for hedge fund managers to share information that do not break the bank or give away trade secrets. Cloud-based technology providers that offer visual, interactive client reporting are gaining traction. You could say that Software as a Service (SaaS), as a deployment method is tailor-made for hedge fund managers – there is zero infrastructure to install or maintain, startup costs are low and complexities are reduced. StatPro Revolution, a cloud-based portfolio analytics service, has portfolio sharing and advanced user management features that give fund managers the control they need to decide who to share their portfolios with, exactly what content to share and when to share. And all this at no additional cost.

In addition to clients and regulators, there may be others who could benefit from this controlled sharing. They could be an internal colleague in a different location, an outsourced compliance partner or a distributor. With StatPro Revolution’s roles and permissions management sharing is centralized, so you can create any number of customized roles and link these roles to a specific set of access permissions and users. You have full control over the portfolio analytics that any of these users can see within the system. If you want to hide certain functionality or data, it is as easy as the click of a button. This means that you can quickly disseminate business information to any user with a full and secure audit trail. Hedge fund managers can also decide to share analysis of a certain time period and not the others. This ‘date control’ option gives them much needed flexibility and confidence that they are sharing the right data at the right time for the right portfolio.

This changed hedge fund environment is here to stay and grow. Both hedge fund managers and institutional investors will benefit from increased and smarter reporting, that is secure and controlled. With the right technology partner, hedge fund managers can not only meet the increased demand for transparency but also stand out from competition to gain more business and build more trust.

*Source: Alternative Investment Management Association (AIMA) research paper: Apples and Apples How to better understand hedge fund performance

*Source: Alternative Investment Management Association (AIMA) research paper: Apples and Apples How to better understand hedge fund performance

Find out more about the changing hedge fund environment with our Hedge Fund Technology resource page