Our latest release of StatPro Revolution includes some great functionality, additions and enhancements. Log in to take a look or read more below:

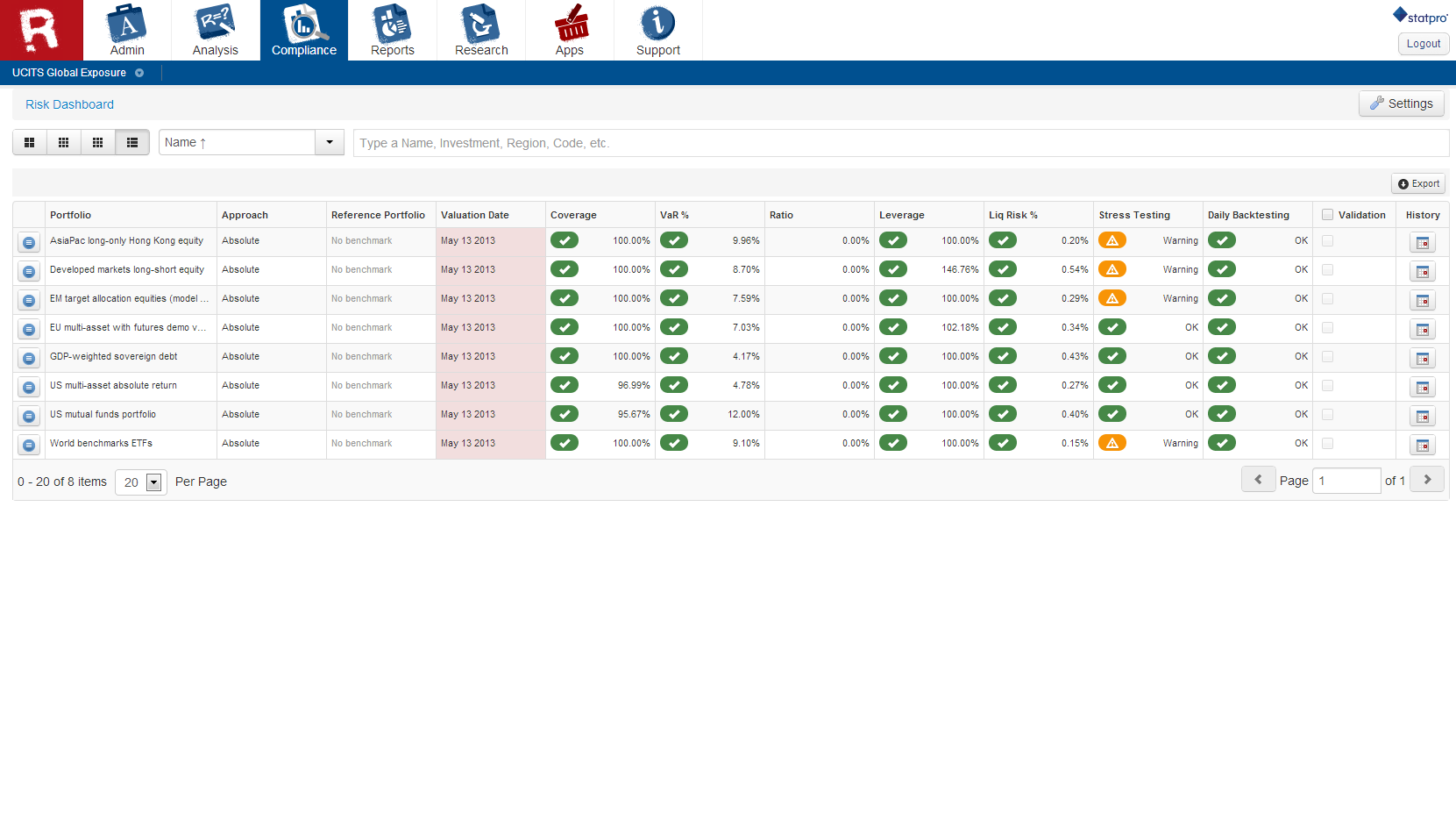

UCITS IV Global Exposure and Liquidity Monitoring module: allows you to oversee the risk and exposure of selected portfolios for compliance with the UCITS IV regulation. Limits can be set for monitoring and a traffic light approach is used to identify early warnings and breaches.

Find out more about the UCITS IV Global Exposure and Liquidity Monitoring module at our Product Briefing.

Dual-listed stocks: StatPro Revolution can now upload and recognize multiple listings of the same stock. Users can map a specific listing using one of the market identifiers (ISIN, Sedol, ticker etc.) or change the listing of an existing security in portfolio holdings. StatPro Revolution will even keep different listings of the same stock separate or aggregated, depending on the context of the analysis. For example different listings of the same stock will be separate when analyzing the portfolio by country or currency, but they will be aggregated when the portfolio is broken down by GICS sector. The same behavior will be displayed by StatPro Revolution reports.

Fixed income attribution enhancement: the interbank yield curve used to be the default for calculating spread and curve effects. This release gives users the option to select either the interbank curve or the government bond curve. The overall fixed income return and contribution will remain the same regardless, but spread and curve effects will differ depending on the curve selection.

Two new fixed income classifiers: Issuer Primary Sector and Issuer Secondary Sector break down the bonds into categories such as Sovereign, Utility, Public, Agency etc.

New risk setting: previously the time frame used by Historical VaR calculation was by default set to two years. With the new setting, users can select two or one years.

Log in now to see these new features.