We are excited to bring you the final part of the advanced portfolio sharing and user management functionality as well as a brand new UCITS/AIF Commitment Leverage calculation module.

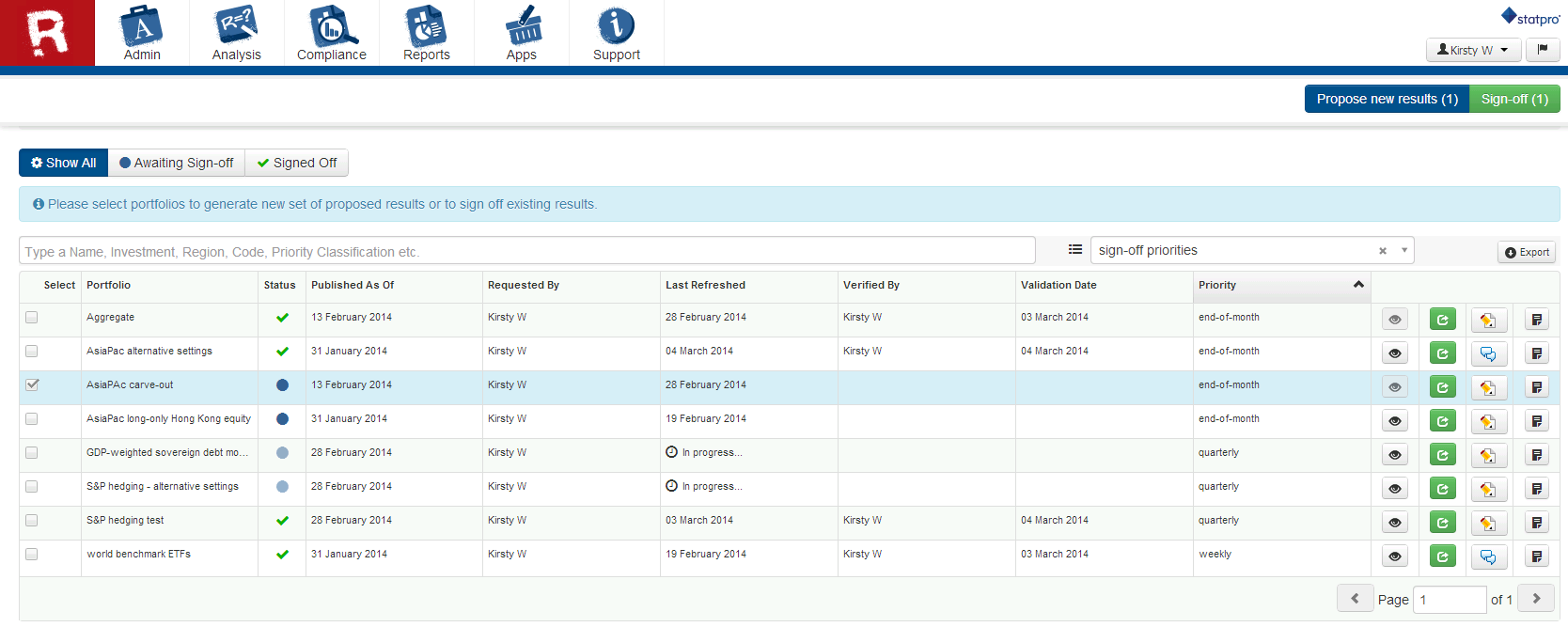

Delayed sharing and results sign-off

Results sign-off marks the completion of portfolio sharing and advanced roles management workflow within StatPro Revolution. Authorized users now have the ability to manage access permissions, invite external people to access StatPro Revolution and see shared portfolios, as well as validate and sign-off portfolio results within selected time frames.

This means any user of StatPro Revolution who is authorized to share portfolios with other users but is not willing to expose the most recent results (e.g. data that hasn’t been checked or reconciled) will now be able to share portfolios with a pre-set end date e.g. ‘end of last month’ or ‘end of the year’.

This will give you the confidence and flexibility in your communications to clients while maintaining full control over your portfolio results.

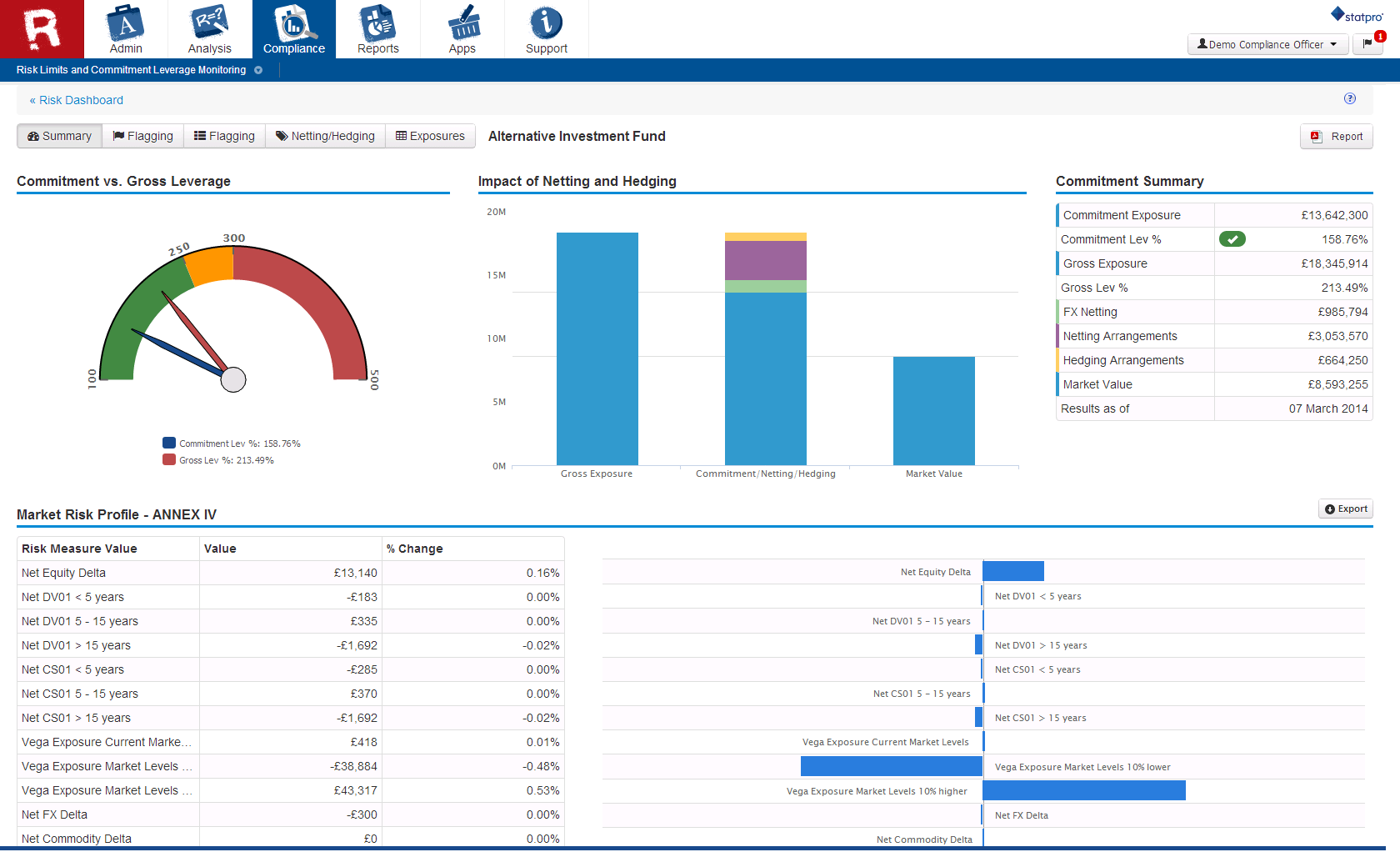

Risk Limits and Commitment Leverage Monitoring for UCITS and AIF

The AIFMD introduces an EU-wide harmonized framework for monitoring and supervising risks posed by AIFMs and the AIFs they manage. Ahead of the directive implementation deadline set out in AIFMD for mid-2014, we are introducing a Commitment Leverage calculation module for UCITS and AIF (in addition to the existing VaR Approach).

This cost-effective solution will dramatically reduce and streamline your everyday compliance workload.

Read: New Insights for Asset Managers: How Technology Can Drive the Most Effective Middle Offices

While computing the Gross and Commitment Leverage, the module also provides you with 100% transparency both in your exposure calculations, as well as with Commitment, Netting. Hedging, FX Netting and Exclusion flags, avoiding the “black-box” approach which the regulator is opposed to.

The Risk Limits and Commitment Leverage Monitoring additionally generates a number of inputs into market risk profile as per Annex IV report template of the regulator’s guidelines.

Log in now to benefit from these new features.