We’ve made some great additions and enhancements to StatPro Revolution.

Take a look at the StatPro Revolution App Store, our stock-level equity attribution report and all the other fantastic new features we’ve outlined below.

Attribution by strategy: Segment securities by the strategy to which they belong, so that a security that appears in separate strategies is not merged into one holding.

Index carve-outs: In addition to existing portfolio carve-outs, users can now make carve-outs of constituent level indices. This functionality allows custom segment indices for portfolios focused on a specific sector or country.

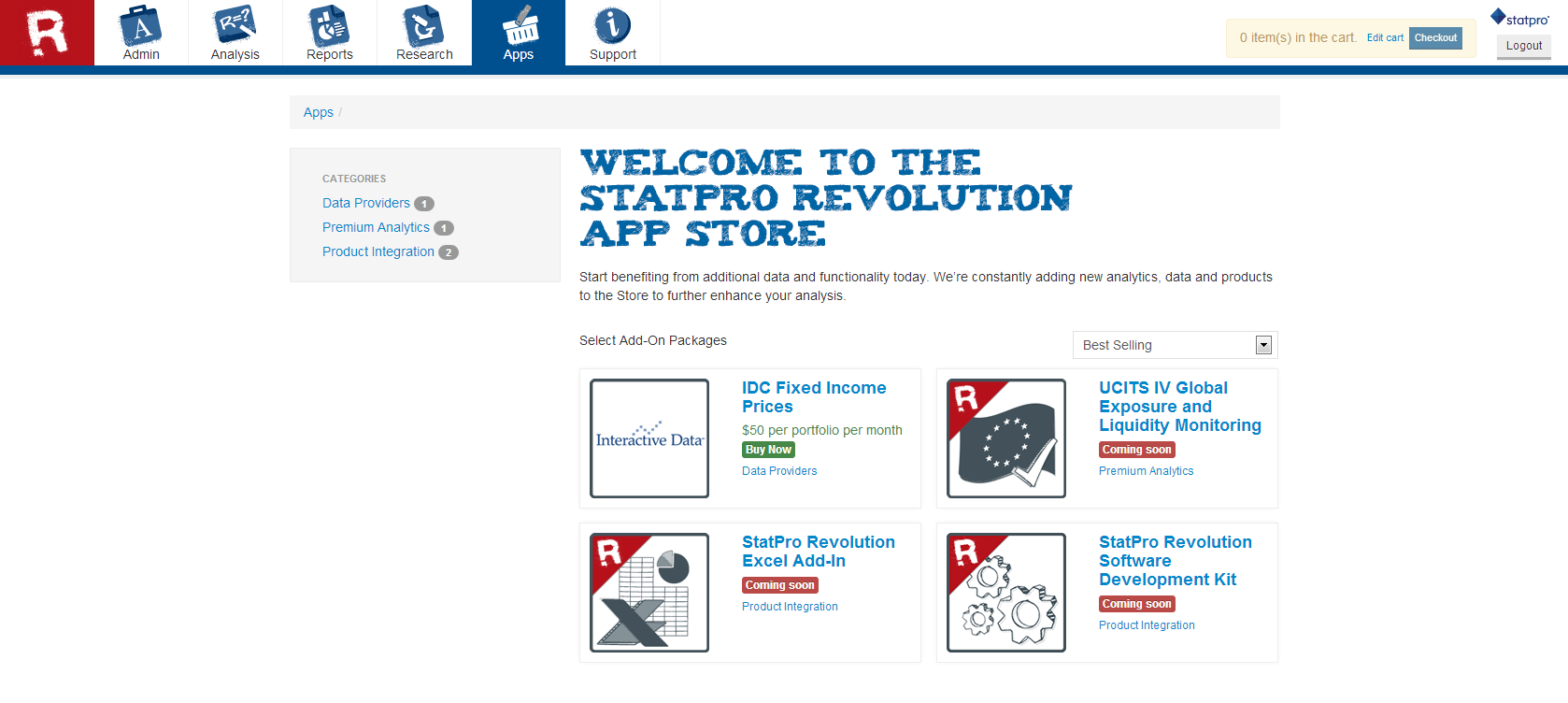

StatPro Revolution App Store: Today, developers and 3rd party data providers can offer their products to users within StatPro Revolution. This month we’re introducing Interactive Data (IDC) prices for fixed income securities. One of IDC’s many services is bond pricing and valuation. IDC prices are now available for bonds in StatPro Revolution portfolios on a paid subscription basis.

Parallel and non-parallel effects in fixed income attribution: We’re making enhancements to our fixed income attribution methodology by replacing three existing curve effects (twist, butterfly and shift) with two more straightforward ones (parallel and non-parallel). Roll-down remains unchanged.

Automatic cash adjustments: When manually making trades using the add transaction option in portfolio holdings, you now have the option to automatically reconcile it with your cash position. This option will be particularly useful for holders of smaller, more passively managed portfolios.

Stock-level equity attribution report: In January we added a new stock-level attribution analysis dashboard, this month we’re adding a specialized report to go with it. That raises the total number of reports available in StatPro Revolution to 25.

Currency-converted portfolios: Analyze the same portfolio in different currencies so that it’s converted to US$ for your American clients and converted to EUR for your European clients without the need to re-upload or clone it. The currency-converted portfolio will remain permanently linked to its “parent” and will automatically reflect all the changes made to it.

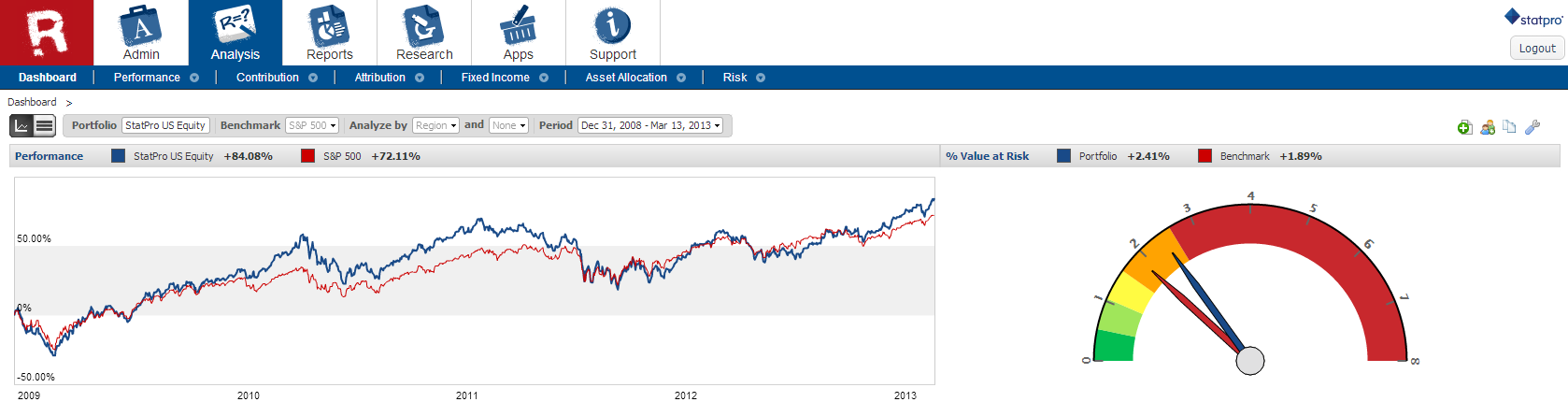

Benchmark VaR: Starting this month, StatPro Revolution will calculate % VaR for syst

em benchmarks and display it in the main analysis dashboard.