Our 50th release includes a host of useful features and functions from increased coverage to new portfolio types and an intuitive portfolio summary page. We’re excited to share what’s new:

Options and OTC derivatives: November’s release marks the inclusion of options and OTC derivatives coverage. Firstly, StatPro Revolution will cover Equity options, Index options, FX options, IRSs and CDSs, with more derivative types coming soon.

New visual portfolio picker: In addition to the existing list view, we have introduced a great visual portfolio picker, showing your portfolios as tiles, color-coded by a measure of your choice (e.g. return, total assets, VaR). This simple new tool will give you an instant snapshot of all your portfolios.

Model portfolios: In addition to holdings and weights & returns, upload types already available in StatPro Revolution, you can now create model portfolios with holdings expressed as a % of the pre-defined market value (e.g. USD 100,000,000). Instrument weights can “drift”, based on their performance, or rebalance at specified intervals. Model portfolios can be used to demonstrate hypothetic segment allocation and instrument selection, or serve as benchmarks for other portfolios.

Carve-outs: In response to customer demand we have added carve-outs to the list of available portfolio types. You can now isolate a chosen segment of your portfolio such as all bonds, all equities in the IT sector, or all assets denominated in EUR and analyze it thoroughly as a separate, stand-alone portfolio. You can also analyze your entire portfolio excluding the selected segment (e.g. all equities ex-IT sector, all instruments ex-bonds etc).

Read: New Insights for Asset Managers: How Technology Can Drive the Most Effective Middle Offices

Broad and Global Asset Class classifications: A blend of equity, fund and derivatives classifiers ideal for multi-asset portfolios, these two new classifications will recognize the holdings of the funds, the underlyings of the derivatives, and break them down accordingly, so that a fund investing in stocks will be assigned to Equity category, while a commodity future will be assigned to Commodity. All classifications existing in StatPro Revolution presently remain unchanged, so if you want all your funds in Funds category, and all your futures in Derivatives, you will still be able to do this.

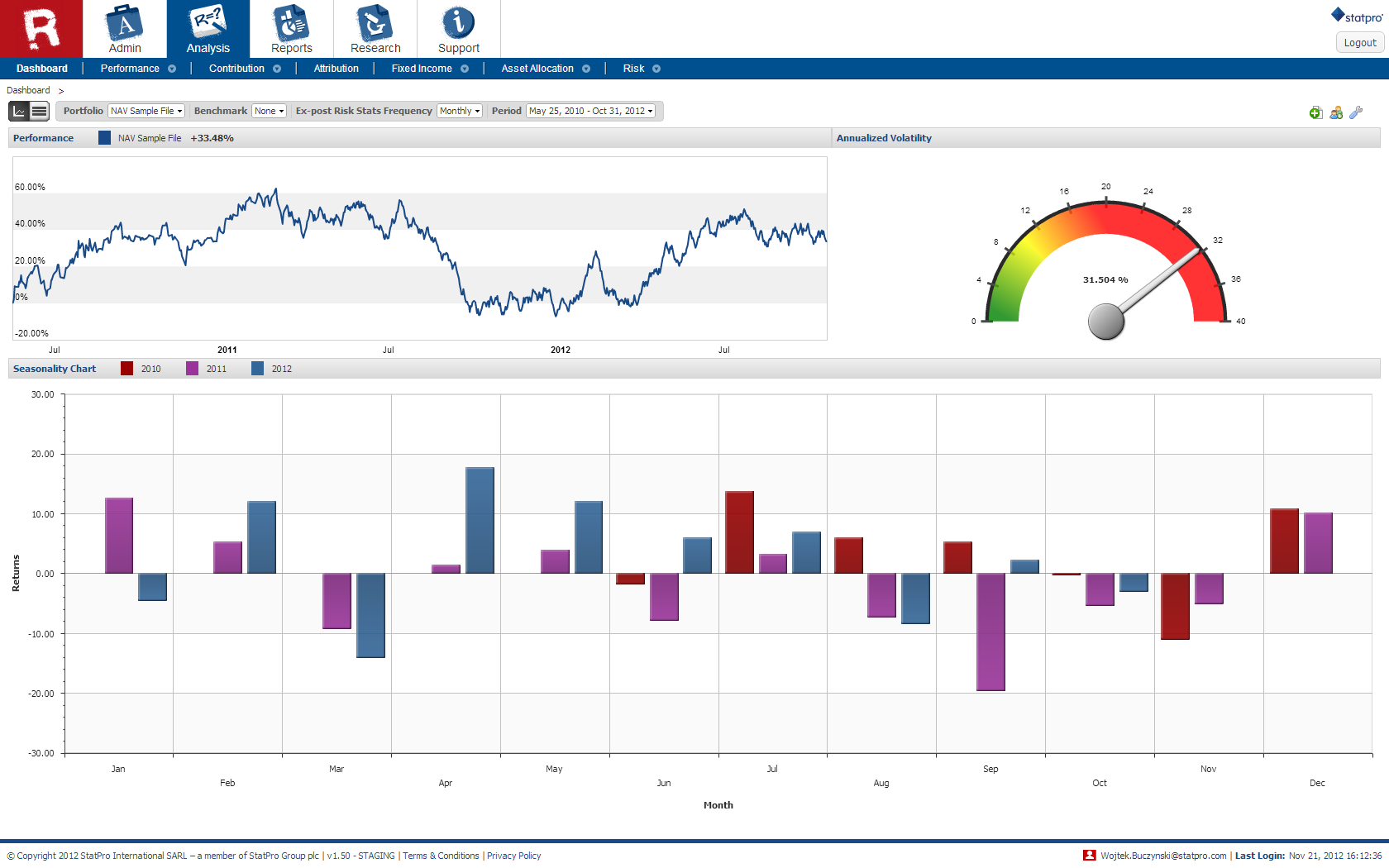

Improved dashboards for NAV-only portfolios: We have optimized the performance dashboards for NAV-only portfolios to display graphs and analysis applicable to this portfolio type only.

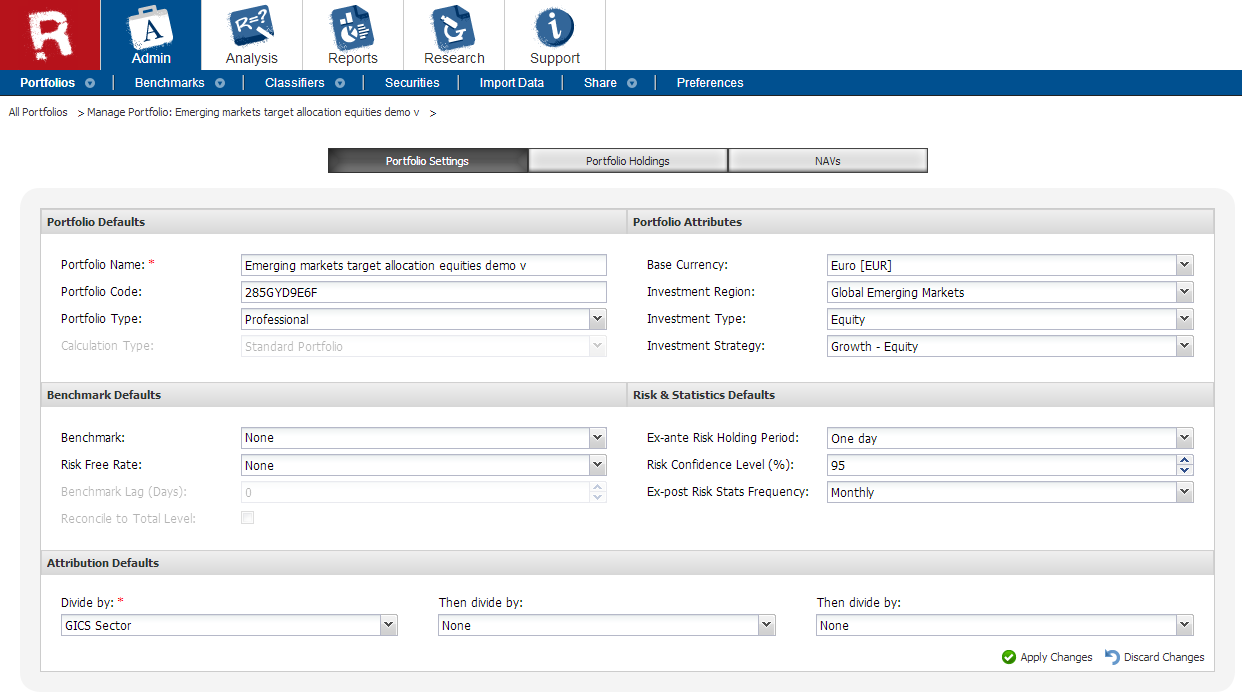

Portfolio attributes: We have enhanced and redesigned the Portfolio Settings page, allowing you to select more attributes of your portfolio. Choose from billing type, portfolio type, portfolio asset class, investment strategy etc. These new attributes will add more transparency to the management of your portfolios.

Log in now to see these new features.