Risk Analytics

Risk

Fast and flexible risk reporting with extended asset class coverage to enable a more transparent illustration of risk exposure and value at risk.

Better risk reporting

Risk is an integral part of generating returns. Managing and reporting your portfolio risk is critical for ensuring client and regulatory confidence in your investment strategy and internal risk management process.

Complete transparency

Scalable and flexible risk reporting

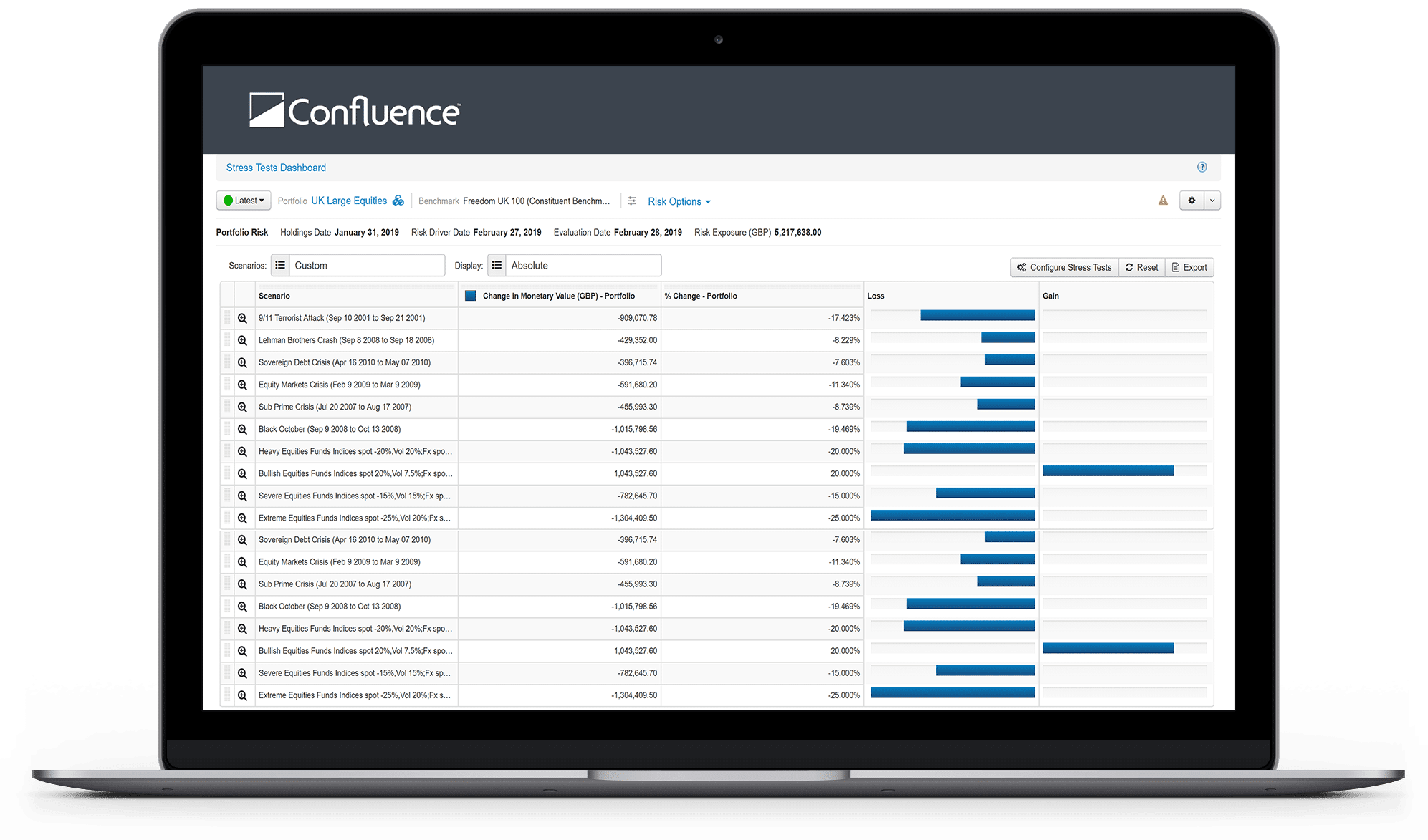

Powered by the cloud and a stateless API, Revolution provides fast and flexible risk reporting with extended asset class coverage to enable a more transparent illustration of the portfolios risk profile, both in absolute and relative terms. The multi-asset class risk model covers hundreds of pricing functions, ranging from plain vanilla instruments to exotic derivatives.

Sophisticated risk analytics

Mitigate and reduce risk as demand grows

Comprehensive risk assessment solution that includes the simulation of changes in risk, stress and liquidity profile upon variations in your portfolio allocation. Supporting industry-standard risk methodologies from value at risk modeling (with and without exponential weighting), stress test and what-if analysis, as well as multi-factor risk modeling, mitigating the risk of your entire organization.

Robust risk driver decomposition

Enhanced transparency

Understand the sources of risk and actively manage them with an award-winning risk driver decomposition analysis tool, that allows you to analyze the exposure of all the drivers underlying your risk analytics, from interest rates to credit spreads, fx rates to equity volatilities, and much more.

Equity Fundamental Factor Model

Intuitive and easy to understand

Implement comprehensive equity risk analysis including trend analysis of all portfolio and risk factors, and provide results on the state-of-the-art Revolution web interface, through data feeds and in board-quality PDF reports.

Risk Analytics

Find out more

Risk Analytics

Find Out More

Additional

Resources

Download

Factsheet

Request

a Demo

Contact

Confluence

Additional

Resources

Crisis Alpha

Liquidity Shortfalls and Record-High Market Volatility Call for More Stringent Stress Testing, Monitoring and Reporting

Market Liquidity Risk: A Scenario Based Approach

Download

Factsheet

Complete the form to get started

Request a

Demo

Complete the form to get started

For enquiries

Contact Confluence

Complete the form to get started

What We Do

Data-Driven Solutions

We are a global leader in data-driven investment management solutions, partnering with our clients to deliver products and services designed to optimize efficiency and control.