Multi-Asset Risk

Risk

Fully-fledged multi-asset risk improving the transparency, consistency and repeatability of the investment and risk process.

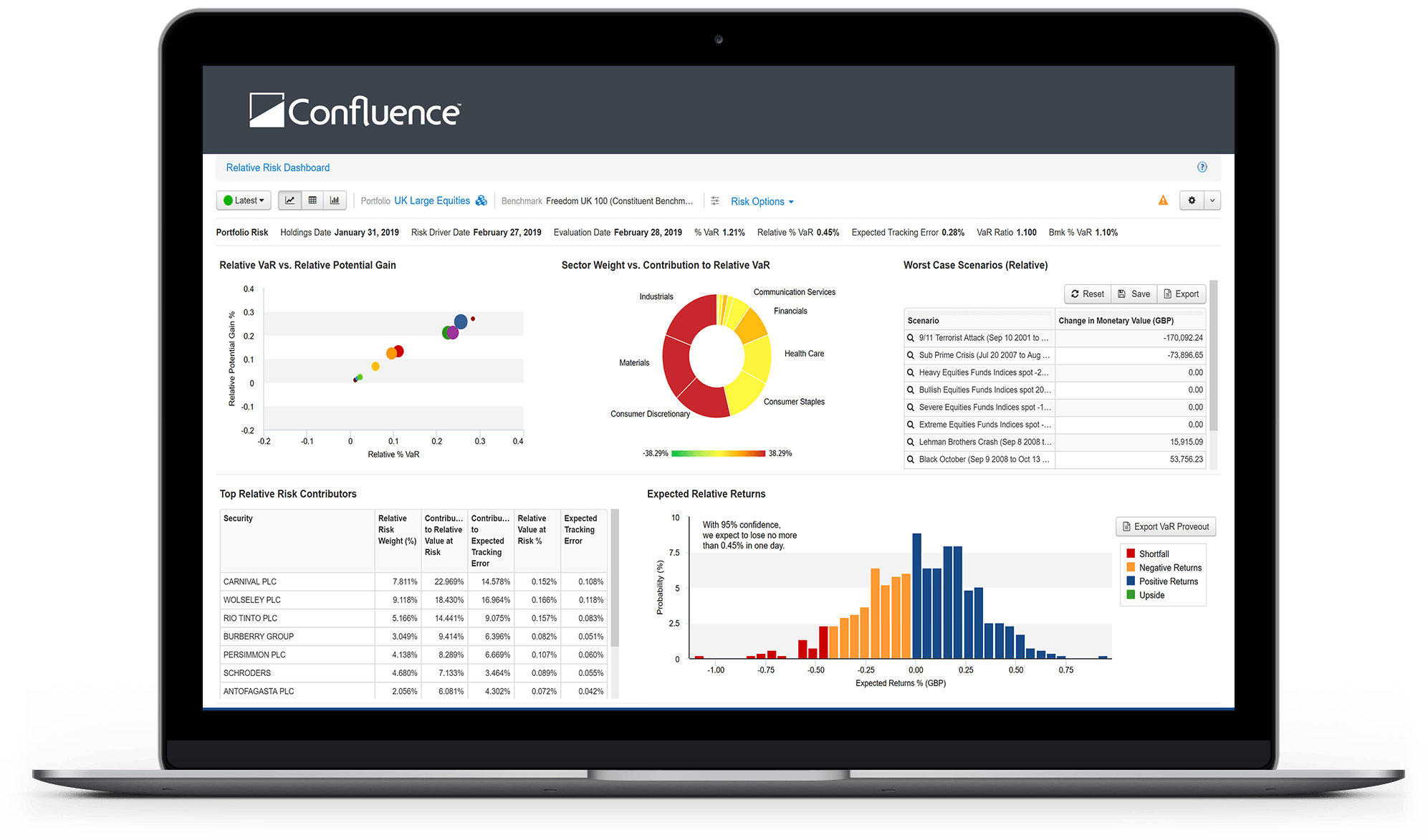

Transparent, consistent and reliable risk

Increase AUM with better internal and external communication with institutional clients and flexible reporting to improve the transparency, consistency and repeatability of the investment and risk process.

Market risk engine

Flexible risk framework

Truly cross-asset risk solutions that allow you to model and simulate returns of equity, fixed income, derivatives, unlisted and private assets, on the same platform under a common risk framework.

With a flexible risk framework, you can calibrate and parametrize the risk engine to match your portfolios investment strategies. Simulate asset returns based on observed market movements or use a factor approach. Visualize ‘fat-tails’ and non-normality.

Manage your cashflows driven investment strategies with advanced analytical capabilities

Tailored, comprehensive solution

Implement cashflows driven investment strategies and easily project the liabilities, monitor the surplus/deficit of the schemes and manage the market risk sensitivities of both the assets and liabilities.

Leverage best-of-breed data set, including proprietary interest rates and inflation curves to model the liabilities. Implement and monitor interest rates and inflation overlays though a set of dedicated modules.

Effective multi-asset ESG risk analysis of products and mandates

ESG Ratings and Reporting

Mitigate risk and implement an ESG Ratings and Scores approach your investments to ensure compliance with legislations.

Make informed decisions by analyzing the relationship between ESG and market risk, evaluate the risk-adjusted return implications of applying ESG constraints and easily produce accurate reporting, or monitor ESG-related risk signals.

ESG portfolio reporting

Integrate your data

Mitigate risk and improve returns by utilizing combined portfolio ESG ratings, corporates and government exposure, ensuring continuity across your investment strategy.

Multi-Asset Risk

Find out more

Multi-Asset Risk

Find Out More

Additional

Resources

Download

Factsheet

Request

a Demo

Contact

Confluence

Additional

Resources

Crisis Alpha

Liquidity Shortfalls and Record-High Market Volatility Call for More Stringent Stress Testing, Monitoring and Reporting

Market Liquidity Risk: A Scenario Based Approach

Download

Factsheet

Complete the form to get started

Request a

Demo

Complete the form to get started

For enquiries

Contact Confluence

Complete the form to get started

What We Do

Data-Driven Solutions

We are a global leader in data-driven investment management solutions, partnering with our clients to deliver products and services designed to optimize efficiency and control.