Regulatory Reporting

Regulatory

Reduce cost, maintain compliance, and automate the regulatory reporting process.

On-demand transparency and regulatory reporting

Meet regulator and client demands with automated creation of both required and customized reporting templates to manage portfolios and remain compliant with regulatory reporting mandates. Reduce cost, maintain compliance and increase efficiency within the regulatory reporting process across reports, geographic location and regulatory authority with one automated end-to-end system.

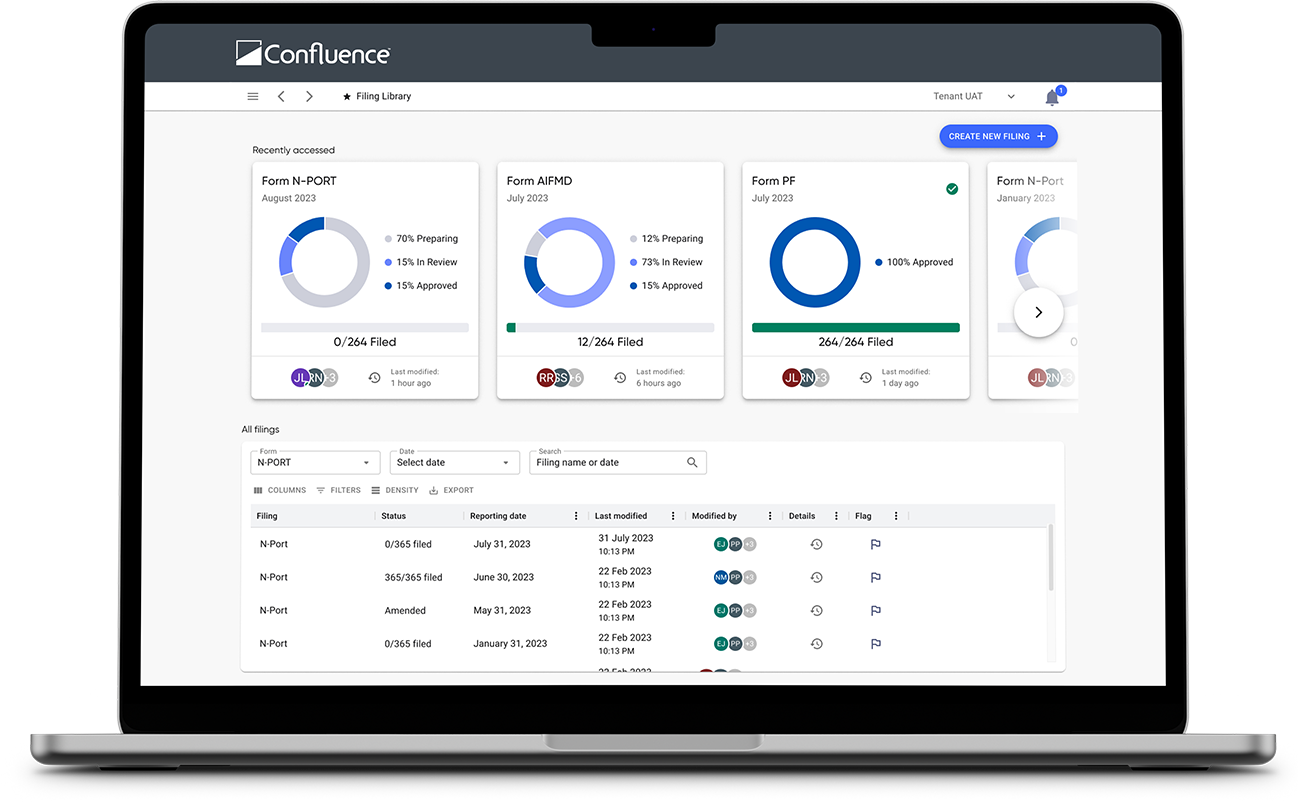

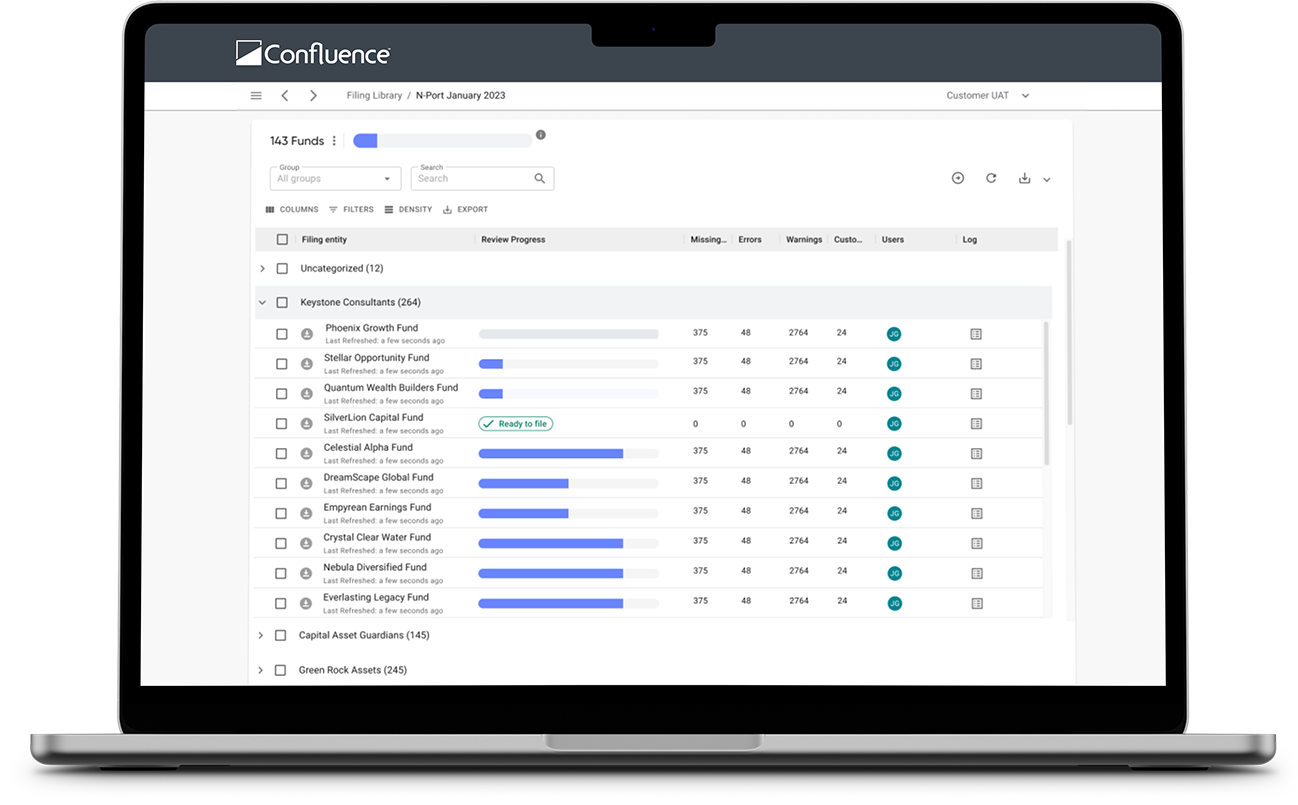

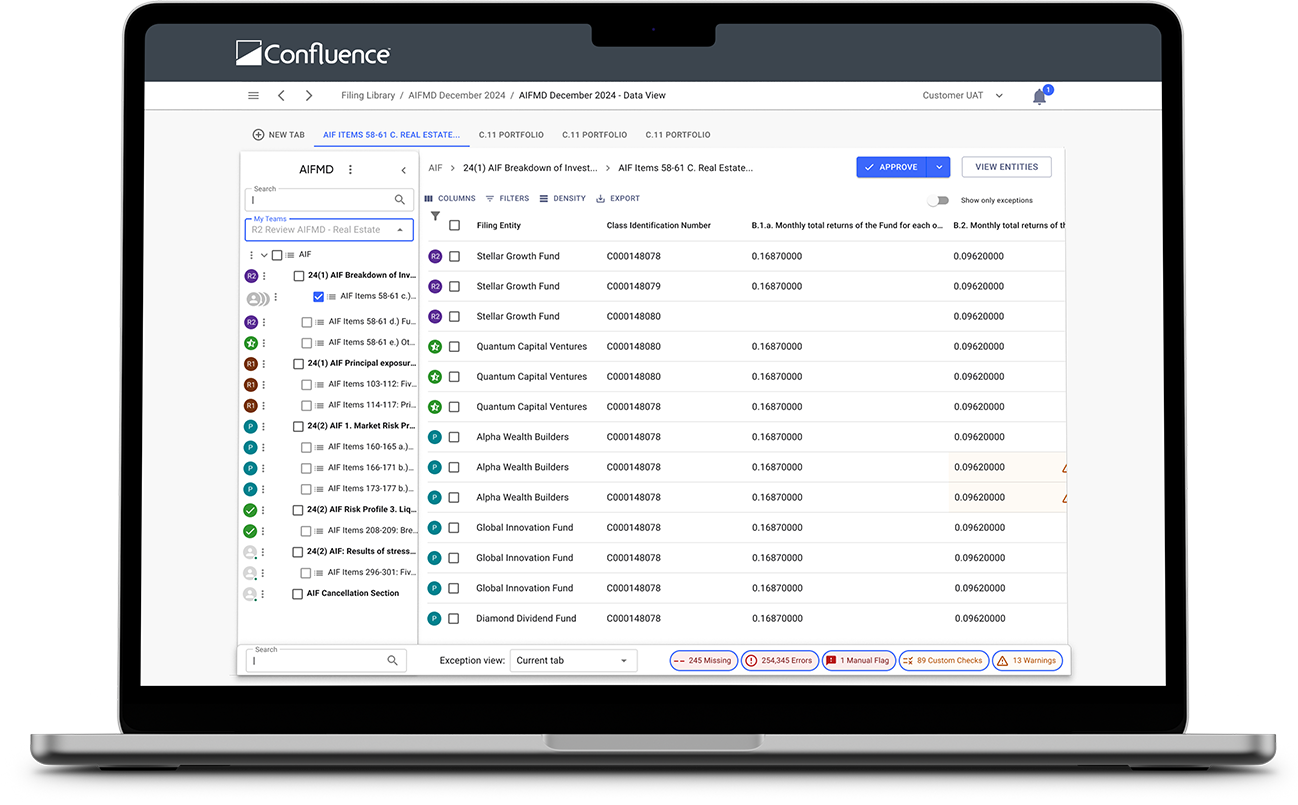

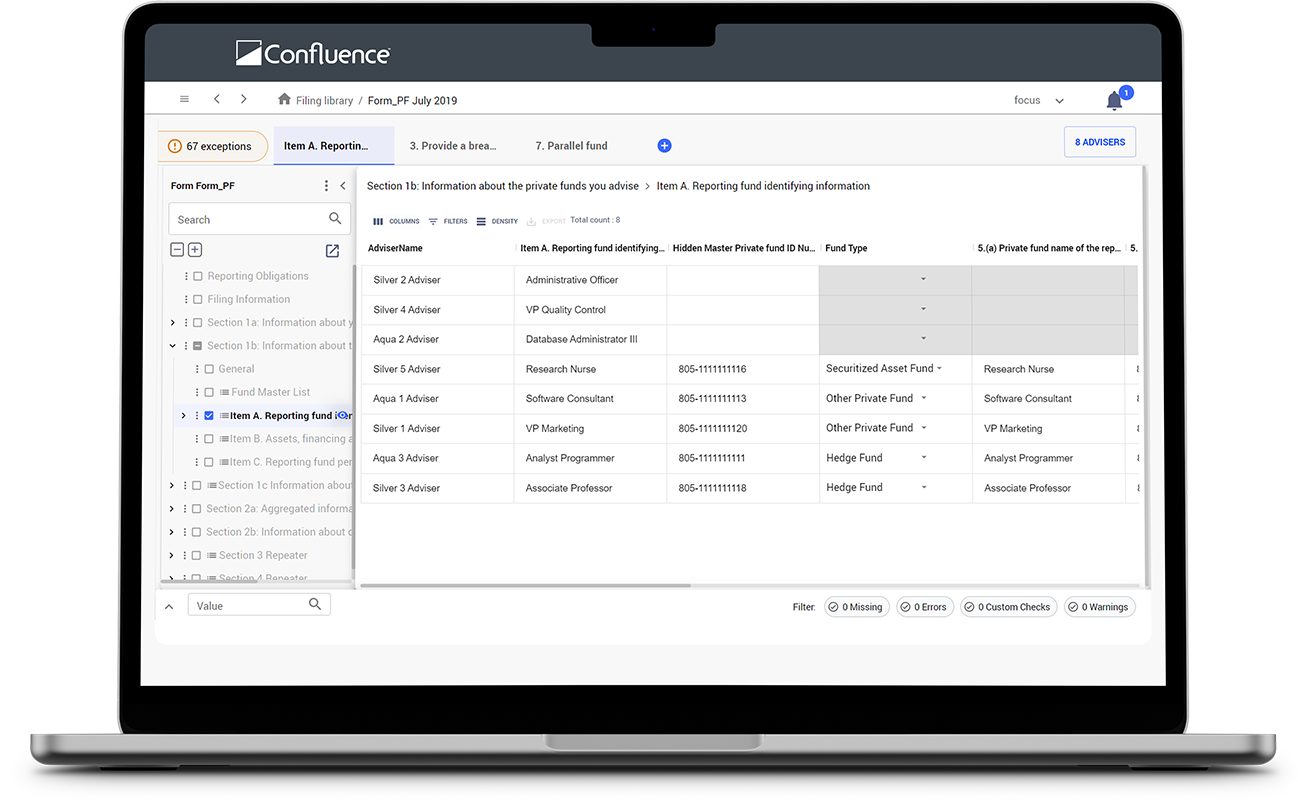

NextGen Regulatory Reporting

Transform regulatory reporting with a solution built for speed, accuracy, and efficiency. Omnia is a reliable and scalable solution to global regulatory reporting challenges; providing flexibility across the filing lifecycle, from automation of complex data integration needs to flexible filing views and workflow management.

Omnia’s cloud-based delivery enables availability and agile deployment of new or updated forms, helping users to keep up with the pace of regulatory change.

Rapid Response to Regulatory Change

Adaptable regulatory reporting platform

With compressed timelines and frequently changing regulatory mandates, minimize disruption and easily accommodate and deliver reporting to clients and governing bodies. Omnia empowers you to manage regulatory reporting while reducing cost and complexity with an end-to-end filing solution that’s more efficient, accurate, and compliant.

Managed Services

Augment Your Team with Expertise and Efficiency

While our technology brings superior automation and user experience to your team, you also have the option to embed our experts into your day-to-day reporting processes. In our Managed Services delivery model, experts from our Regulatory Reporting Center of Excellence drive source data integration, filing preparation and filing review – freeing your team to focus on secondary review and other value-added tasks. Leverage our scale and expertise to reduce cost and increase efficiency.

Reduce Costs and Increase Efficiency

Omnia: One Solution Checks Every Box

- Automated data and filing preparation

- Cost efficiency and economies of scale

- Customizable filing views

- Flexible filing reviews

- Workflow process management

- Accuracy and completeness

- Managed Services outsourcing

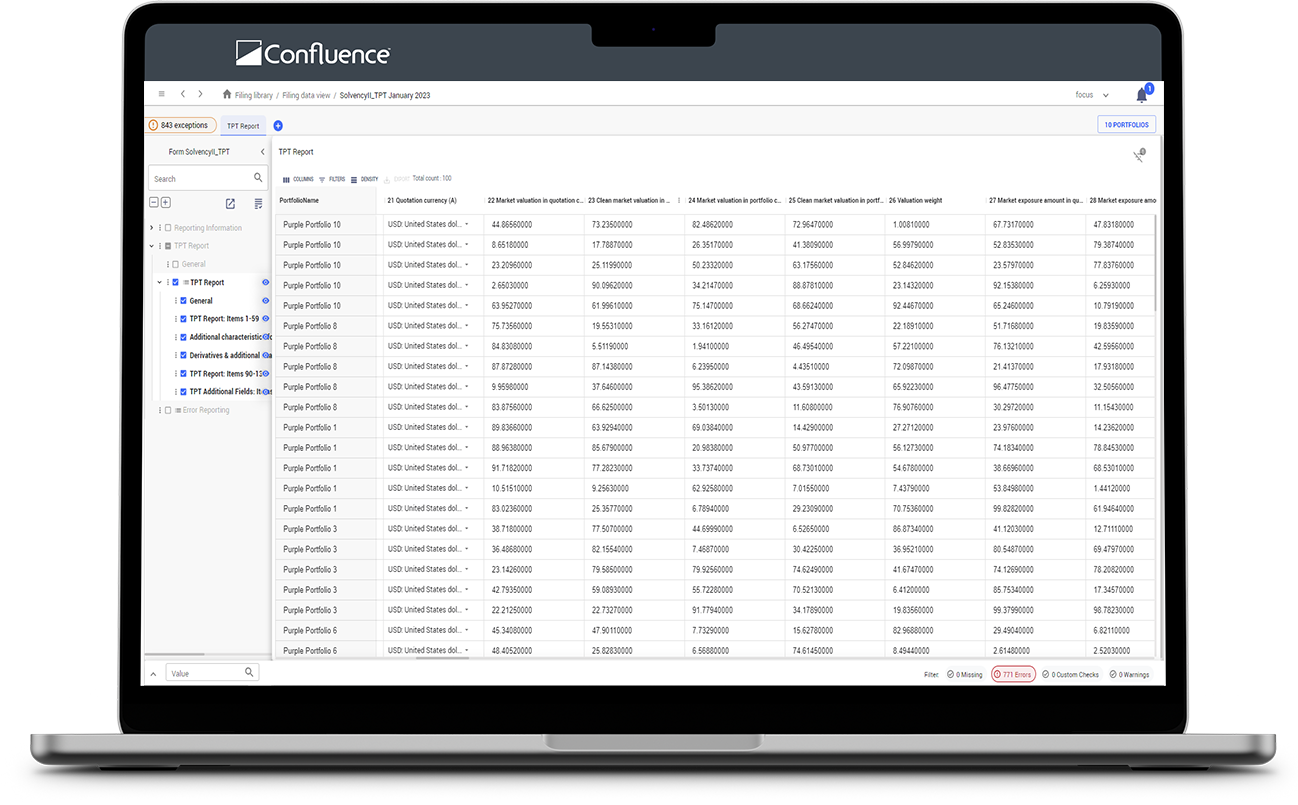

Solvency II Reporting

Produce Solvency II reports and integrate Solvency Capital Requirements (SCR) calculations into portfolio construction transparent data and analytics reporting.

Report Production for Directive and Institutional Clients

Automated workflow functionality

From data upload to delivery of reports, this end-to-end automated solution makes TPT, QRT and SCR reports directly available. SCR calculations, based on the EIOPA standard formula, with a full set of customization options is available – including exclusion of concentration SCR, application of transitional equity shocks to the full portfolio or just a subset, aggregation and decomposition of the sub-SCR for any category.

Our solution offers full transparency

of the results and calculations, availability of the sub-SCR at the position’s levels and detailed available calculations.

Manage Solvency II Investment Implications

360-degree view of your portfolio

SCR calculations, along with a wide range of analytics provide you with a 360-degree view of your portfolio from a risk, performance and capital charges perspective. Advanced analytical libraries offer integration of Solvency II capital charges into portfolio construction, while decomposition of the sub-SCR alongside risk factors monitor the cost implication of the investments.

Customized Regulatory Reporting

Leverage your regulatory reporting data by delivering customized reports to additional stakeholders. Create customized reports in multiple output formats with access to more than 900 measures and make use of pre-calculated results for greater speed or on-the-fly calculations for enhanced flexibility.

Create Unique Reports

Flexible objects-oriented report designer

Client needs often vary from the strict regulator formatting requirements, and now you can better meet those needs and augment the value of regulatory reporting data with custom-formatted reporting. The flexible and intuitive objects-oriented report designer allows you to select measures and format them to create unique reports specific to your needs for instant or batch reporting. Save your report definitions as templates to make automated custom reporting simple and easy.

Meet Evolving Reporting Mandates

Remain compliant and manage risk

Assist your fund management clients to maintain compliance and effectively manage risk. Meet evolving reporting requirements and boost the production of flexible and cost-effective solutions for global reporting, investment restrictions and liquidation strategies.

Consolidated Regulatory Reporting Data

A comprehensive data management and reporting framework specifically designed to help investment managers control, maintain, reconcile and disseminate their data to meet their regulatory obligations.

Compliance Agility and Adaptable Reporting

Automate data file collection and preparation

Transparency is paramount for regulatory reporting and calls for superior data management tools, as you manage assets and are required to provide not just the underlying portfolio data, but all of the data necessary to demonstrate regulatory compliance.

Scalable Reporting

Architecture that scales to support growth

Increase your efficiency and reliability by automating the entire regulatory reporting process from data take on, data management all the way up to report generation and dissemination, the solution scales effortlessly as your regulatory reporting requirements grows.

Regulatory Reporting Supported Forms

N-CEN, N-PORT, N-LIQUID | N-MFP, MMFR | FORM PF, AIFMD, CPO-PQR | 13F, FORM ADV | CSSF, BCL, SNB QTRLY | MONTHLY NAV, DAILY MFF, MMIF, MMM, NON-IRISH QTRLY, SPV | Solvency II TPT, Solvency II QRTs S.06.02, S.06.03, S.08.01, S.08.02, S.09.02, S.10.01, S.11.01 | SRS 550.0 – Asset Allocation, Portfolio Holdings Disclosure

Regulatory Package |

Description |

Form |

Region |

Domicile/Regulator |

|---|---|---|---|---|

| SEC Modernization | Comprehensive solution for complex monthly and annual fund reporting, and liquidity event reporting. | N-CEN | US/NA | SEC |

| N-PORT | US/NA | SEC | ||

| N-LIQUID | US/NA | SEC | ||

| Money Market Reporting | Periodic holdings-level reporting for US and EU Money Market Funds. | N-MFP | US/NA | SEC |

| MMFR | EMEA | ESMA | ||

| Alternatives | Periodic reporting for US and EU Private, Commodity and Alternative Investment Funds. | Form PF | US/NA | SEC |

| AIFMD | EMEA | ESMA | ||

| CPO-PQR | US/NA | Nntl. Futures Assn. | ||

| Adviser Reporting | Investment adviser registration and shareholding disclosures. | 13F | US/NA | SEC |

| European Administrator Statistical | Periodic statistical balance sheet, holdings and valuations reporting from Luxembourg and Swiss regulators. | CSSF U1.1 | EMEA | CSSF |

| BCL S1.3 | EMEA | BCL | ||

| BCL S.16 | EMEA | BCL | ||

| BCL S2.13 | EMEA | BCL | ||

| BCL TPTOBS | EMEA | BCL | ||

| BCL S2.14 | EMEA | BCL | ||

| BCL S2.15 | EMEA | BCL | ||

| BCL TPTTBS | EMEA | BCL | ||

| BCL S2.16 | EMEA | BCL | ||

| BCL S2.17 | EMEA | BCL | ||

| BCL TPTIBS | EMEA | BCL | ||

| SNB Qtrly | EMEA | Swiss National Bank | ||

| Central Bank of Ireland | Periodic Central Bank reporting for Irish and non-Irish Funds and special purpose vehicles selling into Ireland. | Monthly NAV | EMEA | CBI |

| Daily MFF | EMEA | CBI | ||

| MMIF | EMEA | CBI | ||

| MMM | EMEA | CBI | ||

| Non-Irish Qtrly | EMEA | CBI | ||

| SPV/FVC | EMEA | CBI | ||

| Institutional Reporting | Periodic transparency reporting for funds to their institutional clients, to support the risk monitoring and reporting requirements of those clients. | Solvency II TPT | EMEA | EIOPA |

| Solvency II QRTs S.06.02, S.06.03, S.08.01, S.08.02, S.09.02, S.10.01, S.11.01 | EMEA | EIOPA | ||

| Australian Superannuation Reporting | Periodic prudential and investor reporting for Australian superannuation funds. | SRS 550.0 – Asset Allocation | APAC | APRA |

| Portfolio Holdings Disclosure | APAC | ASIC |

Regulatory Reporting

Find out more

Regulatory Reporting

Find Out More

Additional

Resources

Download

Factsheet

Request

a Demo

Contact

Confluence

Additional

Resources

Preparing for PRIIPs KID: Key Considerations

Liquidity Shortfalls and Record-High Market Volatility Call for More Stringent Stress Testing, Monitoring and Reporting

Download

Factsheet

Complete the form to get started

Request a

Demo

Complete the form to get started

For enquiries

Contact Confluence

Complete the form to get started

What We Do

Data-Driven Solutions

We are a global leader in data-driven investment management solutions, partnering with our clients to deliver products and services designed to optimize efficiency and control.