Regulatory Compliance

Regulatory

Integrated analytics, flexible liquidity monitoring and reporting and regulatory compliance.

Regulatory compliance agility with orchestrated control

Integrated analytics, flexible liquidity monitoring and reporting and regulatory compliance from one comprehensive data-driven solution empowers your team to analyze, evaluate and respond quickly to market conditions and regulatory change.

Liquidity Stress Testing

With liquidity shortfalls and market volatility forcing regulators to enact stringent liquidity testing, monitoring and reporting, there is more scrutiny than ever on the liquidity management of funds.

Our seamlessly integrated solution for ESMA Liquidity Stress Testing (LST) and ESMA Money Market Fund Reporting (MMFR) helps you efficiently complete stress testing and regulatory filings using data load automation, built-in validations, customizable workflow and XML creation capabilities.

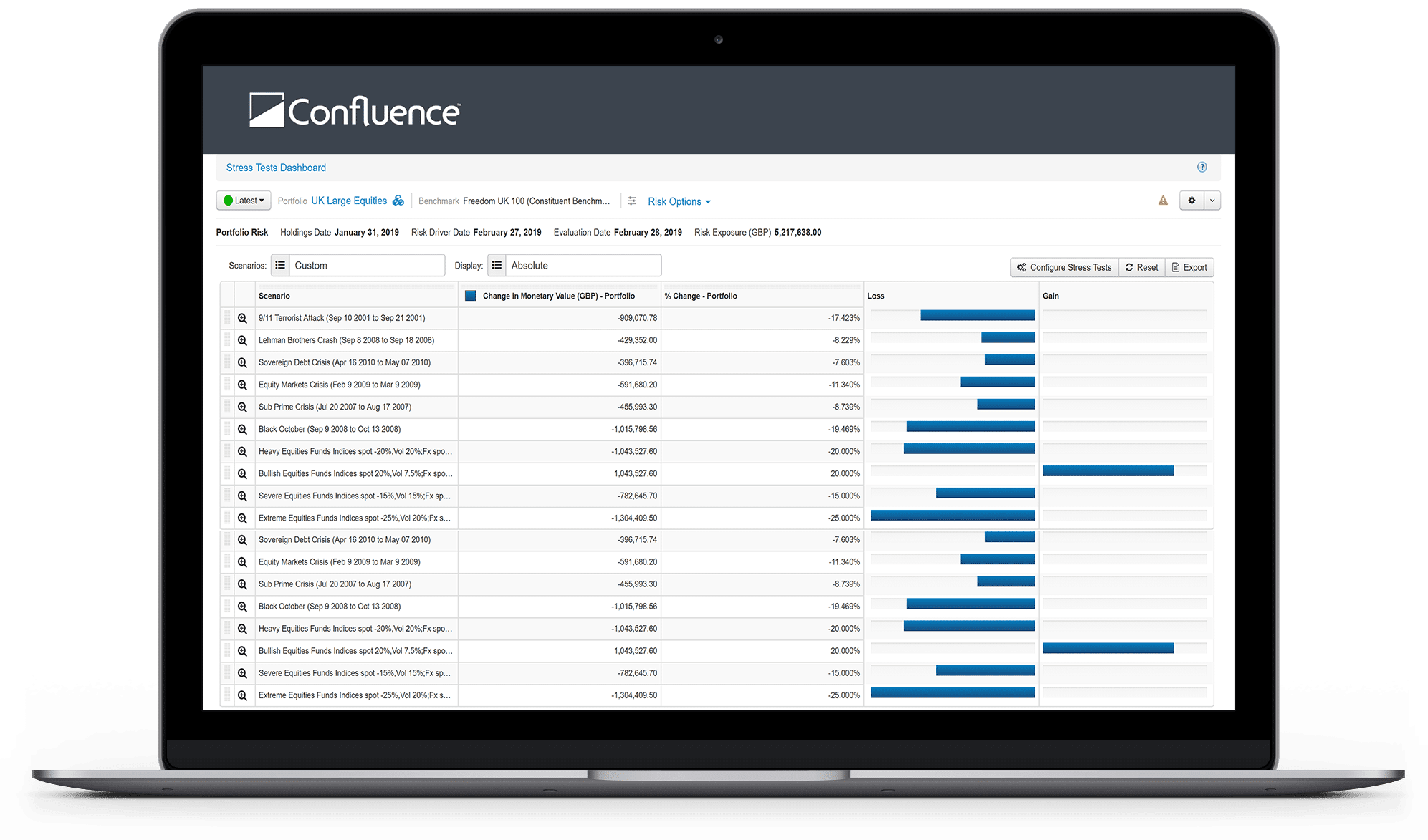

Quantify liquidity risk

Analyze liquidity risk across global market conditions

Our liquidity stress testing solution combines both quantitative and qualitative approaches to create a flexible but accurate representation of how the market handles liquidity. Fund managers can now monitor the liquidity cost across different market conditions, analyze time-to-liquidate trends, and simulate changes in the liquidity profile upon variations in your portfolio allocation.

Analyze Redemptions

Simulate liquidation strategies and monitor redemptions

Stress testing liquidity means analyzing not only the three dimensions of liquidity – costs, time and volumes – but also simulating the liquidation strategies and monitoring your funds’ resilience and redemption coverage capabilities to help you meet global reporting requirements, including ESMA LST and ESMA MMFR.

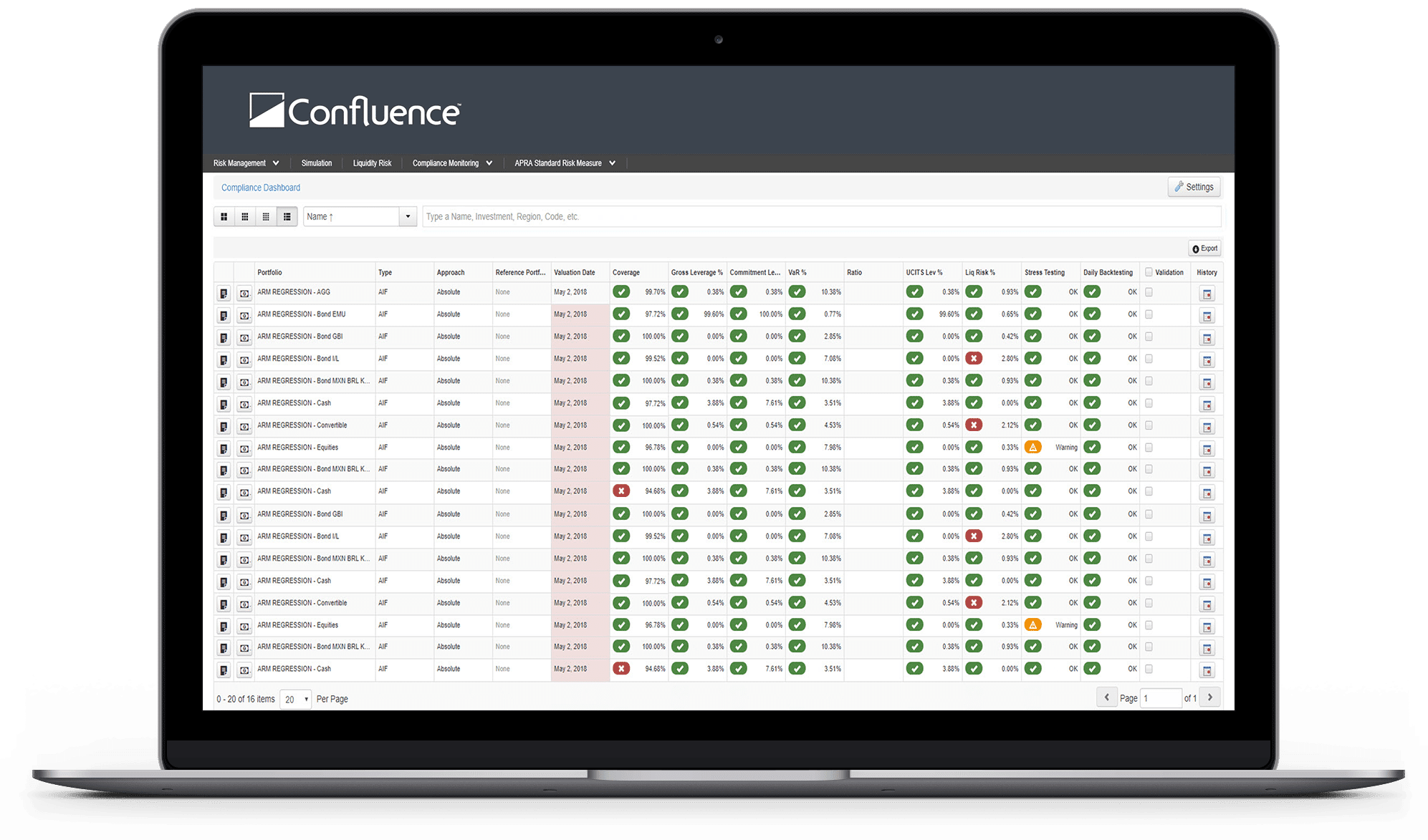

Regulatory Compliance

Responding to regulatory changes with agility and control and communicating risk intelligence to key stakeholders are critical aspects of a successful risk management reporting solution.

Revolution is an integrated scalable system that translates daily monitoring of risk into consumable numbers and advanced reporting, an essential component to your compliance intelligence and risk management strategy. Our broad support helps you comply with multiple global regulatory frameworks, whether you manage or service UCITS, alternatives, or SEC 40 Act funds.

Reduce Cost

Automate risk management and reporting

Remove legacy inefficiencies by digitizing your performance, risk and reporting requirements to save time and resources and provide higher-quality information to your business.

Respond Faster

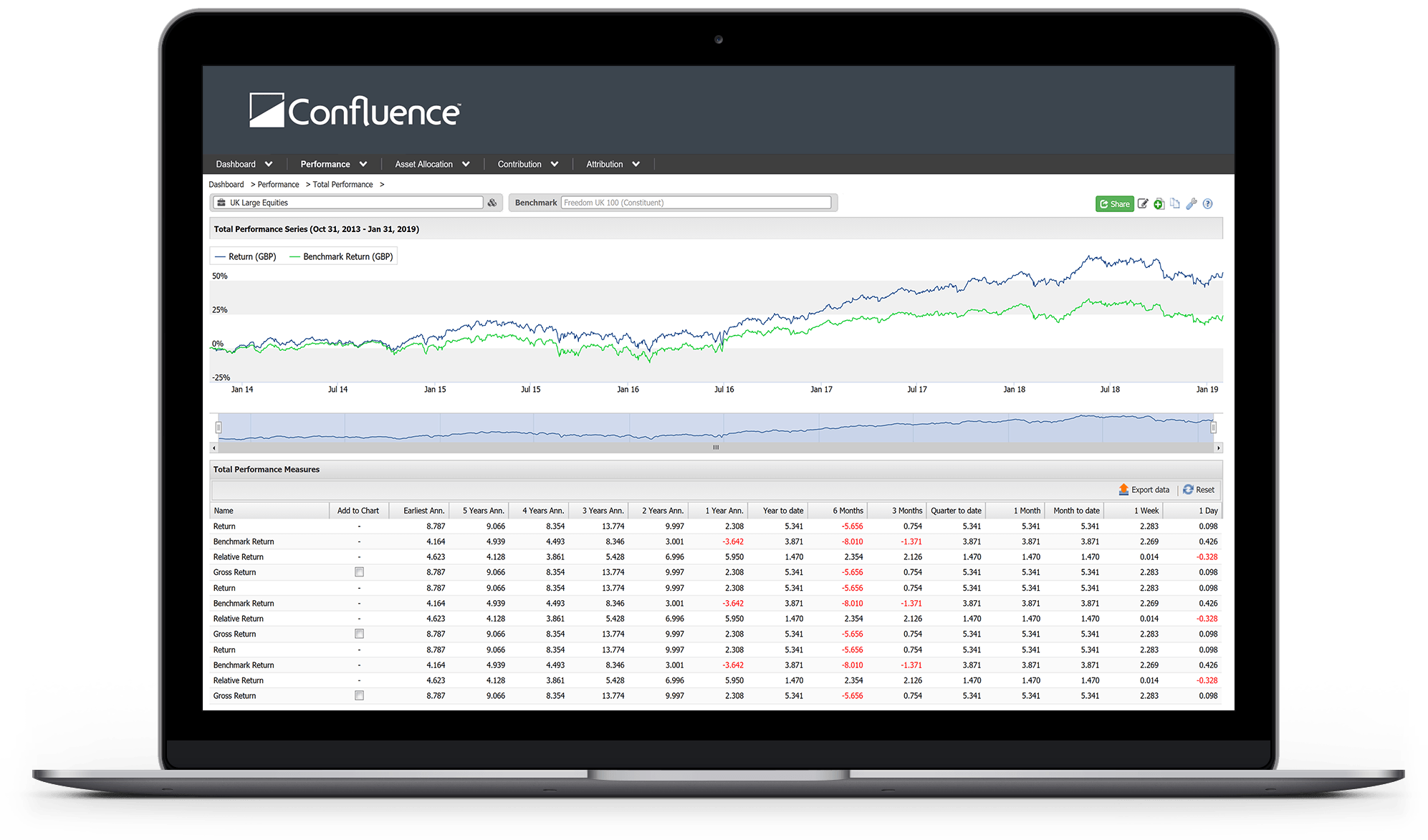

Provide on-demand visuals and transparent analysis

Answer ad-hoc questions quickly, provide granular and informed reporting and identify previously hidden trends without tedious, time-consuming, manual processes with the help of clear and user-friendly indicators.

Streamline analysis and reporting cycles

Centralized Content

By centralizing reporting content and management, analysis and reporting cycles are streamlined with an unlimited* number of users accessing the functionality and data they need, anytime from anywhere.

*Fair usage policy applies

Regulatory Compliance

Find out more

Regulatory Compliance

Find Out More

Additional

Resources

Download

Factsheet

Request

a Demo

Contact

Confluence

Additional

Resources

Preparing for PRIIPs KID: Key Considerations

Liquidity Shortfalls and Record-High Market Volatility Call for More Stringent Stress Testing, Monitoring and Reporting

Download

Factsheet

Complete the form to get started

Request a

Demo

Complete the form to get started

For enquiries

Contact Confluence

Complete the form to get started

What We Do

Data-Driven Solutions

We are a global leader in data-driven investment management solutions, partnering with our clients to deliver products and services designed to optimize efficiency and control.