Post-Trade Compliance

Regulatory

Scalable post-trade compliance reporting solution.

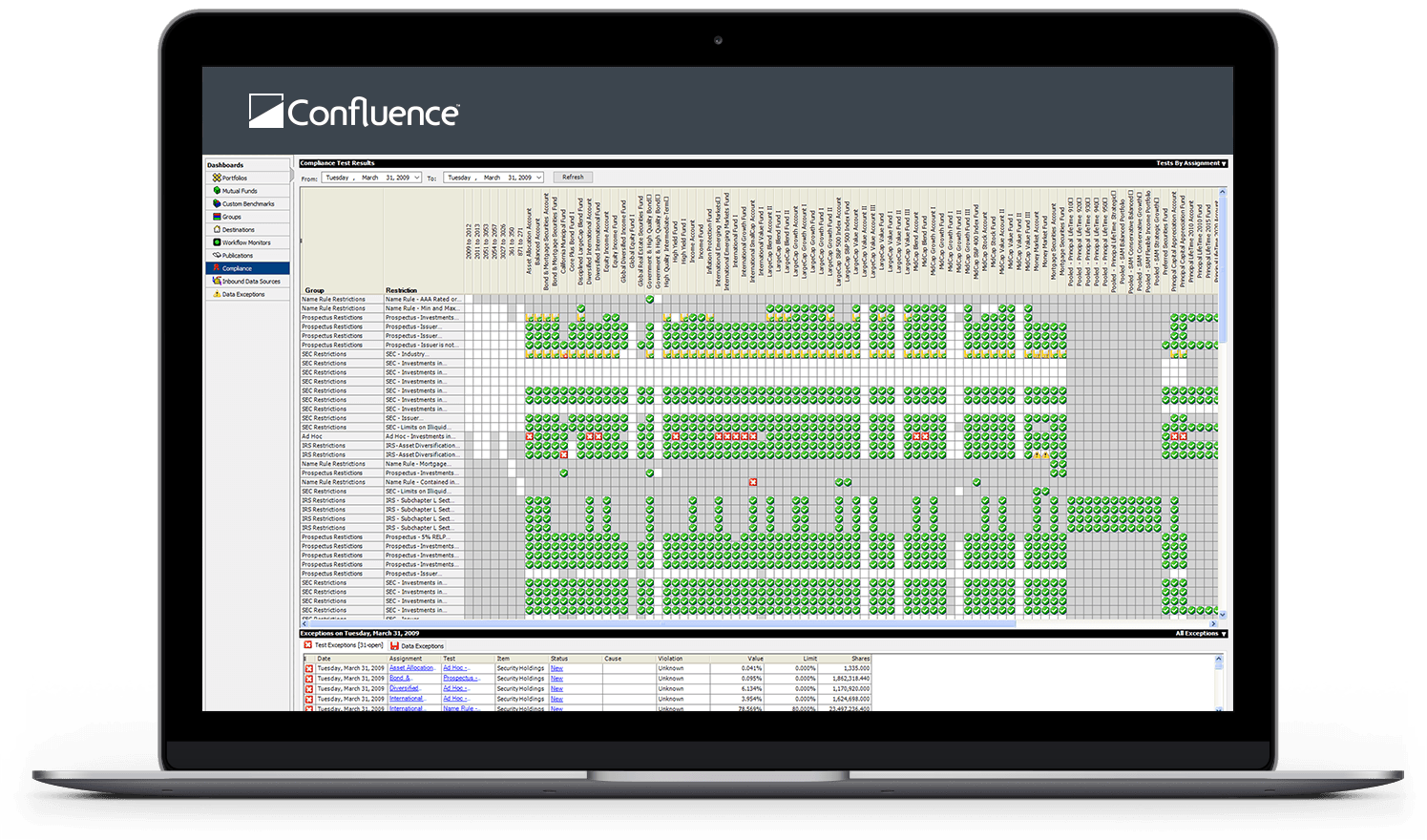

Gain control and oversight of post-trade compliance reporting

Ensuring data integrity and complete oversight of the collection and management of portfolio holdings and security data is paramount to post-trade compliance reporting.

Empower your compliance team to be self-sufficient with robust automated workflow and reporting functionality and monitor investment restrictions to better achieve compliance across complex investment strategies.

Data integrity and independent oversight of the post-trade compliance process

Ensures data integrity and independent oversight enabling you to automate your post-trade compliance process. Reduce costs, eliminate risk, elevate service levels and increase scalability, all while giving your organization a cost-effective and scalable solution.

Data integrity

Eliminate manual processes and reduce errors

Automatically collect portfolio, holdings and security-level data from your fund accounting system and other third-party sources, validate them against a standard restrictions library, established warning and failure thresholds, and other rules that are created to verify the integrity of your data.

Automation

Analyze and Resolve Data Exceptions

Automatically escalate test exceptions, produce restrictions summaries and historical test results for delivery to compliance executives, board members, auditors or regulators. Access test results dashboard to analyze and resolve exceptions and test warning failures and automatically create an audit log of exceptions and actions taken.

Support the full lifecycle of compliance

Monitor investment guidelines prescribed from any source, to better achieve compliance across complex investment strategies, increased regulatory scrutiny and stringent investment guidelines.

Build and support a sustainable culture of compliance monitoring and breach management, allowing you to effectively manage counterparty risk, credit risk, liquidity risk, leverage, client mandates and regulatory rulebooks.

Transparency of underlying investment data and breach results

Consistent Daily Compliance Process

Consistent, daily compliance processing with full transparency to underlying investment data and breach results provide comprehensive reporting and inquiry management, including breach classification and severity breakdown, compliance certificates, breach age analysis and daily changes in compliance status.

Post-Trade Compliance

Find out more

Post Trade Compliance

Find Out More

Additional

Resources

Download

Factsheet

Request

a Demo

Contact

Confluence

Additional

Resources

Preparing for PRIIPs KID: Key Considerations

Liquidity Shortfalls and Record-High Market Volatility Call for More Stringent Stress Testing, Monitoring and Reporting

Download

Factsheet

Complete the form to get started

Request a

Demo

Complete the form to get started

For enquiries

Contact Confluence

Complete the form to get started

What We Do

Data-Driven Solutions

We are a global leader in data-driven investment management solutions, partnering with our clients to deliver products and services designed to optimize efficiency and control.