Prism Analytics

Institutional Plan Data Insights

Exclusive Insights into Institutional Asset Trends

The premiere solution to help you stay ahead in the world of Institutional Asset Management with data-driven intelligence that empowers your business growth.

Unlock Growth Opportunities

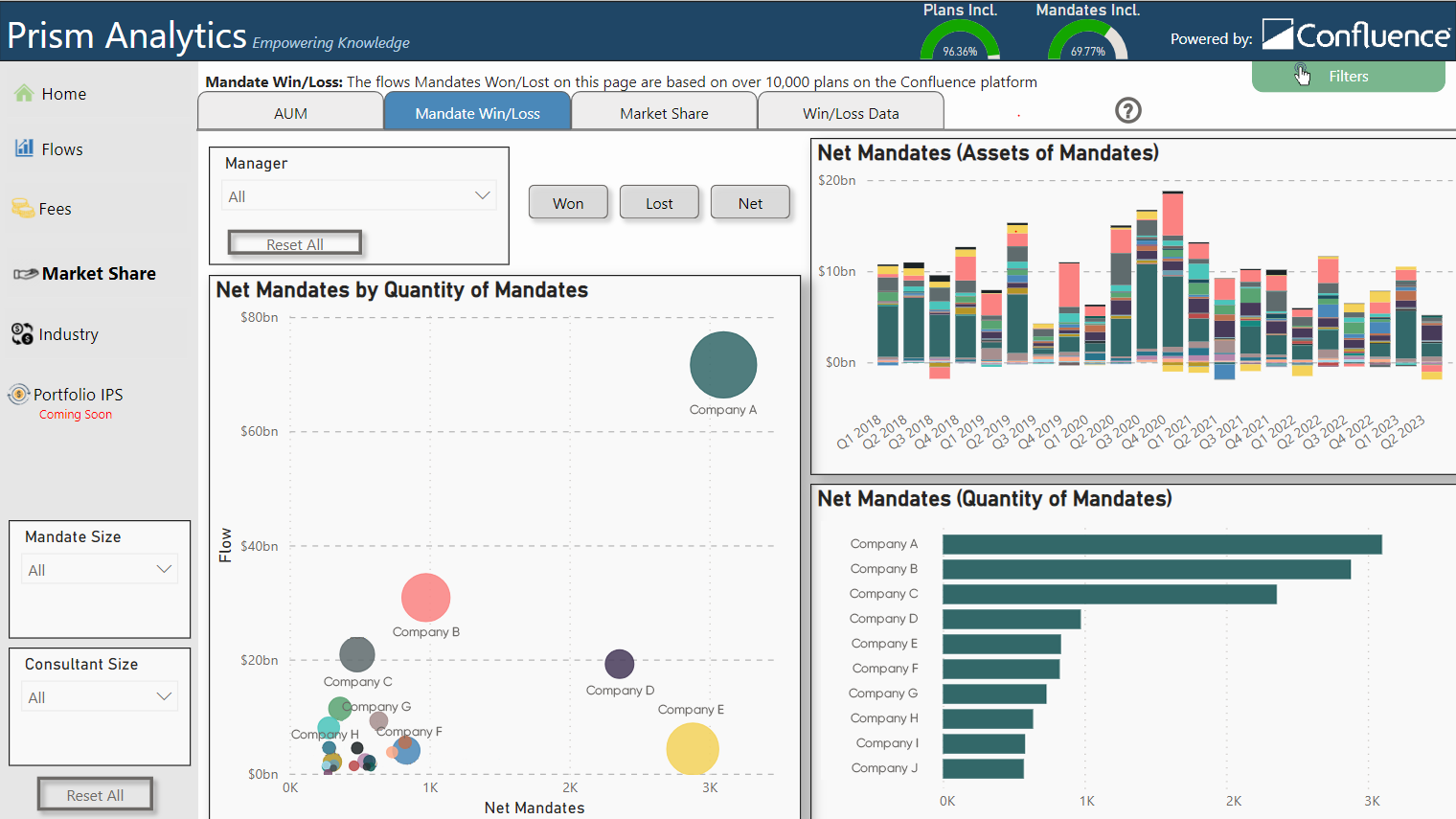

Prism Analytics offers unique perspectives on the Institutional Asset Management landscape, helping you realign your sales and marketing strategies for business growth. Positioned at the crossroads of Investment Consultants, plans, and Asset Managers, Prism Analytics captures cash flows and current account durations across peers, delivering comprehensive channel-level insights into asset movements.

Stay Ahead of Trends

See emerging trends before they become trends with comprehensive reporting covering all major plan types and asset classes. Prism leverages PARis data, providing asset managers with unique market insights sourced from consultants.

Asset Manager Institutional groups can easily:

- Identify Buyer Segments: Understand who is currently buying your investment types.

- Track Winning Managers: Determine which managers are securing mandates.

- Analyze Fee Structures: Examine fees by asset class, client type, plan type, and investment vehicle.

- Monitor Asset Flows: Track asset flows by channel.

- Assess Market Share: Measure market share by manager and mandates won and lost.

- Identify Market Leaders: Discover top market share holders.

Unlock Precise Insights

Prism offers a comprehensive end-to-end solution for creating insightful Institutional Investment analysis and reporting. Providing more accurate, unbiased data precisely when you need it, across plan types and asset classes.

Drive Institutional Distribution Opportunities

Prism Analytics equips you for winning assets for business growth by:

- Identifying Opportunities

- Quantifying Opportunities

- Managing Mandates

Anticipate Market Needs

Prism Analytics helps you spot market trends early by:

- Showcasing market segment characteristics with proprietary data, boasting extensive U.S. coverage.

- Offering insights into how assets move, revealing post-transaction fees, and providing advanced knowledge of public disclosures.

- Accessing intelligence on thousands of private and public plans.

Key Advantages of Prism Analytics:

Prism Analytics helps you spot market trends early by:

- Quality: Data provided by Investment Consultants with a fiduciary responsibility to ensure accuracy, unlike Asset Managers with potential biases. Prism avoids double-counting assets that other sources may encounter.

- Timing: Data is available five weeks after the quarter-end, aligning with consultants’ reporting obligations to plan firms.

- Comprehensive: Investment Consultants offer extensive data elements, drawing from PARis, which manages plan assets, returns, policies, fees, cash flow, and more.

Our solutions drive insights across:

13K+

Institutional plans400K

Portfolios$7.5T+

AUAPerformance Measurement

Find out more

Performance Measurement

Find Out More

Additional

Resources

Download

Factsheet

Request

a Demo

Contact

Confluence

Additional

Resources

Efficiency in the Aggregate: Why Private Wealth Managers Should Adopt Composites

Unlocking the Advantages of Composites and the GIPS® Standards

Why firms are struggling to meet the looming deadline on the SEC Marketing Rule and how they can accelerate compliance

Download

Factsheet

Complete the form to get started

Request a

Demo

Complete the form to get started

For enquiries

Contact Confluence

Complete the form to get started

What We Do

Data-Driven Solutions

We are a global leader in data-driven investment management solutions, partnering with our clients to deliver products and services designed to optimize efficiency and control.