An integrated approach is key for effective performance and risk management, but can also do a great deal to help operational efficiency.

An integrated approach is key for effective performance and risk management, but can also do a great deal to help operational efficiency.

Boutique asset managers, especially, hold the tight running of their ships in high regard. After all, they do not have big budgets to squander on unwieldy processes. They also need to work with smaller pots of gold and navigate their assets under management out of troubled waters or into better places more quickly.

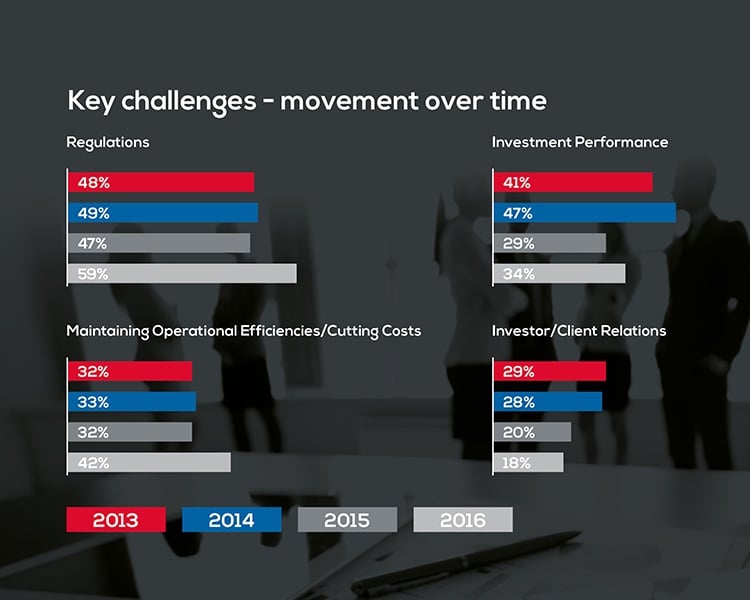

Main agenda issue

Source: On the road to digitalization, Linedata

Elsewhere, PwC has found that unlike traditional – often siloed – approaches, integrated performance and risk management can help firms to:

- Quantify risk appetite and tolerance.

- Identify potential risks across the business portfolio.

- Assess risks to performance goals.

- Channel financial and operational resources to maximize the risk-reward proposition.

- Align financial incentives for risk taking with potential outcomes.

In addition, PwC says that identifying risk can also reveal inefficiencies. In other words, instead of simply being a “must-do” activity to meet the demands of third parties, risk management is actually an opportunity to achieve improvements on the bottom line – important to all firms, but particularly pertinent to boutique managers.

“The process of connecting risk and reward starts at strategy setting,” they explain.

“When company leaders understand the greatest sources of value creation and destruction across their organizations, when they assign clear accountability for risk management and performance management, and when they systematically quantify the rewards associated with the risks, they change the decision-making game for their managers.”

The importance of technology

Within this context, technology is key to an integrated approach. As the TABB Group’s report, The new boutique asset manager states:

“Technology is now deemed the critical solution to meet regulatory compliance, limit risk exposure and efficiently manage existing resources more effectively.”

In a separate study, Ernst & Young also found that IT flexibility was a major dependency for asset managers:

“Top-quartile asset managers (by way of automated risk prevention) were able to link into a seamless system architecture, enabling them to perform “what if” scenarios according to model, product or portfolio criteria. They were able to slice and dice real and synthetic portfolios to assess risks, evaluate yield curves, analyze credit risks, analyze VaR and (decomposition of) track error or evaluate underlying NAVs.”

Being able to perform this sort of analytical capability in an efficient and accurate way is a clear advantage, especially for boutique managers who need to process their data quickly in order to work fast and lean.

Therefore, having a system that is able to make sense of it all and turn around data to deliver meaningful and actionable insight is mission critical. In an environment where masses of data are being run every day, being able to process and analyze it quickly offers real competitive advantage. With this in place, managers can make decisions quickly to improve returns and business efficiency is also maximized.

In recent years, better integration and analysis has been achieved in the alignment of front and middle offices and the need for high quality employees who are able to make the most of the various processes that weave between front and middle office.

Such employees can unify risk and performance and add to the bottom line by embracing increased automation, efficient use of data and more streamlined processes. Having the right people in place who actively seek to improve process and harness the capabilities of technology means workflows can finally become less resource intensive.

This is a trend that is set to continue as firms – particularly boutique managers – continue to scrutinize their processes and procedures in order to provide market agility and operational efficiency.

Takeaways:

- Identifying risk also reveals inefficiency.

- Regulations and maintaining operational efficiencies increasingly preoccupy the asset management world.

- Business risk through a lack of efficiency can be costly.

- Technology is now deemed the critical solution.

- There is a significant desire for benchmarking effectiveness, fitness for purpose and market best practices.