StatPro Revolution has features that are very easy for our clients and prospects to grasp.

The value of StatPro offering Revolution on a per fund/portfolio/model basis is attractive to the accounting folks (i.e. less of dent on their operating budgets than a bulky enterprise license fee). The value of our SSAE 16 Level 2 audit attestations make the operations/ data security teams feel that they are entrusting their data to a world class operating partner (i.e. StatPro’s processes follow strict permission based rules). The value of StatPro processing all of the security master data always brings a smile to the face of the market data teams (i.e. building repeatable/accurate jobs to handle market data is hard). In fact, I could go on and on about how all of the business functions at the typical asset manager can benefit from using a true cloud service platform. However, for me personally, the one aspect that is the most exciting about StatPro Revolution has to do with our “sharing capability”.

The concept of sharing a portfolio with a trusted partner is simply too good to be true. I’ll highlight a few situations that will help explain my enthusiasm for this capability within StatPro Revolution. And, to connect the concept of sharing directly to StatPro Revolution, I should explain that when a portfolio is loaded into the tool, the owner/user can click through a simple wizard to assign access to the portfolio to a trusted and registered user in their tenancy. It is possible to give the recipient of sharing either read-only or read/write access. The StatPro Revolution development team has built in some additional “sharing” features within these processes that address concerns around availability, date stamping of data and other asset management specific requirements.

Global Funds: Imagine the scenario where a Large Asset Management (LAM) firm in the US runs a domestic fund. This asset manager is so large that they have a global presence. In fact, they will have local teams in various capital markets hubs who will offer (sell) this fund to regional institutional investors. For instance, they have a team in Singapore and the Singapore team will be active in ensuring the Singapore buy side could invest in the fund. As the regional team needs to have up to date performance information on the fund in order to answer any questions that investors or prospects might have, logging into web based StatPro Revolution to view the fund enables the local teams to be independent. The old school model would have the Singapore team waiting for the team at HQ in the US to come to start their work day, process the request and send it back to Singapore. Remember, the time difference between New York and Singapore is 12 hrs. This simple request for information from the regional team might take two whole days to process. The ability of a platform like StatPro Revolution to empower a regional team to be self-sufficient is important. The process for sharing portfolios with the Singapore team requires only seconds to set up and the daily updated fund information from the US will automatically be available for Singapore users. Furthermore, restrictions can be placed on how the information is shared to allow only data that has been approved and signed off, to be viewed. Restrictions can also be put in place so that the Singapore users can view and utilize the results, but are not able to make any changes to the settings or underlying data. The regional teams want to succeed and having access to information at the right time (in the right language) will make a world of difference to their success. I have no doubt that a regional team with access to StatPro Revolution will keep existing clients happier and entice more investors with their impressive responsiveness.

Consultants: The buy side depends on consultants to help them select, manage and rate asset managers. There are many reasons for this relationship such as a public employee pension plan not having the skill sets/ systems to manage money in-house or the systems to discover, rank and assess their fund managers. It is very common to see a pension plan having an investing mandate, which is made up of five different funds from five different asset managers. In this case, the pension plan will use a consultant to select the five funds. Hopefully, you are thinking ahead and already see how “sharing” might help in this case. Without a tool like StatPro Revolution, the pension plan is entirely dependent on their consultant to monitor the fund managers and to ensure that mandates are being followed. The consultant might send a hard copy report that they have put together each month but this is hardly going to be effective or timely. A better solution would have the pension plan insist that their Portfolio Managers sign up for StatPro Revolution and “share” the fund with both the consultant and the pension plan investment committee. This would ensure that all parties involved have the most current and up to date performance and risk information.

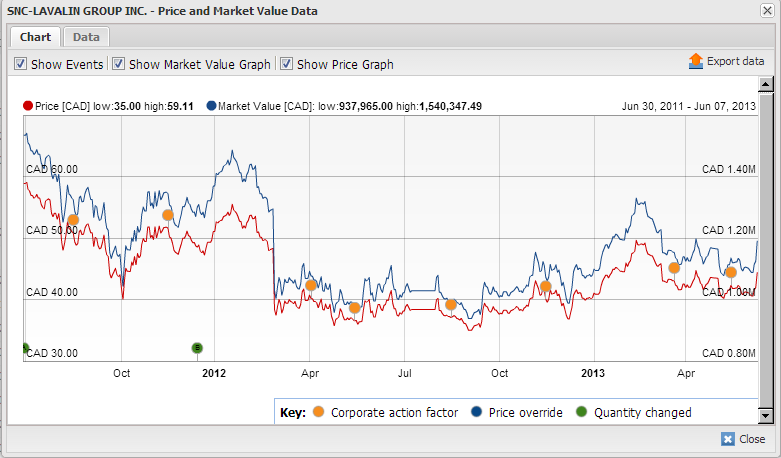

In Canada, I frequently use the example of SNC-Lavelin (a global infrastructure engineering company) to contextualize “sharing” to prospects. SNC Lavelin is widely held in Canada amongst the large asset managers but over the past year has been caught up in a bribery scandal that has had a negative impact on its share price. The local fund managers that did not have a tool to share the impact of SNC Lavelin’s volatility with their investors on a daily basis really put their clients in a bind. Imagine how much tension and stress would have been relieved if the fund manager could have simply said “Well, just log onto StatPro Revolution with your secure ID and see for yourself what the impact of SNC Lavelin’s volatility is on the fund, as I’ve just shared the portfolio with you”. Contrast, this with the investor having to wait until the next report from the fund manager or trying to get the fund manager on the phone for an update and it is easy to see that self-serve sharing model is superior.

And as an aside, for those fund managers who think that they can continue to operate without giving their investors daily access to the fund’s performance, be prepared to answer some very tough questions. My feeling is that the days of sending a monthly report to your investors will simply not stand up in today’s demanding marketplace, especially when tools like StatPro Revolution are so easy to implement.

Private Wealth: The one funny story that we hear about wealth management services for the ultra-high net worth segment is that their advisors have worse technology that the lowly self-directed online retail brokerage client (like me). This doesn’t really make much sense since the HNW segment would expect that they always get the best of everything and so why would financial services be different. Unfortunately, it is not the case since many HNW people don’t see daily performance data, aggregated holdings, risk assessments or other important financial statistics calculated on their holdings. So imagine, for a private bank looking for a quick win to improve their client services and satisfaction levels, how StatPro Revolution can solve a lot of client satisfaction issues. With StatPro Revolution as one of the arrows in their quiver, the private bank would quickly be able to leverage the sharing capabilities to ensure that their client, their client’s legal team, their client’s accounting team and their client’s business advisors have the ability to see exactly what assets their clients have and how well they have been performing. Note: this scenario could easily benefit a family office as well. So, my view here is that a system like StatPro Revolution and its ability to share, will allow for an innovative leap in capabilities that will help keep the valuable ultra-high net worth client satisfied.

All the above scenarios show how powerful the concept of sharing portfolios can be. At StatPro, we are confident that this approach is faster, less expensive, more accurate and more secure than current untimely and push driven distribution approaches like email, portals etc.