Q4 2025

Sector Insights Dashboard

January 27, 2026

Prepared by:

Introduction

This report introduces the Sector Insights Dashboard, a new quarterly analysis that provides a clear, factor-based view of U.S. equity sector performance. Leveraging Style Analytics® data, the dashboard brings together sector weights, valuation dynamics, and factor exposures to highlight what is driving returns beneath the surface of the market.

By combining cross-sector comparisons with security-level insights, this inaugural edition aims to help investors better understand how style factors, market conditions, and sector leadership interact, offering a consistent framework that can be tracked and compared over time.

Sector breakdown and background

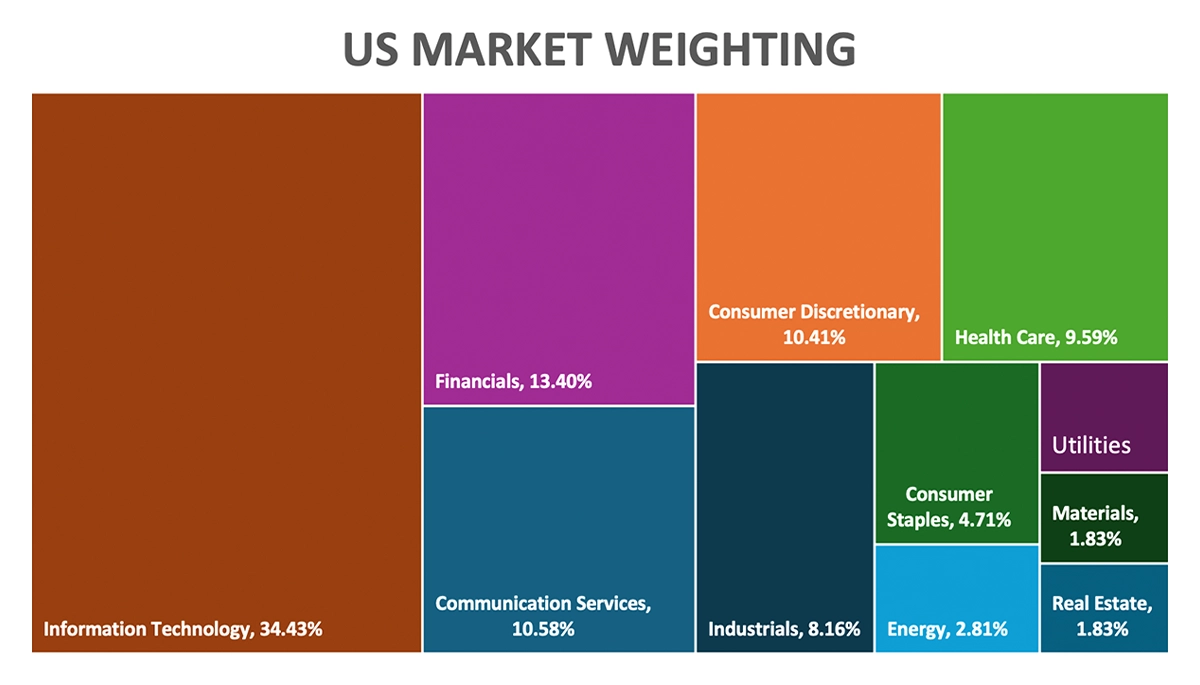

Figure 1: Sector Weighting of US Equity as of Q4 2025

Source: Confluence® Style Analytics®Technology has held the largest weight in the U.S. equity market since the mid-2010s, reflecting the scale, profitability, and sustained earnings growth of mega-cap platform companies, with factor exposure concentrated in Growth and Momentum due to persistent earnings upgrades and strong price trends. Financials rank second, underpinned by their central role in the U.S. financial system and consistent cash-flow generation, resulting in a dominant Yield bias driven by dividends and buybacks. Communication Services holds the third-largest weight, supported by large, cash-generative media and platform firms, and shows a Value tilt as returns are increasingly anchored in current earnings and free cash flow rather than accelerating growth.

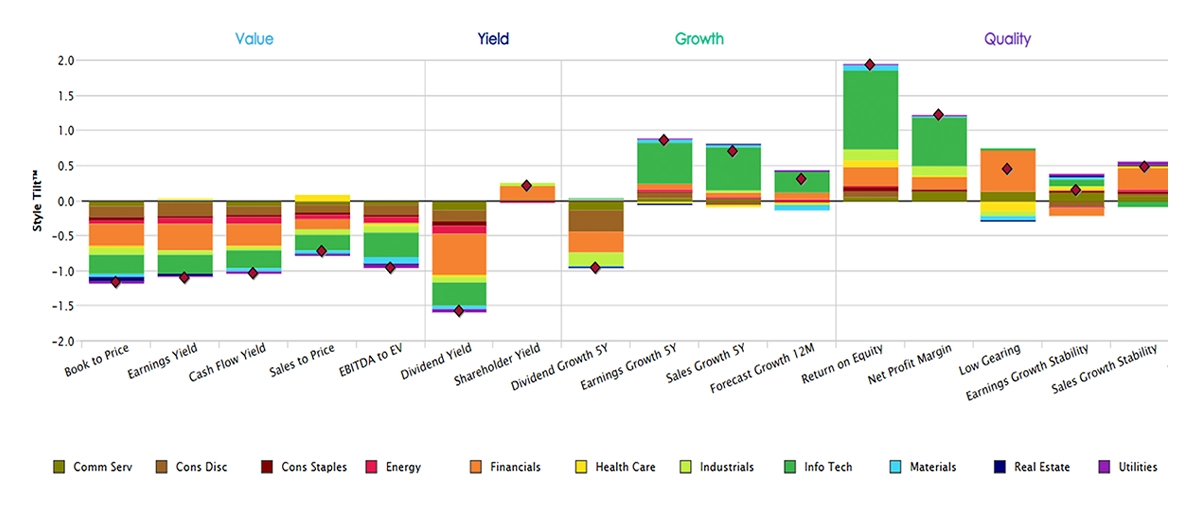

Figure 2: U.S. Sector Factor Tilts as of Q4 2025

Source: Confluence Style AnalyticsValuations and returns

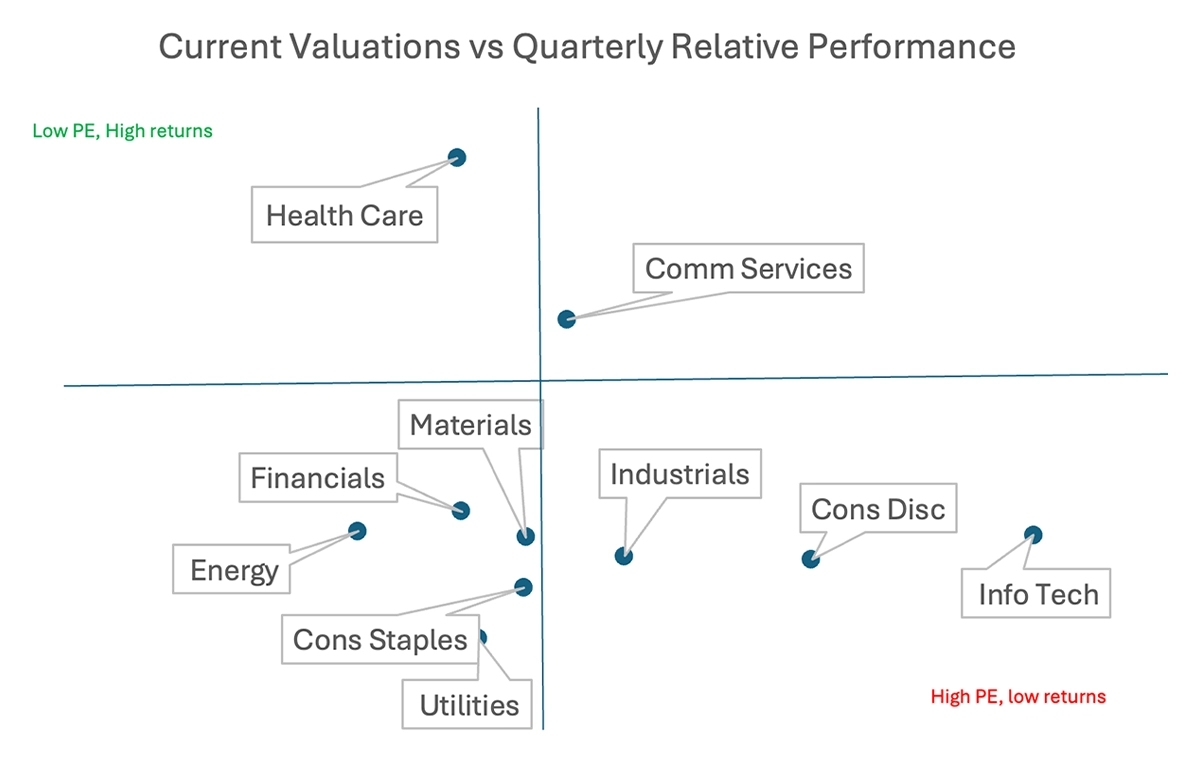

The chart below illustrates the relationship between sector valuations and Q4 2025 returns across the U.S. equity market. Health Care stood out during the quarter, delivering the strongest returns while also trading at relatively attractive P/E levels, making the sector appealing from both a performance and valuation perspective. Communication Services posted positive relative returns versus the broader market, though its valuation remained less compelling than Health Care's. In contrast, traditionally higher-valued sectors such as Information Technology and Consumer Discretionary posted negative returns in the final quarter of 2025, as elevated valuations limited upside and led to underperformance, weighing on overall market returns. Health Care’s outperformance in Q4 was driven by a combination of attractive starting valuations, improving earnings visibility, and late-year rotation into defensive sectors, as investor focus shifted away from high-valuation growth areas toward more predictable cash flows.

Figure 3: Relationship between Valuation and Returns

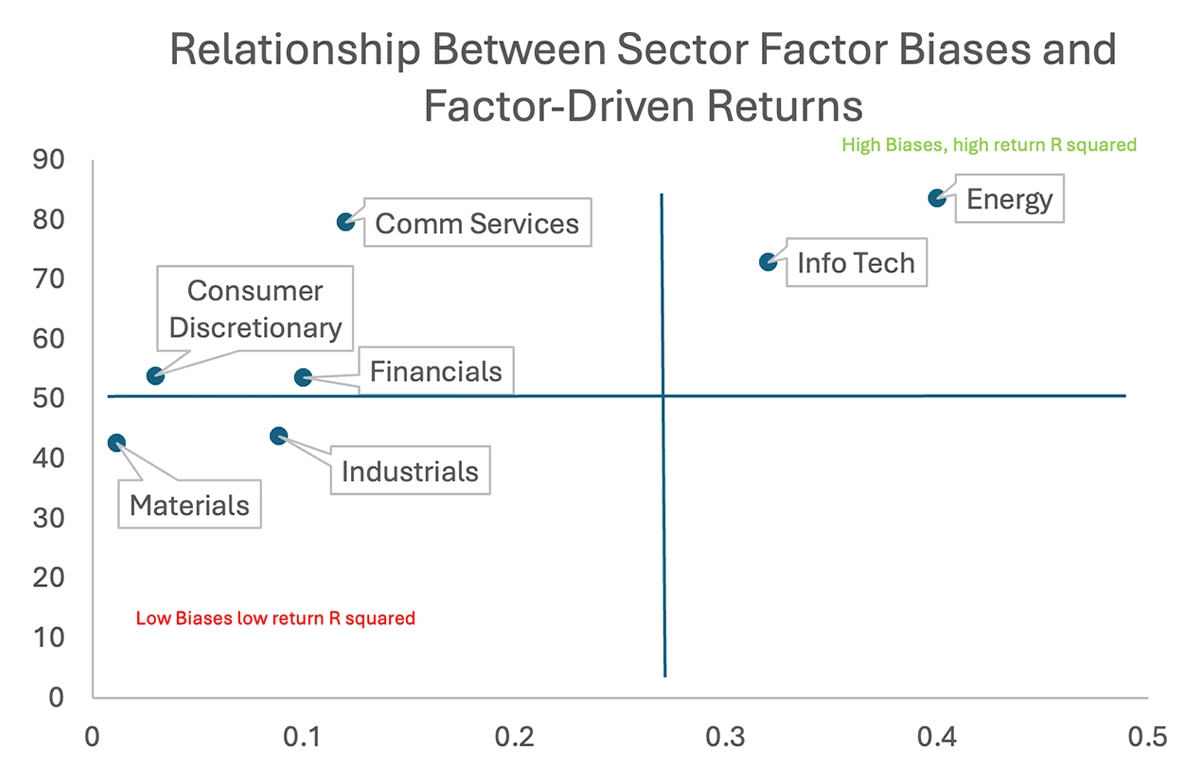

Factor driven returns and sector factor biases

The chart below highlights notable differences across sectors in how factor biases translate into realized returns over the past five years. Info Tech and Energy stand out as the sectors where factor exposures, specifically Growth and Value, respectively, exhibit the strongest relationship with returns, as reflected by relatively higher R² values. In contrast, Consumer Discretionary, Financials, and Communication Services display pronounced factor biases toward Growth, Yield, and Value, respectively; however, the R² analysis suggests that these biases have had limited explanatory power for returns over the same period. This disconnect indicates that factors beyond their stated style tilts likely drove sector returns in these areas. Meanwhile, sectors such as Materials and Industrials show minimal factor bias overall, suggesting a more neutral factor profile with limited dependence on traditional style drivers.

Figure 4: Relationship between factor biases and factor driven returns

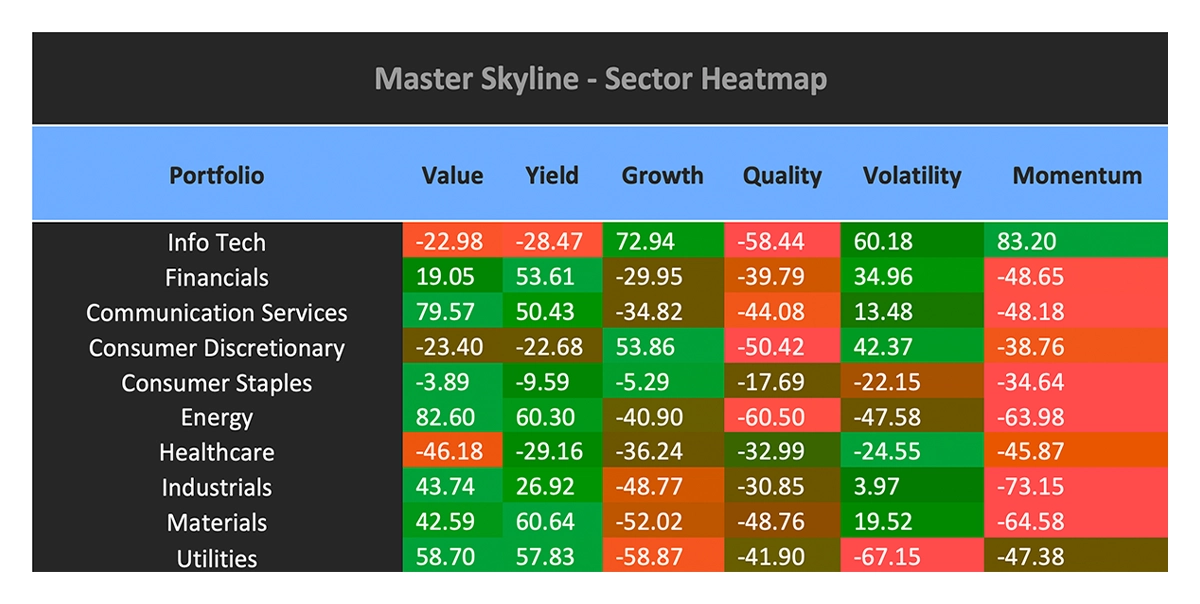

Source: Confluence Style AnalyticsHow S&P master skyline’s tilts and contributions stack up against the MSCI ACWI

Relative to the MSCI ACWI Index, the US equity market exhibited a pronounced tilt toward Quality factors in December, reflecting its higher exposure to sectors such as Inf Tech and Financials. This bias is underpinned by the dominance of large-capitalization US companies, particularly in Big Tech, which continue to lead globally in innovation and earnings durability, thereby reinforcing the market’s high-quality growth-oriented profile. Compared with MSCI ACWI, the US market also differentiated itself across several key sub-factors, including return on equity, net profit margins, and Forecast 12M revisions, with Info Tech as the primary driver of these dynamics.

Figure 5: Contribution of US sector factor tilts compared to MSCI ACWI as of Q4 2025

Source: Confluence Style AnalyticsAnalyzing the major U.S. market sectors

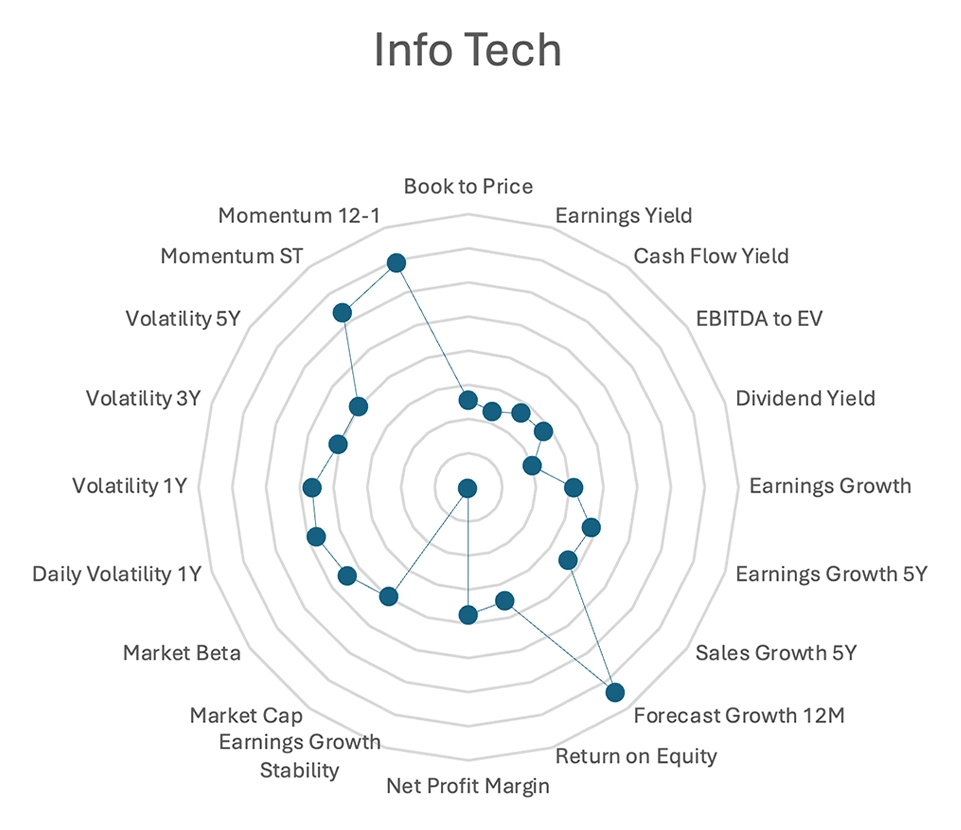

Info Tech

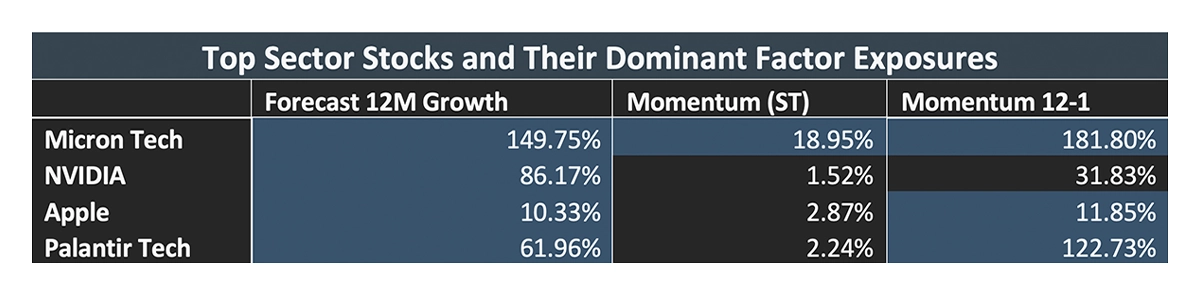

In December, Info Tech performance was primarily driven by strong 12-month forecast growth, short-term momentum, and momentum 12-1 relative to the broader US equity market. Investor confidence in Info Tech’s earnings outlook has been driven by sustained AI and cloud investment, resilient enterprise demand, and improving earnings visibility, which led analysts to revise forward estimates higher. Strong margin discipline and scalable business models among US mega-cap tech firms further reinforced expectations of durable growth relative to peers.

In December, the US Technology sector’s performance was mainly supported by Micron Technology, NVIDIA Corp, Palantir Tech, and Apple Inc. Micron’s 12-month forward growth forecast surged to 150% by year-end 2025, driven by robust demand for AI-related memory products, tighter industry supply boosting prices, and a series of analyst upgrades raising earnings and price targets ahead of its Q1 2026 earnings report source. Palantir’s elevated momentum factor was primarily fueled by investor optimism over its accelerating AI-driven growth, record revenue gains, and expanding commercial and government contracts, which propelled the stock higher and maintained strong upward price trends source. For the month, Palantir’s 12 1 momentum reached a peak of 123%.

Figure 6: Top Sector Stocks and Their Dominant Factor Exposures

Source: Confluence Style AnalyticsFigure 7: Info Tech Radar Chart

Source: Confluence Style AnalyticsFinancials

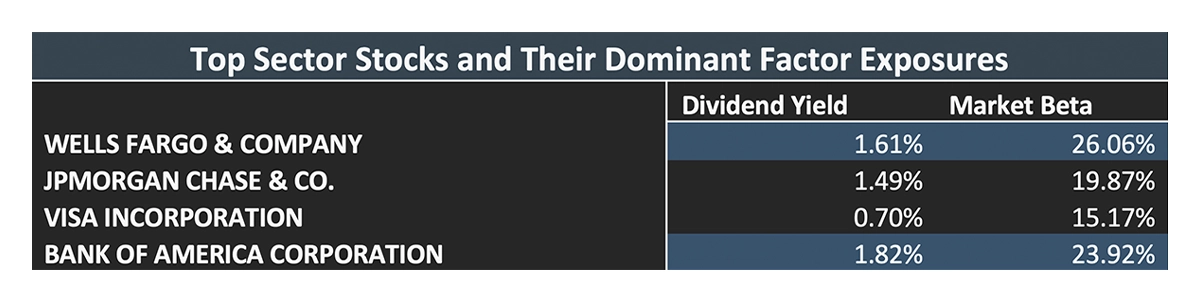

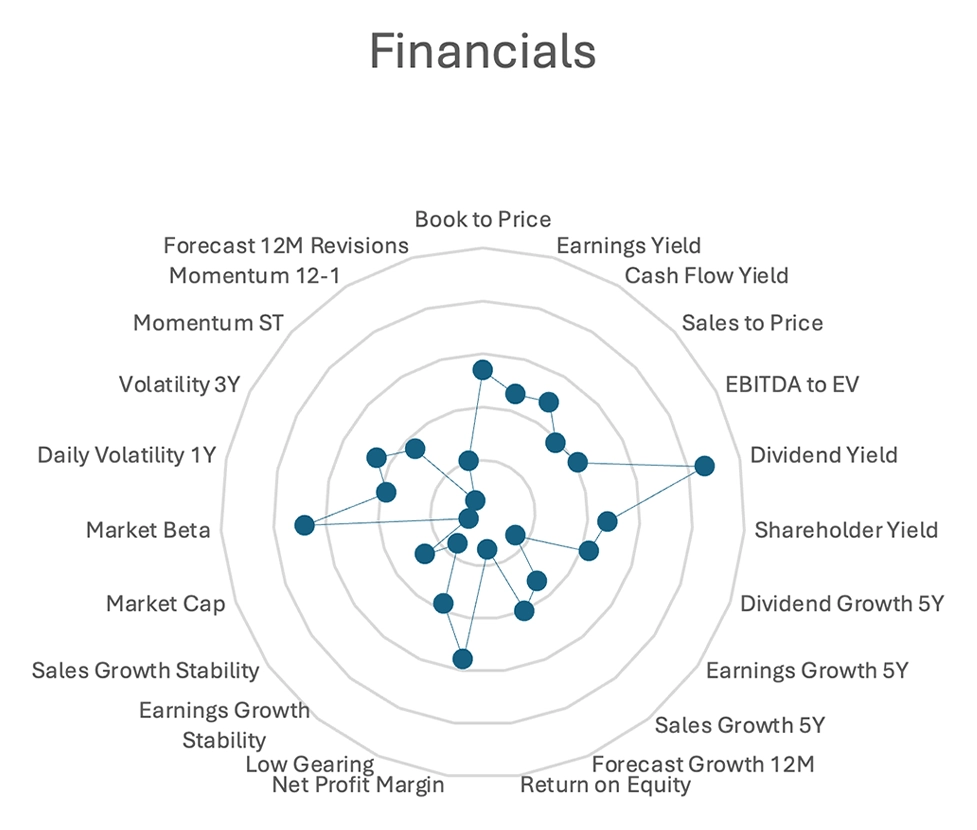

In December 2025, the Financials sector showed a bias toward Dividend Yield and Market Beta amid higher interest rates and resilient earnings from major banks and insurers, which supported attractive dividend payouts. Rising rates improved net interest margins, boosting profitability and cash flows available for dividends, while strong macroeconomic sentiment and sector rotation into cyclical financial stocks amplified sensitivity to broader market movements, reflected in elevated market beta. Together, these factors made the sector both yield-attractive and responsive to market trends, reinforcing its factor profile for the month.

The key contributors to the U.S. financial sector include JPMorgan Chase & Co., Wells Fargo, Visa Inc. and Bank of America. In December, Wells Fargo and Bank of America posted high dividend yields driven by strong profitability, higher interest rates boosting net interest margins, and their consistent capital returns, while their earnings’ sensitivity to broader market and economic conditions also contributed to a high Market Beta.

Figure 8: Top Sector Stocks and Their Dominant Factor Exposures

Source: Confluence Style AnalyticsFigure 9: Financials Radar Chart

Source: Confluence Style AnalyticsCommunication services

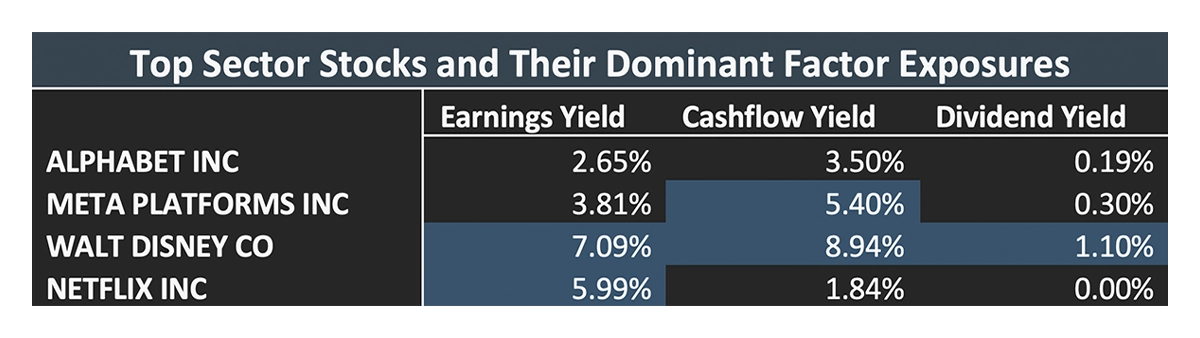

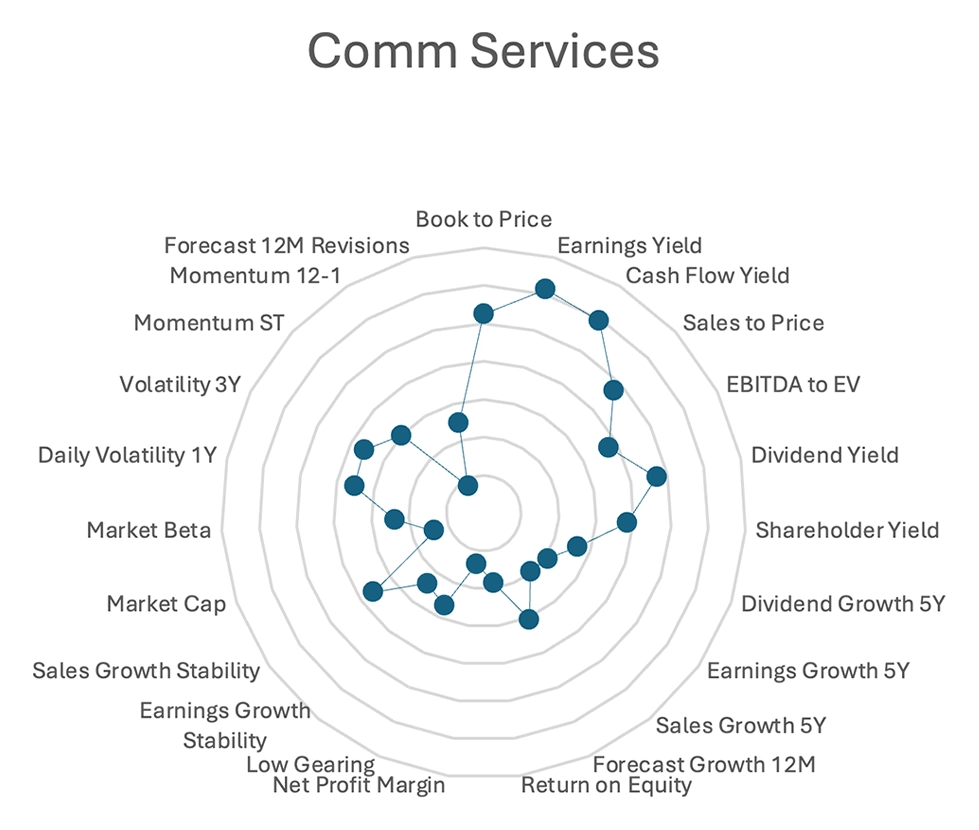

The communication services sector comprises leading, profitable companies with strong competitive moats and resilient earnings supported by factors such as digital advertising. These firms exhibit stable cash flows and consistent profitability. The Communication Services sector is primarily driven by Value and Dividend Yield factors, reflecting the characteristics of the companies that dominate this space. Many are mature, cash-generative businesses such as telecom operators and media firms, that may not grow as rapidly as tech peers but offer stable earnings and predictable cash flows.

Top players of this sector include Netflix, Meta, Alphabet and Walt Disney. In Dec 2025, Netflix and Alphabet exhibited high momentum factor exposure, largely driven by their strong recent price performance. In December, Walt Disney posted high earnings and cash flow yields as improving profitability and stronger operating cash flow boosted returns. Growth in park revenues, better streaming margins, and a relatively modest stock valuation combined to make Disney’s earnings and cash generation stand out in the market. In December, Netflix’s earnings yield surged as strong subscriber growth, improving margins, and disciplined cost management boosted profitability, making the stock more attractive relative to its price.

Figure 10: Top Sector Stocks and Their Dominant Factor Exposures

Source: Confluence Style AnalyticsFigure 11: Communication Services Radar Chart

Source: Confluence Style AnalyticsConsumer Discretionary

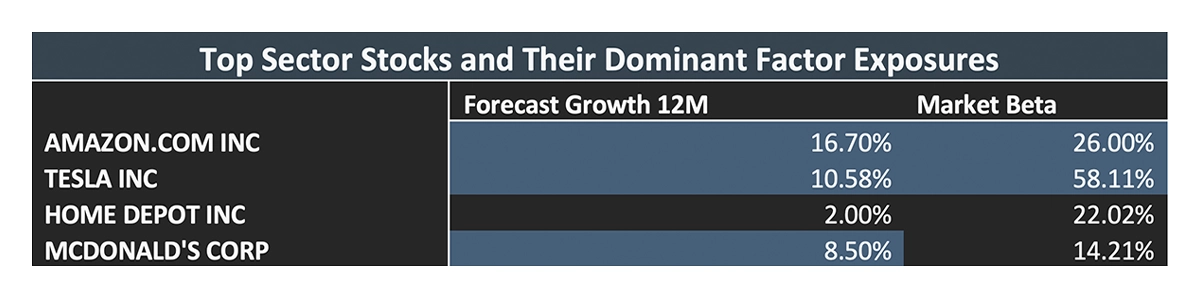

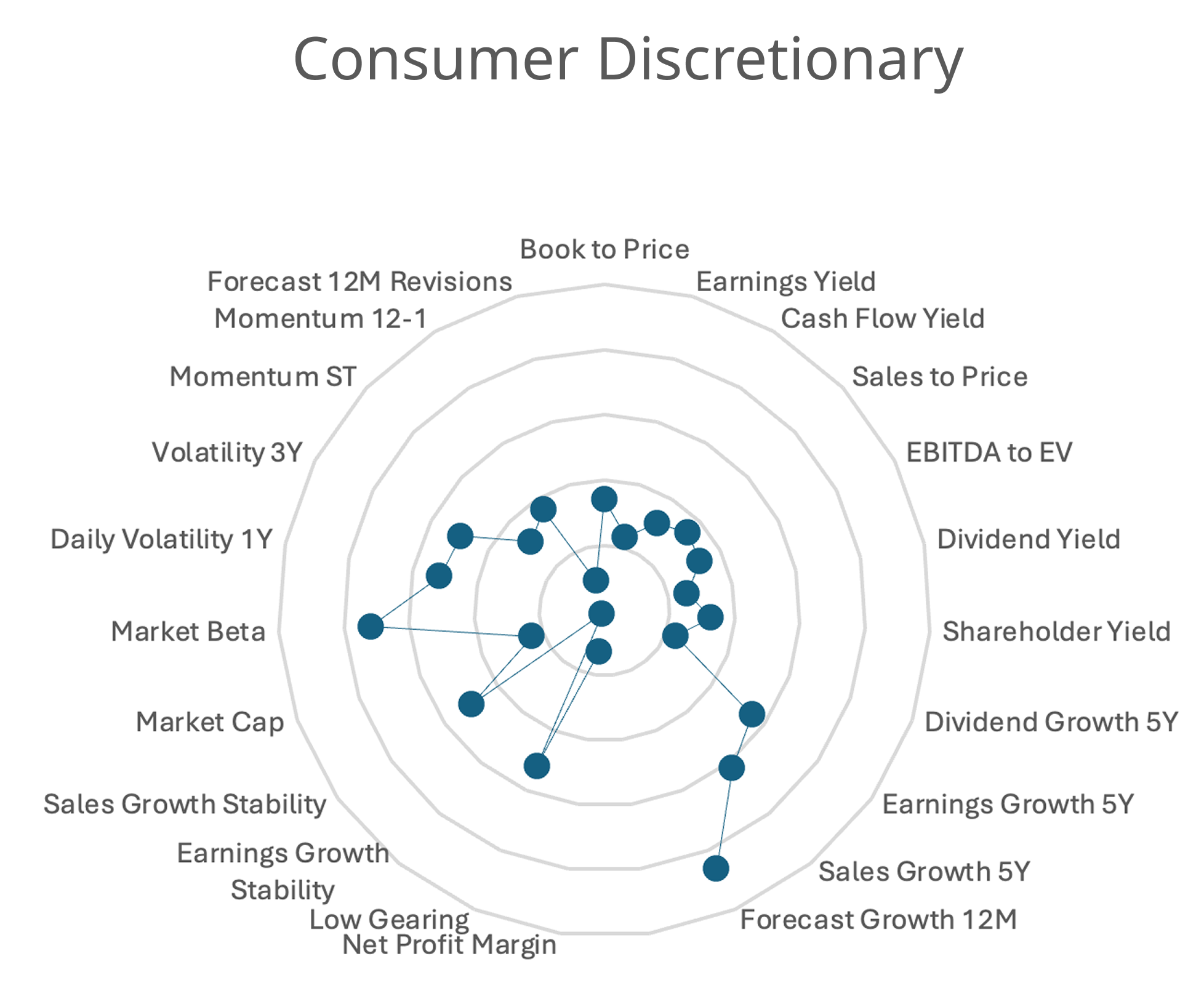

Consumer discretionary, the fourth-largest sector in the US equity market, was primarily driven by Market Beta and 12-month forward earnings revisions in December. Strong contributions from major names such as Amazon, Tesla, and Home Depot helped propel the sector’s performance, reflecting both their sensitivity to broader market trends and the positive adjustments to earnings expectations as investors anticipated continued growth and robust demand across e-commerce, automotive, and home improvement segments.

Amazon’s high 12-month growth forecast in December 2025 was driven by strong momentum in AWS, particularly from AI and cloud infrastructure demand, robust e commerce performance, expansion in its advertising business, and strategic investments in automation and efficiency—all of which boosted investor confidence in its forward earnings potential. Tesla’s high Market Beta in December 2025 reflected its strong sensitivity to broader market movements, fueled by investor enthusiasm around AI, robotaxi developments, and ongoing volatility in its automotive performance, which amplified price reactions to both positive and negative news.

Figure 12: Top Sector Stocks and Their Dominant Factor Exposures

Source: Confluence Style AnalyticsFigure 13: Consumer Discretionary Radar Chart

Source: Confluence Style AnalyticsConclusion

As Q4 2025 drew to a close, U.S. equity sector performance underscores the importance of understanding how valuations, factor exposures, and macro-driven rotations interact beneath headline returns. While Information Technology and Consumer Discretionary remain structurally important due to their size and long-term growth potential, elevated valuations constrained performance late in the year, highlighting the growing sensitivity of returns to starting price levels. In contrast, Health Care emerged as a clear standout, combining attractive valuations with improving earnings visibility and defensive characteristics that resonated amid year-end risk moderation.

The factor lens further reveals meaningful dispersion across sectors. Some areas, such as Information Technology and Energy, demonstrated strong alignment between factor exposures and realized returns. In contrast, others exhibited weaker explanatory relationships, suggesting that idiosyncratic drivers and company-specific fundamentals played a larger role. Relative to global equities, the U.S. market continued to differentiate itself through a pronounced Quality bias, supported by superior profitability, balance sheet strength, and earnings durability, particularly within large-cap technology and financial firms.

Taken together, these dynamics reinforce the value of a granular, factor-based approach to sector analysis. Rather than relying solely on broad sector allocations, investors can benefit from understanding how valuation discipline, factor sensitivities, and evolving market leadership interact over time. As market conditions continue to shift, this framework provides a robust foundation for assessing relative opportunity, managing risk, and positioning portfolios with greater precision.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence® Technologies

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with over 700 employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com