Q4 2025

Factor Performance Analysis

Value Factor Leads Global Equity Markets in 2025

January 13, 2026

Prepared by:

Market Background

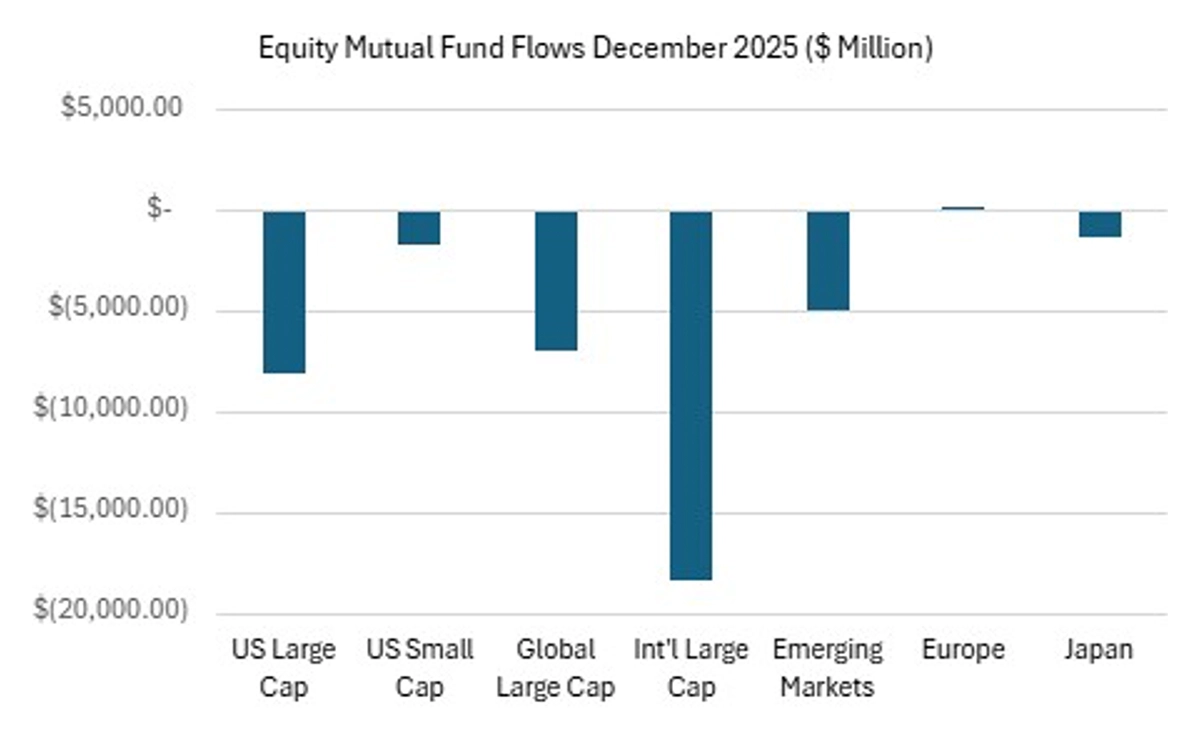

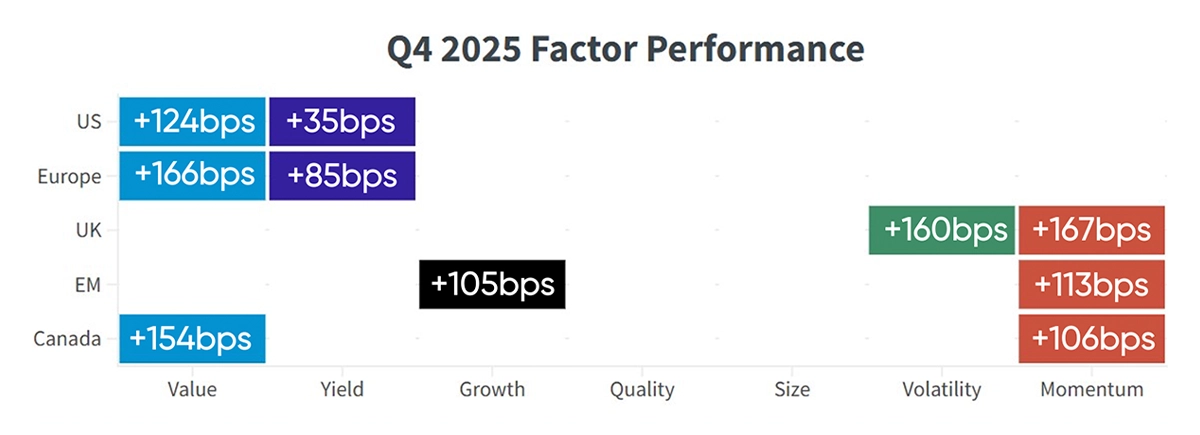

In 2025, global equity markets were supported by easing inflation, stabilization, and a shift toward more accommodative monetary policy, which improved risk sentiment and valuations. Performance was broad-based across developed and emerging markets, with Europe and emerging markets rebounding strongly. Factor leadership widened, with Value and Momentum outperforming alongside selective Volatility, reflecting improved market breadth and renewed investor confidence.

Crude oil prices declined to around $56 per barrel by the end of December and extended their losses into the first week of January, before recovering modestly to approximately $58 per barrel toward the end of the week. In contrast, gold prices maintained a strong upward trend throughout December, rising steadily and reaching about $4,503 per ounce in the final week of the month, reflecting sustained demand for safe-haven assets.

Bitcoin surged to new all-time highs in the middle of the year before undergoing sharp corrections in the second half, ultimately ending 2025 with flat to slightly negative returns amid elevated volatility and changing investor sentiment.

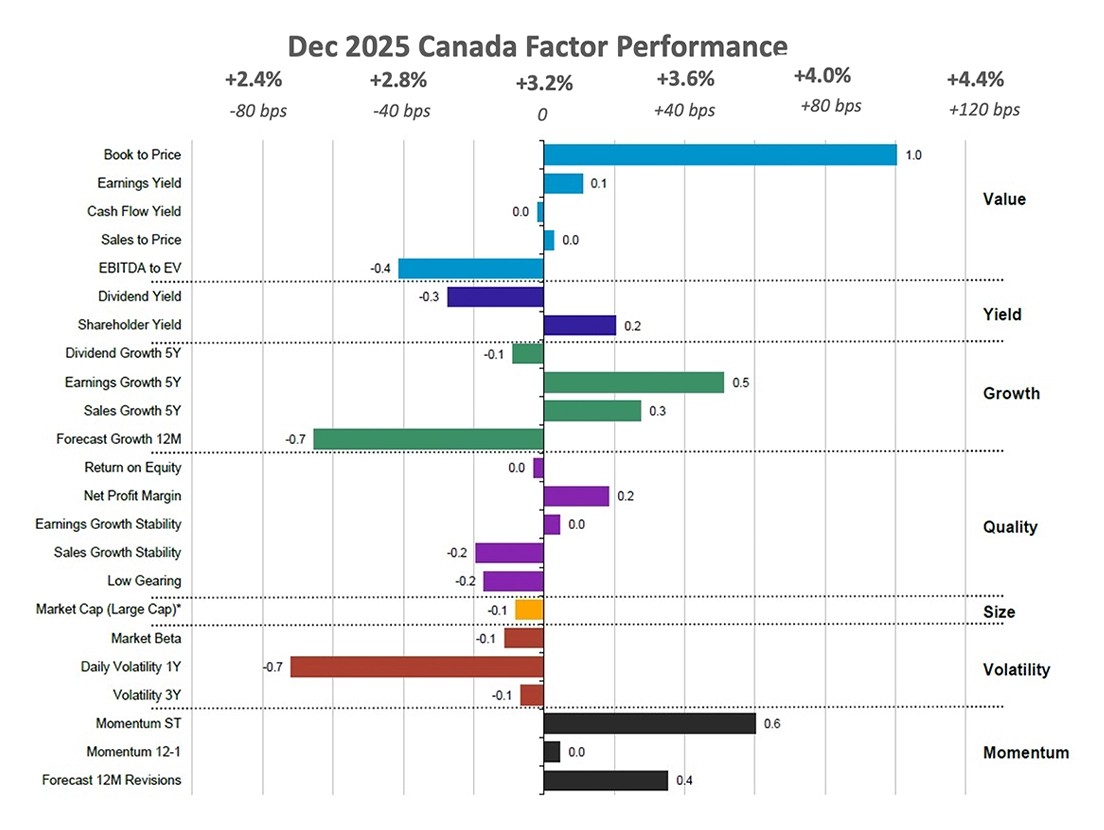

Figure 1: December 2025 Mutual Fund Flows data.

Source: Confluence Style Analytics

Factor Summary

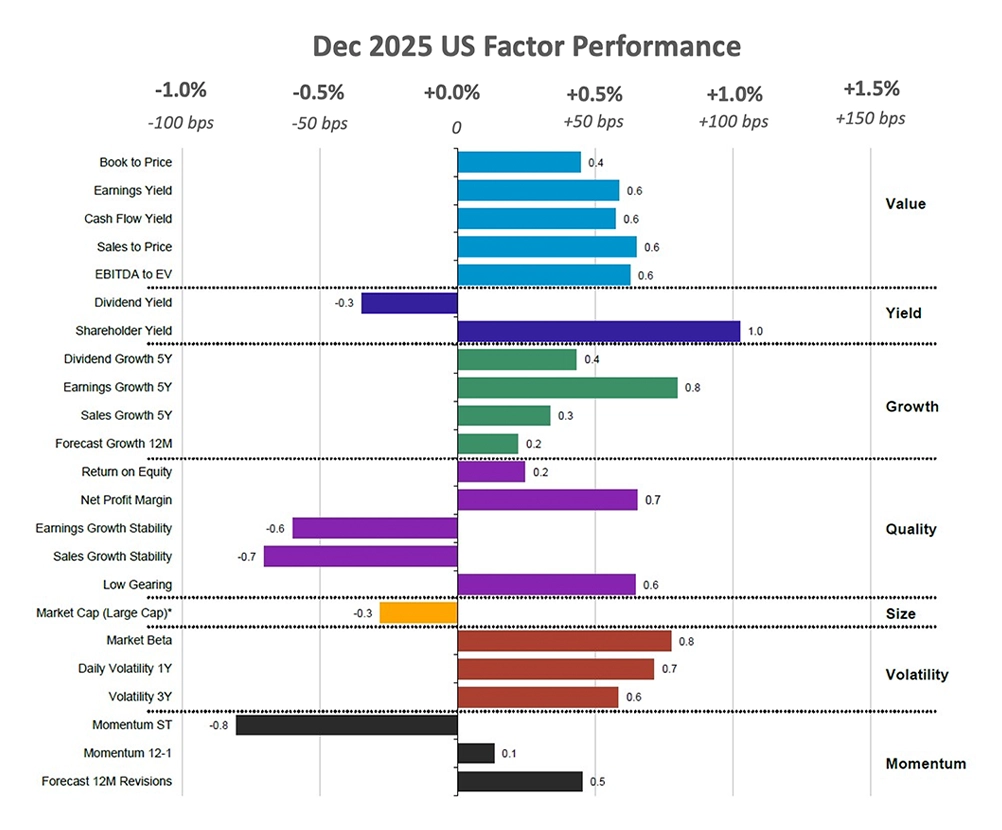

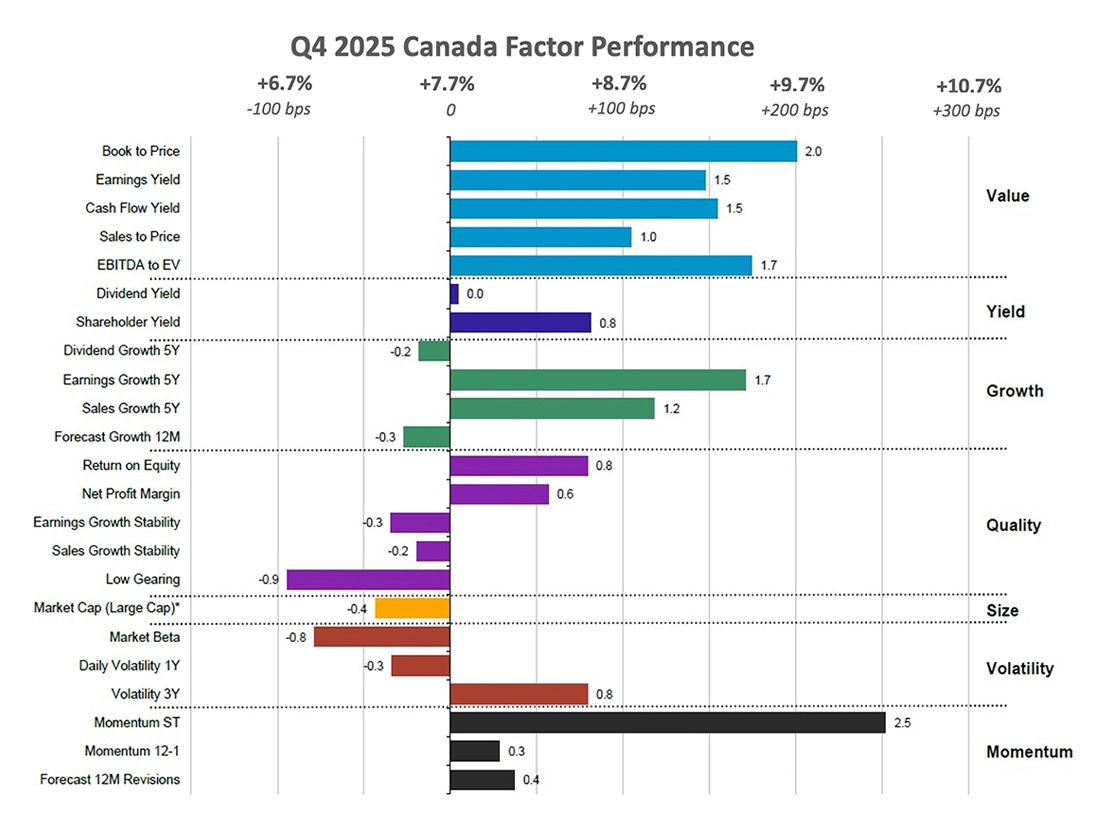

Figures 2 & 3: Regional relative factor performance (country and sector adjusted) for December ’25 and Q4 ‘25

Source: Confluence Style Analytics

US Equities

Relative to December of the prior year, factor leadership in the U.S. equity market shifted meaningfully. In December 2025, Value and Volatility factors delivered positive outperformance, in contrast to December 2024 when these factors did not contribute. The U.S. equity market posted a flat return in December 2025, with performance driven mainly by Value sub-factors. Compared with the same period last year, large-cap stocks underperformed. In addition to Value and Volatility, Growth also outperformed the broader market.

Shareholder yield outperformed the U.S. equity market in December 2025 because the prevailing factor regime favored value-oriented and cash-generative stocks. In a flat market with large-cap underperformance, investors rewarded firms that demonstrated disciplined capital allocation through dividends and buybacks, allowing shareholder-yield strategies to outperform despite having limited market beta.

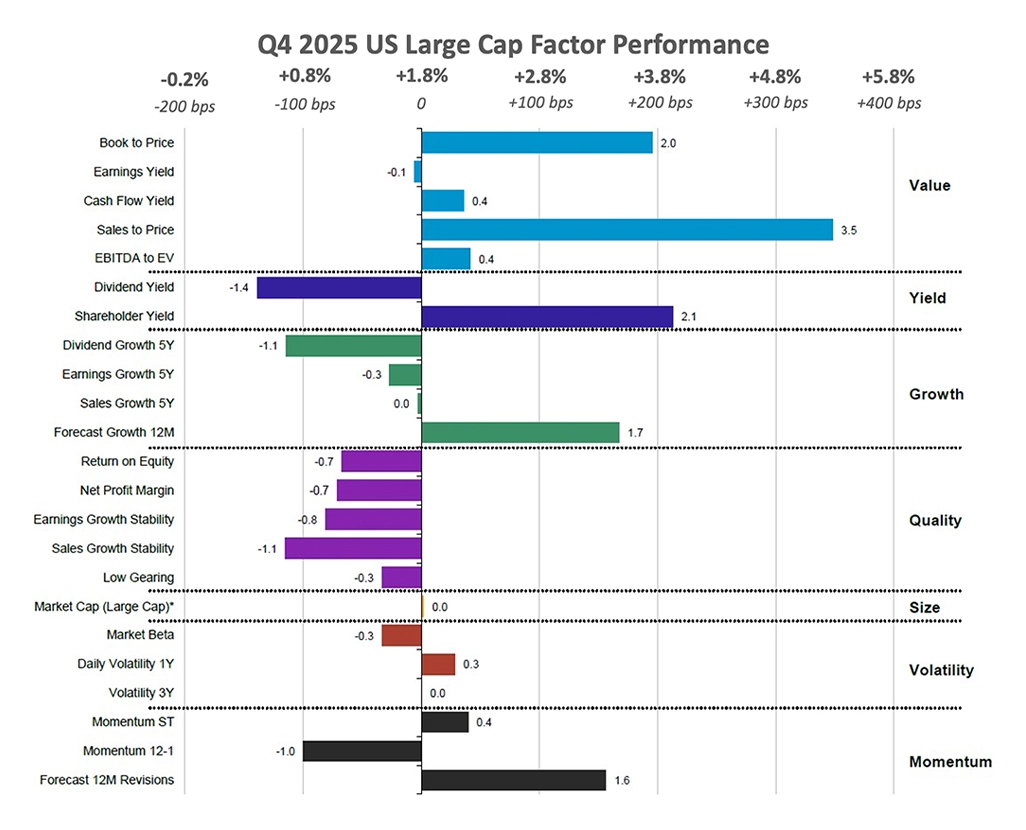

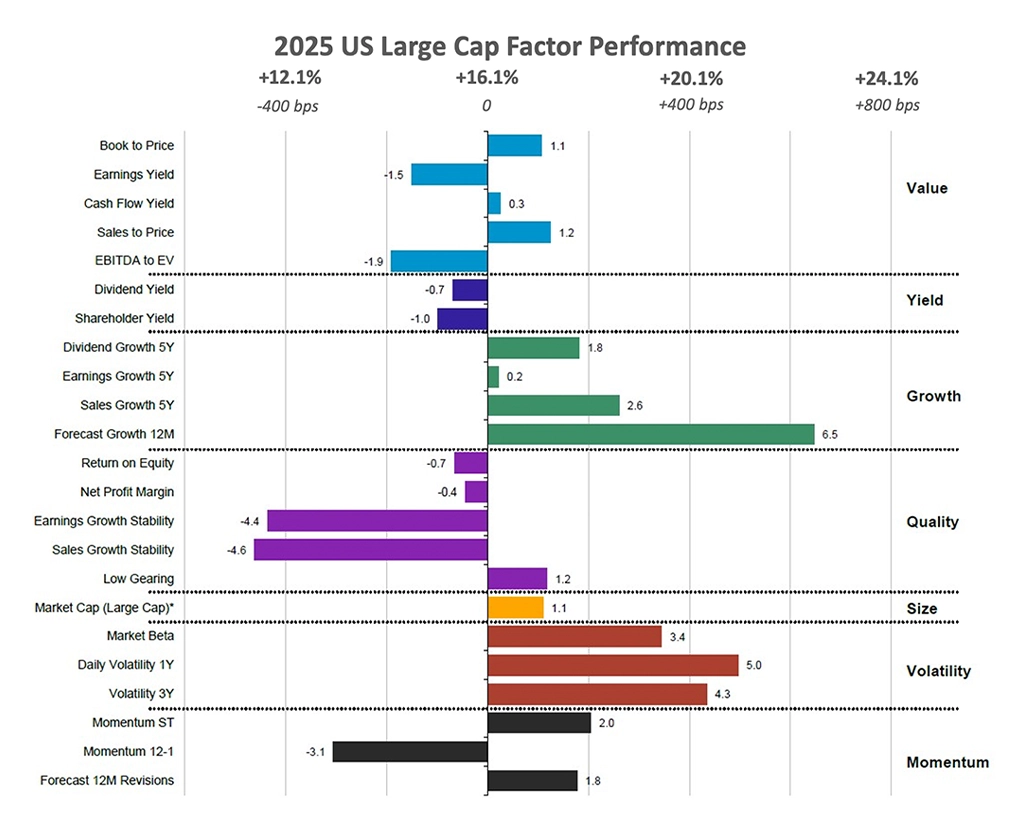

While the broader U.S. equity market delivered a solid positive return of approximately +16% in 2025, performance moderated relative to the strong outperformance seen in the prior year. This deceleration was driven mainly by reduced performance from Momentum and large-cap stocks. In contrast, investor preferences shifted toward Value compared to the previous year, with increased relative support. Momentum performance in U.S. equities weakened in 2025 as market leadership broadened beyond a narrow group of dominant stocks. Increased factor rotation reduced large-cap dominance, and higher volatility led to more frequent reversals, undermining the persistence of trends that had strongly supported momentum strategies in the prior year.

This quarter saw a strong outperformance from Value sub-factors, marking a shift in investor preferences from earlier quarters. This rotation boosted overall Value performance for the year and signaled a transition in investor bias toward companies with more attractive valuations heading into the coming year.

Figure 4: December 2025 US Factor Performance (sector adjusted)

Source: Confluence Style Analytics

The annual U.S. inflation rate was 2.7% in December 2025, the lowest since July and down from 3.0% in the previous quarter. The unemployment rate declined slightly to 4.4% in December 2025, down from a revised 4.5% in November.

Notable outperformers with high forecast growth over the 12 months that led the annual and Q4 performance of the region include consumer discretionary company Amazon.com Inc. (5.1% in Q4) and healthcare company Eli Lilly and Company (+5.5% in Q4). Information technology company Apple Inc. (+7% in Q4) and consumer staples company Walmart Inc. (8% in Q4) also contributed to the fourth-quarter performance, led by the sales-to-price subfactor. Companies that contributed to the outperformance of U.S. equities in December, led by the shareholder yield subfactor, include the Information Technology company NVIDIA Corp (5.4% in December) and the financials company Visa Inc. (5% in December).

Figure 5: Q4 2025 US Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 6: 2025 US Factor Performance (sector adjusted)

Source: Confluence Style Analytics

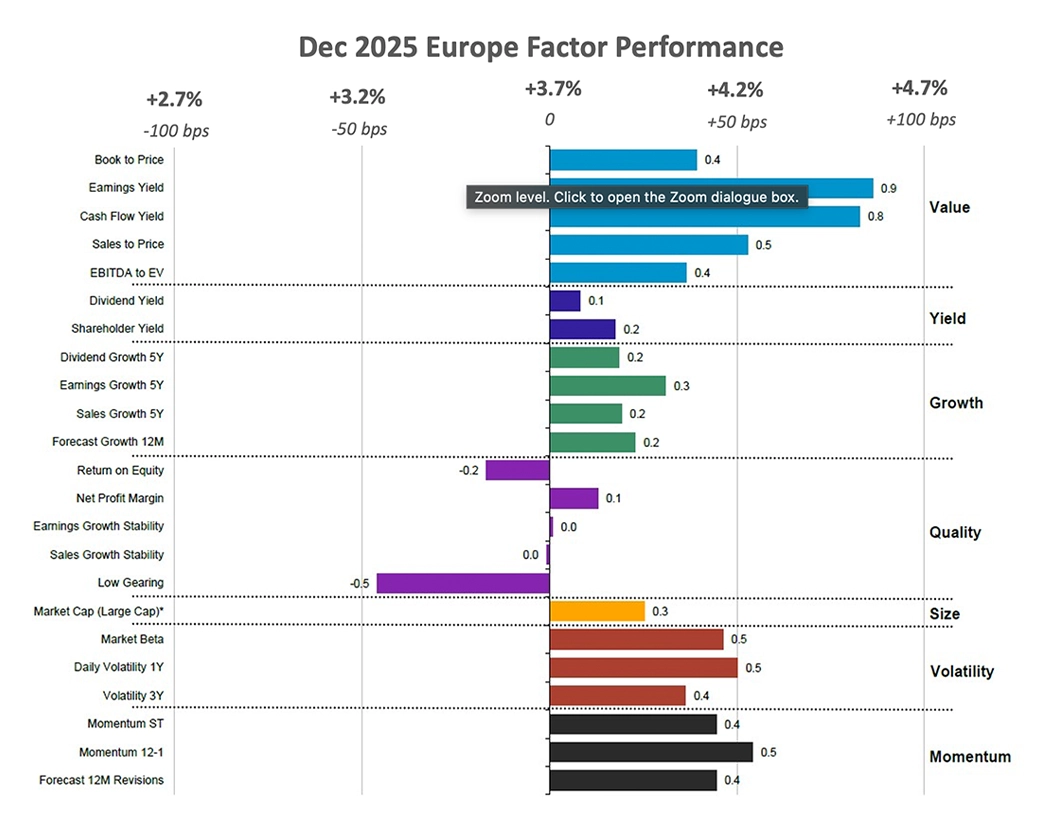

European Equities

European equity markets outperformed their U.S. and UK counterparts in December 2025. This relative strength was driven primarily by Value and Momentum, with additional support from Volatility and Growth. While most factors contributed positively to the region’s performance during the month, gains were partially offset by weaker performance in the Quality factor.

In contrast to the broad underperformance of European markets in December of the prior year, the strong performance in December 2025 was driven by the Volatility and Momentum sub-factors, in addition to the continued strength of Value and Growth seen in the previous December. European value stocks outperformed growth stocks, and the sustained directional trend of cyclical stocks leading the market contributed significantly to Momentum outperformance.

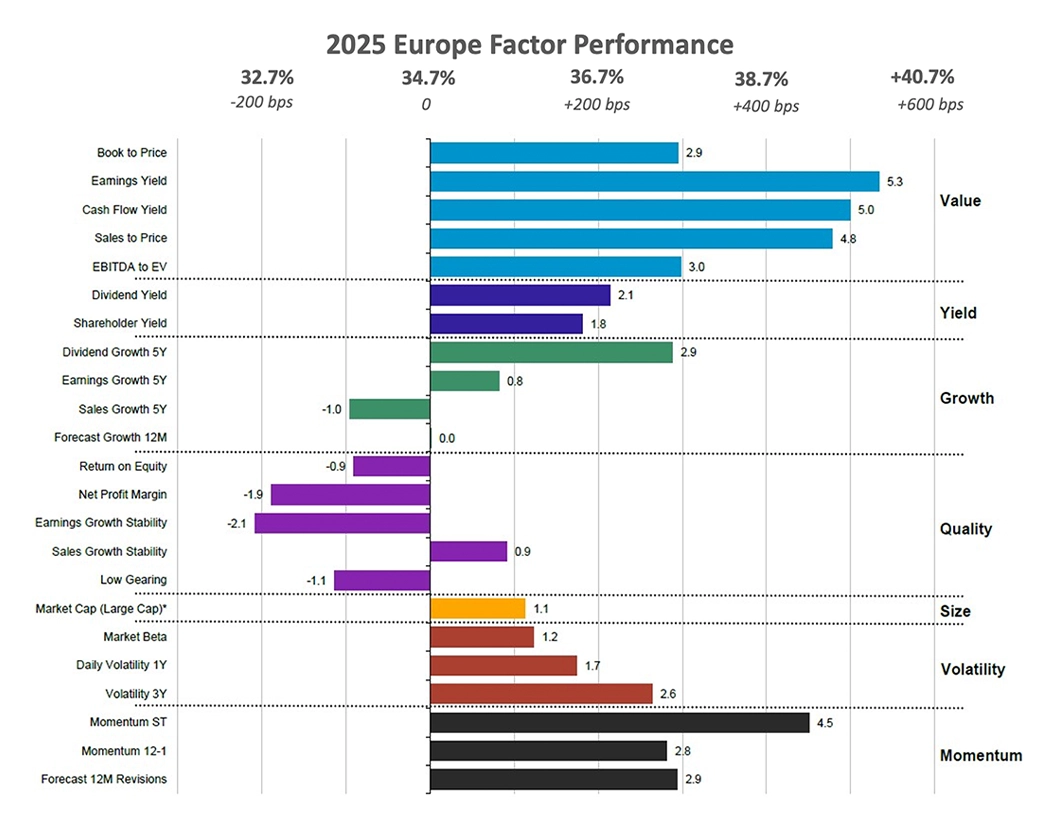

Compared with the modest overall return of 2.3% in 2024, European equity markets delivered resilient returns of 34.7% this year, mainly driven by the strong outperformance of the Value and Momentum factors.

Euro area consumer price inflation eased to 2.0% in December 2025, down from 2.1% in November. The euro area unemployment rate declined to 6.3% in November from 6.4% in October, while manufacturing production rose by 1.5% year-over-year in October.

In 2025, investors preferred companies with short-term momentum in the Eurozone region, which included French consumer discretionary company LVMH Moët Hennessy Louis Vuitton (+25% in Q4) and German financial services company Allianz SE (+9.2% in Q4). Companies with sales-to-price subfactors that contributed to the outperformance of the Euro Zone in Q4 include Spanish financial company Banco Santander SA (14.4% in Q4) and French consumer discretionary company Christian Dior SE (22.0% in Q4). Companies that contributed to the region's performance in December, led by the Market Beta subfactor, include Italian financial company UniCredit SPA (12.0% in December) and German industrial company Siemens Energy AG (5.6% in December).

Figure 7: December 2025 Europe Factor Performance (sector adjusted)

Source: Confluence Style Analytics

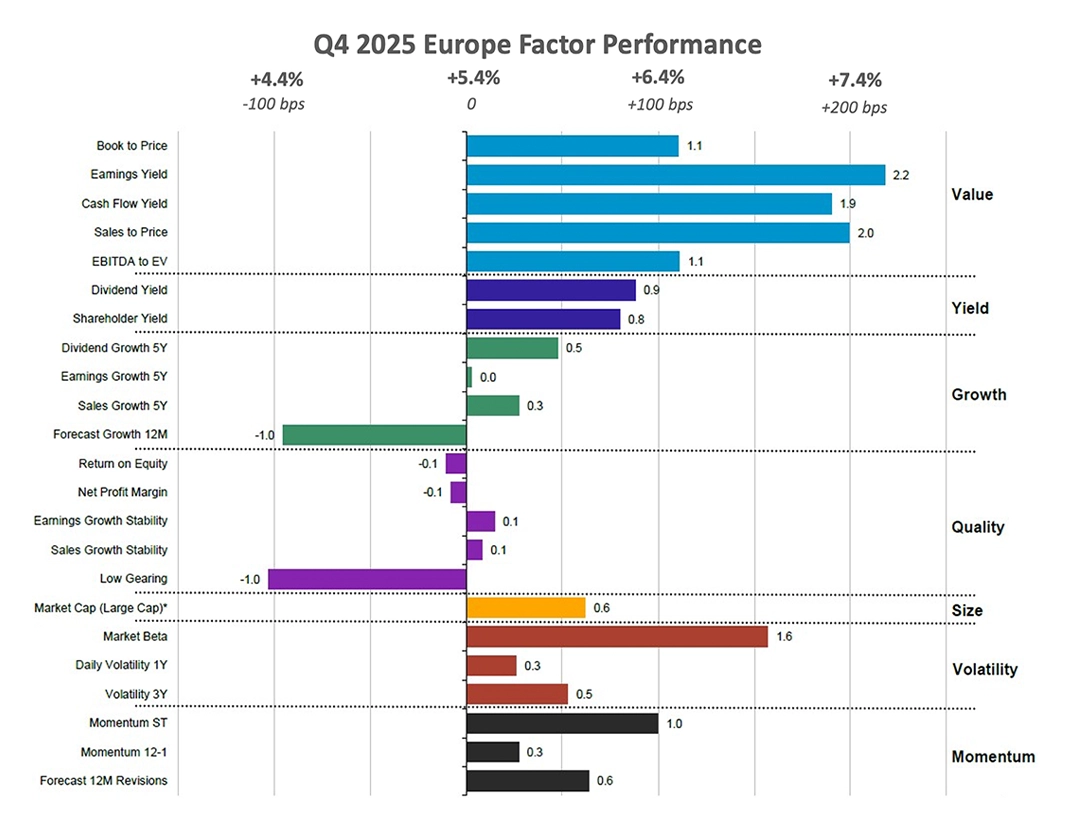

Figure 8: Q4 2025 Europe Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 9: 2025 Europe Factor Performance (sector adjusted)

Source: Confluence Style Analytics

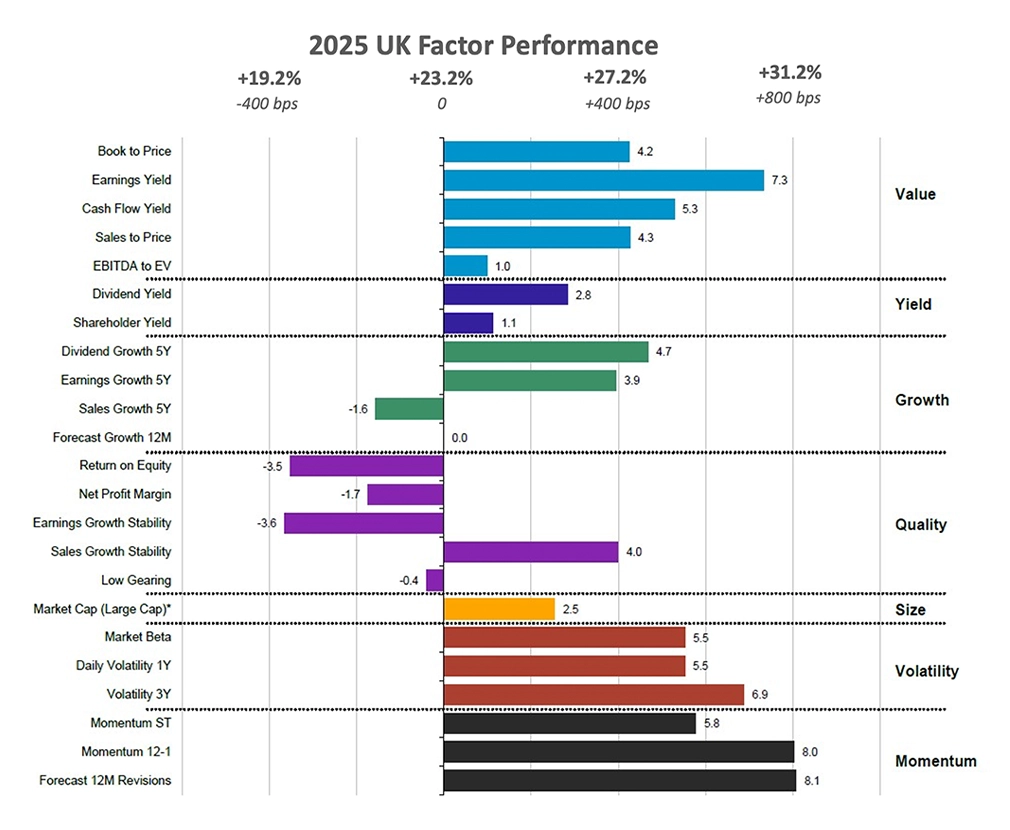

UK Equities

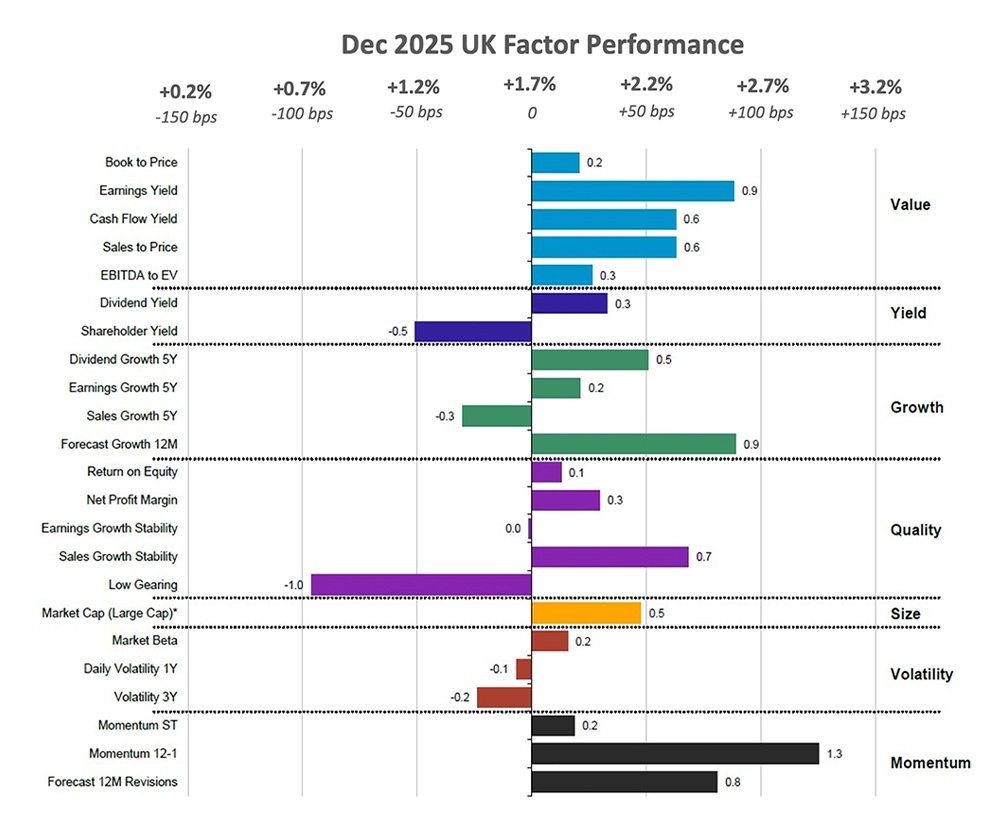

The UK equity market delivered a return of 1.7% in December 2025. In the final month of the year, Value and Momentum were the primary drivers of performance, while, similar to other developed markets, Quality sub-factors detracted from returns. Volatility also underperformed and weighed on the region’s performance during the month.

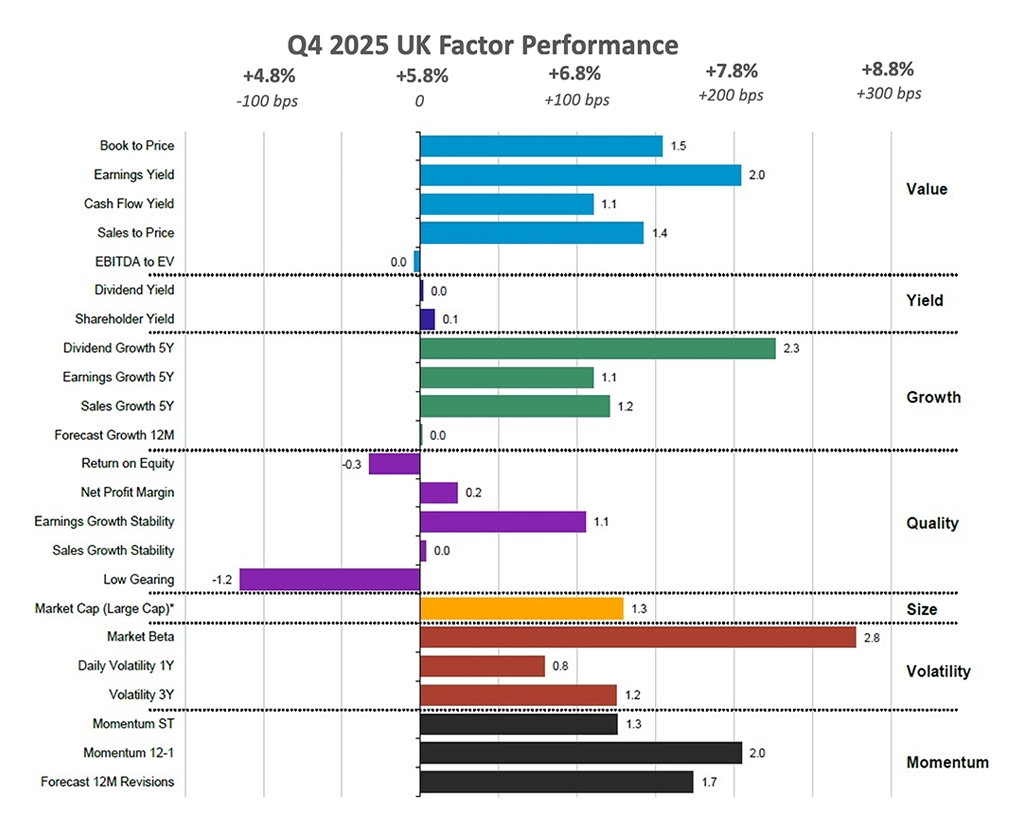

Compared with the prior year, the UK equity market delivered significantly stronger annual performance. While Value and Yield sub-factors performed broadly in line with the previous year, Momentum and Volatility saw substantial outperformance in 2025. This strength in both factors was consistent with the trends observed in the factors during the quarter.

UK inflation eased to 3.2% in November 2025, its lowest level in eight months, down from 3.6% in October. The unemployment rate rose to 5.1% in the three months to October 2025, while manufacturing output increased by 0.5% month-on-month in October, rebounding from a 1.7% decline in September.

Equities were driven by strong earnings yield, which contributed to the region's outperformance in the fourth quarter, including consumer staples company British American Tobacco Plc (+10% in Q4) and materials company Rio Tinto Plc (+22.5% in Q4). Companies with notable Volatility 3Y outperformance contributing to the annual returns of the UK region include financial company Barclays Plc and energy company BP Plc.

Figure 10: December 2025 UK Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 11: Q4 2025 UK Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 12: 2025 UK Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Emerging Market Equities

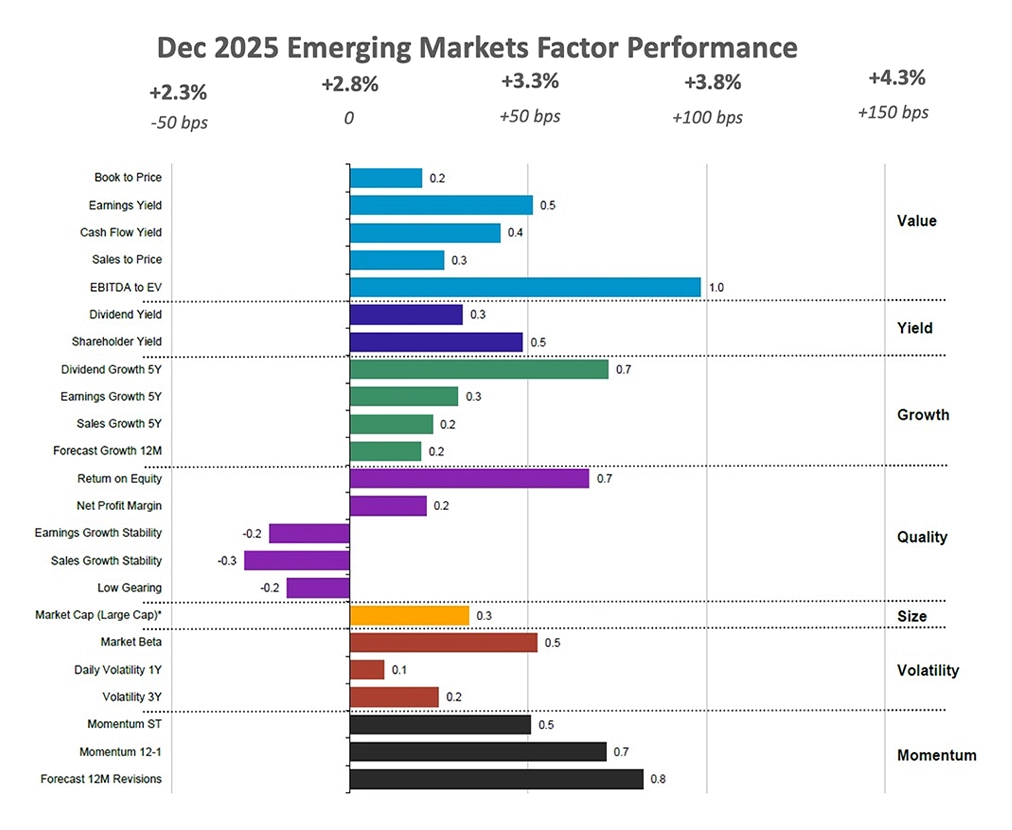

Like its developed market counterparts, emerging market equities delivered positive performance in December 2025. The region’s returns were driven by strong outperformance in the Value, Momentum, Yield, and Growth sub-factors, with large-cap stocks making a meaningful contribution to overall performance.

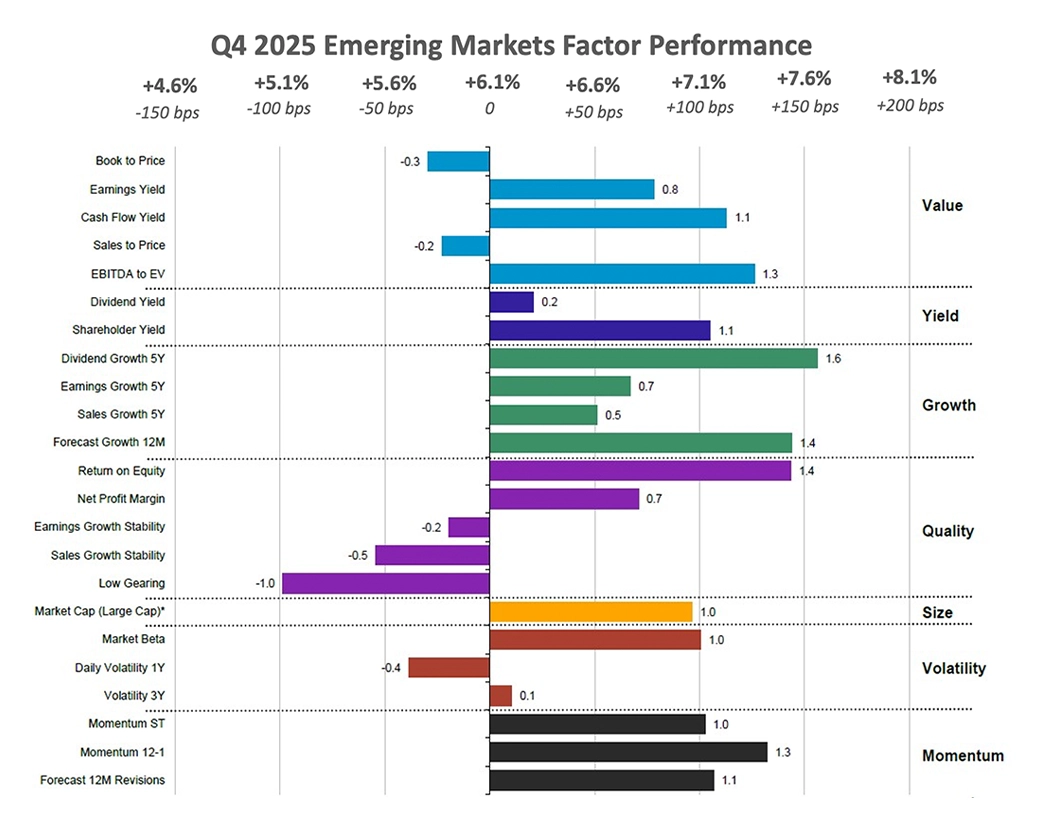

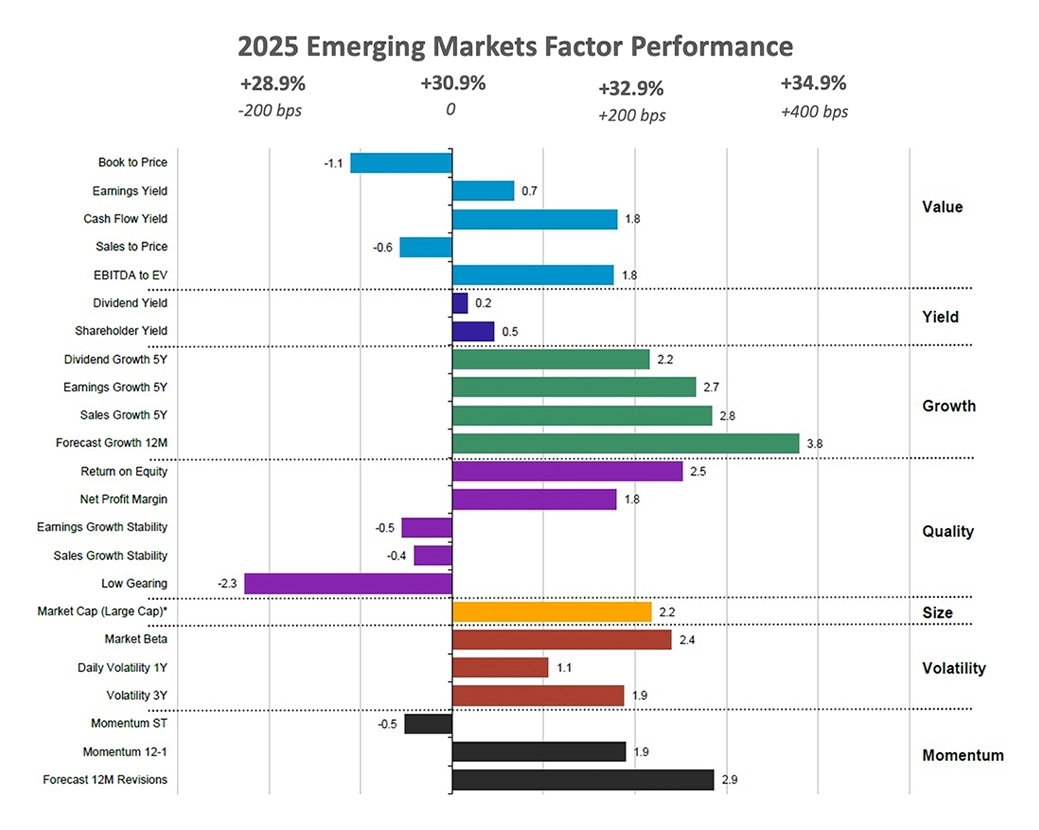

Following the underperformance of emerging markets in the prior year, the region delivered a strong rebound in 2025, posting an annual return of 30.9%. This outperformance was driven primarily by Growth, Volatility, and Momentum factors. In contrast to the previous year, when Value underperformed in emerging markets, factor performance improved notably in 2025.

In 2025, emerging market equities drew significant investor interest as a softer US dollar amplified returns by boosting the value of local-currency gains. Additionally, EM stocks traded at a discount relative to developed markets, making them particularly attractive to investors.

India’s consumer price inflation rose to 0.71% year-on-year in November 2025, up from October’s record low of 0.25%. In China, annual inflation edged up slightly to 0.8% in December from 0.7% the previous month. South Korea’s annual inflation rate fell modestly to 2.3% in December, down from 2.4% in the prior two months. India’s unemployment rate declined to 4.7% in November, marking its lowest level since at least 2018. Meanwhile, China’s manufacturing production grew 4.6% year-on-year in November 2025.

Emerging Markets equities that outperformed in the fourth quarter of 2025, captured by the forecast 1-year revisions, include a Taiwanese Semiconductor Manufacturing company (+15.6% in Q4); a Chinese financials company, Agricultural Bank of China (+19.2% in Q4). Notable outperformers with ROE that outperformed in Dec and Q4, led by momentum 12-1, include Chinese financials company Industrial and Commercial Bank of China (+12.7% in Q4), Chinese financials company China Construction Bank Corp (5.5% in Q4). Outperformance in December, led by high ROE in the region, was contributed to by companies such as Foxconn Industrial Internet Co., Ltd. (3.5% in December) and China Life Insurance Co., Ltd. (6.0% in December).

Figure 13: December 2025 Emerging Markets Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 14: Q4 2025 Emerging Markets Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 15: 2025 Emerging Markets Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Canadian Equities

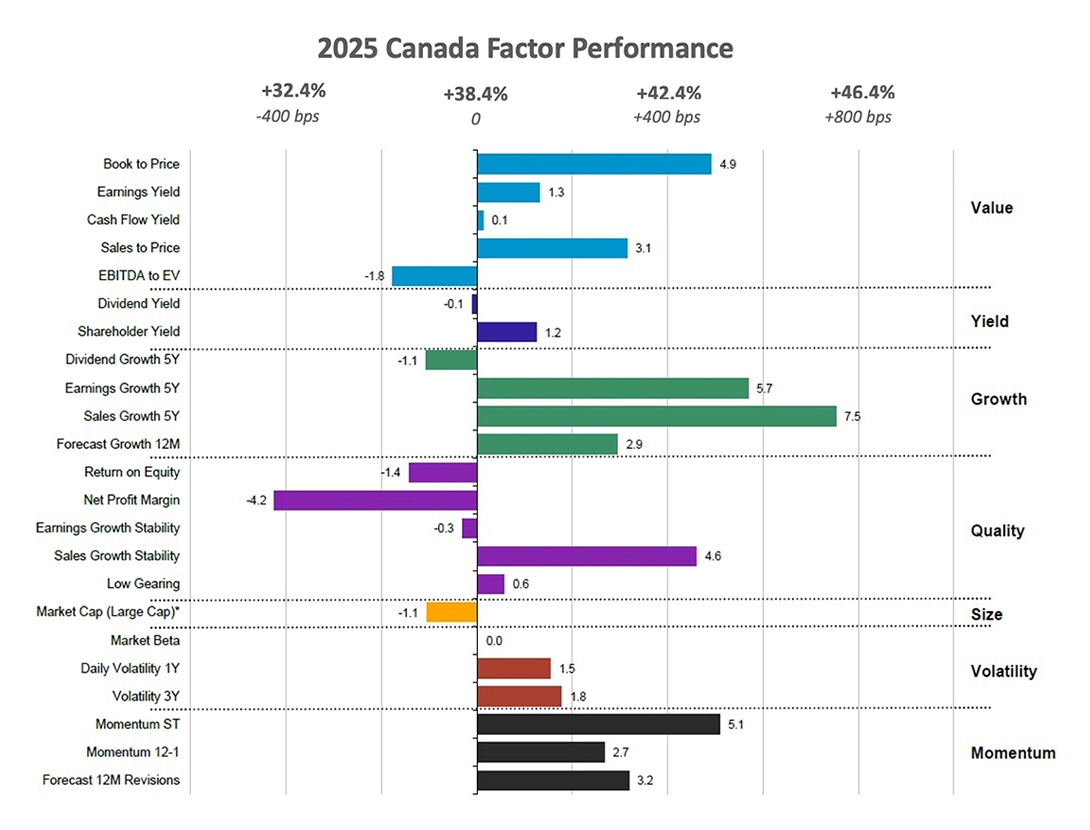

Canadian equity markets exhibited a mixed factor trend in December 2025. The region’s positive performance for the month was primarily driven by Value and Momentum, with Value also showing strong performance over the quarter alongside Momentum. Similar to the factor trends observed in 2024, Canadian equities exhibited a mixed overall pattern throughout the year. Moderating inflation and stable monetary conditions provided support to the region's equity markets; however, softer economic growth, weak manufacturing activity, and mixed factor trends limited the upside.

Canada’s headline inflation remained steady at 2.2% in November 2025, unchanged from October. The unemployment rate rose to 6.8% in December, up from 6.5% the previous month and above market expectations of 6.6%. Meanwhile, Canada’s Manufacturing PMI edged up slightly to 48.6 in December from 48.4 in November.

The Value stocks with a high book-to-price ratio that supported Canadian markets in December mainly include financial companies, such as Toronto Dominion Bank (+11.8% in December and 19.1% in Q4) and Bank of Nova Scotia (+6.2% in December and 15.6% in Q4). Key companies driving short-term momentum in the quarter were the financial company Royal Bank of Canada (+16.6% in Q4), the materials company Barrick Gold Corp (33.5% in Q4), and the information technology company Shopify Inc (+10.1% in Q4).

Figure 16: December 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 17: Q4 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 18: 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Conclusion

The global equity landscape in 2025 marked a clear transition from narrow, concentration-driven leadership toward broader, more balanced participation across regions and factors. As inflation pressures eased and monetary conditions became more supportive, investor preferences shifted decisively toward valuation discipline, cash flow resilience, and cyclical exposure. This environment allowed Value and Momentum to reassert leadership across most regions, while selective Volatility provided additional support during periods of market adjustment.

Importantly, factor performance became more differentiated and regionally nuanced, underscoring the value of granular, data-driven analysis in portfolio construction. The rotation away from mega-cap dominance and toward a wider opportunity set improved market breadth and reduced reliance on a small group of stocks to drive returns. As markets enter 2026, the persistence of these trends will depend on the durability of economic stabilization and policy normalization. In this context, diversified factor exposure and disciplined risk management remain essential tools for navigating an increasingly complex global equity environment.

Style Analytics

The industry-leading, visually compelling portfolio insights for the asset management industry.

Analyze factor exposures with confidence.

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.