Q4 2023

Plan Universe Allocation

& Return Analysis

Defined Benefit plans post their best quarterly performance in three years.

by:

Executive Summary

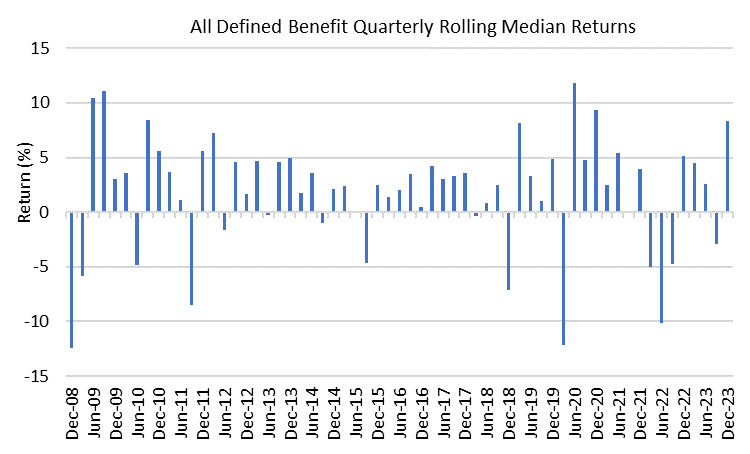

Markets rallied, especially toward the end of the year, after the Federal Reserve’s optimistic comments propelled U.S. equity markets to two-year highs. Despite lingering challenges such as geopolitical tensions and the high cost of borrowing, the potential of loosening monetary policy renewed optimism in global markets. Defined benefit plans, buoyed by positive performance during the fourth quarter from all asset classes other than Real Estate, posted their strongest quarterly return since Q4 2020.

Highlights

- All defined benefit plans’ performance rebounded in the fourth quarter, posting their highest return since Q4 2020, with a median return of 8.38%.

- U.S. equity continued to drive performance across defined benefit plans, at a median level returning 12.04%. Comparatively, the median returns for U.S. fixed income and alternatives were 6.46% and 2.78.%.

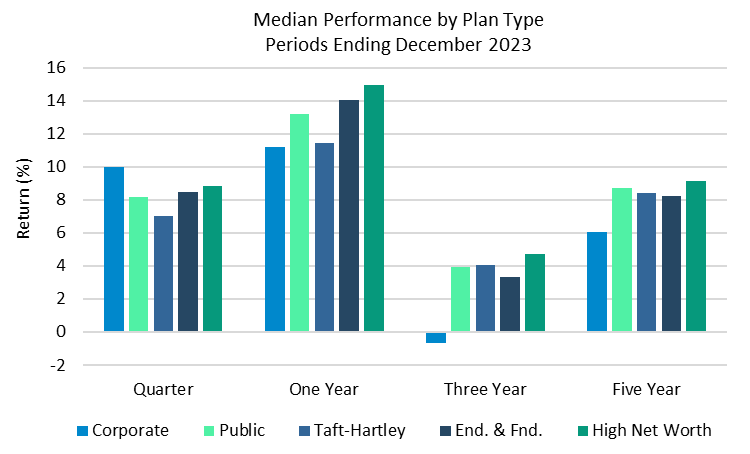

- Corporate defined benefit plans, driven by their fixed income allocation to long bonds, were the best performers by plan type during the quarter, returning 9.97% at a median level.

- Taft-Hartley plans lagged peers for the quarter with a median return of 7%, trailing other plan types by nearly 2% on average.

Plan Performance Over Time

Source: Investment Metrics, a Confluence company

Historical Plan Comparison

Corporate defined benefit plans returned 9.97% at a median level in Q4 of 2023, outperforming all plan types. While long bond performance in December buoyed corporate plan performance during the quarter, that same exposure underperformed for the year; therefore, corporate plans lagged other plan types with a median return of 11.22% in 2023. The plans with the highest exposure to equity (Public, Endowments & Foundations, High Net Worth) posted the strongest performance for the year.

Source: Investment Metrics, a Confluence company.

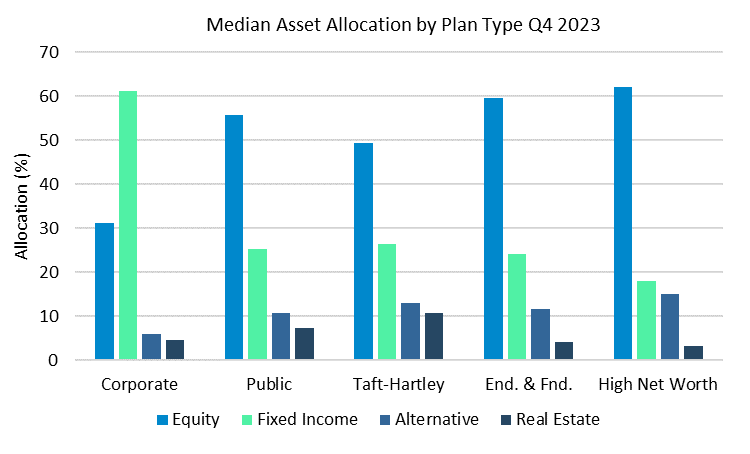

Q4 Plan Allocation Analysis

Source: Investment Metrics, a Confluence company.

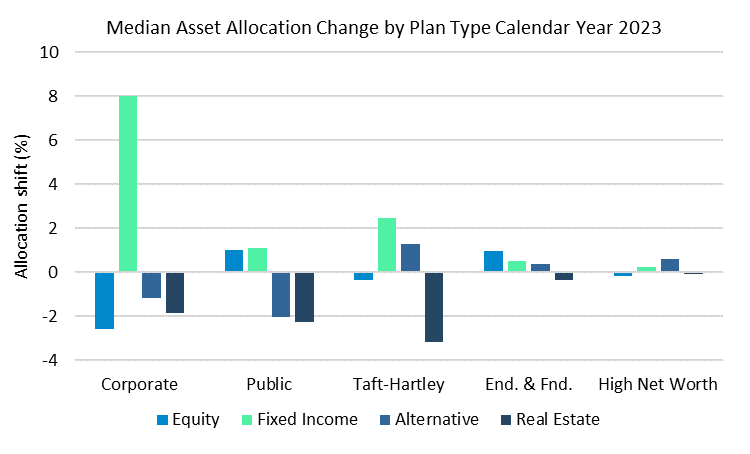

Source: Investment Metrics, a Confluence company.

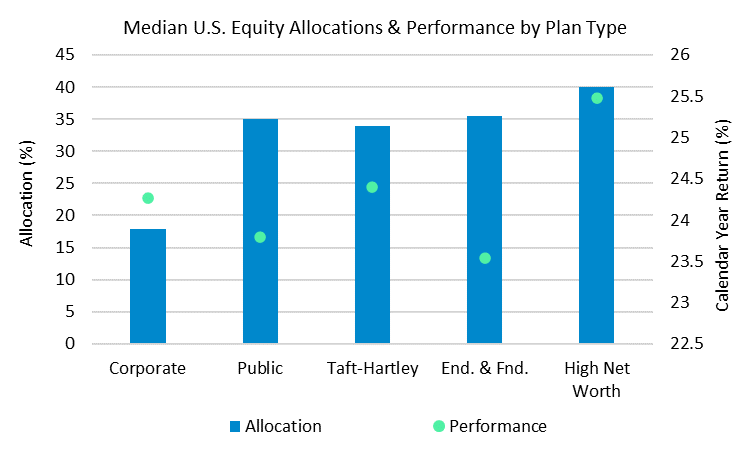

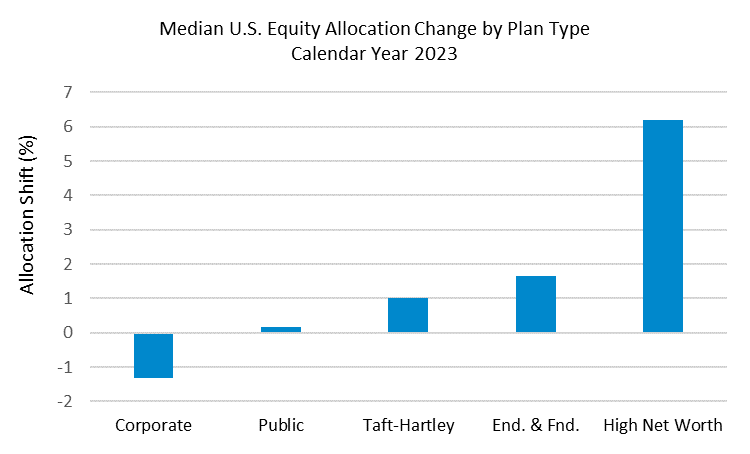

U.S. Equity Performance

The public U.S. equity market posted very strong returns in 2023; for defined benefit plans, the median U.S. equity return was 24.18%. Corporate plans continue to be underweight U.S. equity with a median allocation of 17.9%, roughly half the allocation compared to other plan types. For the year, all plan types, other than Corporates, increased their allocation to U.S. equity. High Net Worth plans, which were the best performing plan type for the year, increased their allocation to U.S. equity and had the strongest performance within the assets class, returning 25.5% at the median level.

Source: Investment Metrics, a Confluence company.

Source: Investment Metrics, a Confluence company.

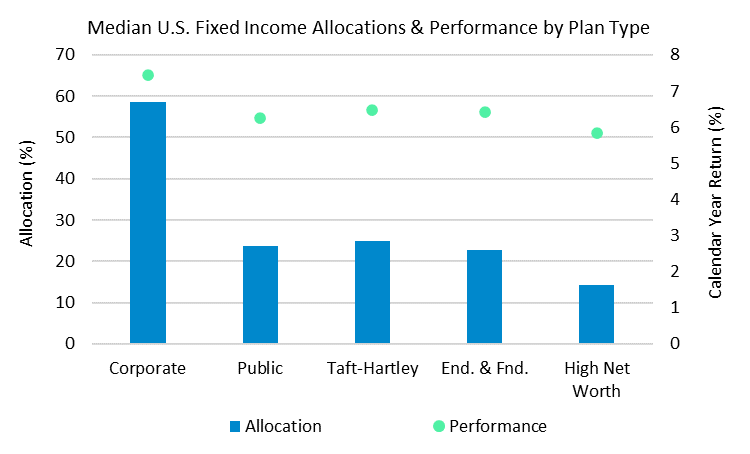

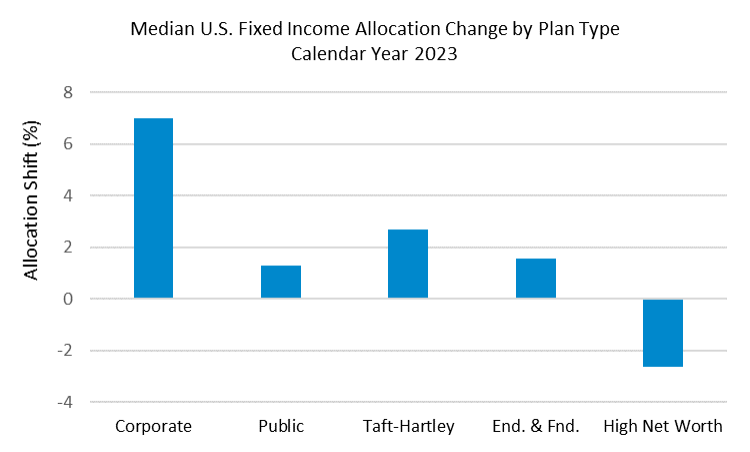

U.S. Fixed Income Performance

All plan types other than High Net Worth increased their allocation to U.S. Fixed income in 2023. Corporate plans, which have the highest allocation to the asset class at 58.5%, had the highest increase in allocation as well as the best performance within the asset class.

Source: Investment Metrics, a Confluence company.

Source: Investment Metrics, a Confluence company.

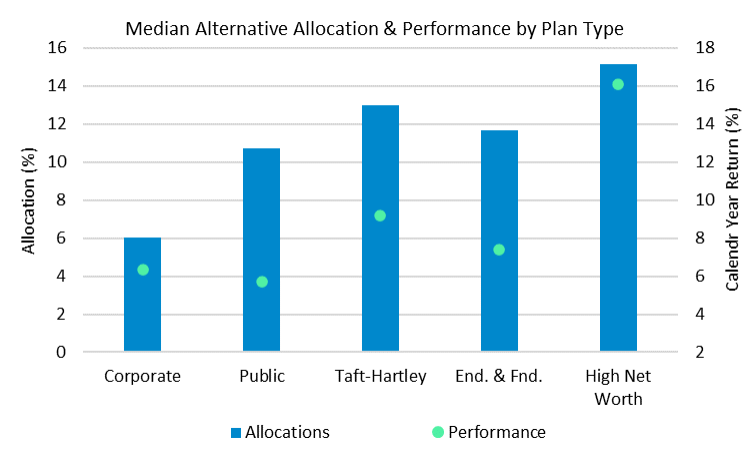

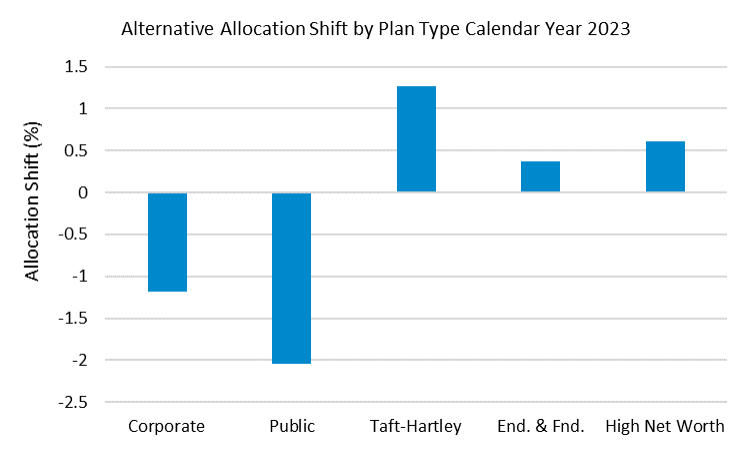

Alternatives Performance

The plans that increased their allocations to Alternatives during the year (Taft-Hartley, Endowments & Foundations, High Net Worth) also have the highest allocations. Public plans had the largest pullback to alternatives during the year, down 2% at the median level. Public plan’s performance in Alternatives also lagged all other plan types, returning 5.7% for the year, while the median across all defined plans was 6.9%.

Source: Investment Metrics, a Confluence company.

Source: Investment Metrics, a Confluence company.

Investment Metrics Plan Universe

Investment Metrics Plan Universe is the industry’s most granular analytics tool for plan sponsors, including standard and custom peer group comparisons of performance, risk, and asset allocations by plan type and size. The data is sourced directly from over 4,000 institutions using our reporting and analytics solutions, including investment consultants, advisors, and asset owners. Plan Universe is updated quarterly and typically available on or near the following schedule: preliminary data available on the 14th business day after the quarter end, a second cut on the 21st business day, and a final cut on the 29th business day. The data includes 20+ years’ history on:

- Trust Funds, Corporates, Public Plans, Taft-Hartley, Endowments & Foundations, High Net Worth, Health & Welfare, and custom groups.

- Asset Allocations are broken into equity (US, global, global ex-US), fixed income (US, global, and global ex-US), alternatives, real estate (public and private), multi-asset and cash. Emerging Markets allocations are available for equities and debt securities.

- Net and gross performances displayed by quartile with full percentiles via download.

- With all information aggregated by Plan Size.

Disclaimer

The information contained in this communication is for informational purposes only. Investment Metrics, a Confluence company, is not providing legal, financial, accounting, compliance or other similar services or advice through this communication. Recipients of this communication are responsible for understanding the regulatory and legal requirements applicable to their business.