Q3 2025

Factor Performance Analysis

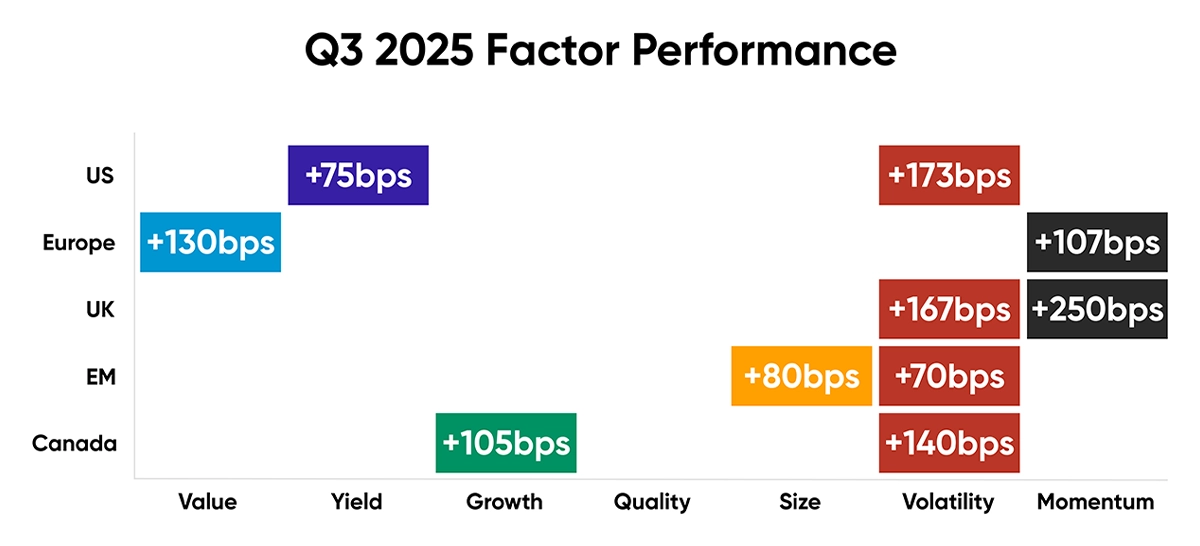

Risk-On Rally: Momentum and Volatility Dominate

Prepared by:

Market Background

Global equity markets posted strong performance in the third quarter of 2025, underpinned by a combination of easing trade tensions, excitement surrounding artificial intelligence (AI), and supportive monetary policy. One of the key drivers of market sentiment was the easing of global trade tensions. The extension of the U.S.–China trade truce, along with renewed agreements with other key trading partners, helped alleviate fears of supply chain disruptions and a slowdown in global commerce. Meanwhile, the ongoing boom in AI continued to energize markets, led by Volatility and Momentum across the international markets. Monetary policy remained a critical tailwind. The U.S. Federal Reserve implemented its first rate cut of the year and signalled the possibility of further easing, reinforcing global risk appetite.

Oil prices declined to $62 per barrel by the end of September, down from $64 at the previous month-end. Bitcoin delivered a strong performance in Q3 2025, driven by rising institutional interest, record trading volumes, and solid market fundamentals. While its price fluctuated within a defined range, it demonstrated resilience amid ongoing macroeconomic uncertainty.

Gold prices reached a new all-time high of $4,140 per ounce in the first week of October, as investors increased safe-haven demand amid rising US-China trade tensions and growing expectations of further U.S. interest rate cuts.

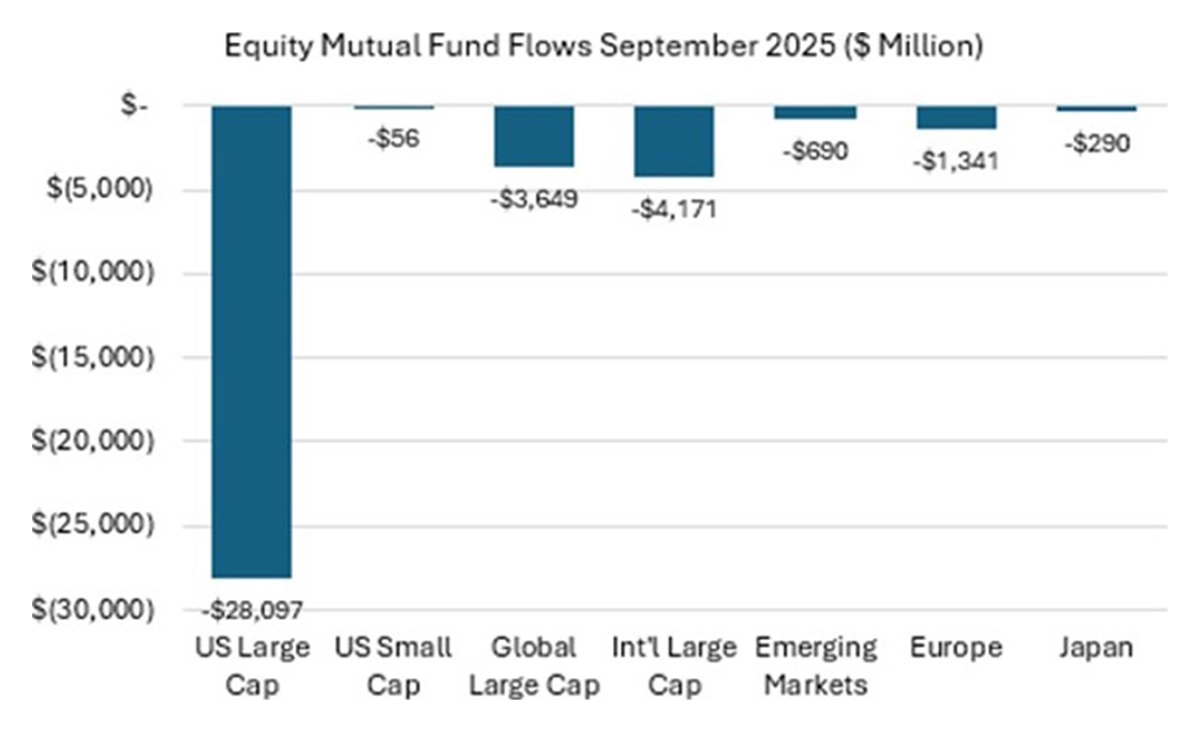

As shown in Figure 1, fund flows in September 2025 remained broadly consistent with the previous month, marked by significant outflows from U.S. large-cap funds, followed by international large-cap funds. These substantial equity mutual fund outflows were primarily driven by heightened investor caution and profit-taking after a prolonged, record-breaking rally in global equity markets. Contributing factors included uncertainty surrounding elevated U.S. bond yields, geopolitical tensions, ongoing trade disputes, and concerns over a potential government shutdown, all of which weighed on market sentiment.

Figure 1: Sept 2025 Mutual Fund Flows data.

Source: Confluence Style Analytics

Factor Summary

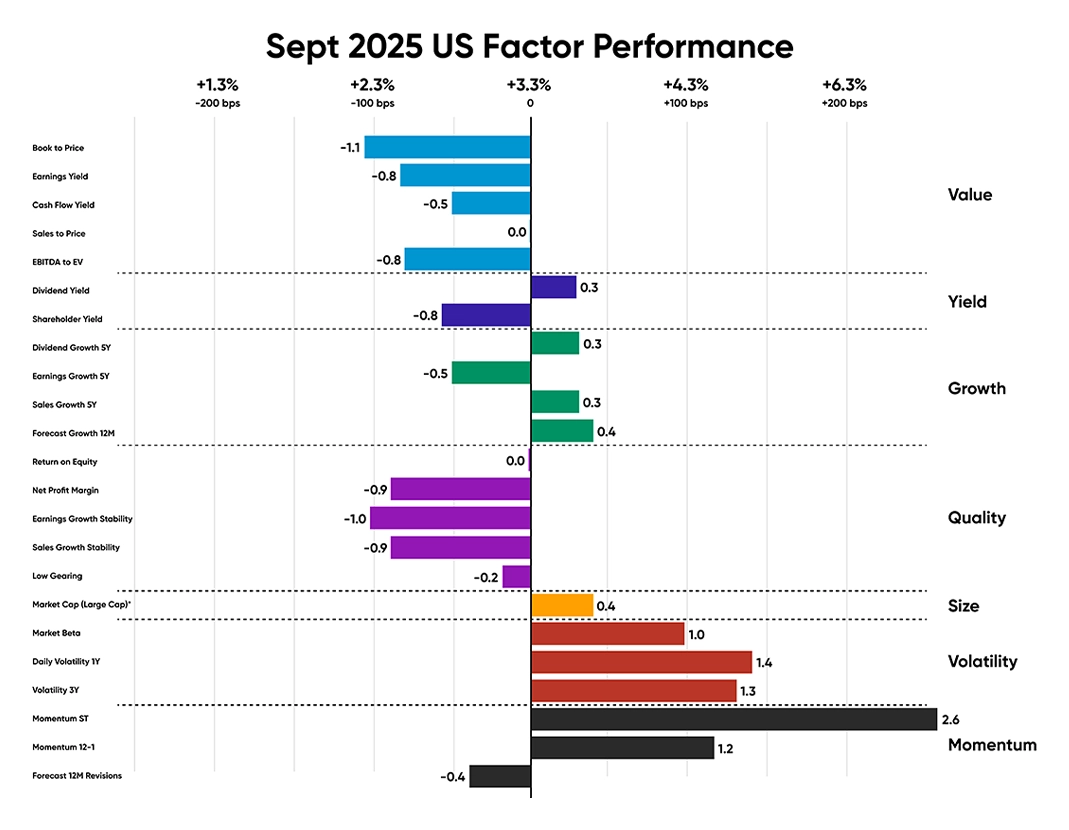

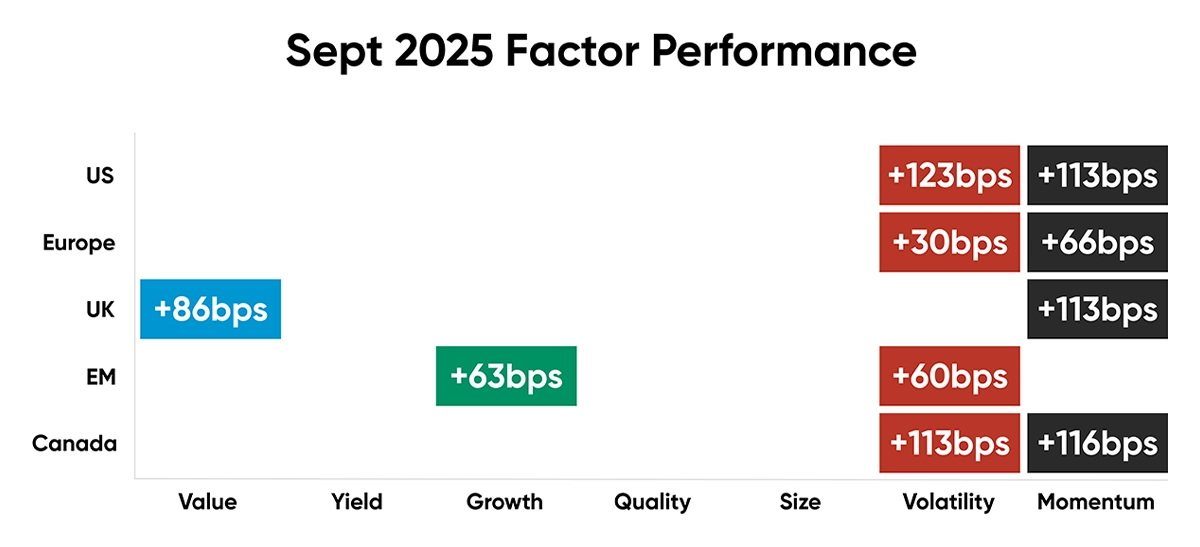

Figures 2: Regional relative factor performance (country and sector adjusted) for Sept ’25 and Q3 ‘25

Source: Confluence Style Analytics

US Equities

Investor uncertainty persisted in U.S. equity markets throughout the third quarter of 2025 and into September. Amid shifting risk appetite, more volatile stocks outperformed the broader market. In particular, volatile stocks rebounded in September following a difficult August, driven by renewed optimism in key growth sectors, especially technology and AI. Conversely, value stocks underperformed in September compared to the previous month, as market leadership rotated back toward mega-cap and high-beta growth names, while several value-oriented sectors lagged.

Additionally, Momentum stocks also reversed their trend from August, outperforming and leading U.S. equity market performance in September by 113 bps relative to the broader market. A combination of strong earnings trends, the Federal Reserve’s first interest rate cut in nearly a year, sustained optimism around AI, and resilient economic data drove the outperformance of these stocks. The Fed lowered its policy rate by 25 bps and signalled the possibility of further cuts, marking a shift toward a more accommodative stance. This policy pivot provided a tailwind for growth and momentum-oriented stocks, as lower borrowing costs support both business investment and elevated valuations. Robust second-quarter earnings—particularly from technology and AI-focused companies—further boosted investor confidence and increased demand for high-momentum names, especially within the tech sector.

U.S. annual inflation rate accelerated this month, rising to 2.9%, its highest level since January, after holding steady at 2.7% for the past two months. The employment population ratio in the United States held steady at 59.6% in August, while US manufacturing output increased by 0.2% during the same month, surpassing expectations after recording a -0.1% decrease in July.

Figure 3: Sept 2025 US Factor Performance (sector adjusted)

Source: Confluence Style Analytics

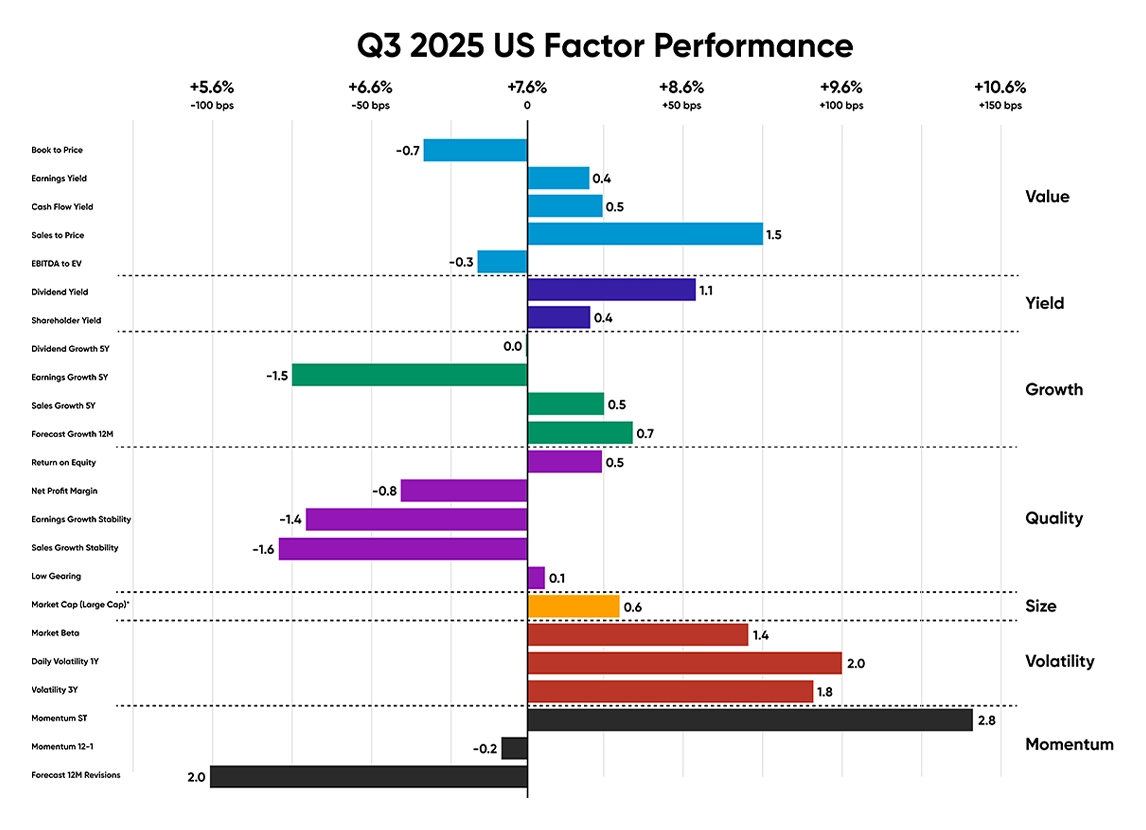

Securities with high short-term momentum that outperformed the region's performance in this quarter include mega-cap information technology companies like NVIDIA Corp (16% in Q3), Consumer discretionary companies Tesla Inc (61% in Q3), and communication services company Meta Platforms Inc (10% in Q3).

Companies like Broadcom Inc. (31% in Q3) and financial company JPMorgan Chase & Co. (21% in Q3) led the region's performance, characterized by high daily volatility and 1-year outperformance in this quarter.

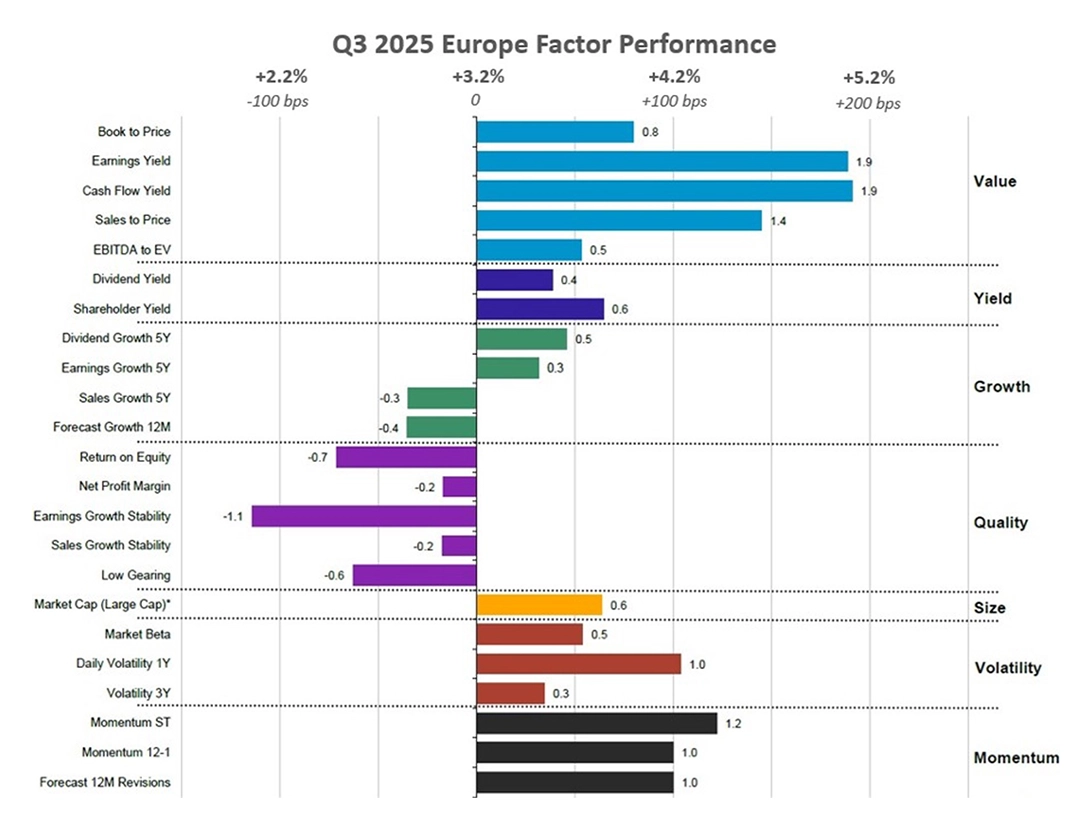

While Value stocks delivered mixed results in September, following strong outperformance in August 2025, driven by rising long-term interest rates that supported sectors like financials and banks, their performance over the full quarter still led to outperformance within the Eurozone market.

Figure 4: Q3 2025 US Factor Performance (sector adjusted)

Source: Confluence Style Analytics

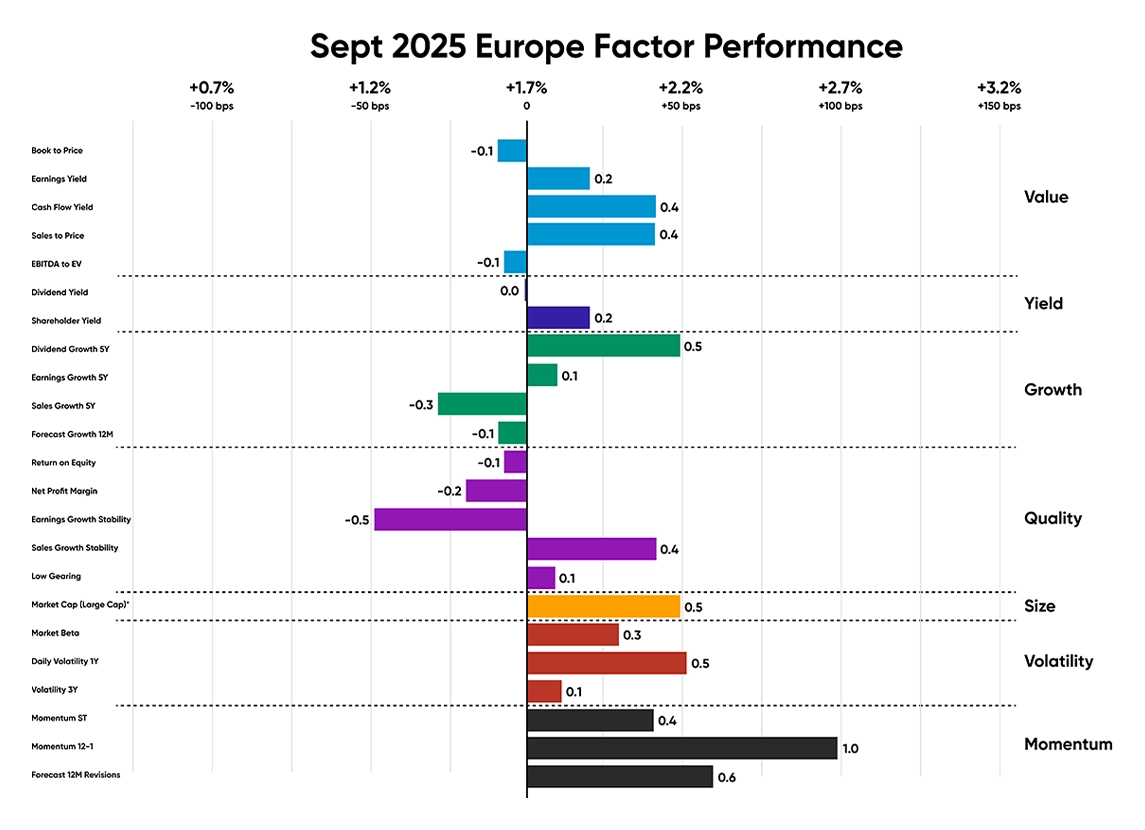

European Equities

European momentum and volatility equities demonstrated a strong rebound and notable resilience despite persistent trade tensions, geopolitical risks, and macroeconomic headwinds. In contrast to the tech-driven momentum seen in the U.S., Europe experienced a more balanced sector rotation, led by financials and industrials—sectors that are typically more cyclical and momentum-sensitive. Stable economic growth projections and ongoing disinflation supported the region’s recovery, benefiting stocks with strong upward price trends.

Consumer price inflation in the Euro area increased to 2.2% in September 2025, up from 2.0% in the previous three months. The Euro area’s seasonally adjusted unemployment rate rose slightly to 6.3% in August 2025. Meanwhile, manufacturing production in the region grew by 2.2% in July 2025. Notable outperformers with momentum 12-1 include the energy company Saudi Arabian Oil Co. (+5% in Q3), the Chinese financial company China Construction Bank Corp. (+10% in Q3), and the Taiwanese information technology company Taiwan Semiconductor Manufacturing Co. (+9% in Q3). The companies with high cashflow yield, which contributed to the region’s performance, include Spanish financials company Banco Santander (20% in Q3) and Italian financials company Unicredit SPA (20% in Q3).

Figure 5: Sept 2025 Europe Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 6: Q3 2025 Europe Factor Performance (country/sector adjusted)

Source: Confluence Style Analytics

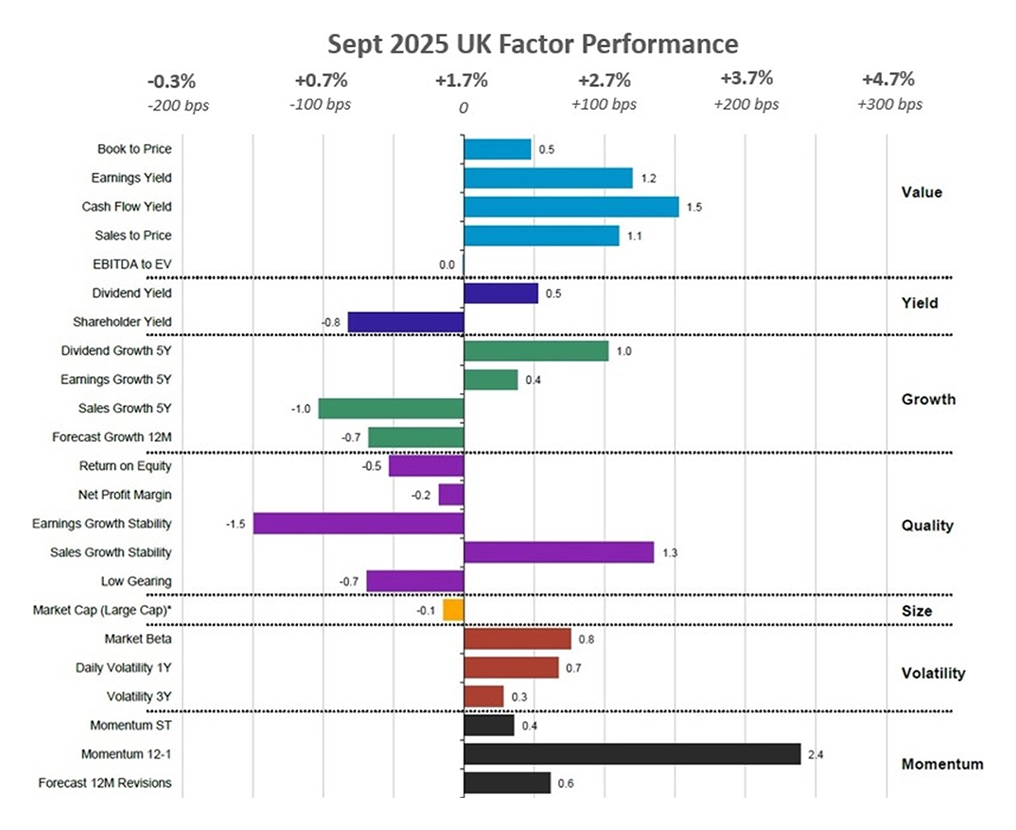

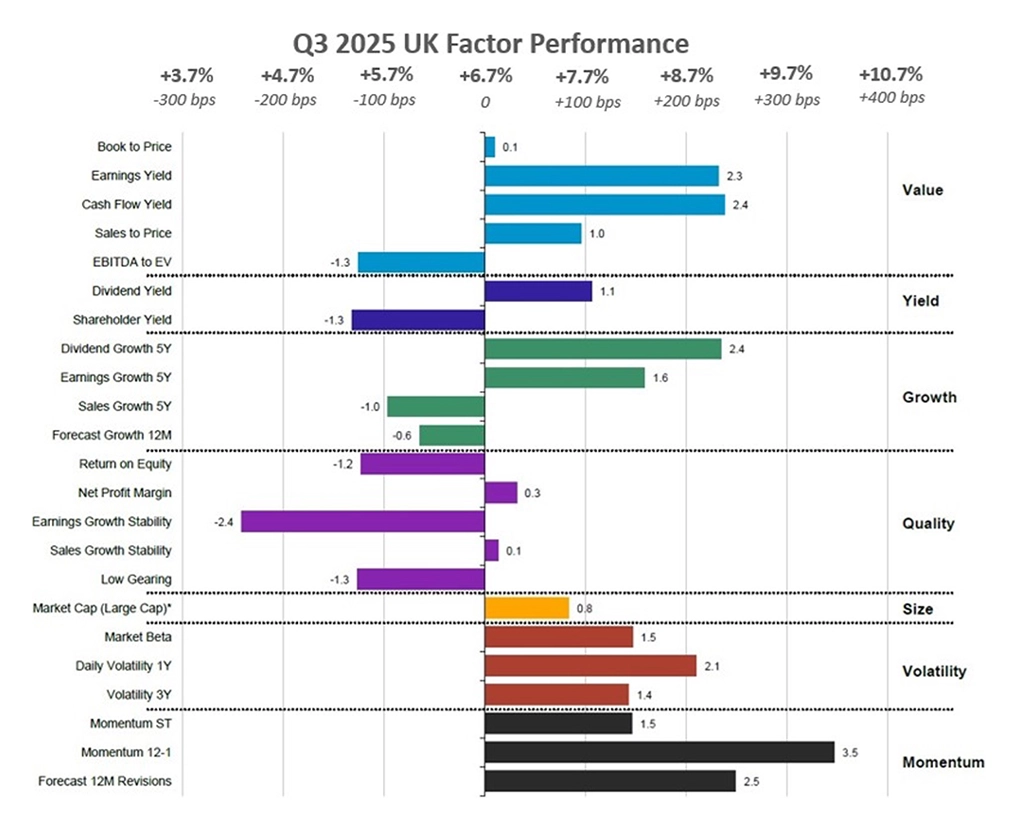

UK Equities

In September 2025, Value stocks outperformed in the UK, driven by attractive valuations and their relative resilience amid market uncertainty. Weak global trade data, particularly from China, and broader economic concerns prompted investors to seek safety in UK equities, which were trading at significant discounts to fair value. Dividend-paying companies with strong balance sheets gained popularity, boosting the performance of dividend yield and earnings growth subfactors, as investors sought both income and downside protection.

Momentum stocks also outperformed in the UK compared to August, supported by improving market sentiment and a series of positive catalysts. Better-than-expected corporate earnings from major UK firms fueled optimism. Lastly, ongoing enthusiasm for technology and innovation sectors—represented in UK momentum names—further fueled the outperformance in September versus August.

Meanwhile, persistent concerns over Chinese trade data, volatile commodity prices, and geopolitical tensions in Europe drove sustained market swings. This elevated volatility made UK Volatility stocks increasingly attractive as portfolio hedges.

The UK’s annual inflation rate remained unchanged at 3.8% in August 2025. Meanwhile, the unemployment rate rose to 4.8% in the three months to August, slightly above market expectations and up from 4.7% in July. Additionally, manufacturing production declined by 1.3% month-over-month in July 2025, reflecting continued weakness in the industrial sector.

Momentum 12-1 equities that helped the region outperform in this quarter include financials company HSBC Holdings Company (+26% in Q3), energy company Shell PLC (+4% in Q3). Companies with high cash flow yields include Energy company BP PLC (+22% in Q3) and Industrial company Ferguson Enterprises Inc. (27% in Q3).

Figure 7: Sept 2025 UK Factor Performance (county/sector adjusted)

Source: Confluence Style Analytics

Figure 8: Q3 2025 UK Factor Performance

Source: Confluence Style Analytics

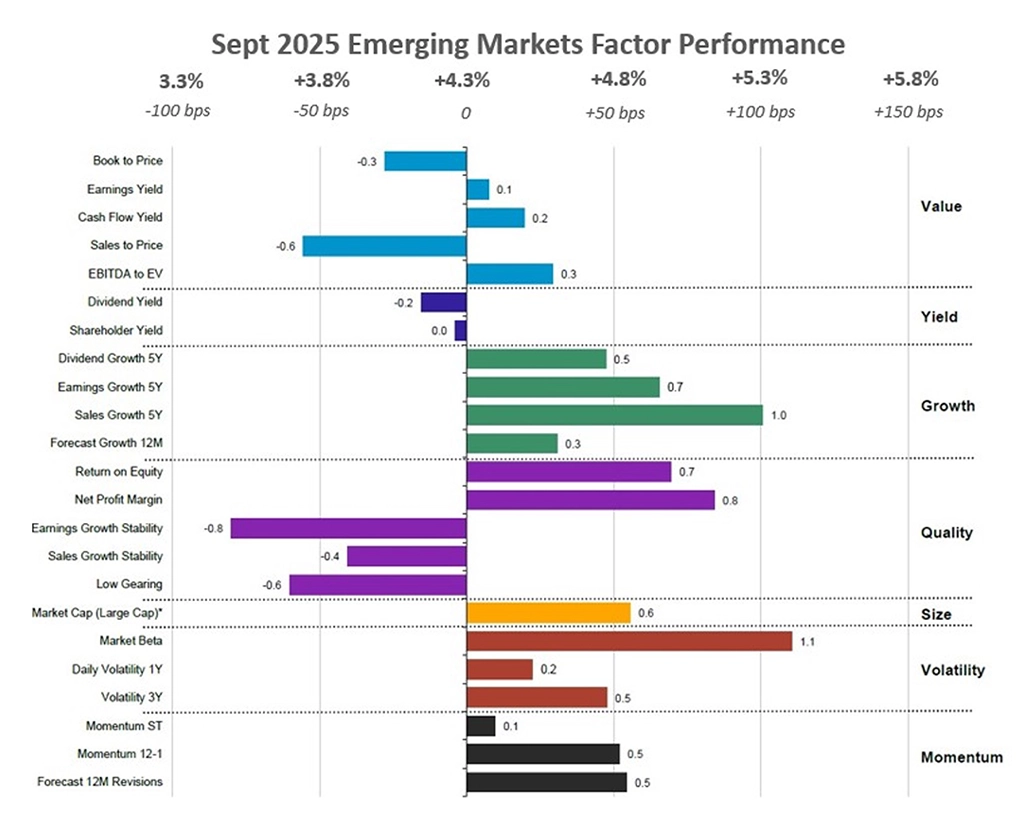

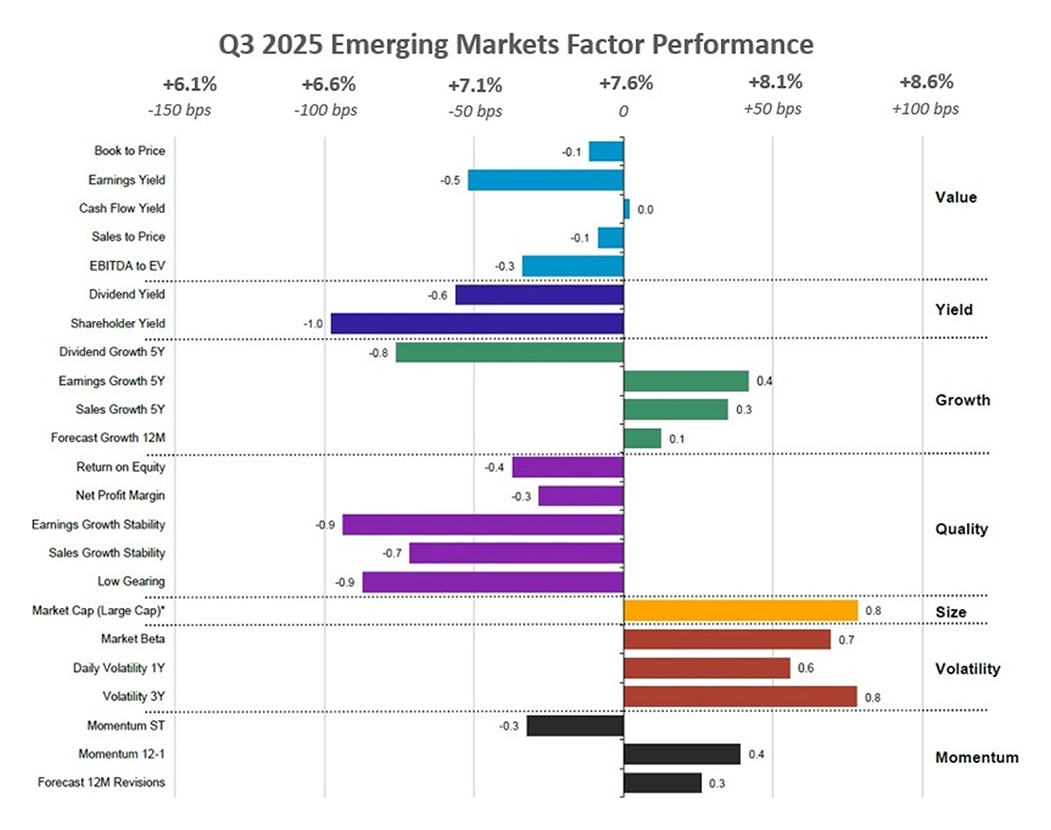

Emerging Market Equities

In September 2025, growth and volatility stocks outperformed across Emerging Markets, driven by a renewed risk-on sentiment following the U.S. Federal Reserve’s first interest rate cut of the year. This shift toward monetary easing, coupled with a weaker U.S. dollar, boosted investor appetite for higher-return assets, making EM equities more attractive to global investors seeking growth opportunities outside the U.S.

Strong corporate earnings—particularly in technology sectors tied to artificial intelligence and innovation—further supported growth stocks. Markets in China, South Korea, and Taiwan led the rally, benefiting from robust performance in the tech sector and continued domestic policy support for chipmakers and AI-related industries.

China stood out as the top performer for the quarter, with investors favoring large-cap stocks due to their relative stability and significant exposure to key growth drivers such as strong semiconductor demand and rising AI exports, despite ongoing macroeconomic uncertainties.

In August 2025, China’s consumer prices declined by 0.4% year-over-year, following a flat reading in the previous month, while the country’s surveyed unemployment rate rose slightly to 5.3%, exceeding market expectations. In South Korea, consumer prices increased by 2.1% year-over-year in September, up from a 1.7% rise in August, while the seasonally adjusted unemployment rate edged up to 2.6% in August from 2.5% in July.

Companies that led by daily Volatility 3Y in Emerging Markets this quarter include Chinese energy company Petrochina Co ltd (+37% in Q3); and industrials company Contemporary Amperex Tech Co Ltd (+14% in Q3).

Figure 9: Sept 2025 Emerging Markets Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 10: Q3 2025 Emerging Markets Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Canadian Equities

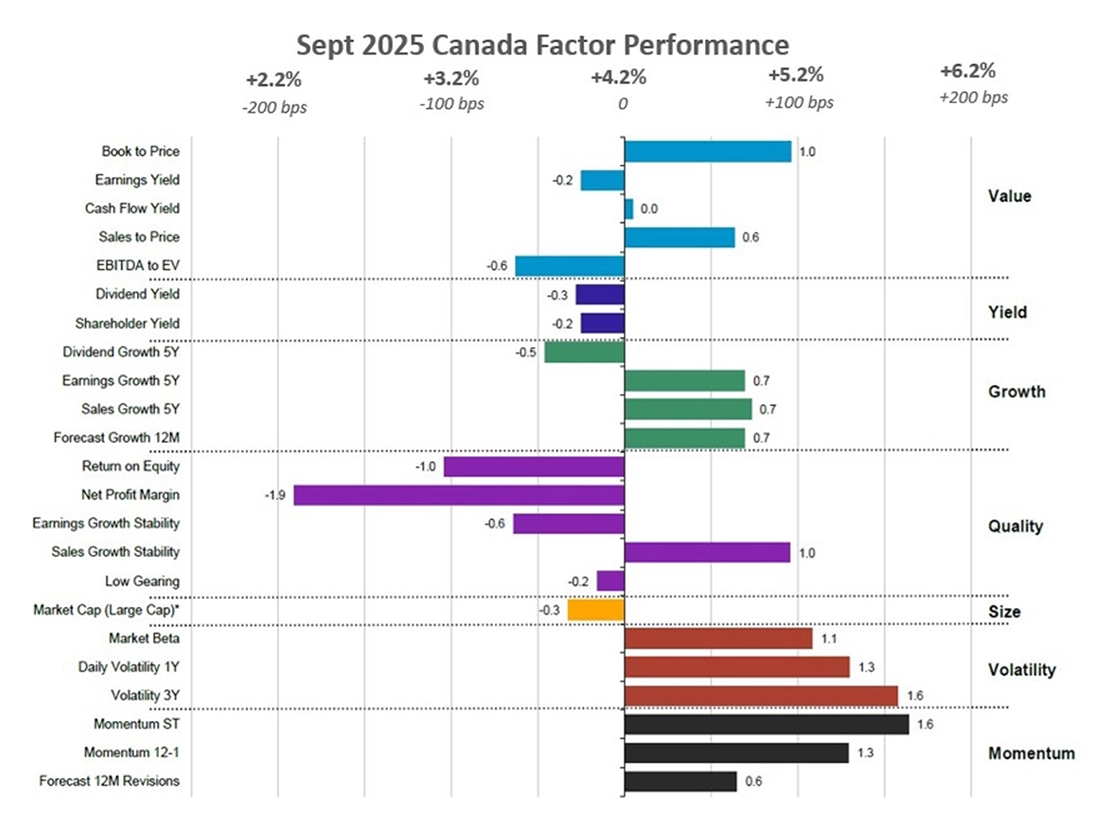

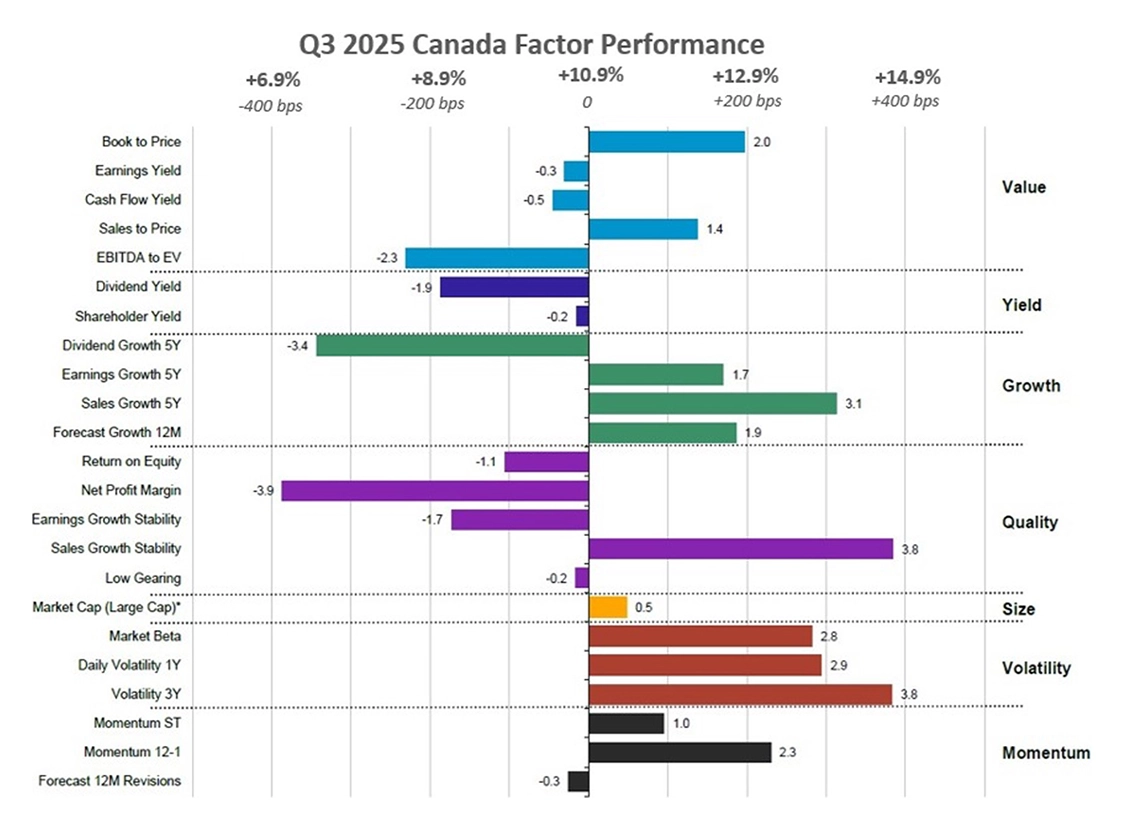

In September 2025, Volatility and Momentum stocks outperformed in Canada, driven by rising market activity, policy developments, and sector-specific dynamics. Trading volumes picked up as investors returned from the quieter summer months, contributing to increased volatility and sharper price movements.

Over the entire quarter, Growth stocks largely led the performance in Canada, supported by strong momentum in the technology and materials sectors, which posted significant price gains. Investor sentiment was further boosted by easing trade tensions, solid economic growth, and expectations of continued monetary support—factors that strengthened risk appetite and favored growth-oriented investments. Robust earnings and positive outlooks from large- and mid-cap growth companies, particularly those benefiting from strong demand in tech and basic materials, also played a key role in the outperformance of growth stocks during Q3.

Canada’s annual inflation rate increased to 1.9% in August 2025, up from 1.7% in July. Manufacturing sales are projected to decline by 1.5% in August, following a 2.5% rise in July. Meanwhile, the unemployment rate held steady at 7.1% in September, slightly better than market expectations of 7.2%. The outperformance of the Sales Growth Stability subfactor led the region’s performanc this quarter include Info Tech company Shopify Inc (+33% in Q3) and Brookfield Corp (14% Q3). Canada’s outperformance which was led by volatility 3Y subfactor, includes financial companies like Bank of Montreal (17% in Q3) and Bank of Nova Scotia (18% in Q3)

Figure 11: Sept 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 12: Q3 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Conclusion

At the same time, regional divergences remained pronounced — with Value strength in the UK and Eurozone contrasting with Growth leadership in North America and Emerging Markets. This dispersion highlights the continued importance of factor diversification and active monitoring of macro and policy dynamics.

As markets enter the final quarter of the year, investors face a complex backdrop of easing interest rates, elevated valuations, and shifting sector leadership. Confluence’s analytics and reporting solutions remain essential for navigating this evolving landscape — delivering the precision, insight, and confidence required to interpret rapid market rotation and position portfolios effectively for what’s ahead.

Style Analytics

Style Analytics Fixed Income is now available globally. To learn more or request a demo, click on the link below.

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.