Report

Q3 2023

Factor Performance Analysis

Global equities lose their momentum in Q3

by:

Market Background

From a factor perspective, global equity markets have shifted preferences. Initially, there was a strong inclination towards Volatility subfactors, especially high beta, in developed markets from Q1 to Q2. However, the focus now seems to be on Quality subfactors, indicating a more risk-averse approach from investors. Earlier in the year, it appeared that many managers were willing to embrace higher risks in volatile equities, which proved beneficial then but could have adverse consequences now. In Q3, all regions except the US exhibited a clear preference for Value equity over Growth equity.

One possible reason for Value’s underperformance in the US during Q3 may be the less aggressive interest rate hikes compared to what was observed in 2022. The Federal Reserve has taken multiple breaks from further rate hikes this year. However, this decision might also signal that high-interest rates are exerting a more pronounced impact on the economy compared to the beginning of the year.

Optimism in Q1 and Q2 waned during the third quarter as multiple metrics veered off course including the US inflation rate. The US labor market witnessed a decline in Q3, marking the lowest monthly new job increase since January 2021. Consumer confidence in the US and Germany decreased even when both saw an upward trend until July 2023.

Furthermore, the price of oil increased by 28% in the quarter, which had been between $70-$80/barrel all year and now has surged to $90/barrel. This will likely not improve in the near term given the recent conflict in Israel. Gold prices have decreased further to $1,848/TOz and Bitcoin, often seen as a risk-on asset, declined from its Q2 high of $30,480 to $27,000, marking an 11% decrease in Q3.

Factor Summary

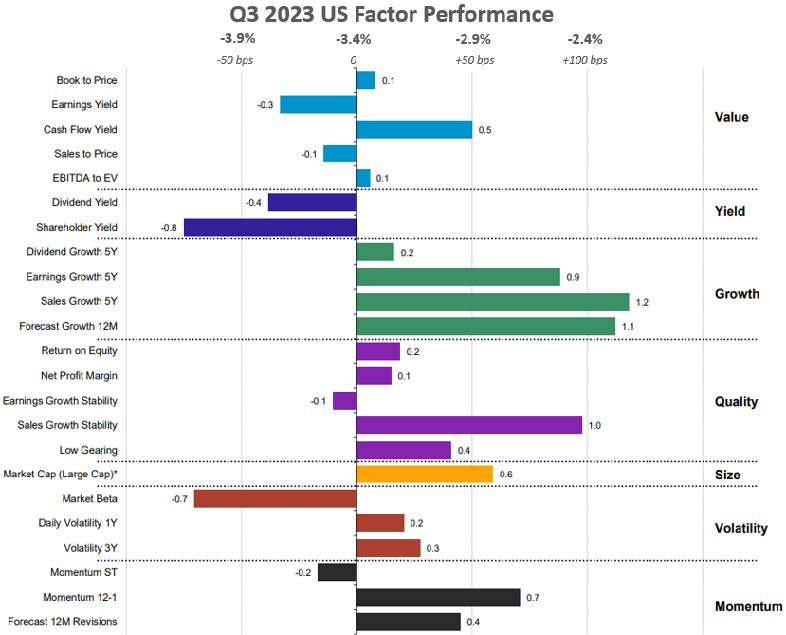

- US Equities: Volatility underperformed, large-cap Quality-Growth stocks outperformed in Q3

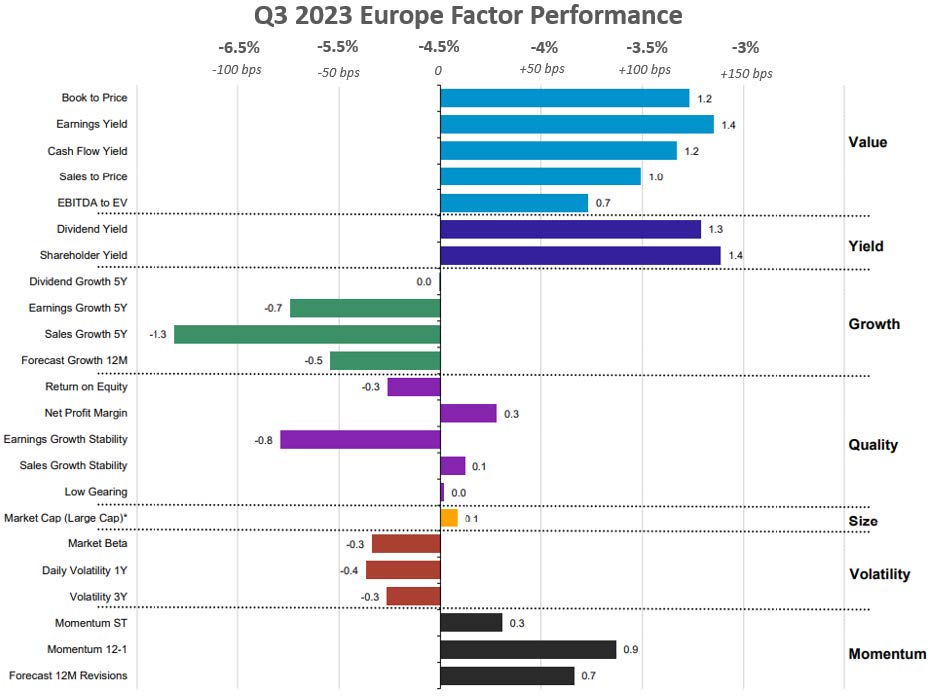

- Europe: Volatility underperformed, large-cap Value and Yield stocks outperformed in Q3

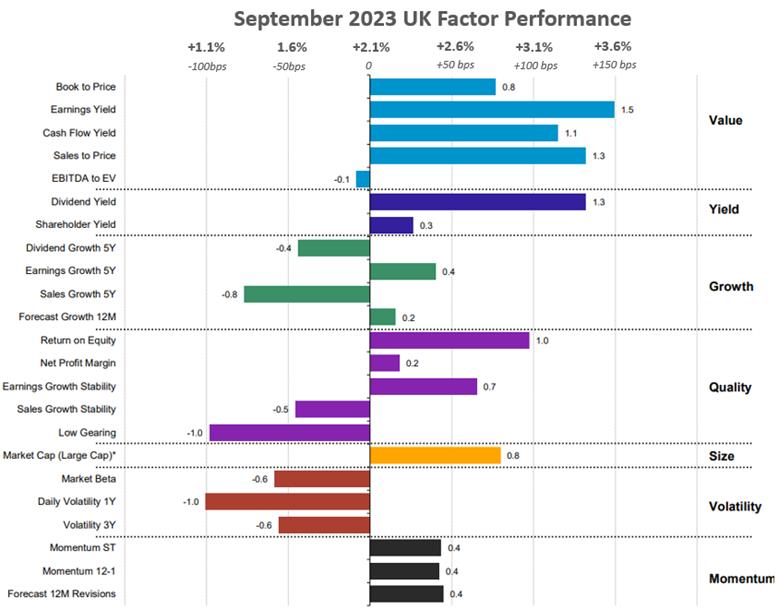

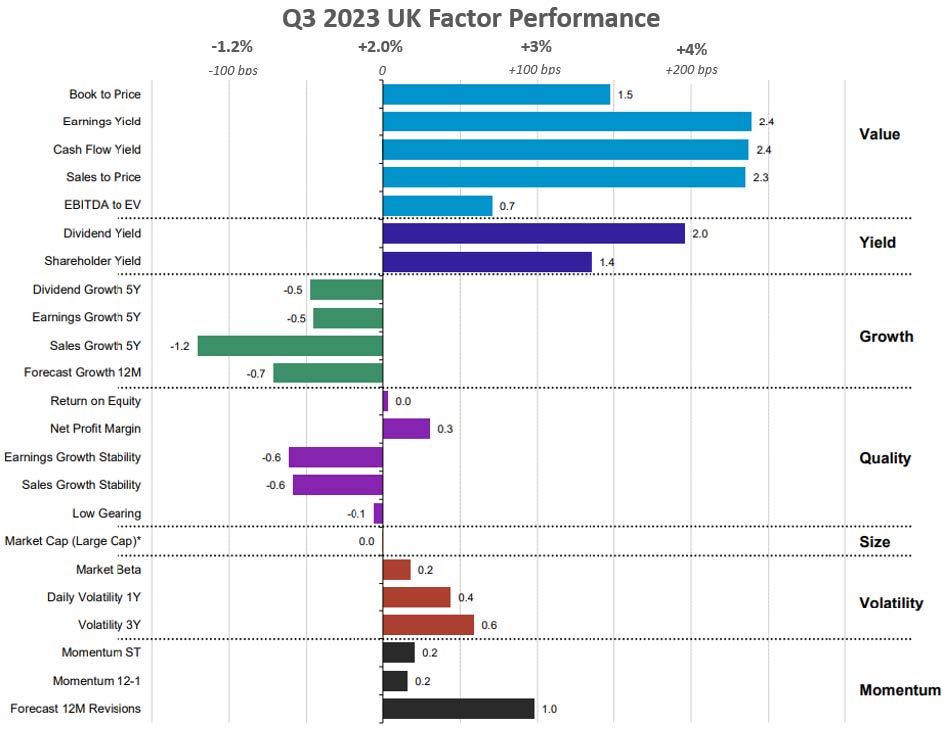

- UK: Quality outperformed in September, Value, and Yield outperformed in Q3

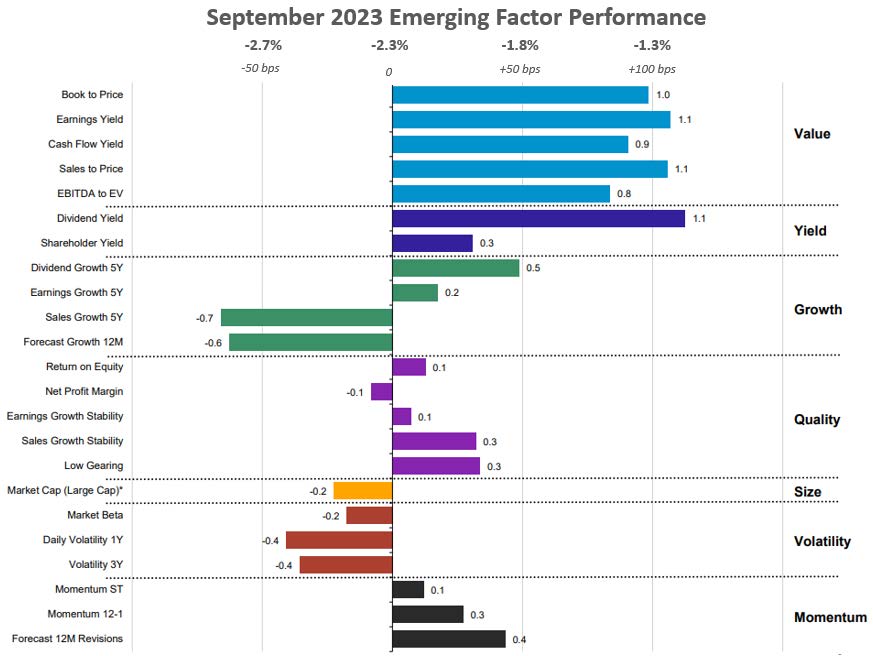

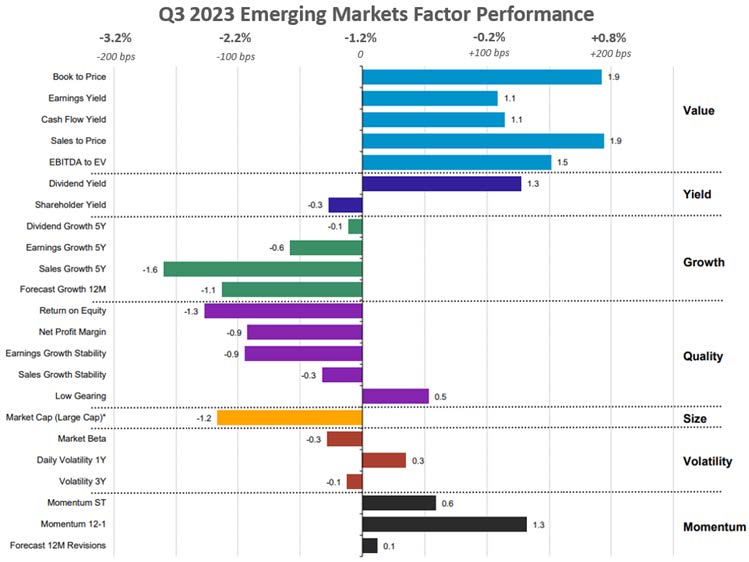

- Emerging Markets: Value outperformed, Growth underperformed in Q3

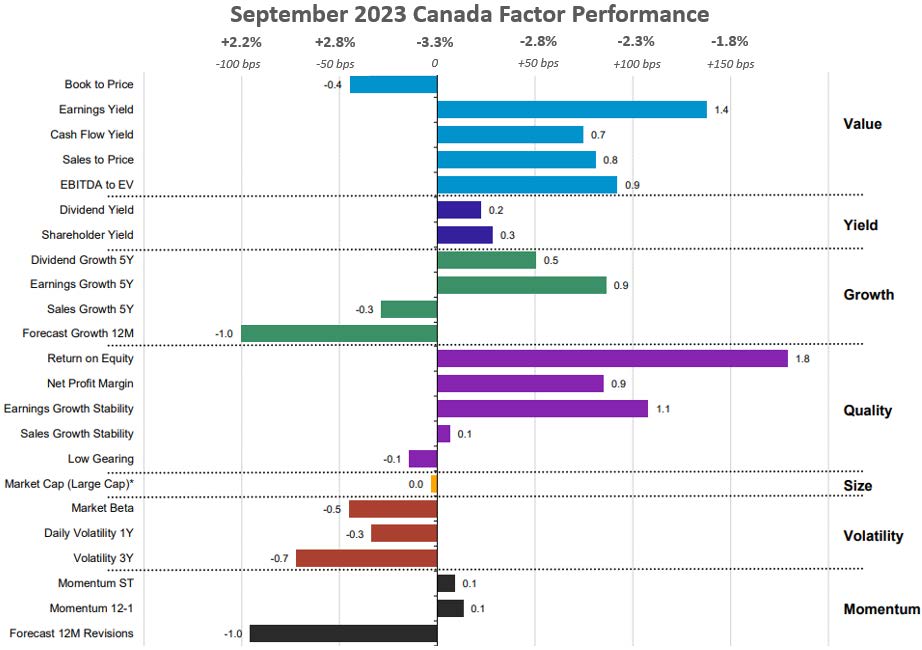

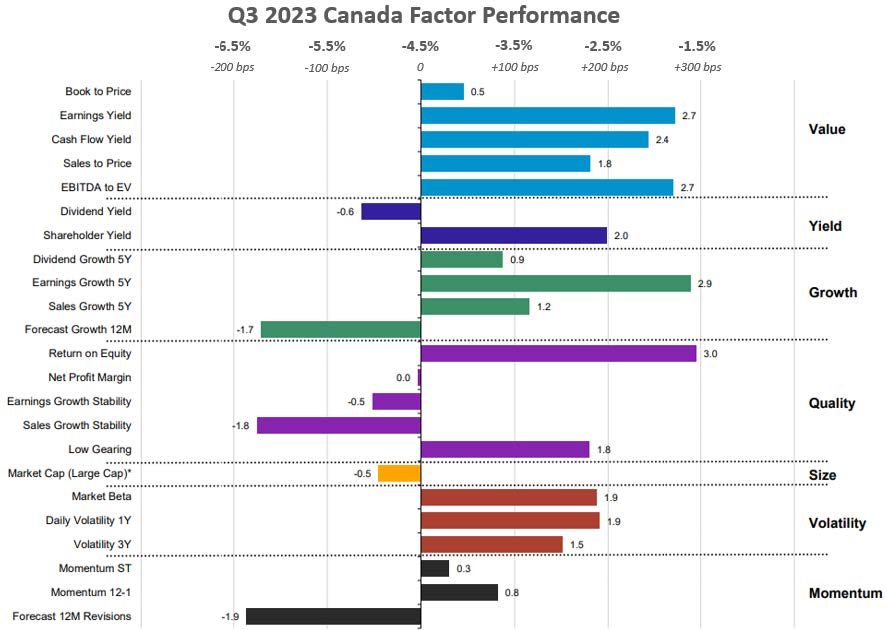

- Canada: Value and Quality stocks outperformed in Q3, mainly earnings yield and return on equity

US Equities

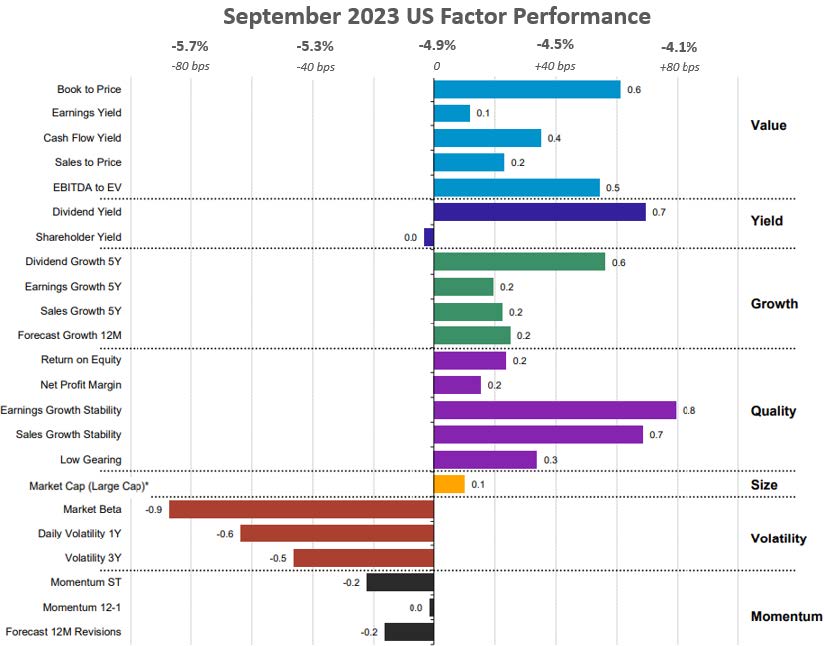

Technically, both Growth and Value did outperform the market, albeit with a modest factor premium this month ranging from -90bps to +80bps. This factor performance trend mirrors the cautious stance adopted by investors. In September, the US market underwent a correction, shedding 4.9% of its value, dragged down by Volatility subfactors like high beta, which underperformed by 90bps. Defensive subfactors like book-to-price, dividend yield, and stability-oriented Quality subfactors such as earnings growth stability and sales growth stability all outperformed by a comparable margin, falling within the range of 60-80 bps.

High beta stocks, which exhibited significant outperformance earlier this year, experienced a dismal performance in September and the remainder of Q3, weighed down by companies like NVidia (-11%) and Oracle (-12%).

Source: Investment Metrics, a Confluence company

Figure 2: Q3 2023 US Factor Performance (sector adjusted)

Source: Investment Metrics, a Confluence company

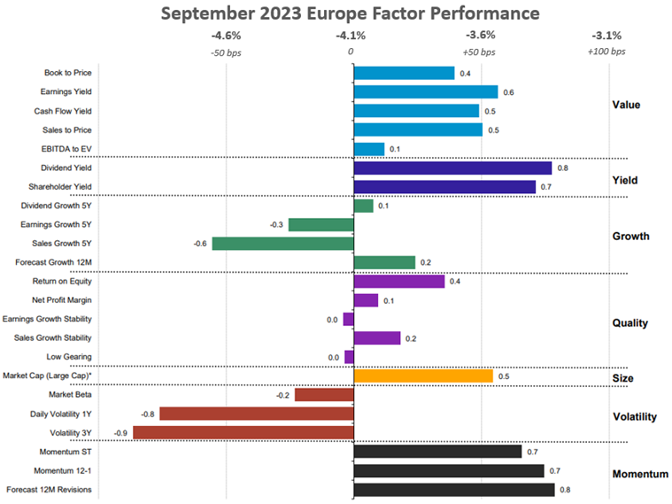

European Equities

During both September and the remainder of Q3, Value stocks characterized by favorable earnings yield and cash flow yield outperformed the European market by a substantial 55bps and even more impressive 255bps, respectively.

Despite the European Union’s inflation rate being nearly double the rate observed in the US, it has fallen below the 6% mark for the first time since February 2022 and is currently displaying a downward trajectory. This is in stark contrast to the US, which has witnessed an increase in its inflation rate over the last two months.

Following the destabilization of European energy prices due to the Russian invasion of Ukraine in 2022, new suppliers have managed to stabilize German and French wholesale energy prices, reducing them to approximately €100/MWh from €190/MWh observed in January 2022. However, the trend in German consumer confidence, which initially exhibited a sharp improvement in the first half of the year, has begun to experience a slight decline instead of continuing its upward trend.

Notable outperformers include HSBC (+6%) and several energy firms such as British Petroleum PLC (+5%), and Shell PLC (+4%)

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

UK Equities

In terms of inflation, the UK finds itself in a similar position to that of Europe, where the annual trend is moving in the right direction but remains uncomfortably high for consumers and businesses, as August’s inflation rate sits at nearly triple the rate of the Bank of England’s long-term target at 6.7%. Just like in the US, the Bank of England also agreed to pause rate hikes in September, which was the first pause since they began hiking rates from an initial rate 0.1% in December 2021 to 5.25% today.

From a quarterly perspective, Value and Yield emerged as dominant forces in the UK market. Several Value subfactors have outperformed the market by a substantial margin, with a particular focus on companies boasting a favorable earnings yield, cash flow yield, or sales-to-price ratio, which have surged ahead by over 230 bps.

Value equities from an earnings yield perspective that helped Value outperform in the region include Glencore (+7%); Melrose Industries (+49%) and IT service provider Computacenter (+12%).

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

Emerging Markets Equities

Throughout the entirety of 2023, this region has exhibited remarkable resilience, displaying a strong inclination towards Value equity. There’s a pronounced focus on stocks characterized by a high cash flow yield and a low book-to-price value, both of which have significantly outperformed the broader market. While shareholder yield delivered a strong performance in Q1 and Q2, it experienced a decline in momentum during Q3. However, high-dividend stocks continued to hold their ground. Notably, stocks with high dividend growth, which was the leading subfactor in the first half of 2023, transitioned to underperforming the market within a single quarter, signaling that while Value continues to excel, the Yield factor is losing some of its previous vigor although the two are typically correlated.

From a book-to-price perspective, Indian companies like Indian Railway Finance Corp (+55%) and Power Finance Corp. Limited (+20%) led the surge observed in Emerging Markets Value equity.

Figure 7: September 2023 Emerging Factor Performance (country and sector adjusted)

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

Canadian Equities

The companies that led Canadian Quality equities to outperform include energy firms like Obsidian Energy (+17%), Athabasca Oil Corporation (+16%) in part due to the surge in oil prices observed in Q3 as well.

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values, relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The information contained in this communication is for informational purposes only. Investment Metrics, a Confluence company, is not providing legal, financial, accounting, compliance or other similar services or advice through this communication. Recipients of this communication are responsible for understanding the regulatory and legal requirements applicable to their business.

About Confluence

For more information, visit confluence.com