Q2 2024

Plan Universe Allocation & Return Analysis

Relatively flat quarterly performance for defined plans.

by:

Executive Summary

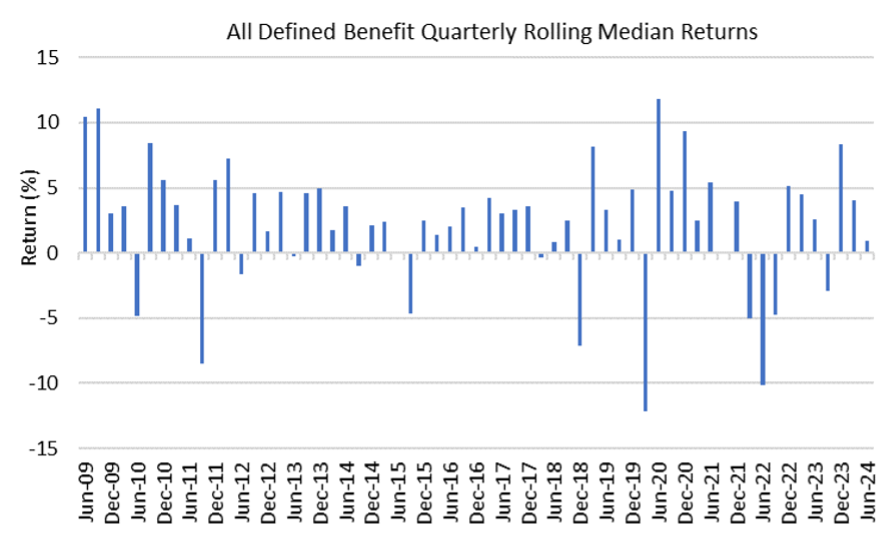

With inflation declining, global equity markets posted another positive quarter, with the MSCI ACWI index returning over 3%. Geopolitical tensions, increasing unemployment, and faltering consumer sentiment, however, continue to present headwinds to global markets. With returns across all asset classes relatively muted, defined benefit plans posted a median return of 0.92%, down more than 3% compared to last quarter.

Highlights

- All defined benefit plans posted positive performance for the quarter, with a median return of 0.92%.

- U.S. equity continued to drive performance across defined benefit plans, at a median level returning 2.55%. Comparatively, the median returns for U.S. fixed income and alternatives were 0.37% and 1.07%.

- Corporate defined benefit plans, driven by their fixed income allocation to long bonds and low exposure to equity, were the worst performers by plan type during the quarter, returning 0.14% at a median level.

- Endowments & Foundations posted the strongest performance for the quarter with a median return of 1.18%.

Plan Performance Over Time

Source: Confluence Plan Universe

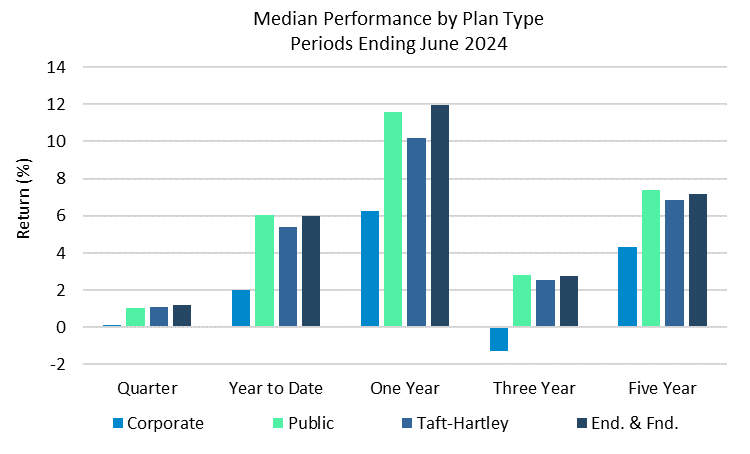

Historical Plan Comparison

Endowments & Foundations returned 1.18% at a median level in Q2 of 2024, narrowly outperforming Public & Taft-Hartley plans. Comparatively, Corporate DB plans returned 0.14% for the quarter, lagging other plan types by 1%. The plans with the highest exposure to equity (Public, Taft-Hartley. Endowments & Foundations) posted the strongest performance for the quarter. However, no plan types outperformed a traditional 60/40 benchmark return of 1.83%. (60% MSCI ACWI Index/ 40% Bloomberg Barclays U.S. Aggregate Index).

Source: Confluence Plan Universe

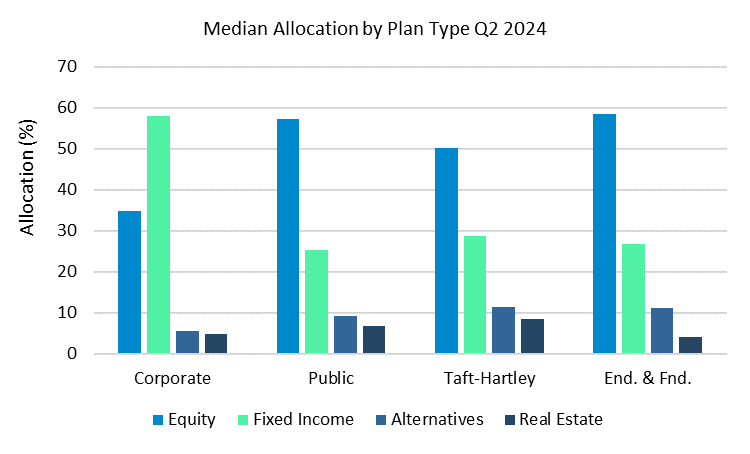

Q2 Plan Allocation Analysis

Source: Confluence Plan Universe

Source: Confluence Plan Universe

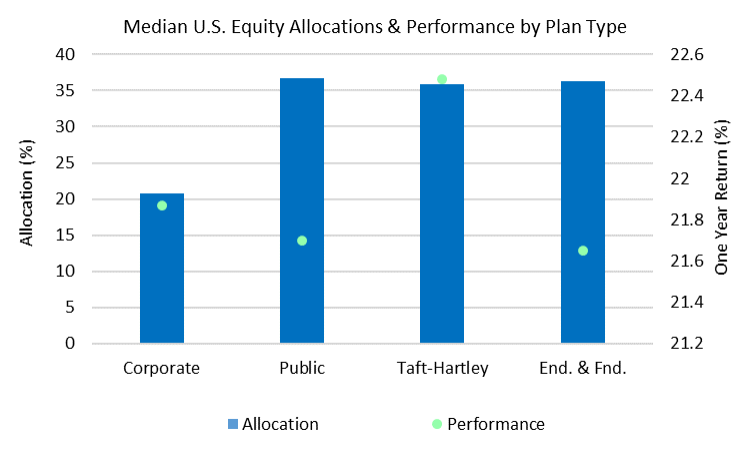

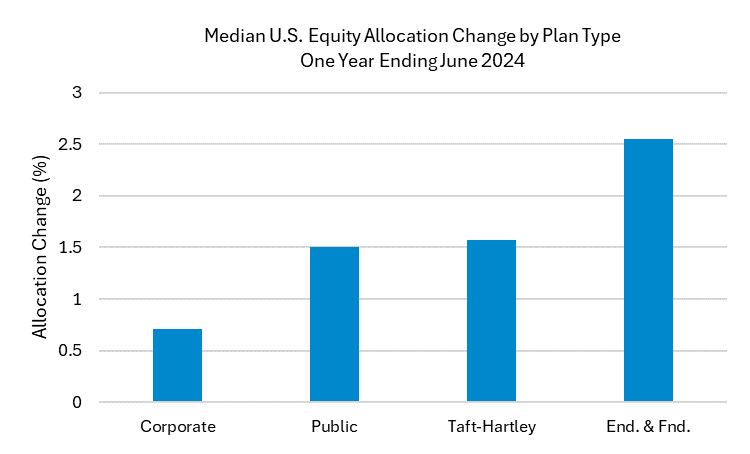

U.S. Equity Performance

The public U.S. equity market posted positive returns in Q2 2024. For defined benefit plans, the median U.S. equity return was 2.55%. Corporate plans continue to be underweight U.S. equity, with a median allocation of 20.8%, roughly 60% of the allocation compared to other plan types. For the year ending June, all plan types increased their allocation to U.S. equity.

Source: Confluence Plan Universe

Source: Confluence Plan Universe

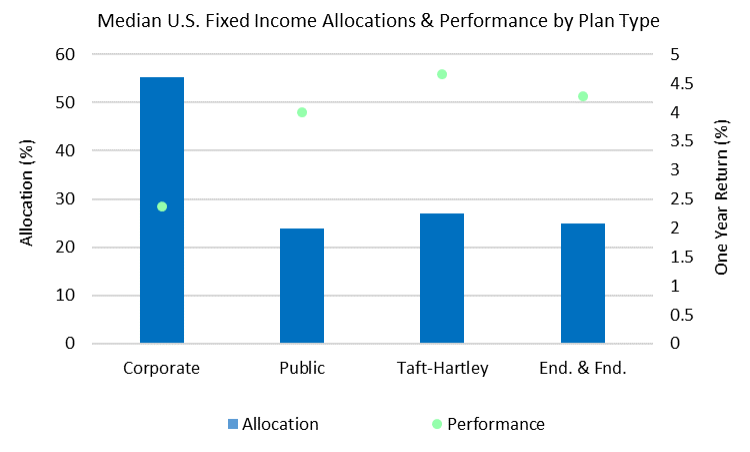

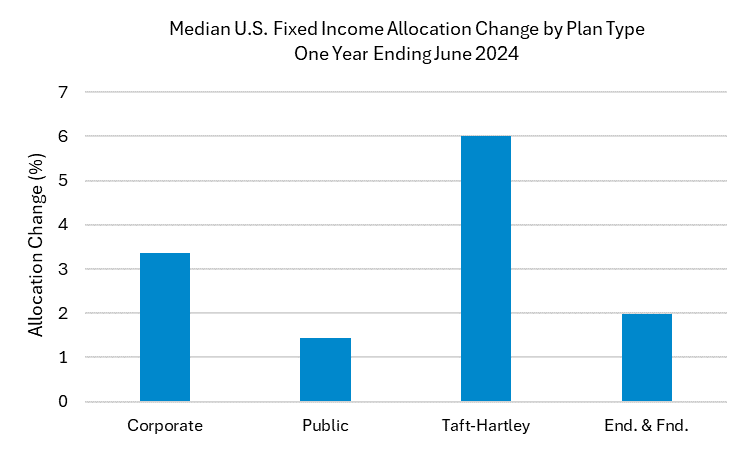

U.S. Fixed Income Performance

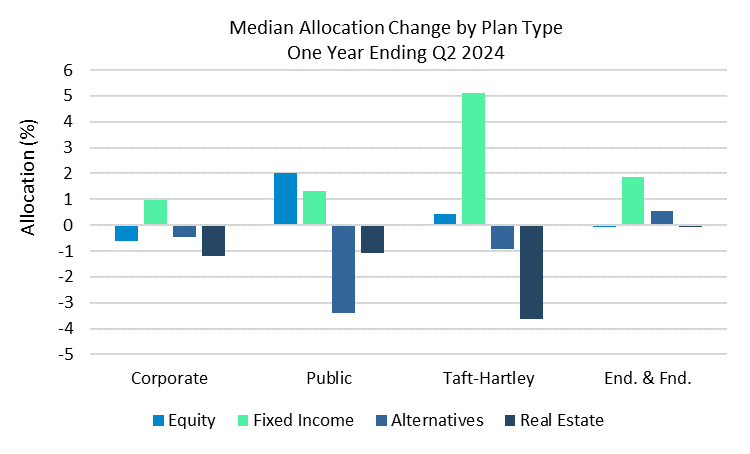

All plan types increased their allocation to U.S. Fixed income over the last year. Taft-Hartley plans have increased their allocation by 6% (from 21% to 27%) in the last year. Corporate plans, which have the highest allocation to the asset class at 55%, also increased their allocation by more than 3% during the last year.

Source: Confluence Plan Universe

Source: Confluence Plan Universe

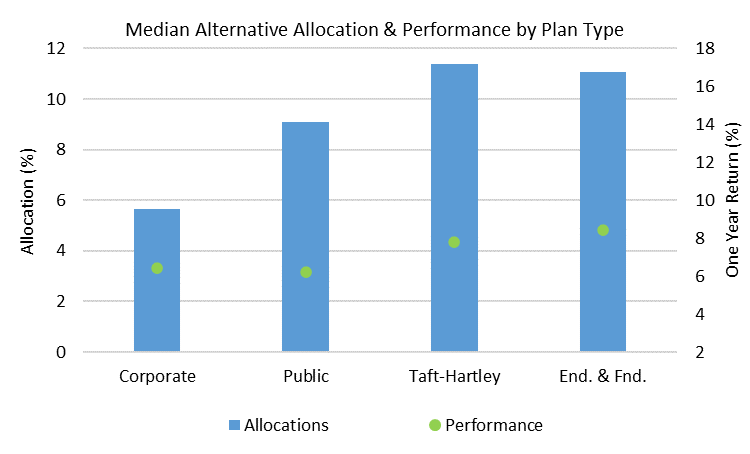

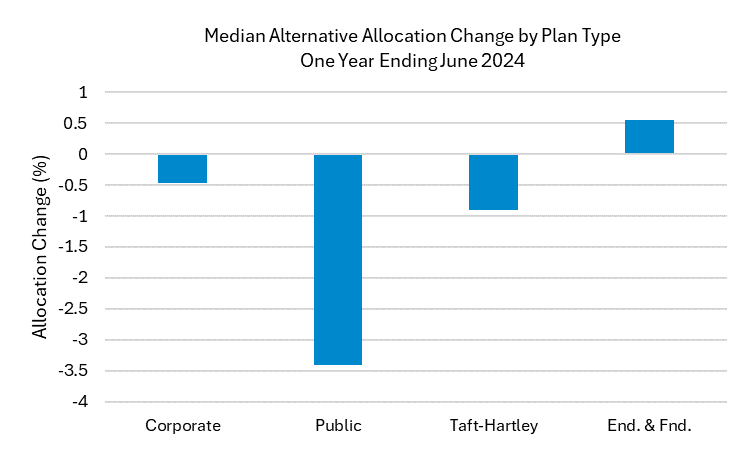

Alternatives Performance

Endowments & Foundations, which posted the strongest performance over the last year, were the only plan type to increase their allocations to Alternatives during the last year. Public plans had the largest pullback to alternatives during the year, down over 3% at the median level.

Source: Confluence Plan Universe

Source: Confluence Plan Universe

Confluence Plan Universe

- Trust Funds, Corporates, Public Plans, Taft-Hartley, Endowments & Foundations, High Net Worth, Health & Welfare, and custom groups.

- Asset Allocations are broken into equity (US, global, global ex-US), fixed income (US, global, and global ex-US), alternatives, real estate (public and private), and multi-asset and cash. Emerging Markets allocations are available for equities and debt securities.

- Net and gross performances displayed by quartile with full percentiles via download.

- With all information aggregated by Plan Size.

Disclaimer

The information provided in this document is for informational purposes only and does not constitute legal, financial, accounting, compliance, or any other professional advice. Confluence makes no representations or warranties as to the accuracy, completeness, or suitability of this information for any purpose. Recipients of this document are solely responsible for ensuring their compliance with applicable laws and regulations. Confluence disclaims any liability for actions taken based on the information provided herein.