Q1 2024

Factor Performance Analysis

Momentum raises the tide

by:

Market Background

Global market attention is on the US Federal Reserve for guidance on approaching declining inflation and positive economic sentiment, ensuring a cautious approach to avoid premature rate adjustments. Despite earlier market anticipation of a rate cut this quarter, US inflation remains above 3%, prompting Jerome Powell’s prudent stance, which postponed market expectations of a rate cut until July. Meanwhile, Europe maintains a leading role in managing inflation, evidenced by reaching a 28-month low of 2.4% in March, with a core rate of 2.9%. The European Central Bank is anticipated to maintain steady rates, though markets speculate a potential 25bps rate cut as early as June, subject to further CPI data.

Oil prices increased to $86/barrel as conflict in Israel and Gaza continues. Bitcoin and other risk-on assets surged on the news of potential rate cuts, hit all-time highs in Q1, even as the market began decreasing expectations for a Q1 rate cut. Finally, gold closed the quarter out +3% at $2,124/TOz. However, it increased significantly in the first week of April, reaching over $2,300/TOz, or +15% since January 1st.

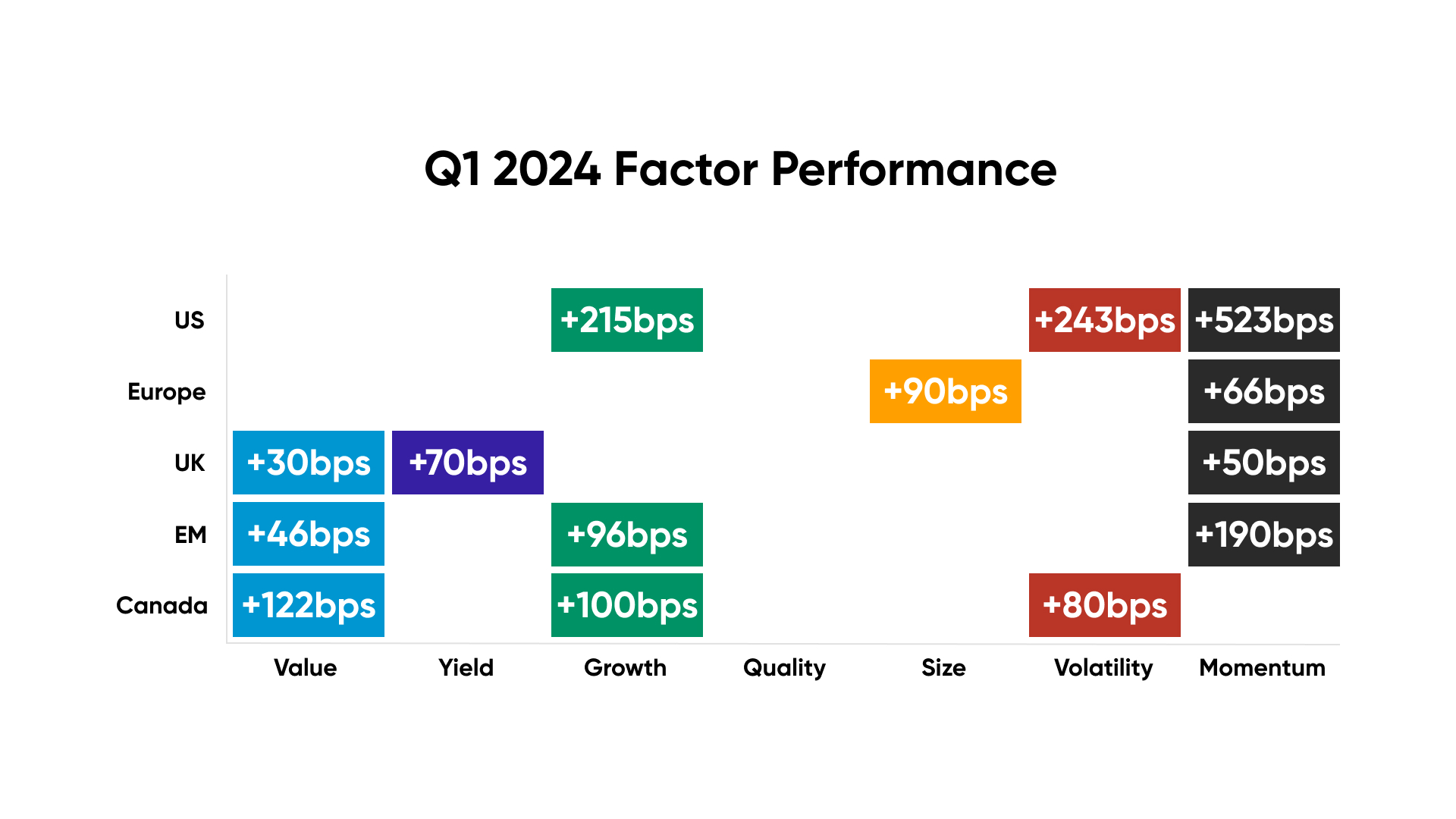

Factor Summary

Source: Investment Metrics, a Confluence company

US Equities

Despite inflation persistently exceeding 3%, other economic indicators portray a positive outlook for the US economy. Consumer spending reached a new all-time high in Q1, totaling $15.5 trillion, while consumer confidence surged to its highest level since July 2021. Although retail sales growth moderated compared to Q4, they remained positive throughout Q1, in contrast with the performance of their European counterparts. Manufacturing production expanded at its quickest pace in nearly two years, accompanied by businesses’ optimism regarding future output growth amidst expectations of improving economic conditions.

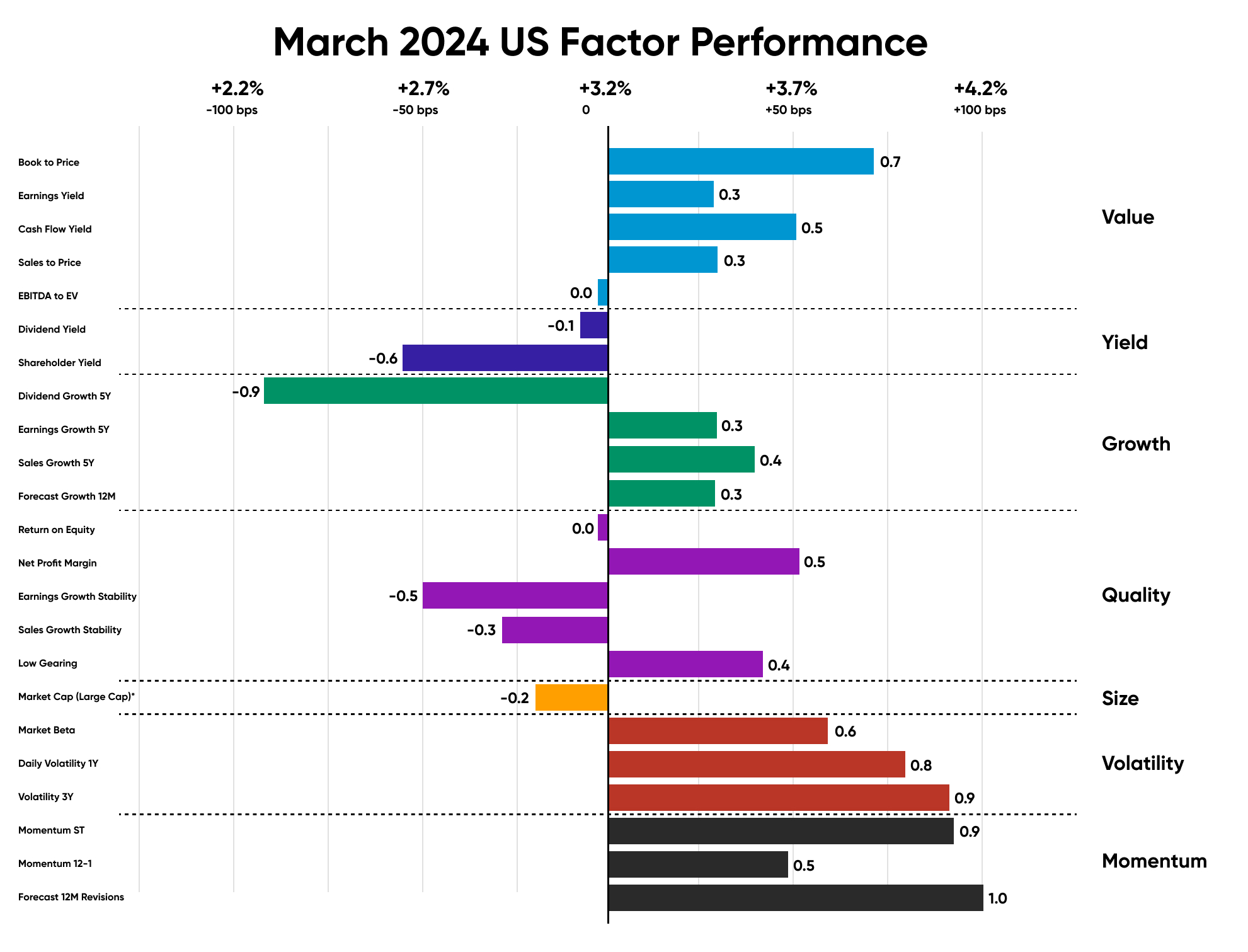

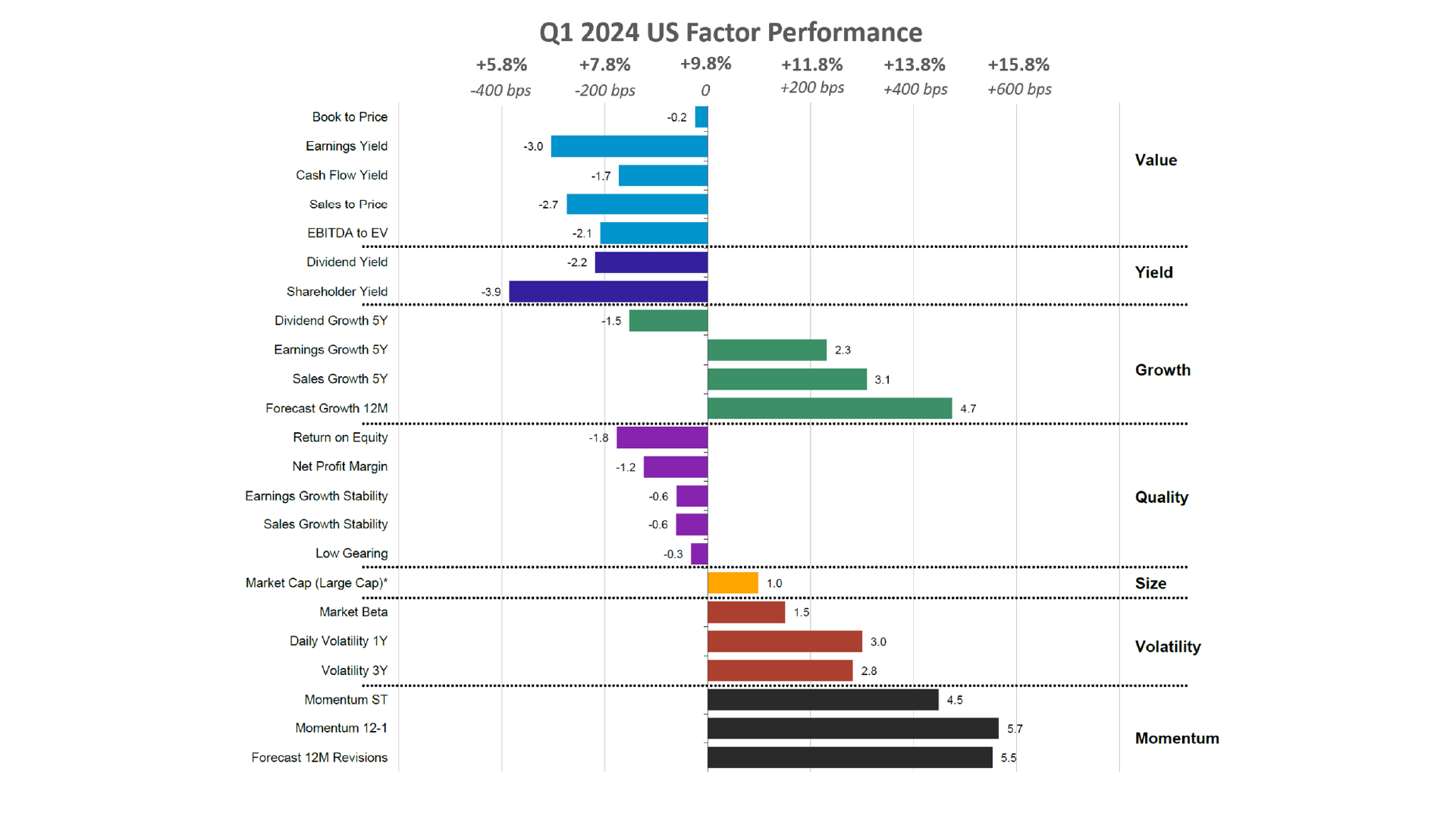

Annual Momentum, exemplified by the “Momentum 12-1” subfactor, led the US market in Q1, driving nearly 600bps of relative performance, with an additional 100bps surge observed in March alone. Growth and Volatility stocks continued their market outperformance, with the “forecast growth 12M” subfactor surpassing market performance by almost 500bps during the quarter.

Momentum 12-1 powered the US stock market this quarter, led by tech stocks like Nvidia and Meta, which respectively returned 82% and 37% in Q1. This rally wasn’t limited to just tech; Stocks in Industrials (General Electric, +37% in Q1; Caterpillar, +24% in Q1), Financials (JP Morgan, +18% in Q1; Berkshire Hathaway, +17% in Q1) and Healthcare (Eli Lilly, +33% in Q1; Merck, +21% in Q1) all contributed to the momentum surge.

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

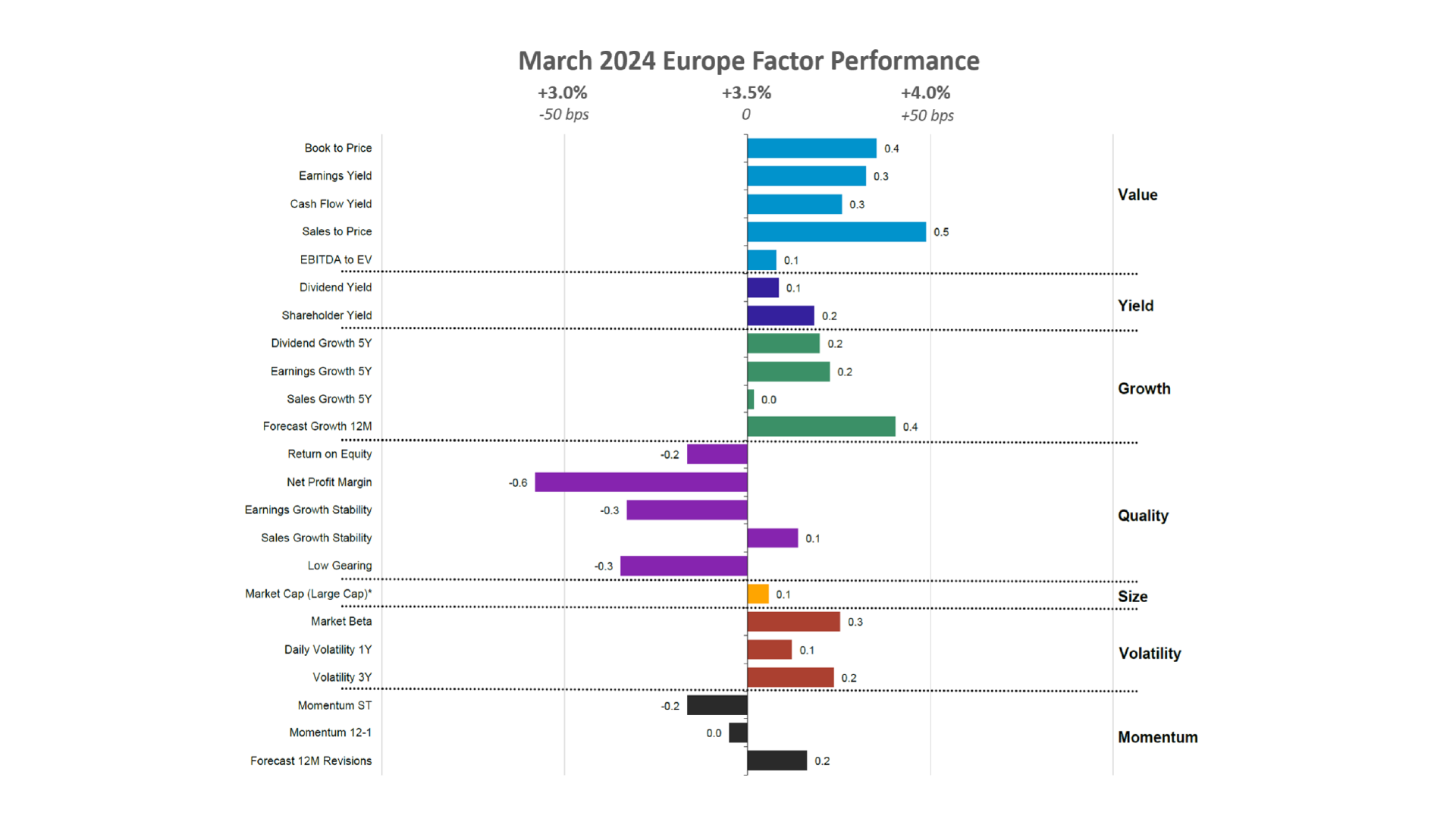

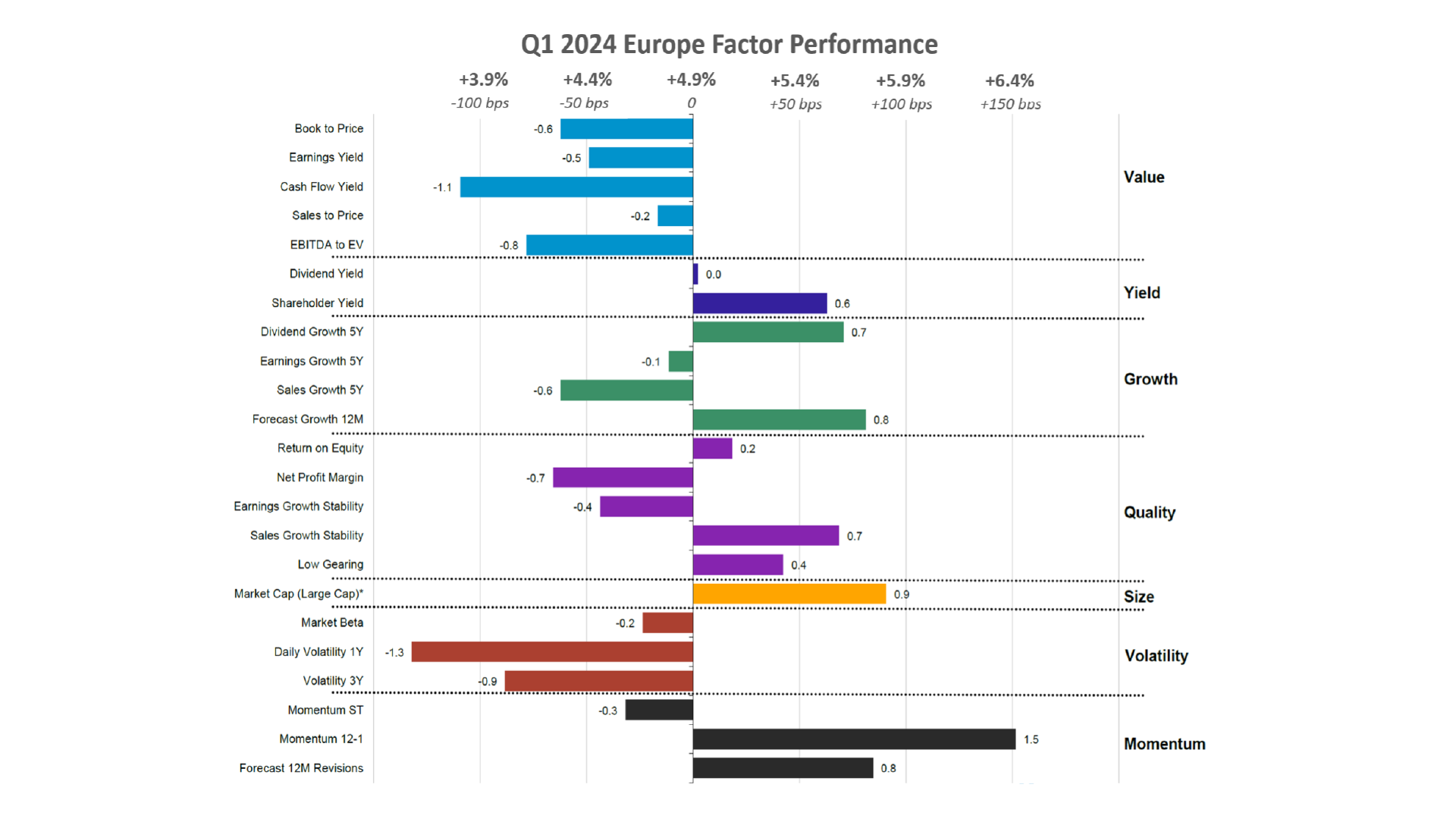

European Equities

In the Eurozone, inflation exceeded expectations in Q1, reaching a 28-month low of 2.4%, prompting anticipation of potential ECB rate cuts in June, as indicated by German 10Y Bund falling to 2.2%. European consumer spending remained steady, rising by 0.06% from the previous quarter, with consumer confidence hitting its highest level since 2022. However, the S&P Global Construction and Manufacturing PMI’s declined this quarter, extending a 12-month output decline streak, while retail sales fell by 0.50% in February after similar decreases in December and stagnation in January.

Notable outperformers with strong price momentum include Spanish bank BBVA (+31% in Q1), Italian bank Unicredit SPA (+40% in Q1), and German industrial firm Daimler Truck Holding AG (+35% in Q1).

Source: Investment Metrics, a Confluence company

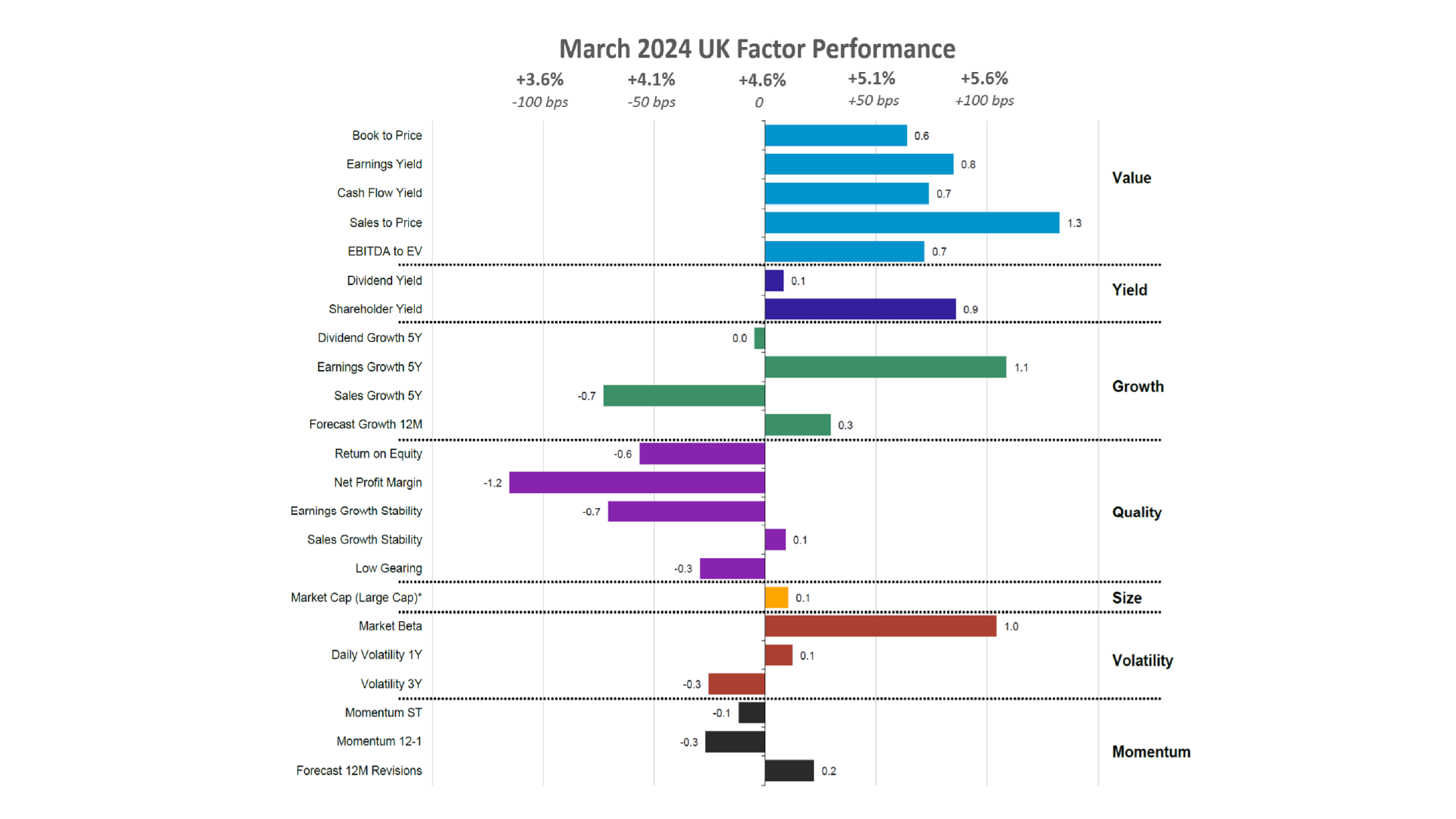

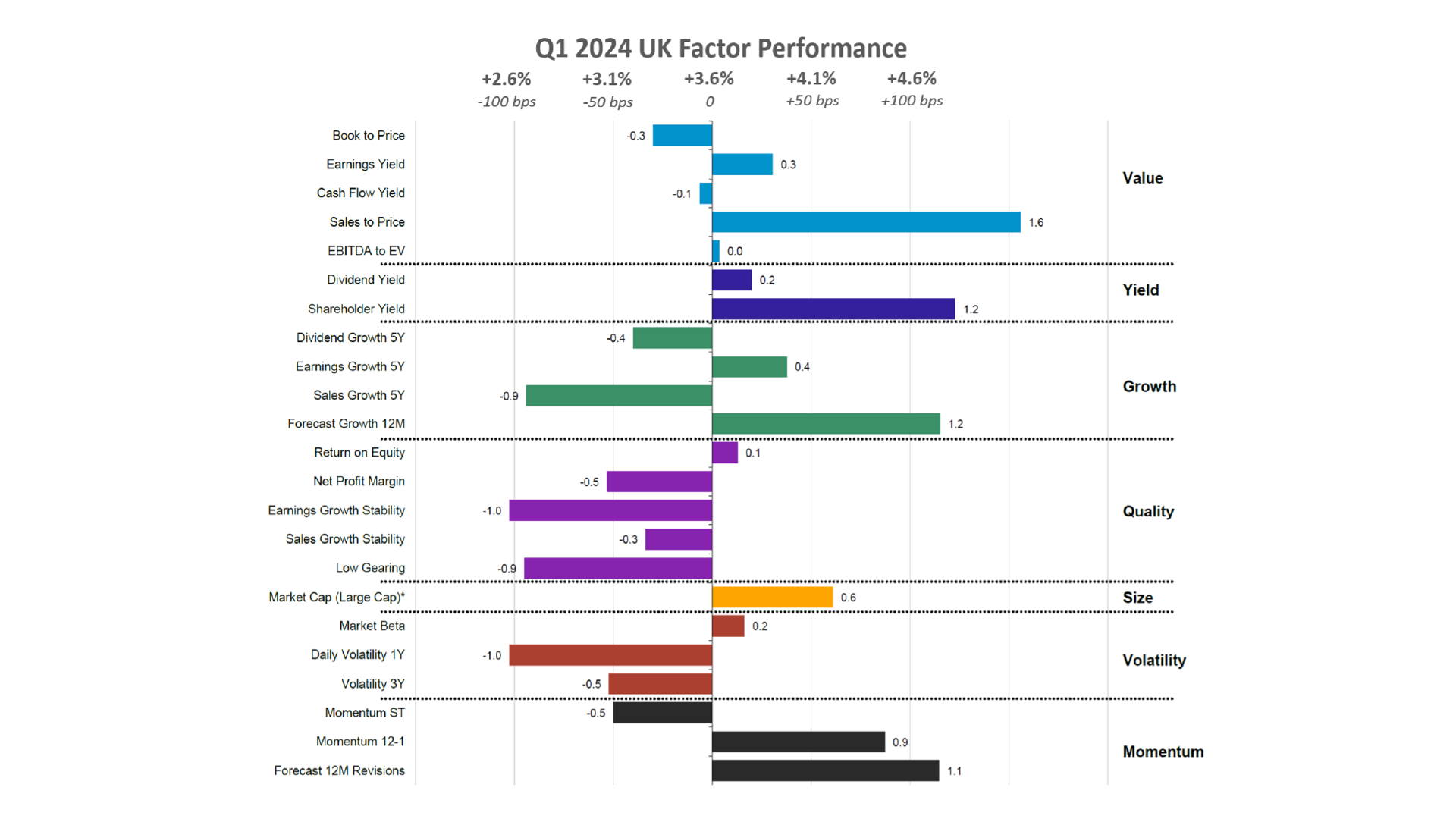

UK Equities

nearly 100bps. Over Q1, the UK still underperformed Europe by approximately 100bps, a significant improvement from the over 900bps underperformance observed in Q4.

Inflation in the UK declined to 3.4% after stagnating at 4% between November and January, contrasting with the US where inflation increased month-on-month. Despite this, unemployment in the UK rose slightly to 3.9%, and retail sales remained stagnant as of February. Consumer confidence also remained negative, signaling persistent pessimism, although there have been slight improvements in future expectations. Additionally, after six consecutive months of decline, both the S&P Construction and Manufacturing PMIs surpassed 50 in March, indicating expansion in activity for the first time since July 2022.

Like their European counterparts, the factor trend in the UK was less clearly defined compared to the US. March showed a distinct preference for Value stocks, particularly those with a strong sales-to-price ratio, as evidenced by the quarterly chart where sales to price outperformed all other subfactors by +140bps.

Value equities from a sales-to-price perspective that helped Value outperform in the region include pharmaceutical firm GSK PLC (+17% in Q1); Airspace company BAE Systems (+20% in Q1); Insurance company Beazley PLC (+28% in Q1) and NatWest Group (+25% in Q1)

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

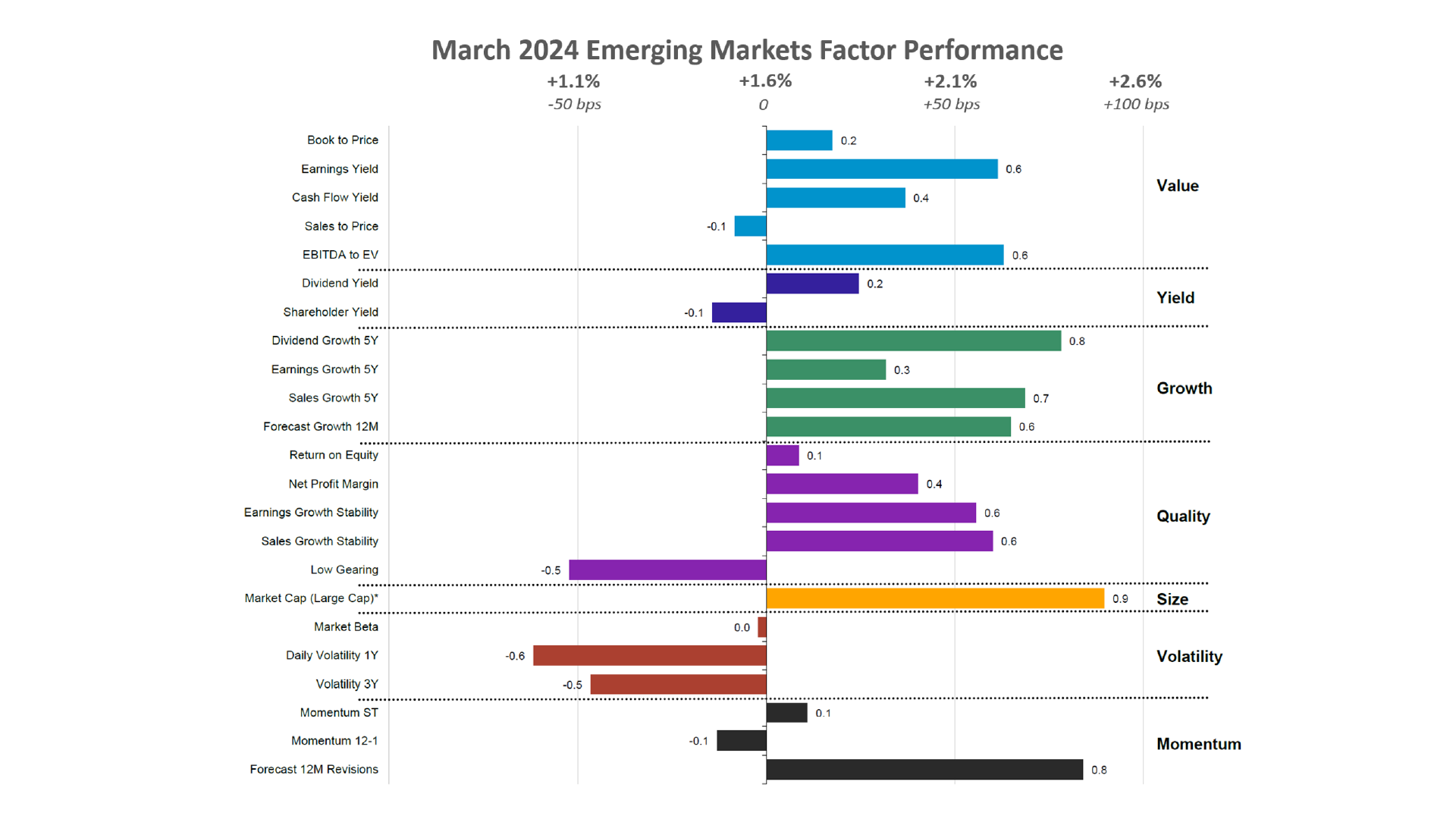

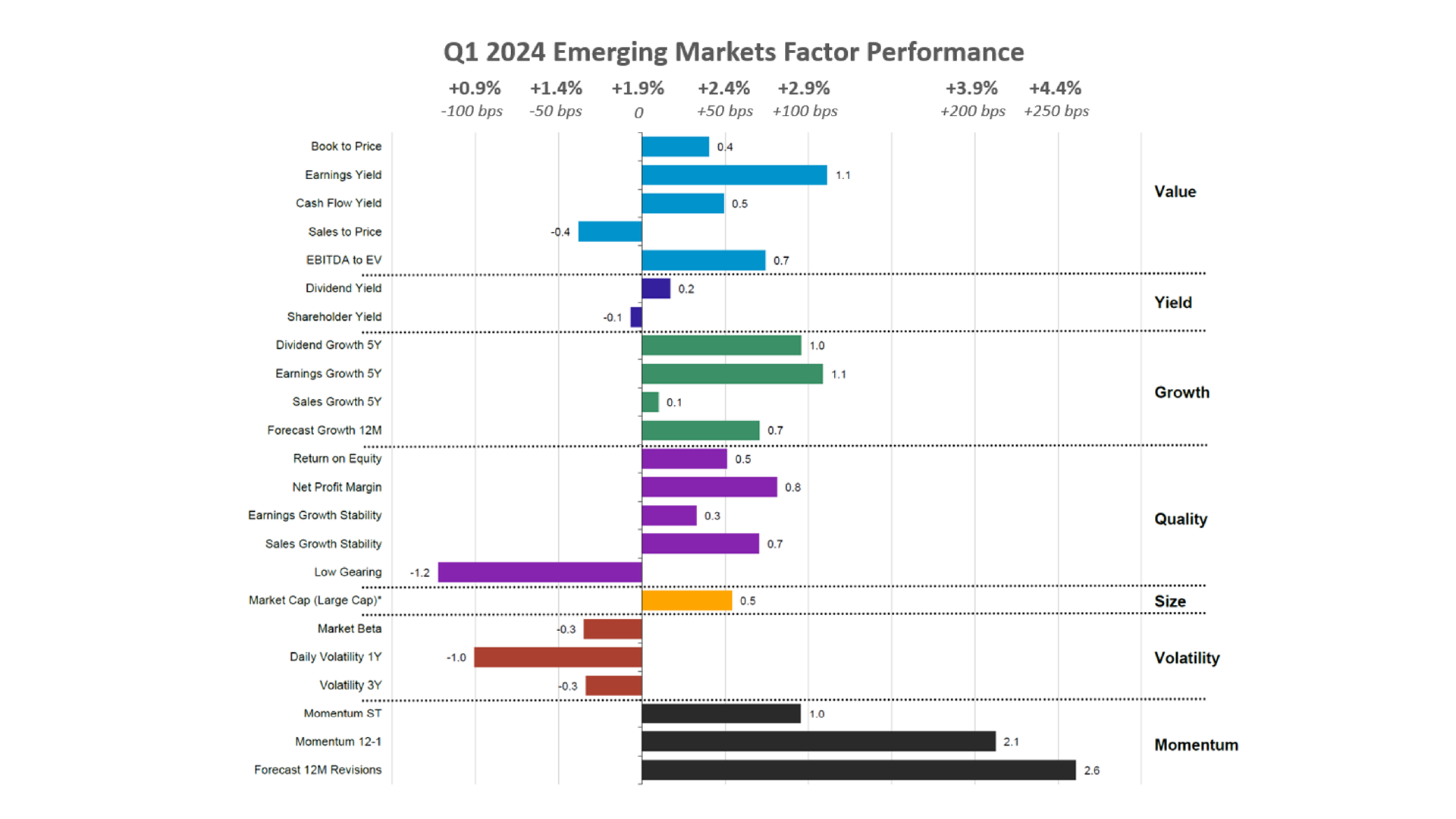

Emerging Market Equities

Additionally, there was a significant change in Growth equity performance, with all Growth subfactors driving outperformance in both the monthly and quarterly perspectives for the first time in years.

Companies that led Emerging Markets this quarter include TSMC (+26% in Q1); China Shenhua Energy Company (+22% in Q1); Chinese technology company Foxconn (+47% in Q1) and Agricultural Bank of China (+14% in Q1).

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

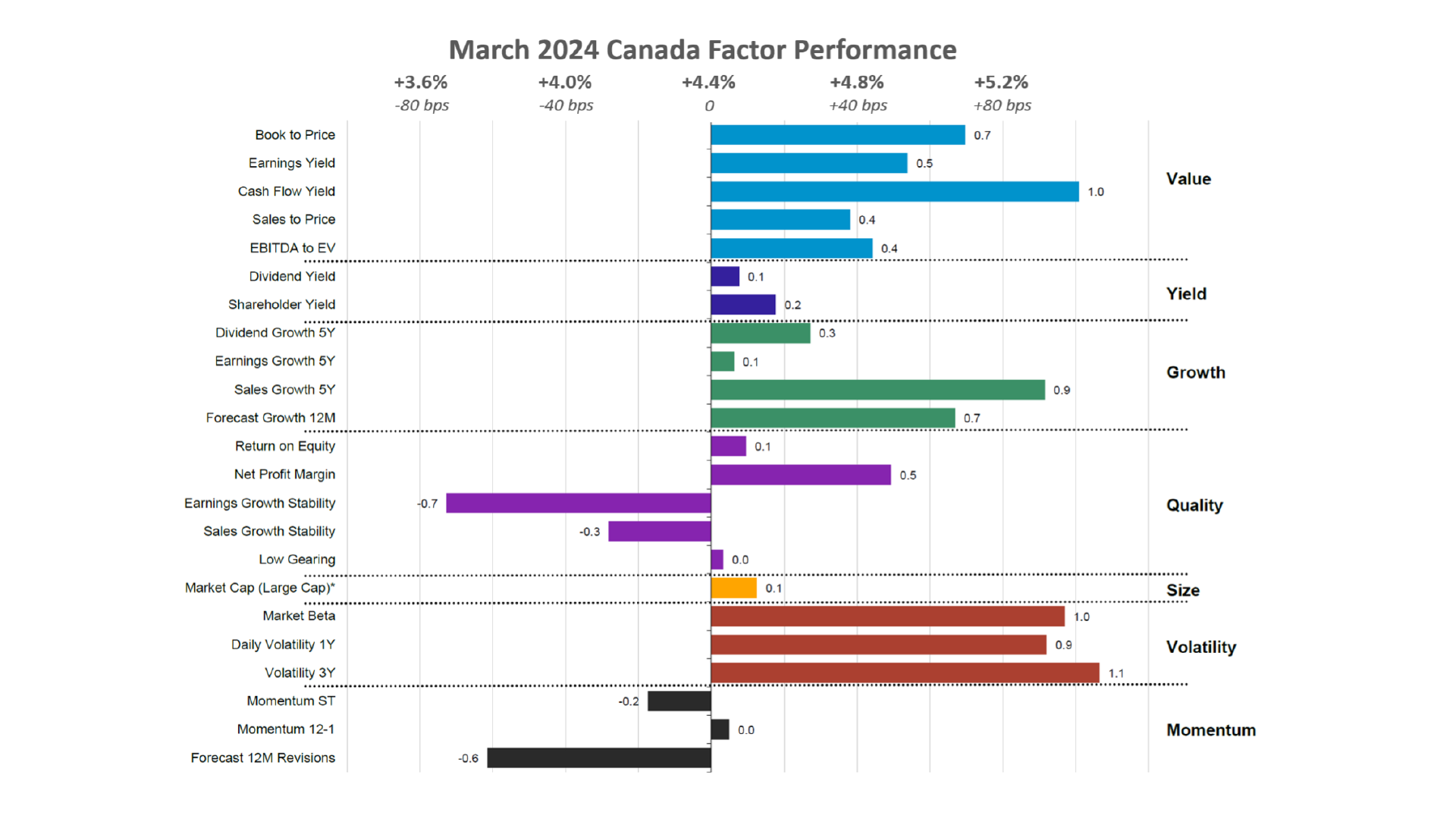

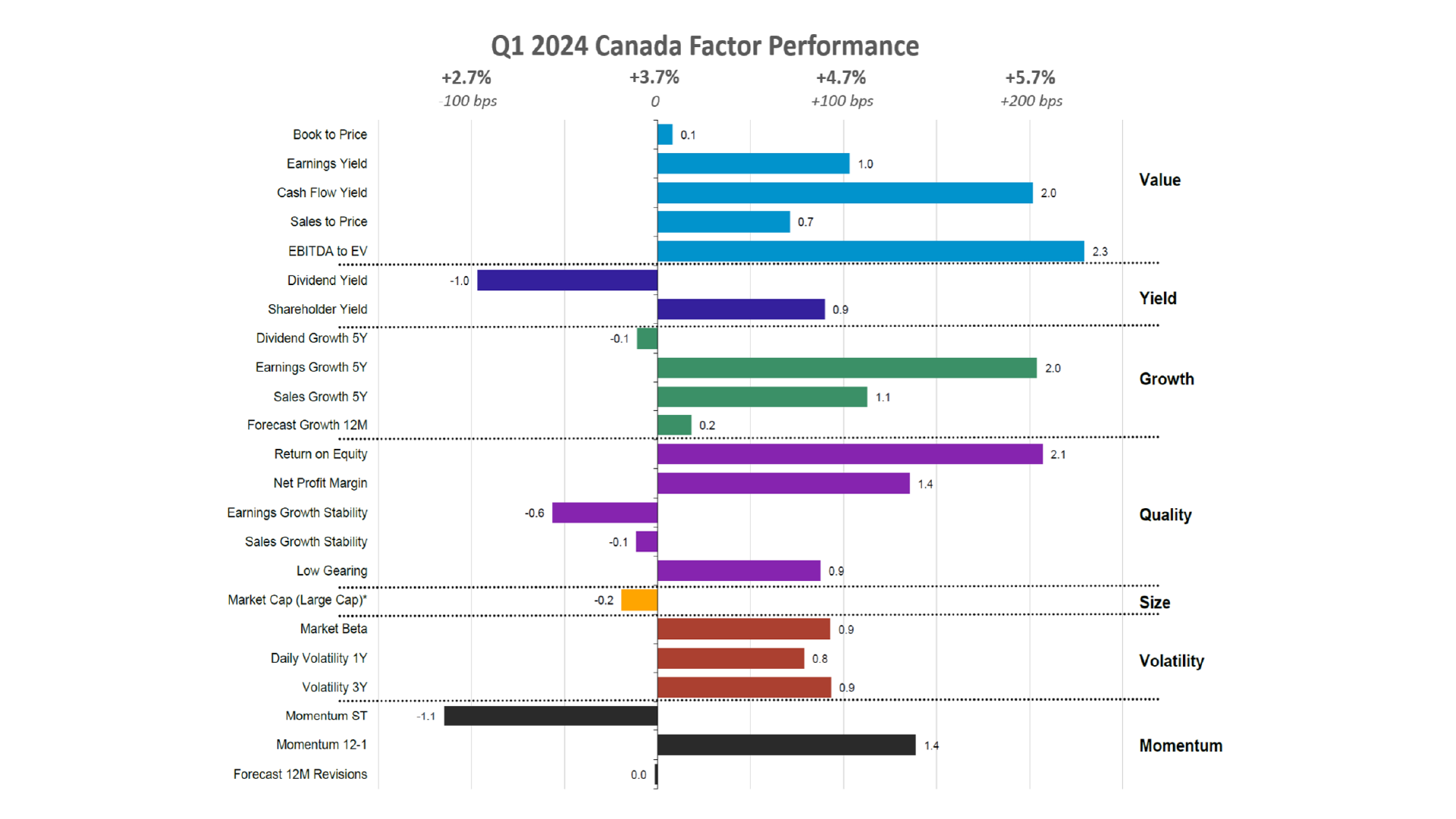

Canadian Equities

Like its American neighbors, inflation remained stubbornly sticky in Canada, hovering above 3% all of Q4 before dipping down to 2.8% in February, falling just behind Europe when it comes to reaching the long-term 2% target. Consumer spending has also maintained its pace from Q3 and Q4 2023, However, unemployment reached 6.1% in March, and manufacturing has contracted for the 11th consecutive month, albeit at the slowest rate in the past year.

The value stocks with a high EBITDA-to-EV ratio that led Canadian markets in Q1 mainly include companies in Energy (Suncor Energy Inc., +16% in Q1; Cenovus Energy, +20% in Q1; Imperial Oil, +21% in Q1), Financials (Fairfax Financial Holdings, +18% in Q1; Nuvei Corp., +20% in Q1), as well as tech firm Celestica Inc. (+52% in Q1) and healthcare company Green Thumb Industries (+30% in Q1).

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values, relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The information contained in this communication is for informational purposes only. Investment Metrics, a Confluence company, is not providing, legal, financial, accounting, compliance or other similar services or advice through this communication. Recipients of this communication are responsible for understanding the regulatory and legal requirements applicable to their business.