Preliminary Report

October 2023

Q3 Plan Universe Performance Snapshot

by:

Plan Universe Performance

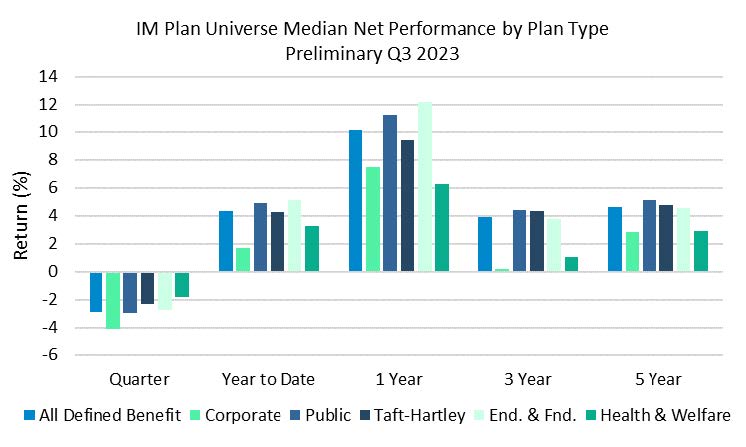

During the third quarter of 2023, equity markets sold off, triggered by a rapid rise in bond yields due to the Fed’s tight monetary policy. Substantial challenges, including rising geopolitical tensions, the high cost of borrowing, and inflationary pressures, continue to plague the global economy. The Investment Metrics All Defined Benefit Plan Sponsor Universe posted a median net return of -2.9% for the third quarter and 4.35% for the year ending September 2023.

Though plan performance turned negative after posting three consecutive positive quarters, all plan types other than Corporates outperformed a traditional 60/40 benchmark return of -3.25%. (60% MSCI ACWI Index/ 40% Bloomberg Barclays U.S. Aggregate Index). For the quarter, Health & Welfare and Taft-Hartley plans posted the strongest performance with median returns of -1.76% and -2.28%, respectively. Year to date, endowments & foundations posted the strongest performance with a median return of 5.13%.

All Defined Benefit: 648, Corporate: 135, Public: 247, Taft-Hartley: 175, End. & Fnd: 721, Health & Welfare: 159

Source: Investment Metrics, a Confluence company

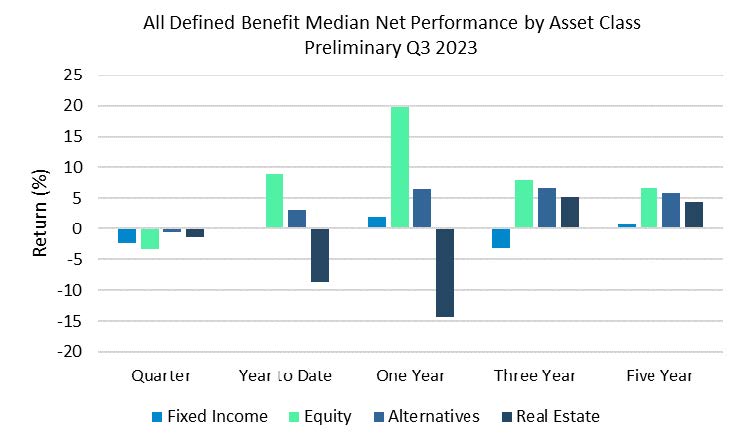

Compared to other plans, the strong year-to-date results for endowments & foundations were mainly driven by their high exposure to equity and alternatives, which were the top-performing asset classes. As Figure 2 highlights, the year-to-date median equity and alternative returns across all defined benefit plans were 8.91% and 3.04%, respectively, significantly outperforming other asset classes.

Source: Investment Metrics, a Confluence company

Investment Metrics Plan Universe

Investment Metrics Plan Universe is the industry’s most granular analytics tool for plan sponsors, including standard and custom peer group comparisons of performance, risk, and asset allocations by plan type and size. The data is sourced directly from over 4,000 institutions using our reporting and analytics solutions, including investment consultants, advisors, and asset owners. Plan Universe is updated quarterly and typically available on or near the following schedule: preliminary data available on the 14th business day after quarter end, a second cut on the 21st business day, and final cut on the 29th business day, the data includes 20+ years’ history on:

- Trust Funds, Corporates, Public Plans, Taft-Hartley, Endowments & Foundations, High Net Worth, Health & Welfare, and custom groups.

- Asset Allocations broken into equity (US, global, global ex-US), fixed income (US, global, and global ex-US), alternatives, real estate (public and private), multi-asset, and cash. Emerging Markets allocations are available for equities and debt securities.

- Net and gross performances displayed by quartile with full percentiles via download.

- With all information aggregated by Plan Size.

Disclaimer

The information contained in this communication is for informational purposes only. Investment Metrics, a Confluence company, is not providing legal, financial, accounting, compliance or other similar services or advice through this communication. Recipients of this communication are responsible for understanding the regulatory and legal requirements applicable to their business.

About Confluence

For more information, visit confluence.com

In this article: