October 2025

Factor Performance Analysis

Equity performance in the opening month of Q4

November 13, 2025

Prepared by:

Market background

In October 2025, global equity markets posted modest to strong gains. The Federal Reserve’s decision to implement a 25-basis-point rate cut provided a notable boost to investor confidence, reinforcing risk appetite and supporting global equity valuations. This policy shift signaled a potentially more accommodative monetary stance. Emerging markets particularly benefited from the improved sentiment, aided by a weaker US dollar and strong performance within the semiconductor sector. Inflationary pressures continued to prove resilient, while sporadic geopolitical and trade-related uncertainties injected a measure of caution into market dynamics, tempering the otherwise constructive outlook for global equities.

Oil prices experienced significant volatility throughout October, fluctuating sharply before closing the month at $60.97 per barrel, only to decline further to around $57 per barrel during the final week of the month. The month also brought notable volatility for Bitcoin, with mixed performance driven by profit-taking, regulatory developments, and shifting macroeconomic expectations. Typically, sensitive to risk-off sentiment, Bitcoin experienced intramonth weakness but began to stabilize toward the end of the month as investors reassessed risk and renewed interest in crypto assets emerged.

Gold prices trended upward through October, hitting an all-time high of $4,321 per ounce in the final week before easing to $4,019 by the end of the month.

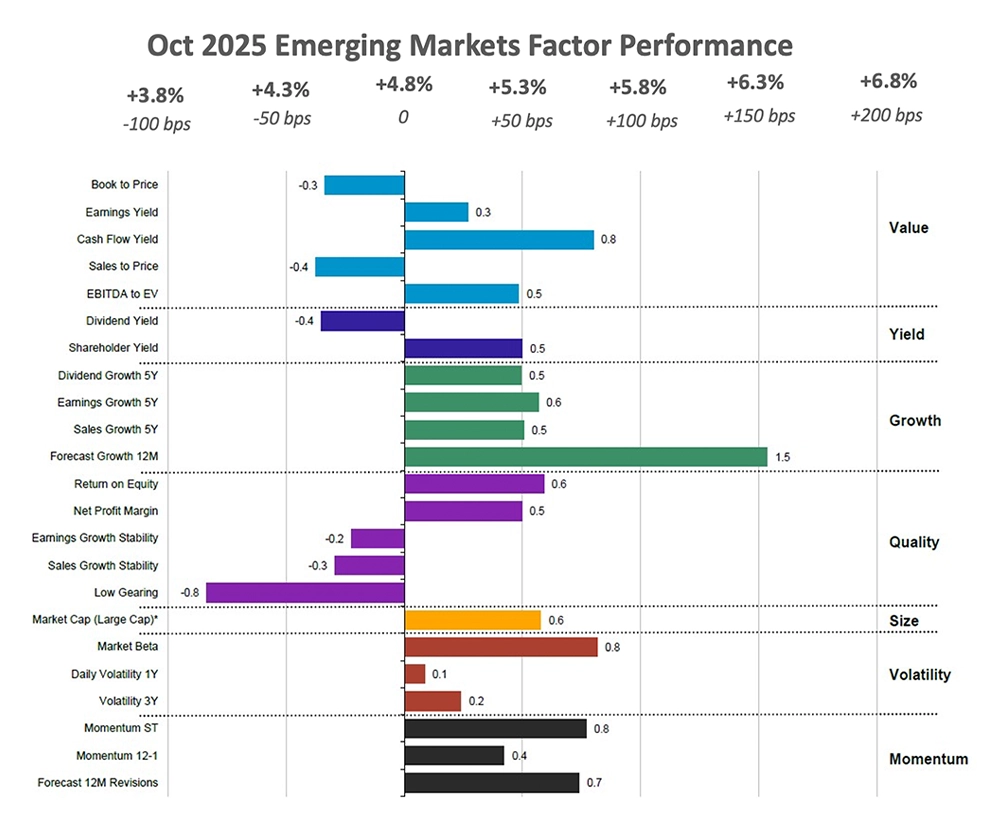

Figure 1: Oct 2025 Mutual Fund Flows data.

Source: Confluence® Style Analytics®Factor summary

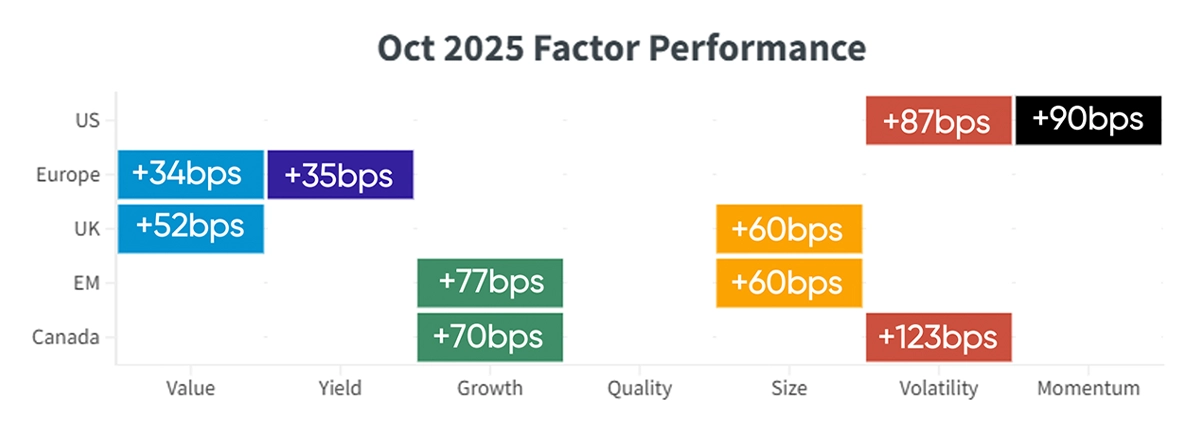

- US Equities: Volatility and Momentum outperformed.

- European Equities: Value and Yield outperformed.

- UK Equities: Value and Size outperformed.

- Emerging Markets Equities: Growth and Size outperformed.

- Canadian Equities: Growth and Volatility outperformed.

Figure 2: Regional relative factor performance (country and sector adjusted) for Oct '25

Source: Confluence® Style Analytics®US equities

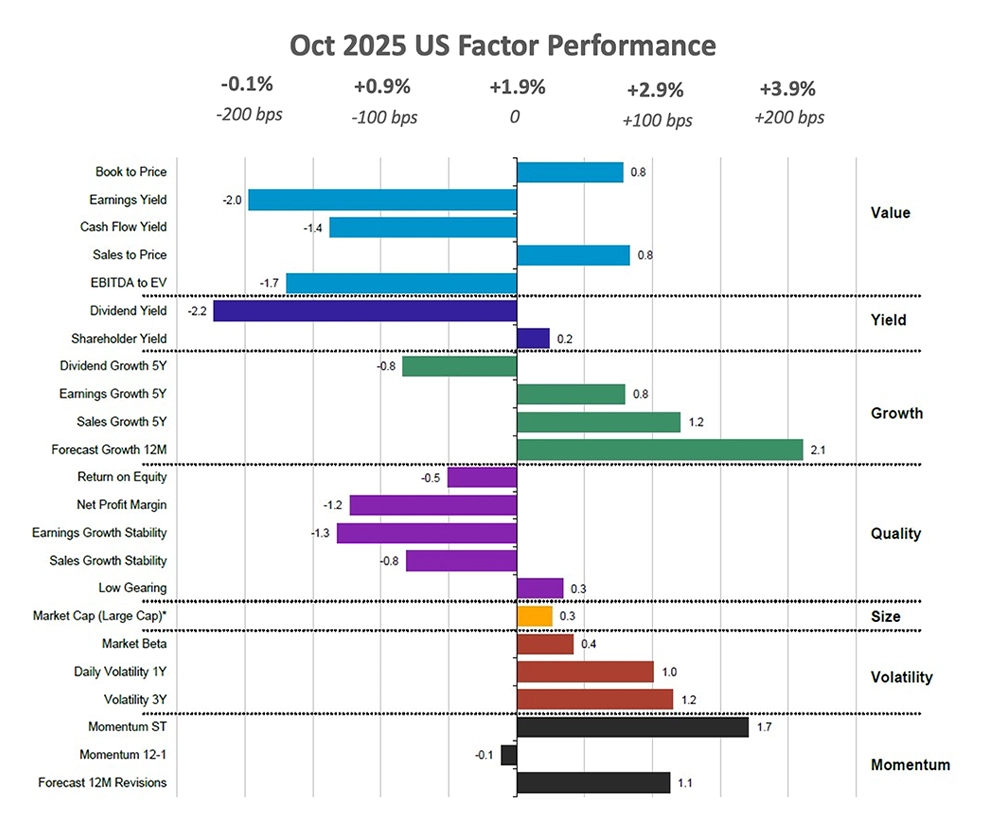

The decline in U.S. equity market performance from September to October 2025 was largely driven by renewed concerns over banking sector weakness and escalating U.S.–China trade tensions. Fears of new tariffs and their potential impact on global supply chains added to investor uncertainty.

The Fed cut interest rates in September, followed by another 25-bps reduction in mid-October, which helped stimulate market activity and boosted the performance of more Volatile stocks as investors repositioned their portfolios. Concurrently, renewed trade tensions—particularly between the U.S. and China, along with concerns about potential tariffs and a possible government shutdown—intensified market volatility. With equity valuations near record highs and economic growth slowing, investors have become more willing to rotate back into higher-risk, Volatile securities.

Alongside Volatility, the Fed’s rate cuts also supported momentum stocks in the U.S. equity market. Strong performances from leading growth names, particularly in the technology and communication sectors, fuelled further gains, as existing market leaders continued to outperform. This trend was consistent with the ongoing outperformance of momentum stocks seen in the previous month. Growth stocks delivered exceptional returns in October 2025, driven by robust earnings from major tech and communication companies.

The annual U.S. inflation rate rose to 3.0% in September 2025—the highest since January, up from 2.9% in August. The unemployment rate also edged higher, reaching 4.3% in August from 4.2% in the prior month, in line with market expectations and marking the highest jobless level of the year. Meanwhile, U.S. manufacturing output increased by 0.2% in August.

Stocks with high forecast growth over the next 12 months, which contributed to the performance of U.S. equities in October, include communications services company Alphabet Inc. (16% in October) and healthcare company Eli Lilly and Co. (13% in October). Additionally, companies with high short-term momentum include information technology company NVIDIA Corp (+9% in Oct) and information technology company Broadcom Inc. (12% in Oct), which also contributed to the outperformance.

Figure 3: Oct 2025 US Factor Performance (sector adjusted)

European equities

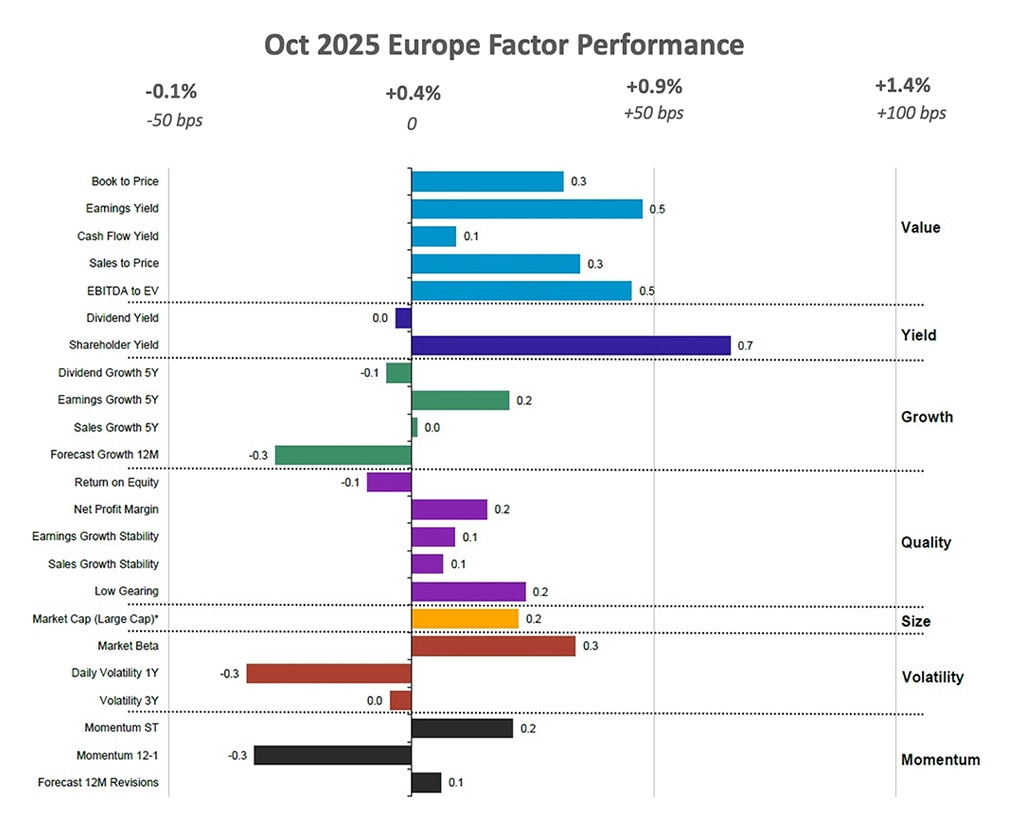

European equity markets declined month-on-month in October 2025 compared with September, weighed down by renewed trade war concerns, political uncertainty in France, and weakening industrial activity across the eurozone. Investor attention centered on France, where President Emmanuel Macron faced pressure to appoint a new prime minister before a self-imposed deadline, as the central bank warned that political gridlock was beginning to impact economic growth.

This month, Value and Yield stocks in Europe outperformed other market factors, supported by their defensive qualities, attractive valuations, and stable income streams. Amid heightened market volatility and economic uncertainty, these characteristics made them particularly appealing. With bond yields fluctuating and investors seeking dependable returns, high-dividend stocks drew increased interest.s with strong cash flow yields.

Euro area consumer price inflation eased to 2.1% in October 2025, down slightly from 2.2% in September. The unemployment rate remained steady at 6.3% in September, unchanged from the previous two months. Meanwhile, eurozone industrial production declined by 1.2% month-on-month in August 2025, reversing a previously reported 0.5% increase in July.

Key European stocks with strong shareholder yields that outperformed in October include French consumer discretionary company LVMH Moët Hennessy Louis Vuitton (+16% in Oct), French healthcare company Sanofi SA (+10% in Oct), and Italian utilities company Enel SpA (7% in Oct).

Figure 4: Oct 2025 Europe Factor Performance (country and sector adjusted)

Source: Confluence® Style Analytics®UK equities

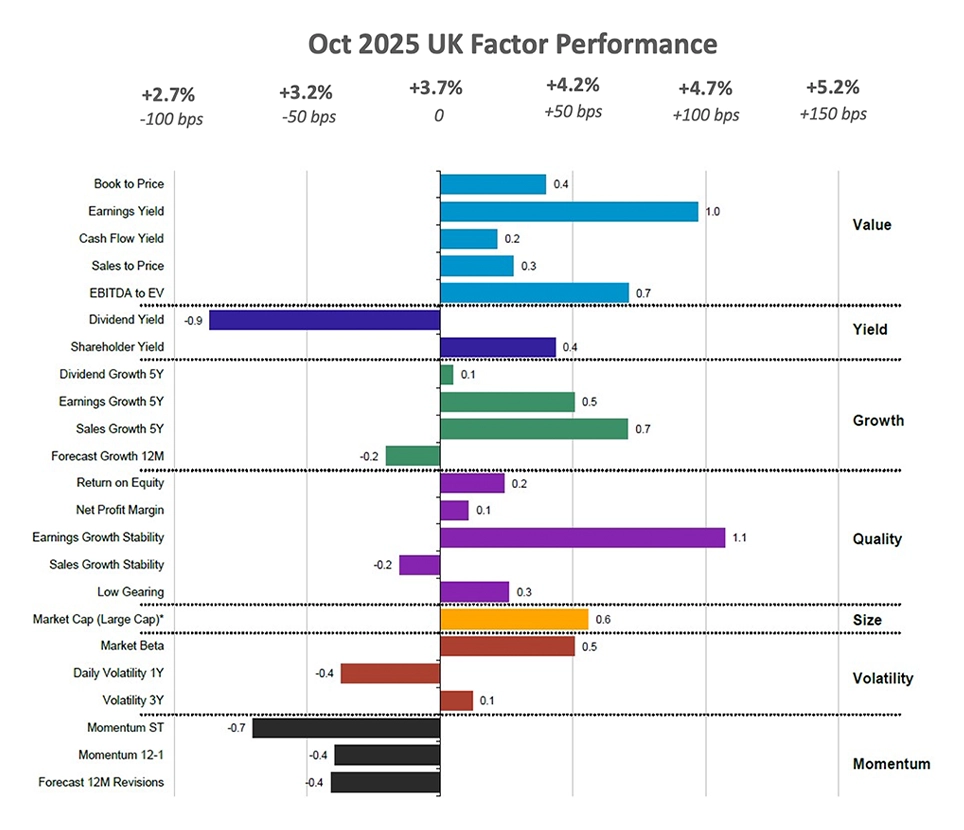

UK equities outperformed global developed markets in October 2025, supported by the Bank of England’s accommodative stance. Although the central bank did not alter interest rates during the month, regulators introduced reforms to banker bonus rules effective October 16, reducing deferral requirements to enhance the UK’s financial sector competitiveness. A weaker pound also boosted export sales, contributing to strong performance in export-oriented and rate-sensitive sectors.

The outperformance of Value subfactors in October in the UK region continued to be consistent with the trend observed in the previous month. In contrast, securities with high Momentum factor exposure displayed a complete reversal from their prior underperformance. Furthermore, while large-cap stocks in the UK lagged in the previous month, they outperformed in October. Many large-cap UK firms generate a significant share of their revenue overseas, making them less exposed to domestic economic and political risks. This global diversification benefited them from stronger international demand and favorable currency movements. The rally in UK equities was therefore concentrated in a select group of large-cap stocks underpinned by solid fundamentals and investor rotation away from higher-risk segments.

The UK’s annual inflation rate held steady at 3.8% in September 2025, unchanged for the third consecutive month. The unemployment rate rose to 5 % in the third quarter of 2025. Meanwhile, manufacturing output increased by 0.7% month-on-month in August, following a downwardly revised 1.1% decline in July.

British stocks with strong earnings yields that outperformed this month include healthcare company GSK Plc (+10% in Oct) and materials company Rio Tinto Plc (+9% in Oct).

Stocks with high earnings growth stability in the UK market that contributed to the region's outperformance include consumer staples company Unilever Plc (2% in October), energy company Shell Plc (5% in October), and financials company London Stock Exchange Group Plc (9% in October).

Figure 5: Oct 2025 UK Factor Performance (sector adjusted)

Source: Confluence® Style Analytics®Emerging market equities

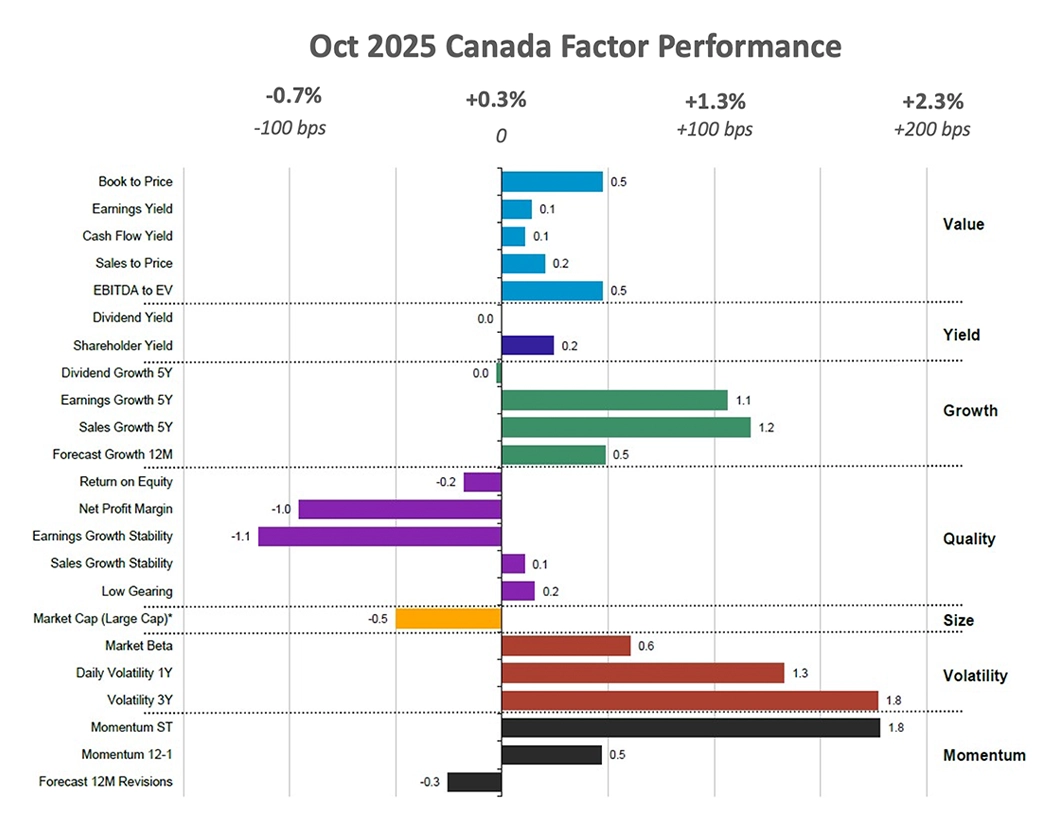

Many emerging market currencies appreciated against the U.S. dollar, boosting returns for investors in local assets and reflecting solid macroeconomic fundamentals and sustained capital inflows. Country-specific factors such as increased political stability in Argentina following the elections and improved economic forecasts for India also supported regional outperformance.

Consistent with the previous month, Growth, Momentum, and Volatility factors outperformed across the region, while large-cap companies also continued to lead performance. Firms with the strongest forecasted 12-month growth outperformed the broader emerging markets in October 2025, as investors favored companies demonstrating robust earnings momentum and innovation-driven growth potential.

In China, consumer prices rose by 0.2% year-on-year in October 2025, while the surveyed unemployment rate declined to 5.2% in September from August’s six-month high of 5.3%, aligning with market expectations. In India, consumer price inflation eased to 1.54% in September, down from 2.07% in August, whereas the unemployment rate inched up to 5.2% from 5.1%. Meanwhile, South Korea’s consumer prices increased by 2.4% year-on-year in October, exceeding market expectations of a 2.1% rise.

Emerging Markets equities that outperformed in Oct, captured by the Forecast Growth 12M subfactor, include Chinese financials company, Agricultural Bank of China Ltd (19% in Oct); Taiwanese info tech company, Taiwan Semiconductor Manufacturing (14 % in Oct) and Chinese energy company PetroChina Co Ltd (14% in Oct). Companies with progressing 12-month forecast revisions this month include Saudi energy company Saudi Arabian Oil (+5% in October) and Chinese information technology company Foxconn Industrial Internet Co., Ltd. (9% in October).

Figure 6: Oct 2025 Emerging Factor Performance (country and sector adjusted)

Source: Confluence® Style Analytics®Canadian equities

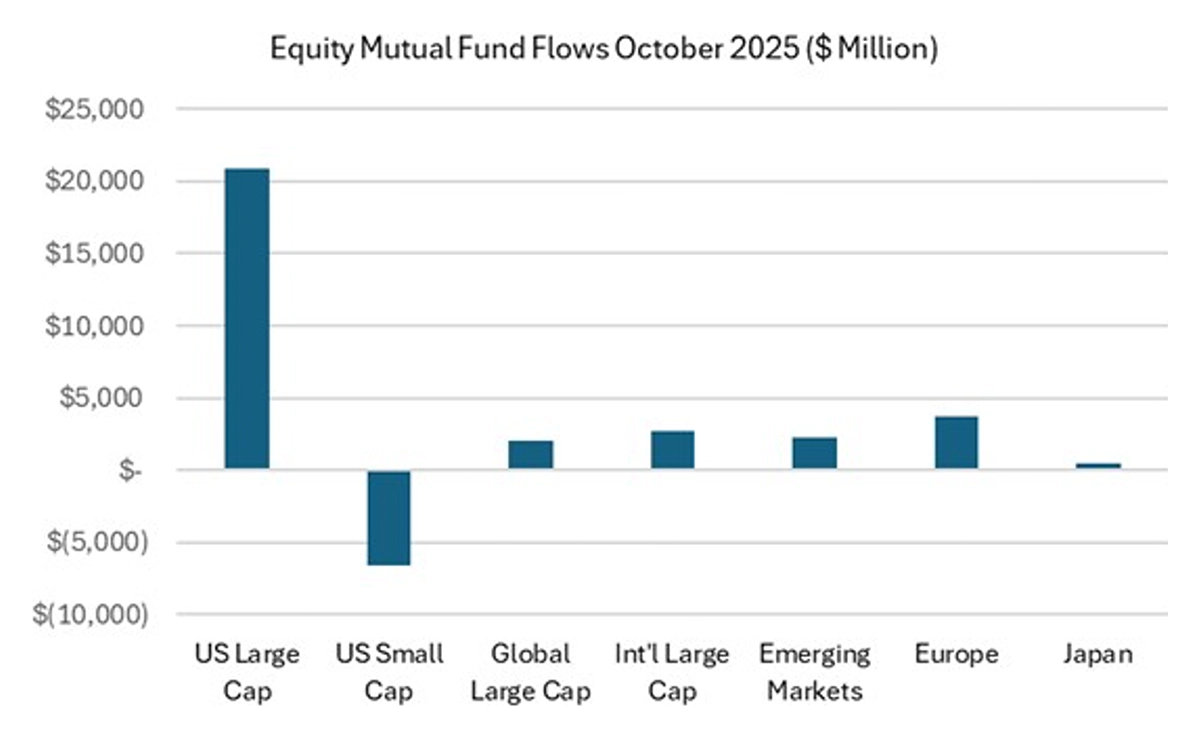

The Canadian equity market declined in October compared to the previous month, reflecting a combination of macroeconomic and domestic headwinds. Persistent inflationary pressures and broader global uncertainty have contributed to heightened volatility, while domestic factors have added to the weakness. Labor market conditions tightened this month, raising concerns that moderating employment growth could weigh on household spending and overall demand in the coming months. Additionally, the recent slowdown in economic activity has been compounded by the impact of U.S. tariffs, which have dampened trade sentiment and growth expectations.

Mirroring trends from the previous month, the Canadian market continued to outperform the Growth, Volatility, and Momentum subfactors. Momentum names benefited from sustained demand for higher-growth and higher volatility exposures, supported by a prevailing risk-on sentiment and favorable earnings revisions among key momentum stocks. As investors rotated toward companies with stronger recent price performance and improving fundamentals, these stocks outpaced more traditional or value-oriented Canadian equities.

Conversely, Quality and Yield factors weighed on overall regional performance. Although Value stocks showed some recovery from the previous month, their relative gains were insufficient to offset broader market weakness. In addition, large-cap stocks continued to lag, further contributing to the region’s underperformance.

Canada’s annual inflation rate accelerated to 2.4% in September 2025, up from 1.9% in the previous month, reflecting renewed price pressures. Meanwhile, the unemployment rate edged lower to 6.9% in October, down from a four-year high of 7.1% in September. Manufacturing output declined by 3.2% in August, underscoring continued weakness in the industrial sector despite signs of stabilization elsewhere in the economy.

Stocks with short-term momentum in the region include financial companies, such as Toronto Dominion Bank (+4% in Oct) and Canadian Imperial Bank of Commerce (+4% in Oct), as well as information technology company Shopify (16% in Oct). High 3Y volatility stocks that contributed to the region’s performance include energy company Cameco Corp (22% in Oct) and info tech company Celestica Incorp (40% in Oct).

Figure 7: Oct 2025 Canada Factor Performance (sector adjusted)

Source: Confluence® Style Analytics®Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence®

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with over 700 employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com