November 2025

Factor Performance Analysis

Global Equities Turning to Safety

December 16, 2025

Prepared by:

Market background

In November 2025, global equity markets posted modest gains as investors shifted from expensive growth and technology stocks into more attractively valued sectors. Concerns over stretched AI and mega-cap valuations fuelled flows into value areas, such as financials and defensive sectors, aided by expectations of further rate cuts and resilient earnings in traditional industries. Consequently, Value broadly outperformed growth across developed markets, driven by valuation appeal and earnings stability amid mixed macro signals.

Oil prices remained largely stable in November, closing the month at $59 per barrel, a slight decrease from the previous month. Meanwhile, gold continued its upward trajectory, climbing to $4,208 per ounce. In November 2025, Bitcoin experienced a sharp decline and increased volatility, dropping from its October highs and erasing much of its year-to-date gains amid a broad risk-off sentiment and macroeconomic uncertainty.

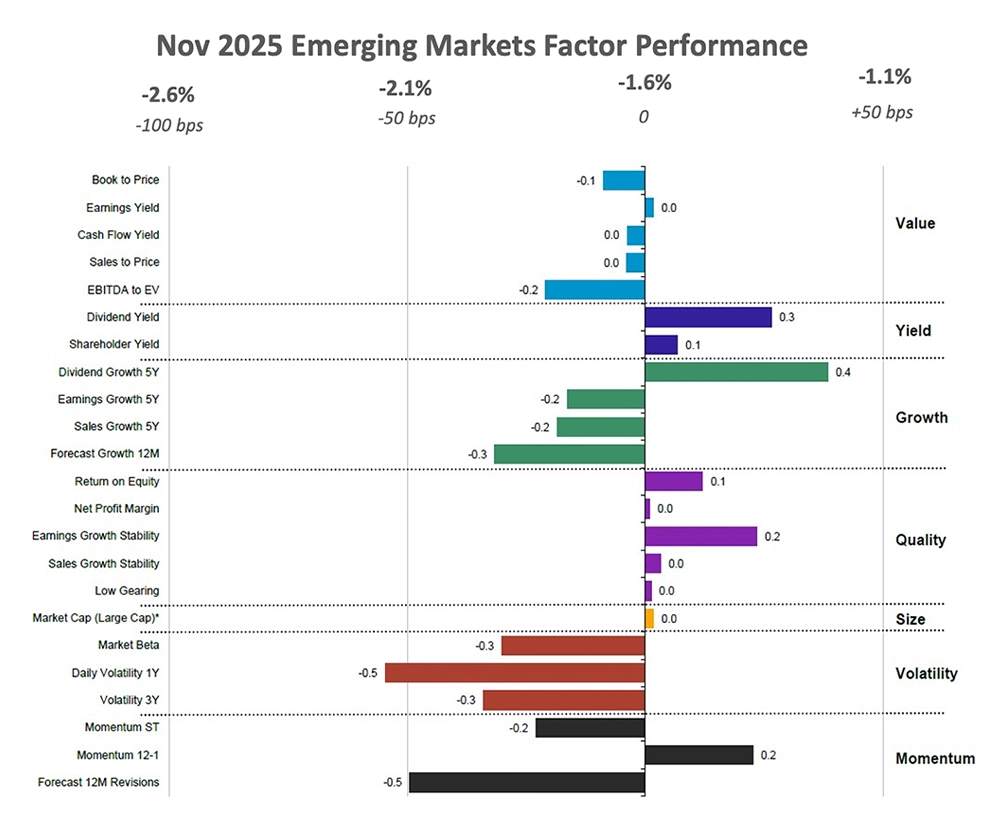

While U.S. growth stocks underperformed in November, fund flows exhibited a lagging trend, with significant capital still being invested in U.S. large-cap growth mutual funds, as shown in the chart below. Similar to October, global equity markets experienced positive inflows during the month.

Figure 1: November 2025 Mutual Fund Flows data.

Source: Confluence® Style Analytics®Factor summary

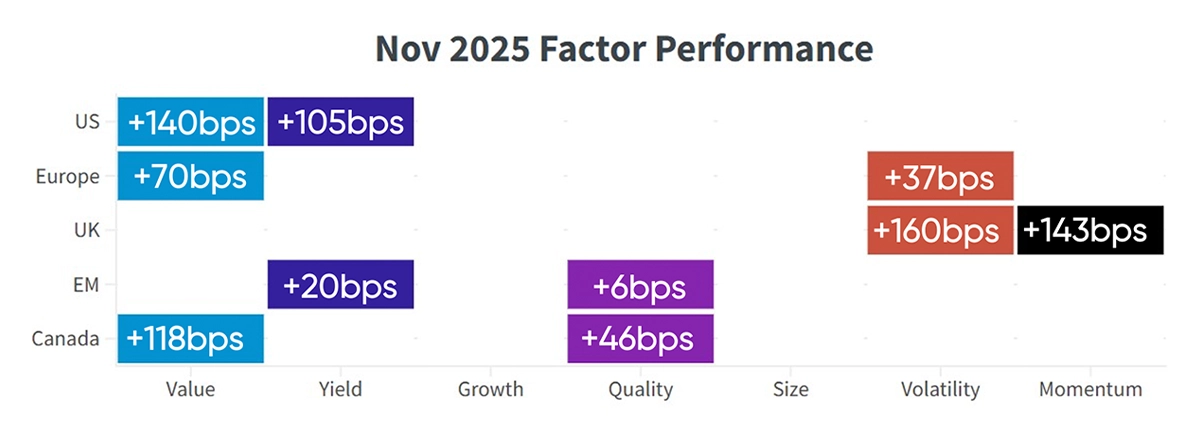

- US Equities: Value and Yield outperformed.

- European Equities: Value and Volatility outperformed.

- UK Equities: Volatility and Momentum outperformed.

- Emerging Markets Equities: Yield and Quality outperformed.

- Canadian Equities: Value and Quality outperformed.

Figure 2: Regional relative factor performance (country and sector adjusted)

for November '25

US equities

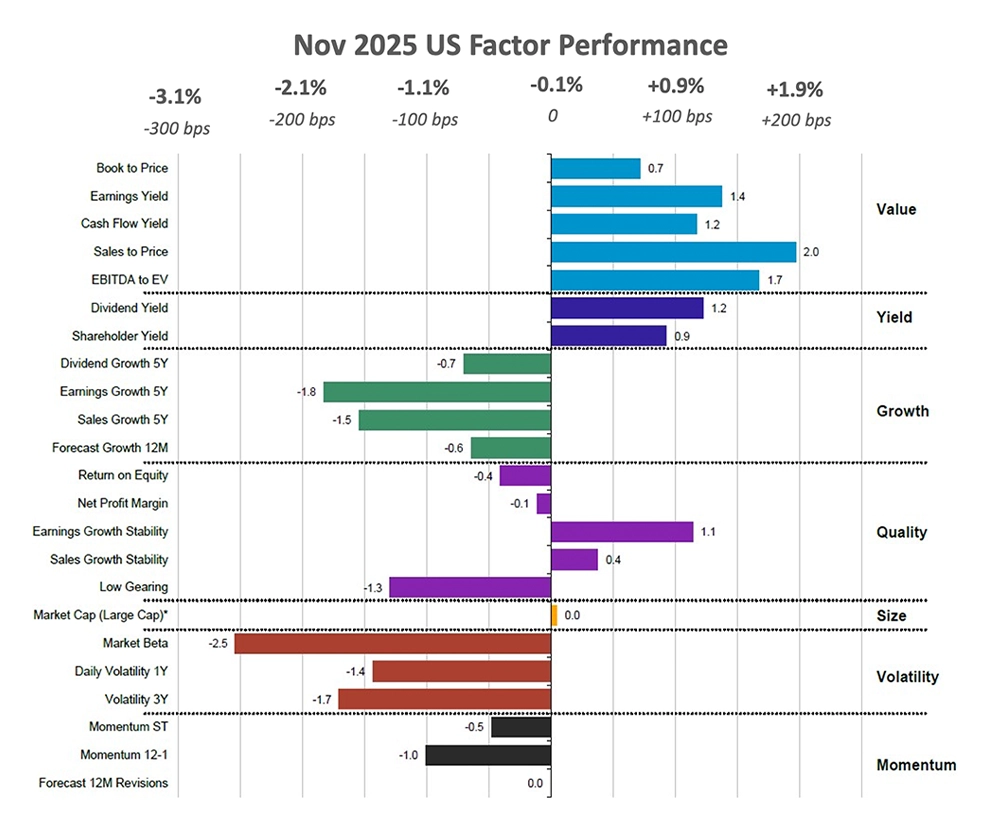

Compared to the previous month, the U.S. equity market shifted from a positive return of 1.9% to a slight decline of 0.1%. The reversal in factor leadership can largely explain this shift. Last month’s gains were driven by Growth, Volatility, and Momentum subfactors, all of which detracted from performance this month. In contrast, the market saw a complete trend reversal, with Value and Yield emerging as the leading contributors to performance.

Value and Yield stocks generally outperform when interest rates stabilize, as investors often rotate out of expensive growth names when discount rates stop declining. This month’s leadership shift reflected that pattern: the Fed’s rate stance prompted a reassessment of equity style preferences, placing pressure on long-duration, growth-oriented stocks whose future cash flows lose relative value when rates show signs of holding steady rather than continuing to fall, as they did the previous month. At the same time, value-oriented and income-producing sectors benefited from stronger relative appeal and a more defensive market tone. As investors absorbed the Fed’s latest guidance, these forces collectively supported the outperformance of Value and Yield factors in the U.S. equity market.

The annual U.S. inflation rate rose to 3.0% in September 2025—the highest since January, up from 2.9% in August. The US unemployment rate rose to 4.4% in September 2025 from 4.3% in August, exceeding market expectations of 4.3%. In September 2025, US manufacturing production remained unchanged month-over-month, following a downward revision to a 0.1% increase in August and undershooting market expectations of a 0.1% gain.

Stocks with high sales-to-price ratios, which contributed to the performance of U.S. equities in November, include information technology company Apple Inc. (3% in November) and the consumer staples company Walmart Inc. (9% in November). Additionally, companies with high dividend yields include information technology company Broadcom Inc. (+9% in Nov) and healthcare company Johnson & Johnson (10% in Nov), which also contributed to the outperformance.

Figure 3: November 2025 US Factor Performance (sector adjusted)

European equities

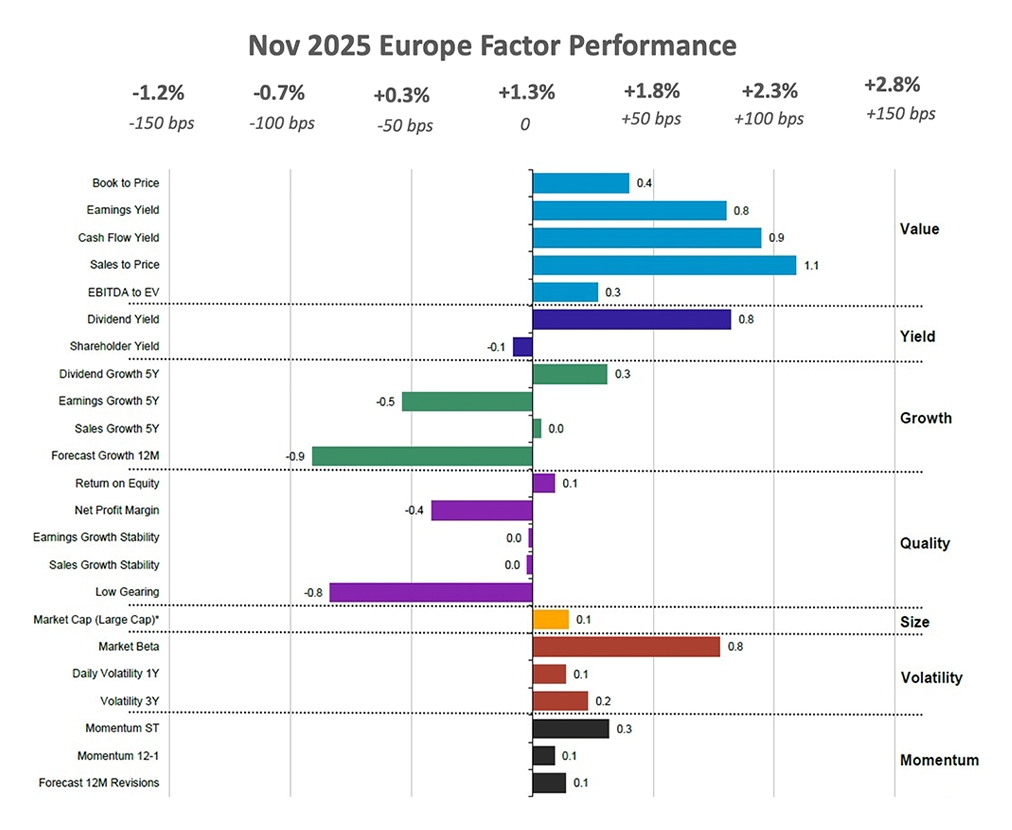

Compared with the previous month, European equities saw a performance improvement, rising from a positive 0.4% to 1.3%. While the overall factor leadership trend remained consistent, several factors that had lagged previously, such as Volatility and Momentum, showed stronger results this month. Like the U.S., the European market was primarily driven by Value factors.

Value continued to outperform in Europe in November, as investors remained positioned in attractively priced, cyclical sectors. What changed this month was the rise of Volatility as a new outperformer, driven by an increase in demand for high-volatility stocks.

Investor risk sentiment and speculation around oversold or high-beta names encouraged investors to shift toward stocks with greater price sensitivity and higher upside potential. This risk-on behaviour—combined with continued pressure on expensive growth stocks—boosted both Value and high-volatility exposures, shaping the region’s factor leadership for the month.

Euro area consumer price inflation increased to 2.2% in November 2025, up from 2.1% in October. Eurozone industrial production increased by 0.2% month-on-month in September 2025, partially recovering from the revised 1.1% drop in August.

Key European stocks with strong market beta that outperformed in November include French consumer discretionary company LVMH Moët Hennessy Louis Vuitton (+4% in Nov) and Spanish financials company Banco Santander SA (+5% in Nov). Leading the market through strong sales to price performance in the region are French consumer discretionary company Christian Dior SE (4% in Nov) and Italian financials Intesa Sanpaolo Spa (4% in Nov).

Figure 4: November 2025 Europe Factor Performance (country and sector adjusted)

Source: Confluence Style AnalyticsUK equities

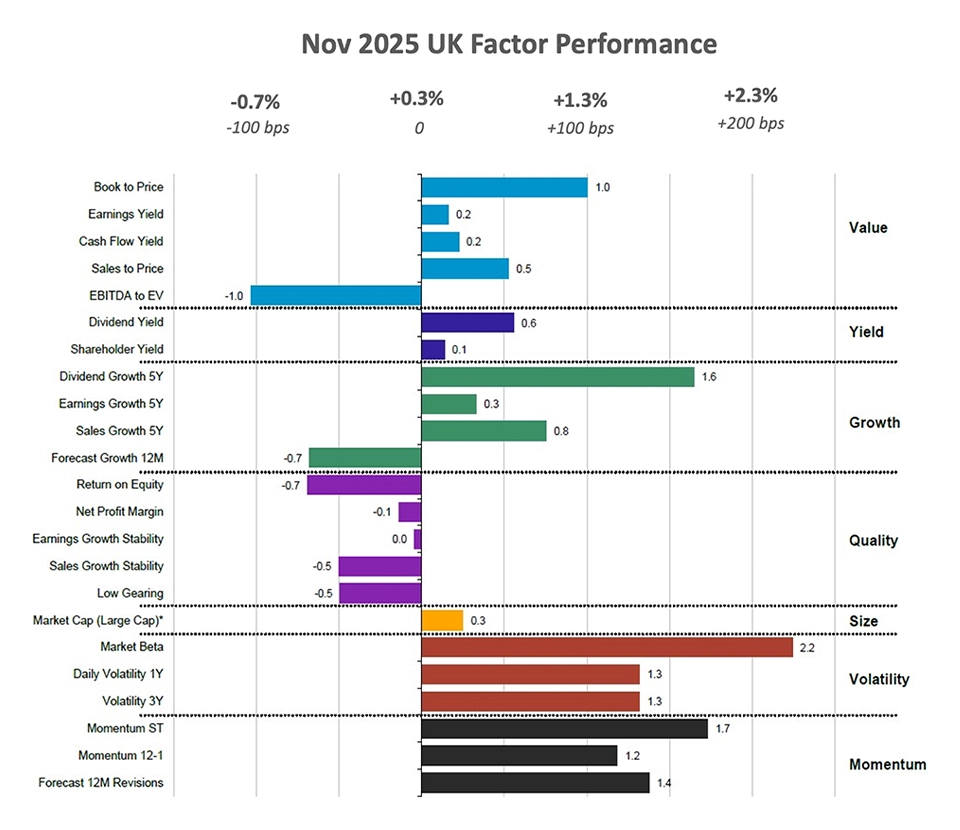

As volatility increased across both global and UK equity markets in November 2025, investors became more cautious and reduced exposure to risk assets amid uncertainty over the future path of interest rates. Although the UK market is less heavily weighted towards technology than the US, global concerns about a potential tech and AI bubble weighed on overall sentiment, further dampening risk appetite. Additionally, following a strong rally in October, this shift in sentiment made November’s performance appear weaker by comparison, even though markets did not experience a sharp sell-off.

Within the region’s markets, and consistent with October’s trends, Volatility and Momentum outperformed by a wide margin. Growth followed, although its performance was dampened by weaker 12-month forecast growth, which lagged the region’s overall return. Value exhibited a similar pattern to Growth, with EBITDA-to-EV weighing on results despite broadly positive contributions from other value sub-factors. Quality continued to underperform across the region.

UK consumer prices increased by 0.4% month-on-month in October 2025, after remaining flat in the previous period. The unemployment rate rose to 5.0% in the third quarter of 2025, marking its highest level in three months. Meanwhile, UK manufacturing output rebounded, rising 0.5% month-on-month in October following a 1.7% decline in September.

British stocks with strong market beta that outperformed this month include consumer staples company British American Tobacco Plc (+14% in November) and healthcare company AstraZeneca Plc (+13% in November).

Stocks with high short-term momentum in the UK market that contributed to the region's outperformance include financial companies Barclays Plc (7% in November), energy company BP Plc (5% in November), and financial services company Lloyds Banking Group Plc (9% in November).

Figure 5: November 2025 UK Factor Performance (sector adjusted)

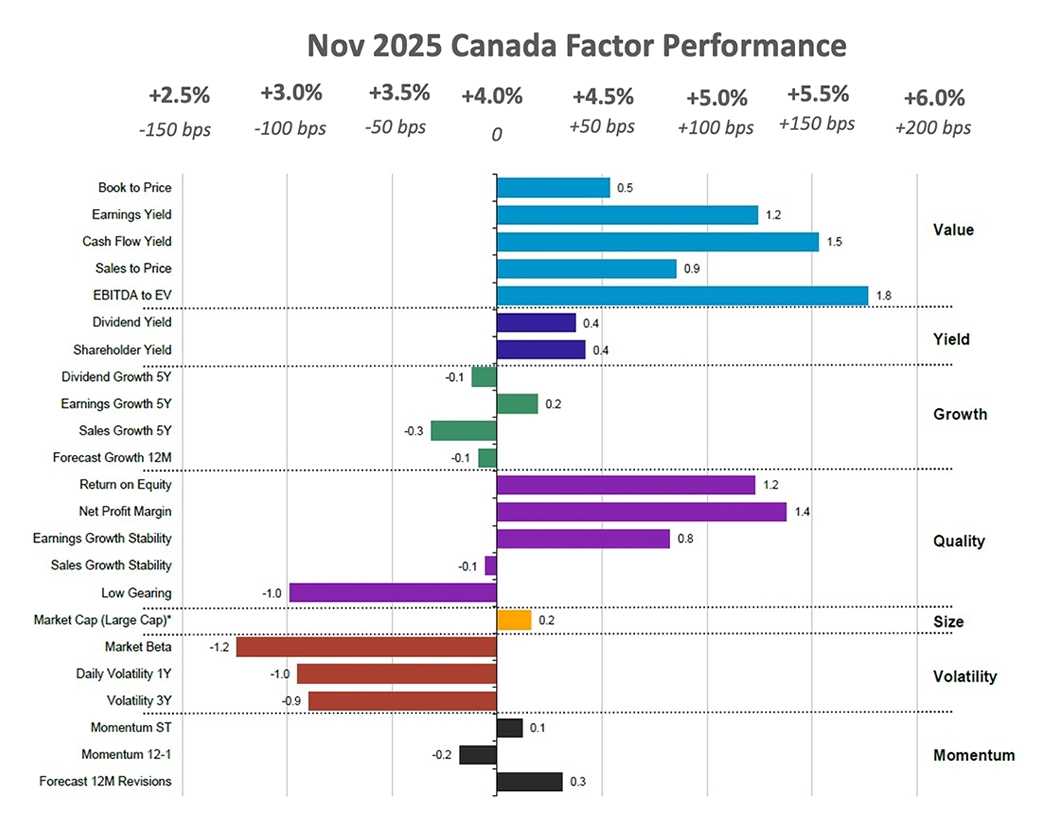

Source: Confluence Style AnalyticsEmerging market equities

Compared with the previous month and developed markets, emerging markets showed a shift in trend in November, with overall outperformance limited to Quality and Yield. Broader market performance was weighed down by significant underperformance in Volatility, Momentum, and Growth. As a result, the region posted a negative return of 1.6%, marking a sharp reversal from the strong investor preference seen in the prior month.

The underperformance of emerging markets in November can be attributed to profit-taking after strong gains earlier in 2025, particularly in major Asian markets. Stretched valuations in technology and other “new economy” stocks prompted investors to lock in gains. Additionally, global macro uncertainty including doubts over near-term rate cuts and concerns about inflated equity valuations, especially in tech and AI dampened risk appetite, increasing selling pressure on EM equities.

In China, the Consumer Price Index fell by 0.1% in November 2025, while the surveyed urban unemployment rate remained unchanged at 5.1%. In Taiwan, annual inflation eased to 1.23% in November, the lowest level since March 2021, and manufacturing production rose 15.38% year-on-year in October 2025. In South Korea, the annual inflation rate held steady at 2.4% in November, its highest since July 2024, while the seasonally adjusted unemployment rate increased to 2.7%.

Emerging Markets equities that outperformed in November, captured by the Earnings Growth Stability subfactor, include a Chinese financials company, Agricultural Bank of China (2% in November), and Industrial and Commercial Bank of China (5% in November). Companies with progressing dividend yield in this month include Chinese financial companies China Construction Bank Corp (+6 % in Nov), Bank of China (9% in Nov).

Figure 6: November 2025 Emerging Factor Performance (country and sector adjusted)

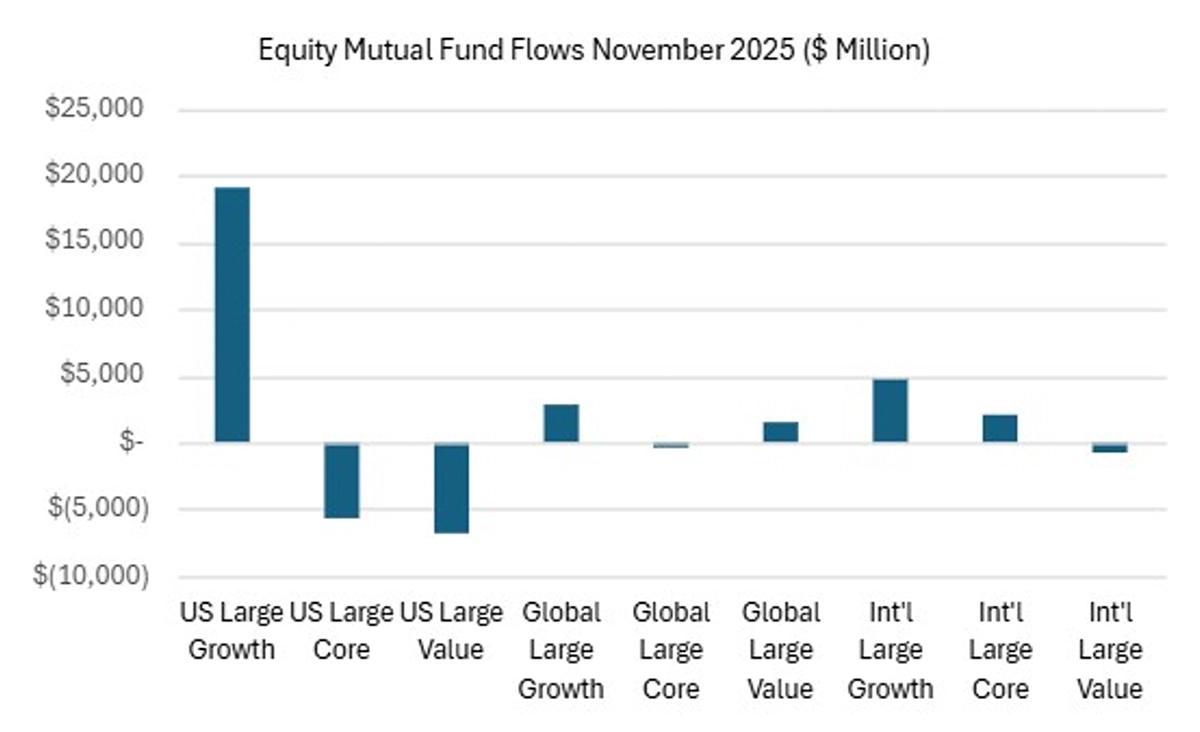

Source: Confluence Style AnalyticsCanadian equities

Canadian equities experienced a shift in factor performance compared with the previous month. While overall market returns were strong, this was primarily driven by the Value and Yield sub-factors. In contrast, Momentum, Volatility, and Growth, which had outperformed the previous month, lagged behind in November. Canadian markets mirrored broader developed market trends, as investor preference rotated from riskier growth assets toward safer, attractively valued, and high-yielding stocks.

Equities in the region, particularly momentum and Growth-oriented stocks, had delivered strong returns in the previous months. Investors took profits, prompting a shift toward more defensive or income-generating stocks. With Value stocks trading at relatively lower valuations, they became more appealing amid a cautious market. Rising concerns about tech and AI bubbles, along with weaker consumer confidence, further encouraged investors to favour safer, dividend-yielding assets over high-beta growth names.

In Canada, the Consumer Price Index rose 0.1% month-on-month in November 2025. The unemployment rate declined to 6.5% from 6.9% over the same period, while manufacturing production fell 1% in September 2025.

Stocks with strong cash flow yield in the region include financial companies, Bank of Nova Scotia (+6 % in Nov), and Canadian Imperial Bank of Commerce (+5% in Nov). High-net-profit-margin stocks that contributed to the region’s performance include financial company Royal Bank of Canada (6% in November), materials company Agnico Eagle Mines Ltd. (9% in November), and energy company Canadian Natural Resources Ltd. (6% in November).

Figure 7: November 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsStyle Analytics

Style Analytics Fixed Income is now available globally. To learn more or request a demo, click on the link below.

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence® Technologies

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with over 700 employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com