November 2023

Factor Performance Analysis

Disinflation and Strength in Volatility

December 13th, 2023

by:

Market Background

Following three consecutive monthly declines, public equity markets in developed and emerging markets rebounded, returning nearly 10% across most regions except for the UK. From a factor perspective, stocks with high volatility over the last year played a crucial role in driving returns this month, followed by a renewed interest in Growth equity in Europe and Emerging Markets, particularly forecasted growth. The UK stood out as an outlier, being the only region to prefer Value stocks and eschewing Growth, resulting in a modest 3% return for its public equity market in November.

A potential reason for this performance deviation is the lag in disinflation between the UK and its developed counterparts. The UK struggled with notably higher core inflation rates than Europe throughout 2023, impacting its factor performance trend. By October, the UK’s core inflation rate decreased to 5.7%, whereas its European counterparts reached that level in August, with a current core inflation rate of 3.6%, even lower than in the US. For comparison, US core inflation reached the 5.7% threshold in April this year and stabilized at 4% as of November.

Disinflation may have left its mark on developed market yields as well. In the US, 10-year yields peaked at 4.88% in October, decreasing by 51 bps to 4.37% this month. Germany and the UK experienced a smaller decrease of about 34-38 bps but marked a clear decline for the first time in six months.

Excluding the UK, the most favored factor across all regions this month was “daily volatility one year”, capturing the standard deviation of the last year’s daily total returns to track short-term volatility and its impact on equity performance. Stocks with high daily volatility in 2023 contributed at least 100bps of outperformance in all markets but Canada, which saw 80 bps, and the US, which saw 190 bps.

Crude oil peaked at $90/barrel in September and declined to $73/barrel in November, nearly approaching the low point observed in May this year. Ongoing conflicts in the Middle East introduce potential uncertainties for oil prices in the remaining months of the final quarter.

Alongside crude oil, natural gas prices decreased by 25% in November to $2.8/MMBtu, significantly lower than both the peaks during the onset of the Russian-Ukrainian War in 2022 and the average price at the beginning of winter in past years. Alternative risk-on assets, particularly cryptocurrency like Bitcoin, also appreciated by 40% so far in the fourth quarter. The surge in volatile assets like cryptocurrency further strengthens the prevailing risk-on sentiment observed in developed markets.

Factor Summary

- US Equities: Volatility and Growth outperformed.

- Europe: Volatility, Quality, and Growth outperformed.

- UK: Volatility, Value, and low gearing (Quality) outperformed.

- Emerging Markets: Volatility and Growth outperformed.

- Canada: Growth and Volatility outperformed.

US Equities

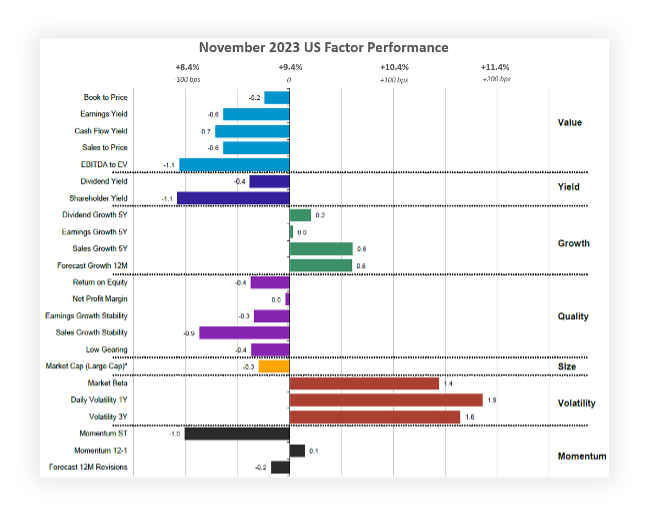

In the past three months, stable Quality stocks focusing on both Yield and Growth have outperformed, while their volatile stocks underperformed. However, November observed a shift to risk-on assets, particularly volatile equities, with the US market returning over 9% this month.

Contrary to the recent trend, Volatility significantly outperformed, with the most volatile stocks outpacing the US market by nearly 2%, representing substantial monthly factor premiums. This month, a notable change was observed as the performance shifted away from large-cap stocks, as stocks in the bottom 30% of the market outperformed the top 70%. The only other style to outshine this month was Growth, demonstrated through both historic sales growth over five years and projected growth over the next year. This pattern echoes the trend observed in Q1 of this year, particularly in January.

Examining the macroeconomic landscape, the surge in Volatility could be linked to consistent improvements in reducing inflation. After a brief increase to 3.7% in Q3, inflation decreased to 3.1% by November, and core inflation remained at 4%, holding that steady since the beginning of Q4. Federal Reserve Chairman Jerome Powell recently indicated that concluding their “sufficiently restrictive” stance would be premature, keeping rates in the 5.25% – 5.5% range. They are prepared to tighten further if needed. However, similar comments have been made since the decision to maintain the current federal funds rate since August, marking the longest period of rate stability since the hiking cycle began in 2022.

Driving the performance in US Volatility in November were prominent names such as private equity giant KKR (+37%); E-commerce favorite Mercado Libre (+34%), and Uber Technologies (+30%). Other volatile outperformers in Tech also outperformed, such as Snowflake Inc (+29%), Workday Inc (+27%), Salesforce (+25%), as well as AMD and Intel, which returned 22% and 23%, respectively.

Figure 1: November 2023 US Factor Performance (sector adjusted)

Source: Investment Metrics, a Confluence company

European Equities

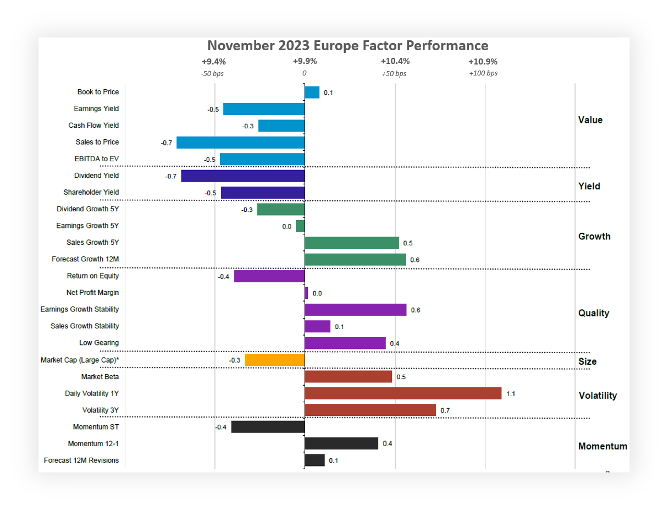

November marked a distinct shift in European factor performance with Volatility stocks taking the lead for the first time, displacing the previously favored Value and Yield equities that European investors preferred throughout 2023. Growth also experienced a surge in Europe, but unlike a defensive focus on dividend growth, the emphasis was on companies with strong sales growth over five years and favorable annual growth forecasts, mirroring the trend seen in the United States.

Similar to the United States, the European core inflation rate continued its descent, decreasing to 4.76% in October. This encouraging data point reinforces the persistence of disinflation, marking the second consecutive month that the core rate fell below 6% year-to-date.

Despite ongoing decreases in German manufacturing, the rate has significantly slowed down since the close of Q2. In the services sector, as tracked by the HCOB Germany Services PMI, there was an increase to just below 50 in November, suggesting the output marginally decreased from last month.

Key drivers of volatile European equity performance this month include Dutch semiconductor firm ASML Holdings (+14%), French construction giant Vinci (+12%), Deutsche Post (+20%) and German semiconductor firm Infineon Technologies (+30%).

Figure 2: November 2023 Europe Factor Performance (country and sector adjusted)

Source: Investment Metrics, a Confluence company

UK Equities

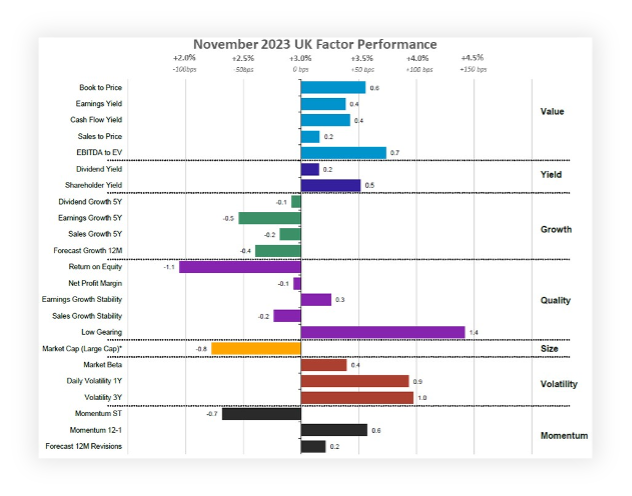

The UK deviated from the Developed Markets trend by continuing to favor Value stocks instead of Growth, aligning with the defensive trend observed in the US and Europe throughout 2022 and parts of 2023. Consequently, the UK market’s performance shadowed that of other Developed Markets, registering a modest 3% gain compared to the nearly 10% seen in its counterparts.

While the UK remains inclined toward Value equities, again led by stocks with a robust EBITDA to EV ratio, investors embraced stocks with both short- and mid-term volatility, which outperformed the market by about 100 bps. Notably, UK investors have been focusing on equities with low debt-to-equity ratios, exemplified by the low gearing subfactor. For instance, under new management, Rolls Royce has significantly reduced loan obligations this year, improving its debt-to-equity ratio YTD, and achieved a remarkable year-to-date return of nearly 223%.

Examining economic indicators, the S&P Manufacturing PMI in the UK mirrored the manufacturing story observed in Germany, narrowly missing an increase in manufacturing over October. However, the services sector saw an improvement over October, with the S&P UK Services PMI rising above 50 again after a lull during Q3. Furthermore, the GfK consumer confidence indicator in the UK highlights that consumer’s perspective on their personal finances is slowly improving, although still in negative territory.

The surge in volatile stocks was led by names like Associated British Foods PLC (+22%); tech company Ocado Group (+34%), Airline group EasyJet PLC (+29%), and engine manufacturer Rolls Royce (+30%).

Figure 3: November 2023 UK Factor Performance (sector adjusted)

Source: Investment Metrics, a Confluence company

Emerging Markets Equities

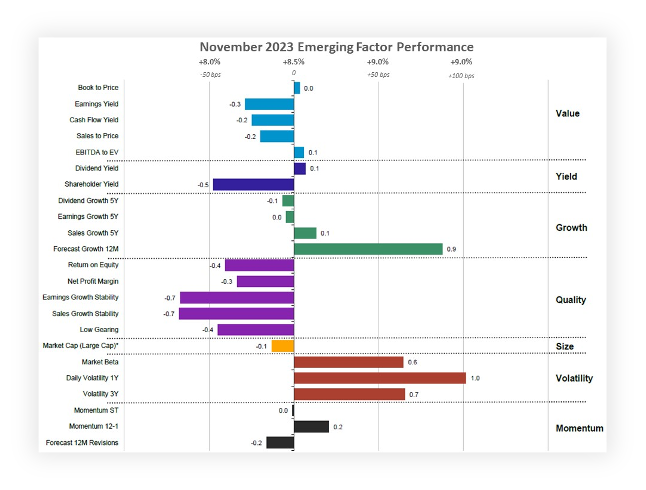

Emerging Markets departed from its year-long trend favoring Value and Yield stocks to match the pattern observed in the US and Canada for the first time in over a year. Volatility emerged as the standout outperformer in this report, surpassing all other factors by 100bps, a significant factor premium for Emerging Markets, which has recently shown lower premiums than in developed markets. The premiums observed this month were notably smaller than other regions except for forecasted growth over twelve months and daily volatility over one year.

Alongside short-term volatility, embodied by the “daily volatility over one year” subfactor, the focal point in the region is now on companies that have robust earnings forecasts over the next year, suggesting investors expect an uptick over the short term.

Some stocks that beat earnings estimates and are driving the surge in Volatility include Mexican food company Grupo Bimbo (+24%), Taiwanese semiconductor manufacturer Mediatek (+16%), and Indian energy firm Coal India (+13%). The surge observed in Growth stock was driven by Indian Oil Corporation (+30%); and Brazilian bank Itau Unibanco (+20%). Notably, South African tech holding company Naspers Limited (+18%) exhibited higher volatility than the regional benchmark over the last year, and its annual earnings growth projection is almost five times larger than the average, which helped drive the performance of both subfactor portfolios.

Figure 4: November 2023 Emerging Factor Performance (country and sector adjusted)

Source: Investment Metrics, a Confluence company

Canadian Equities

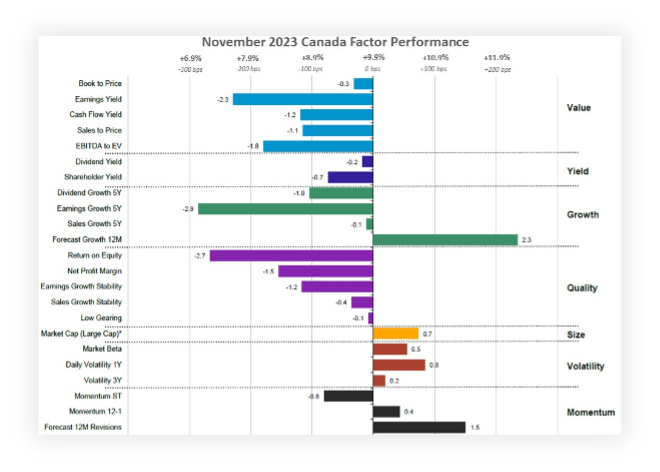

In Canada, the prevailing trend aligns with Europe, where Value and Yield, once strong performers, are now giving way to Growth and Volatility, akin to the shift observed in the United States at the onset of the year. However, the extent of the Growth-Volatility outperformance is notably more modest than in the United States, reflecting Canadian investors’ emphasis on future projected growth rather than existing sales growth.

The factor trend in Canada mirrors the disinflationary patterns across developed markets. Like in the United States, Canadian disinflation is far below that of the UK and even Europe, having decreased to 3.1% in October. Furthermore, mirroring its American and European counterparts, Canada also experienced a substantial return of nearly 10% in November.

Stocks with a high forecasted growth over the next twelve months outperformed the Canadian market by over 2.3%, many of which beat third-quarter earnings estimates. This includes companies like Shopify (+54%), Payment processing company Nuvei (+48%), and e-commerce firm Lightspeed Commerce (+28%).

Figure 5: November 2023 Canada Factor Performance (sector adjusted)

Source: Investment Metrics, a Confluence company

Appendix: How to read the charts

Each factor’s performance is based on the relative performance of its top 50% of stocks by market cap, compared to the overall market. The Size factor uses the top 70% of stocks, as the only exception.

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values, relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The information contained in this communication is for informational purposes only. Investment Metrics, a Confluence company, is not providing legal, financial, accounting, compliance or other similar services or advice through this communication. Recipients of this communication are responsible for understanding the regulatory and legal requirements applicable to their business.