For the new school asset manager, a proper risk framework is indispensible

Good asset managers can speak in depth about the return expectations of their portfolio in the scope of the current macro-environment. However, fewer managers can express themselves in the same depth about the associated market risk expectations of their portfolio. New school asset managers understand that risk and return are two sides of the same coin and therefore employ risk frameworks that allow them to express the risk/return trade-offs of their portfolios in a multifaceted way.

Good asset managers can speak in depth about the return expectations of their portfolio in the scope of the current macro-environment. However, fewer managers can express themselves in the same depth about the associated market risk expectations of their portfolio. New school asset managers understand that risk and return are two sides of the same coin and therefore employ risk frameworks that allow them to express the risk/return trade-offs of their portfolios in a multifaceted way.

A new school asset manager can speak knowledgeably about market risk in terms of:

- Quantifying the diversification benefits and value added via their portfolio construction processes

- Listing out stress tests and scenarios that have been identified as risks to the portfolio and describing how these are simulated to assess the potential impact

- How fund performance, which describes where the portfolio has been, aligns with the current fund risk profile, which describes where the fund is going

- Expressing decompositions of market risk beyond that of an exposure break down by asset class or sector

- Continually monitoring for shifts in the correlation structure of a portfolio or for changing sensitivities of the positions held

Risk as a feedback loop

To be effective, a good market risk framework needs to be more than just a collection of analytics placed into a PDF report. A good risk framework needs to be a vehicle which facilitates conversations both internally with stakeholders and externally with investors.

Internally, a risk framework should force a manager to continually monitor for all potential risks facing a portfolio and assess whether each portfolio return source remains warranted for the level of risk taken. It should also serve as a basis for conversation around how the manager plans to react in stressed markets or in market regime changes. The added structure that this brings to the portfolio management process can be a route to improved performance.

Externally, the same type of conversations should occur with investors. Investors have a wide array of preferences which vary across how they perceive risk, as well as what types of risks they do or do not want from a product. For the asset manager the ability to not only quantify the risks of their product for an investor, but to also potentially offer the ability to tailor a portfolio to an investor’s specific preferences can be a strong differentiator from a client service standpoint.

How to build a risk framework

The StatPro Revolution platform meets the needs of new school asset managers by providing them with the ability to create risk frameworks from a wide selection of risk and performance analytics, delivered in a single cloud-based platform, in a flexible manner.

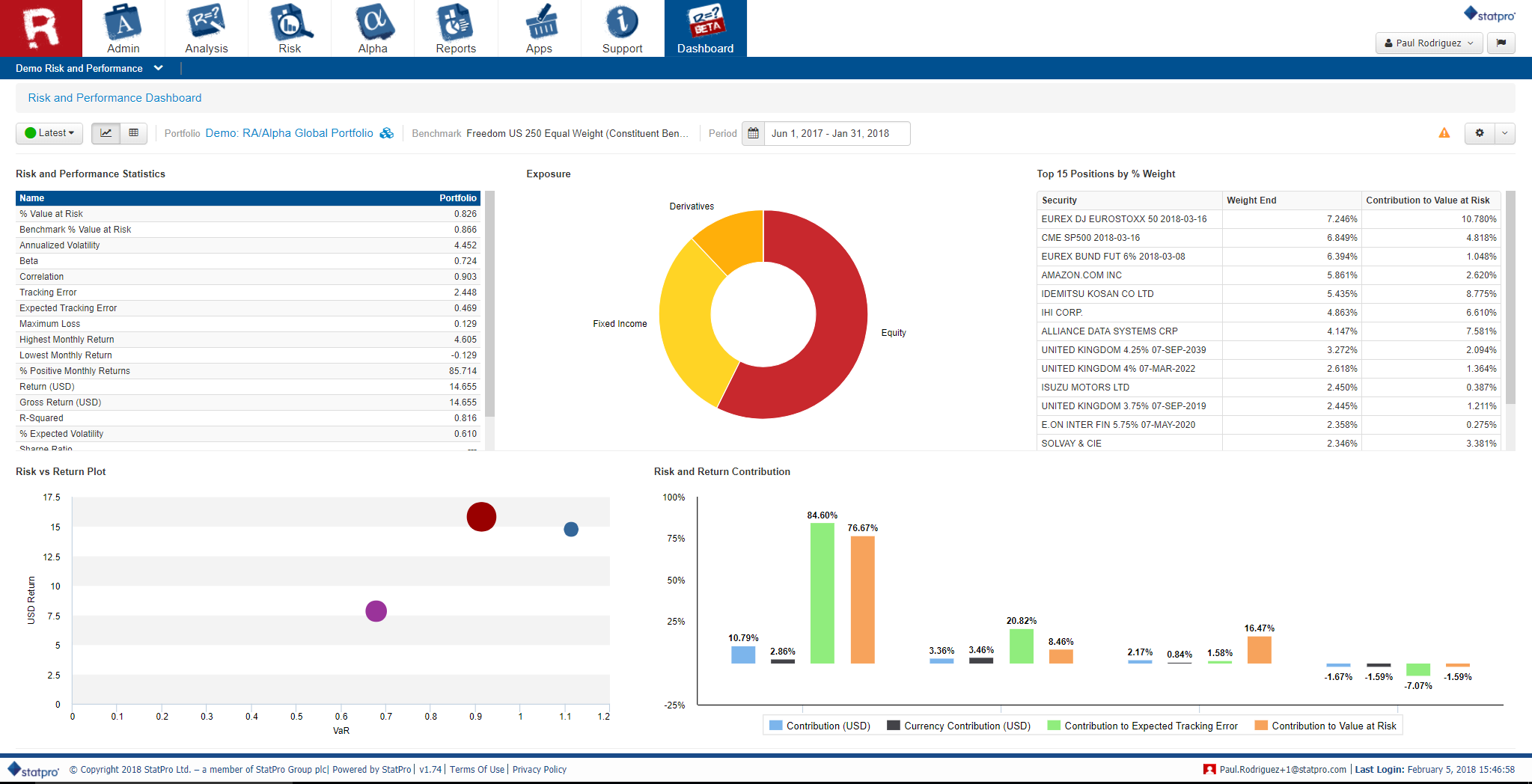

Figure 1: StatPro Revolution Configurable Dashboard

Figure 1: StatPro Revolution Configurable Dashboard

For instance, Figure 1 shows a sample Revolution configurable dashboard displaying a mix of

client-selected risk and performance attribution analytics. Dashboards can be tailored to display all analytics available on the Revolution platform, including historic performance attribution, stress and scenario testing, risk decomposition, and sensitivities across interest rate, credit, inflation and FX.

This gives users the flexibility to monitor analytics like realized tracking error and portfolio volatility side-by-side with future-expected tracking error and portfolio volatility. Likewise, users can view a historic performance attribution side-by-side with a forward-looking risk decomposition.

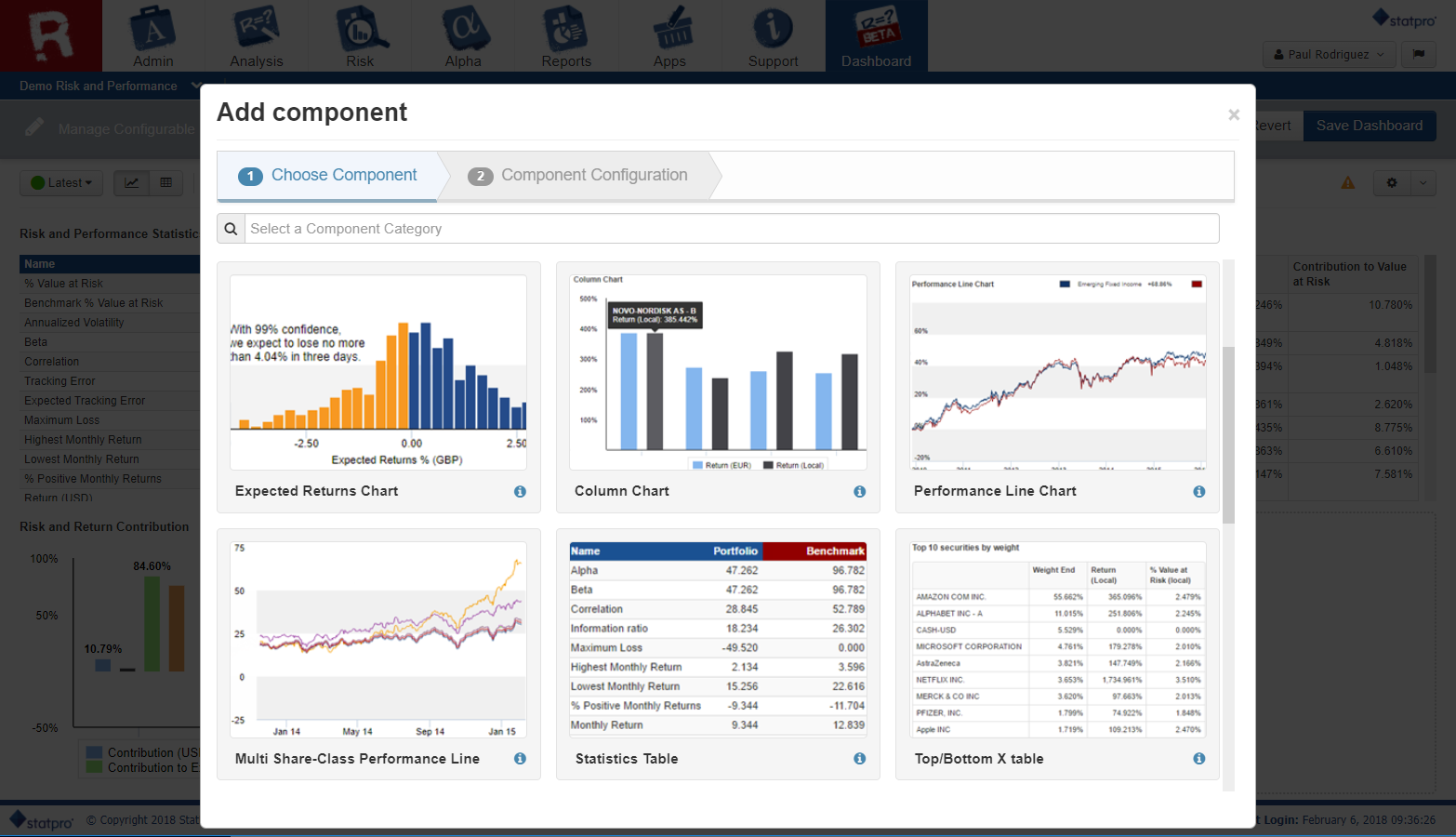

Figure 2: Creating a configurable dashboard in Revolution

Figure 2: Creating a configurable dashboard in Revolution

Dashboards can also be easily updated and customized for all user types within a firm. Figure 2 shows the dashboard configuration screen available to Revolution clients.

Conclusion

Asset managers seeking to differentiate themselves in today’s environment simply cannot treat market risk analytics as a reporting exercise for the middle office. Building a new school risk analytics framework must be a joint effort of the middle and front offices.

The benefits of moving to the new school are clear: A proper market risk framework can allow a manager to be more structured in their own investment process, and also serve as a basis for discussion with investors to understand their investment preferences. Ultimately this will allow a manager to drive home their unique value proposition and prove that their product is superior for the investor’s portfolio.

{{cta(’08b59f3e-3079-4d0f-b99a-ccb854f074e8′)}}