In one sense there ought not to be too much discussion about the relative merits of money-weighted or time-weighted attribution, the attribution methodology must be consistent with the methodology used to calculate the total return of the portfolio, hence for time-weighted returns use a time-weighted attribution methodology and for money weighted returns use a money-weighted attribution methodology.

Perhaps a better starting point therefore is a broader debate about the relative merits of each return methodology.

It is received wisdom in the performance measurement industry to assume that time-weighted rates of return should be used to measure the return of the manager and money weighted rates of return to measure the return of the client. Indeed, before I thought deeply about the subject I would have agreed. Its easy to see how this view developed, the progression from money weighting to time weighting is driven by the need to measure the performance of assets managers accurately and compare their performance with other managers, hence the desire for true time-weighted returns. Download the free white paper

However, the logic then follows that if time weighted returns are appropriate measures for asset managers then money weighted returns must be appropriate for clients. This is a false step in logic; Darwin [i] was right you can’t turn round and crawl back up the evolutionary ladder. We must analyse money weighted returns in isolation not as an automatic alternative to time-weighted rates of return. They do have one advantage that is prized by many; if there is a gain in value in the portfolio then the IRR will always be positive and if there is a loss the return will always be negative irrespective of the cash flow experience.

But does a constant rate of return make sense? It’s an artificial construct useful for forward looking analysis but not for retrospective analysis, we know investment returns are not constant, and we shouldn’t expect the force of return to change simply because we vary the time period of analysis.

Therefore in terms of choice for the client return we must choose between the constant force of return required to generate the end market value or the rate of return we would have achieved had there been no cash flows. In the context of attribution analysis the decision is clear; we are analysing the decisions within the portfolio taken by the manager; we don’t want the weight of total portfolio money to change the attribution result. Ask yourself the question, would the investment decisions, asset allocation and stock selection been different, had a different amount of money been available; almost certainly not.

By all means calculate both the money-weighted and time-weighted total return at total portfolio level and describe the difference between the two as a client timing effect (although in truth it’s a combination of many things including methodology differences)

Incidentally if the money-weighted return (or client return) is greater than the time-weighted return (or manager return) it does not necessarily imply the timing decision is positive; it really depends on the alternative investments available to the client. If the client could have made more money investing in the alternative then the timing decision is not good even if the money-weighted return is greater than the time-weighted return.

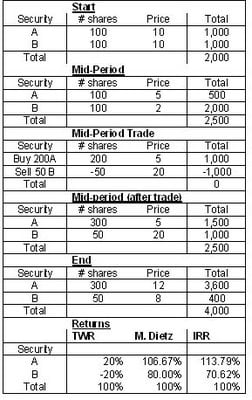

Proponents of money weighted attribution take the false step in logic that control of cash flow requires the use of a money weighted return one further step by suggesting than since managers control internal cash flows then money weighted returns must be more appropriate. As demonstrated in the following example (the data chosen incidentally by the proponents of money weighted attribution to demonstrate their case) true time weighted attribution is able to correctly allocate stock selection and allocation effects of the manager.

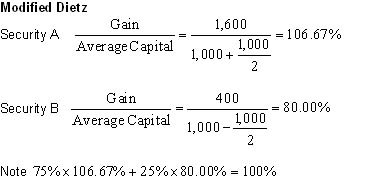

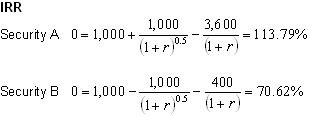

Because there are no external cash flows in this example the total return is the same for time weighted, modified Dietz or IRR methodologies i.e. 100%

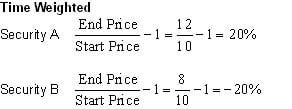

For the entire period the returns for each security are:

To reconcile to a return of 100% the weight in security A must be 68% and the weight in security B must be 32%

68% x 113.79% + 32% x 70.62% = 100%

Actually in this simple form you don’t have to use an iterative method, the solution to the quadratic equation can be found directly using

![]()

Where

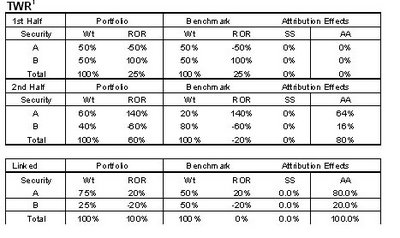

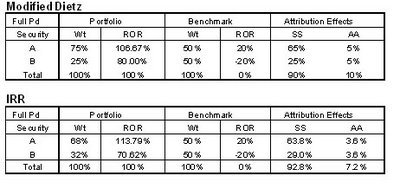

To generate attribution results lets assume a benchmark of 50% in Security A and 50% in Security B

Using the arithmetic Brinson & Fachler methodology including Interaction with Stock Selection the attribution results are as follows:

Neither the modified Dietz nor the IRR money weighted attributions make any economic sense; most of the added value appears to be stock selection. This simply cannot be true since the performance of both security A and security B are the same in both the portfolio and the benchmark. The time-weighted attribution correctly illustrates what is happening in this portfolio. For the initial sub-period the portfolio and benchmark are exactly in line. For the subsequent sub-period the portfolio manager has taken an asset allocation decision to be overweight security A and underweight security B. Incidentally the benchmark weight for the subsequent period must reflect the performance of the underlying assets i.e. 20%:80% not fixed back to 50%:50%. We can be confident this is correct because the period benchmark returns compound to the total period return 1.25 x 0.8 – 1 = 0%

The modified Dietz return is fairly standard, I’m not sure it’s appropriate to show the IRR attribution at all. The attribution results in both the modified Dietz and IRR method are typical, random distribution between stock selection and asset allocation and the consequent loss of information.

In summary time-weighted attribution is currently the dominant form of attribution and it should remain so because:

i) In most cases at portfolio level the time-weighted return methodology is the most appropriate methodology to measure portfolio performance. (Primarily to allow comparison between managers with different cash flow experience)

ii) Internal Rates of Return assume a constant form of return which is not only unrealistic but counter-intuitive in the context of return attribution

iii) Investment decisions are the same irrespective of the amount invested.

iv) The portfolio manager’s control of cash flow timing is a spurious argument in favour of the use of money-weighted returns. Time-weighted attribution methodologies are perfectly capable of measuring manager’s timing decisions.

v) Money weighted attributions misallocate attribution effects between stock selection and asset allocation effects.