July 2025

Factor Performance Analysis

Post Rally Pullback

August 19, 2025

Prepared by:

Market Background

While most regions delivered positive returns relative to the broader market in July, overall performance declined compared to June. The slowdown was most pronounced in Europe and emerging markets, where heightened tariff and trade uncertainties weighed on sentiment. In contrast, UK equities stood out, benefiting from a more favourable trade environment following the announcement of a positive trade agreement with the U.S., which helped reduce tariff-related concerns.

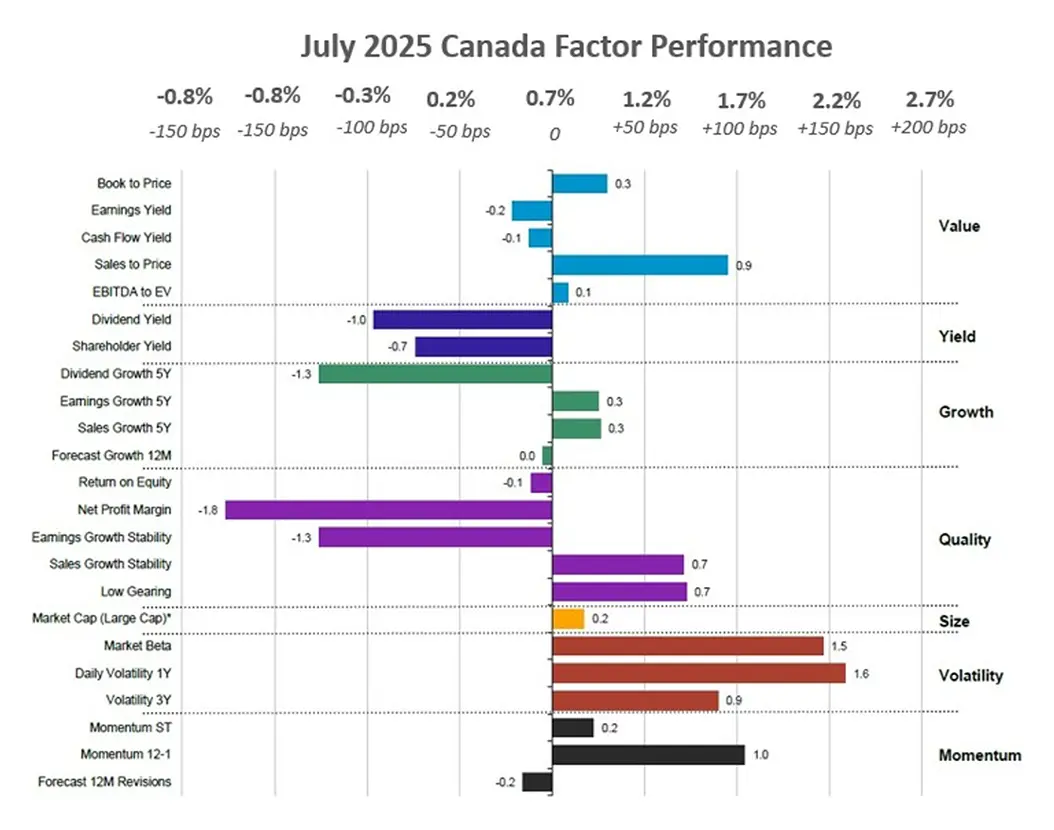

A shift in investor sentiment was evident, as gains from the previous month gave way to a more cautious approach. Investors began stepping back from riskier equities amid growing global trade and geopolitical uncertainties. This caution was evident in reduced net inflows to equity mutual funds in Emerging Markets and Europe, while an increase in inflows was observed in the U.S. Large-cap equities.

Crude oil prices rose to $70 per barrel at the end of the previous month before declining to $62 in the first week of August.

Gold edged down to $3,286 per ounce at the end of July, a slight decline from the previous month. Despite the dip, prices remained elevated as investors continued to seek the traditional safe-haven asset amid rising uncertainty. July was a record-breaking month for spot ETH cryptocurrency ETFs, which saw net inflows surpassing the combined total of all previous months since their inception.

Figure 1: July 2025 Mutual Fund Flows data

Source: Confluence Style AnalyticsFactor Summary

- US Equities: Growth and Volatility outperformed.

- European Equities: Value and Volatility outperformed.

- UK Equities: Volatility and Momentum outperformed.

- Emerging Markets Equities: Value and Size outperformed.

- Canadian Equities: Volatility and Momentum outperformed.

Figure 2: Regional relative factor performance (county and sector adjusted) July 2025

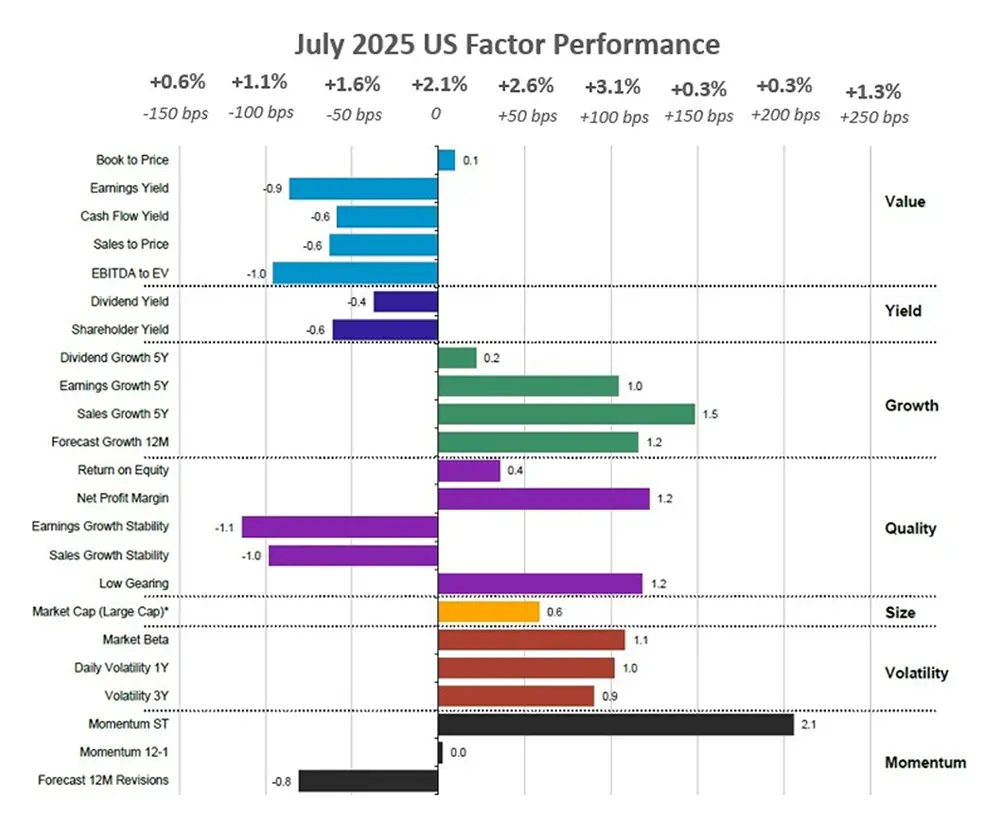

US Equities

U.S. equity markets extended their outperformance trend that began in May, though gains moderated in July, with returns easing to +2.1% from 5.1% the previous month. The slowdown was largely driven by the U.S. jobs report, which revealed significant downward revisions to prior months' data, signalling a weaker labor market than initially believed. Modest payroll growth and rising concerns over labor market vulnerability weighed on investor sentiment and may influence expectations around future Federal Reserve rate cuts. The factors that contributed to the outperformance this month include Growth and Volatility, outperforming the market by 97bps and 100bps, respectively.

Factor trends in the region remained broadly consistent with the previous month, with Growth and Volatility continuing to lead market performance. Although Momentum was not the top contributor to overall outperformance, the momentum short-term factor stood out, delivering a strong 210bps gain. This surge reflected increasing analyst confidence in corporate earnings, reinforcing a positive outlook for the profitability of U.S. companies.

U.S. inflation remained flat in July, but a core measure of underlying inflation rose to a five-month high, driven by rising prices of imported goods due to tariffs, even as gas and grocery prices eased.

Stocks with strong Momentum short-term revisions were key contributors to U.S. equity performance in July. An example was info tech company NVIDIA Corp., which delivered a 15% gain during the month. Additionally, sales growth of 5Y companies contributed to the returns this month, including info tech company Amazon (+6 % in June) and info tech company Meta Platforms (12.4% in July).

Figure 3: July 2025 US Factor Performance (sector adjusted)

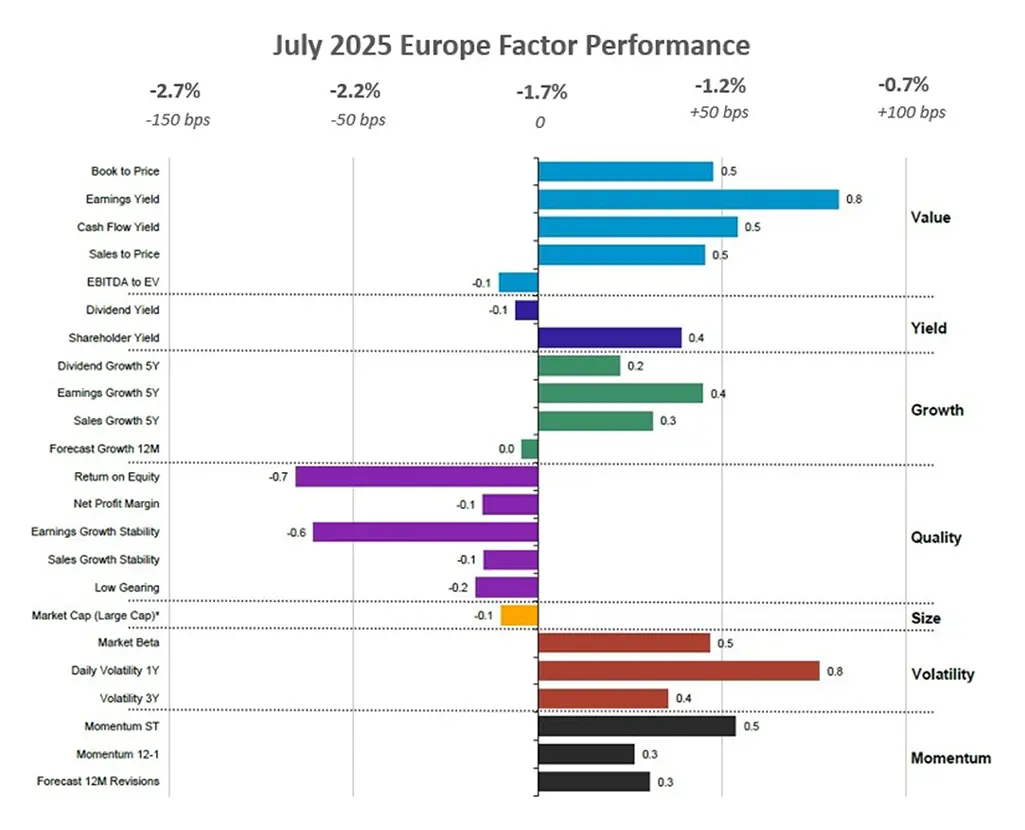

Source: Confluence Style AnalyticsEuropean Equities

European equity markets underperformed in July 2025, posting a -1.7% return, marking a decline from their performance in June. The downturn was driven by a combination of renewed tariff threats from the United States, which reignited concerns around global trade tensions, and persistently weak regional economic data. Indicators such as sluggish industrial output, softer trade activity, and weaker external demand weighed heavily on investor sentiment.

In July, investors shifted away from Quality stocks and rotated into more volatile, value-driven sectors like banks and energy, which outperformed. These sectors were better positioned to benefit from resilient domestic demand and renewed recovery optimism, while export-focused quality stocks lagged. Value and Volatility factors outperformed the region’s market by margins of 44bps and 56bps, respectively.

Eurozone consumer price inflation remained steady at 2.0% year-on-year in July 2025, unchanged from June, while the unemployment rate remained firm during the month. However, signs of economic weakness persisted, with industrial production in the Euro Area declining by 1.3% in June compared to the previous month.

Key European stocks with strong daily volatility 1 Y that outperformed in the month of July include Spanish financials company Banco Santander SA (+6.3% in July) and German industrials company Siemens Energy (+5% in July). High earnings yield company in Eurozone region which contributed to the outperformance of this region include Italian financials company UniCredit SPA (10.7% in July).

Figure 4: July 2025 Europe Factor Performance (country and sector adjusted)

Source: Confluence Style AnalyticsUK Equities

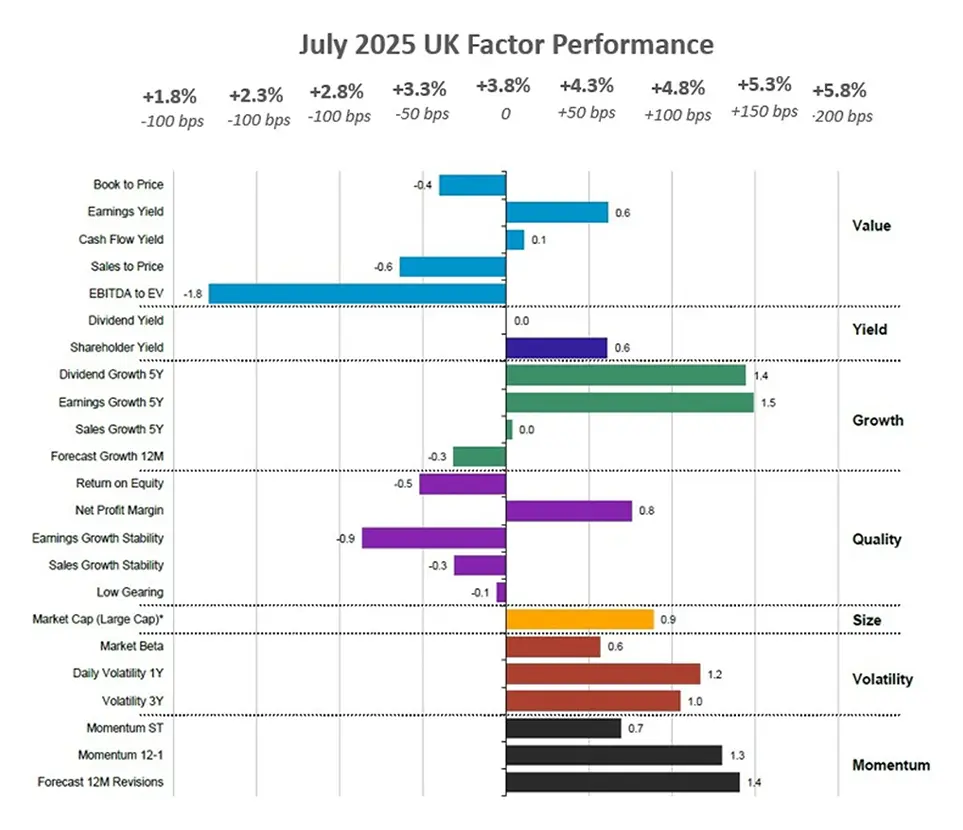

The UK equity market outperformed in July 2025 compared to June, driven by several key developments. Notably, the UK secured its first major trade agreement with the U.S., which, despite being less generous than past deals, offered more favorable terms and reduced trade-related uncertainty relative to the Eurozone markets. Additionally, recent government reforms encouraging investment in UK equities helped lift market sentiment. As a result, investor confidence improved, supporting gains across UK indices.

Like the previous month, the region's equity market outperformance was driven by the continued strength of the Volatility and Momentum factors, which outpaced the broader market by 93bps and 113bps, respectively. Additionally, Large-cap companies made a modest but meaningful contribution, further supporting the region’s positive performance.

The UK’s annual inflation rate climbed to 3.6% in June 2025, marking its highest level since January 2024. Meanwhile, the unemployment rate held at 4.7% for the three months ending in June. On a more positive note, manufacturing production increased by 0.5% month-over-month in June, indicating some resilience in the industrial sector.

British stocks with steady forecast 12M revisions outperforming the UK market include industrials company Relx Plc (2.3% in July), Industrials company Rolls Royce Holdings Plc (+10% in July), and financials company Barclay's PLC (+4.2% in July).

Figure 5: July 2025 UK Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsEmerging Market Equities

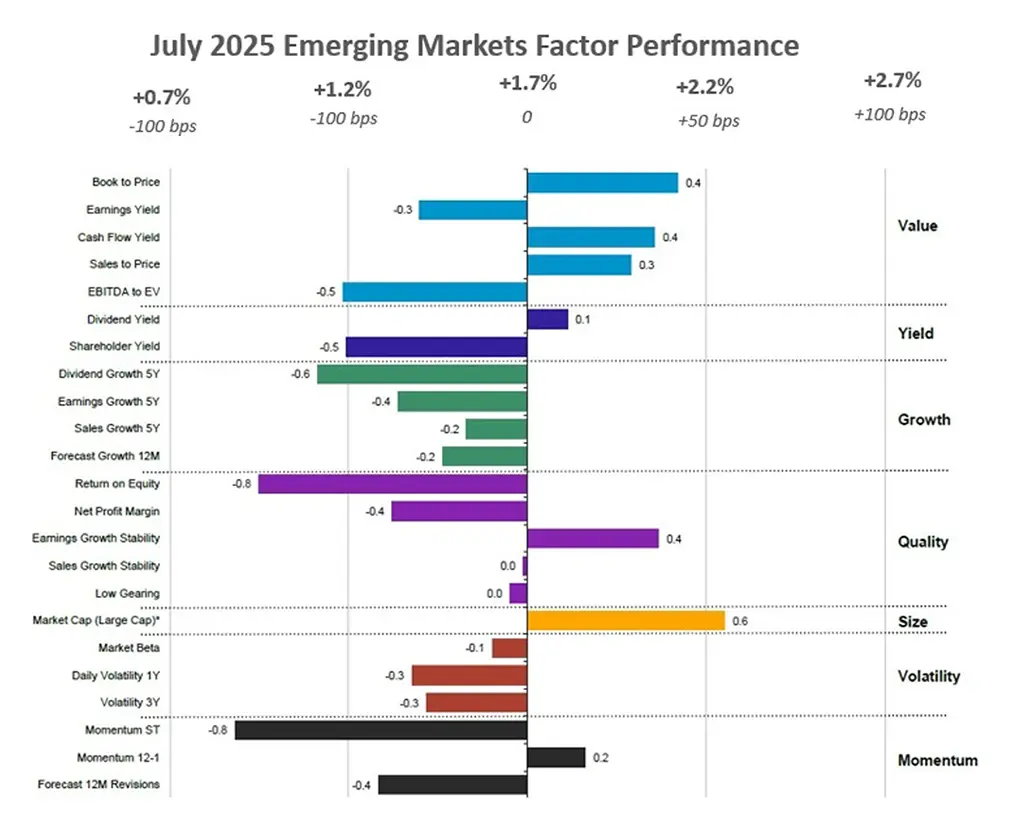

Although Emerging Markets continued outperforming the broader market in July, their performance declined compared to the previous month. Many Emerging Markets stocks had seen substantial gains in the first half of 2025, resulting in stretched valuations. By July, earnings momentum began to slow, particularly in India, which experienced a -5.1% correction. Following a strong second quarter, global investors scaled back their exposure to emerging markets, opting to lock in gains and reassess the macroeconomic and earnings outlook.

July marked a shift in factor performance trends within the region, as the Value and Size subfactors outperformed, each beating the broader market by 60 bps. In contrast, the Growth and Volatility subfactors reversed their strong performance from the previous month, underperforming significantly and weighing on the region’s overall returns. India, Brazil, and export-driven Asian emerging markets, namely South Korea, Taiwan, and Malaysia, were the primary underperformers in the emerging markets segment during July.

India’s annual consumer price inflation eased to 1.55% in July 2025, down from 2.1%, while the unemployment rate remained steady at 5.6% in June. In China, consumer prices were unchanged year-on-year in July, but the unemployment rate increased to 5.2%, from 5% in June. Brazil saw its annual inflation rate slow to 5.23% in July, the lowest level in five months, while its unemployment rate dropped sharply to 5.8% in the second quarter of 2025, down from 7% in the previous quarter.

Emerging Markets Large-cap equities that outperformed in July, captured by the large market cap, include Taiwanese info tech company Taiwan Semiconductor Manufacturing Co Ltd (+4.5% in July) and Chinese communication services company Tencent Holdings (7.5% in July).

Figure 6: July 2025 Emerging Factor Performance (country and sector adjusted)

Source: Confluence Style AnalyticsCanadian Equities

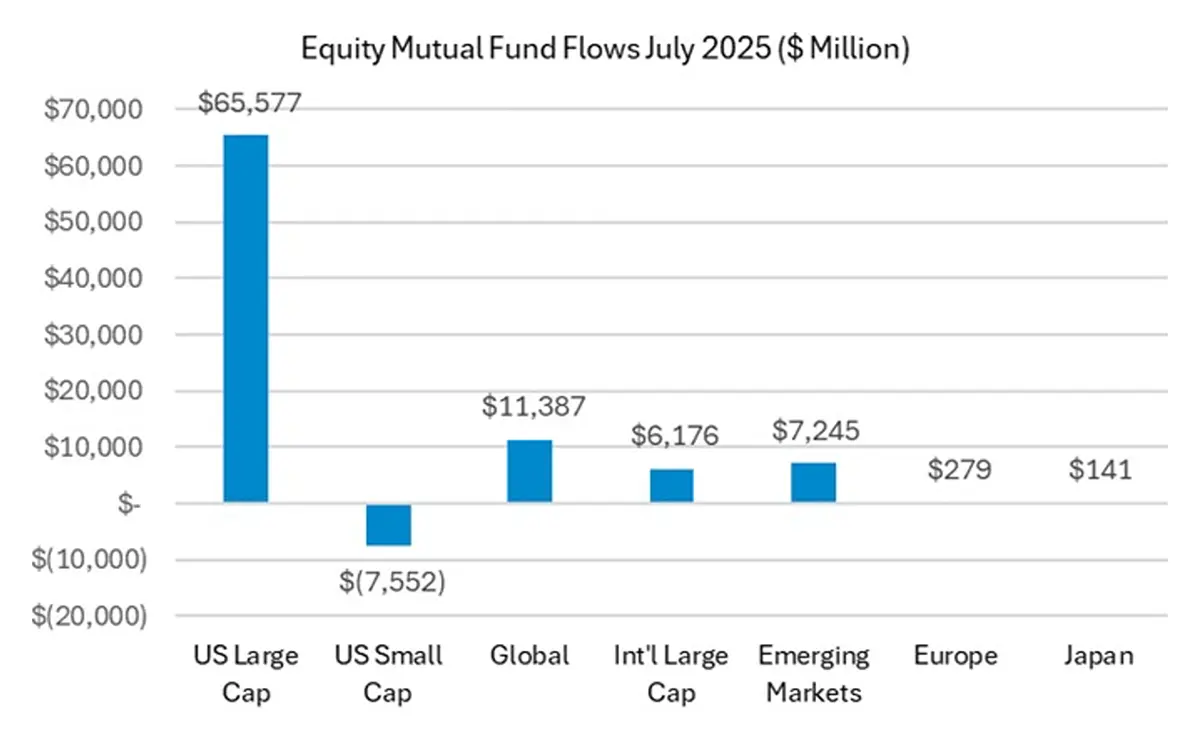

After reaching record highs in June, the Canadian equity market saw profit-taking in July as investor enthusiasm over earlier gains began to wane. The market also reacted to uncertainty surrounding ongoing trade negotiations with the U.S. and the potential for new tariffs, both of which introduced volatility and weighed on investor sentiment.

Compared to the previous month, securities with strong Quality characteristics continued to deliver mixed results, while the Volatility subfactor maintained its outperformance. Momentum also contributed modestly, outperforming the broader region by 33 basis points. In contrast, the Growth subfactor reversed its previous month’s strength, underperforming and weighing on the region’s overall returns.

Canada’s annual inflation rate increased to 1.9% in June 2025, up from 1.7% the previous month. The unemployment rate remained unchanged at 6.9% in July. Meanwhile, home sales dipped slightly to 42,883 units in July, down from 42,912 in June, while manufacturing sales saw a modest rise of 0.3%.

Stocks with a 1Y Volatility, in the region include financials companies like CIBC (+0.9 % in July), financials company Bank of Nova Scotia (+0.7% in July), and energy company Cameco Corp (+7.1% in July).

Figure 7: July 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsStyle Analytics

Style Analytics Fixed Income is now available globally. To learn more or request a demo, click on the link below.

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content of this blog post is for general information purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. The information should not be relied upon as a substitute for specific advice tailored to particular circumstances. Readers should seek advice from appropriately qualified professionals before taking or refraining from any action based on the content of this blog. This blog post is not intended to market or sell any financial instrument and should not be interpreted as an invitation or inducement to engage in investment activities.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in the content of this blog post, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

For more information, visit confluence.com