July 2024

Factor Performance Analysis

Equities Regain Momentum

by:

Market Background

Crude oil dropped to $74/barrel on Aug 2nd after peaking to easing to $81/barrel in early July, the month-end price in July was $74/barrel akin to the previous month-end close.

Gold prices continued to surge in July, peaking to $2,316/ troy ounce at month-end. Crypto became a more prominent topic in the U.S. presidential election debate, despite mixed price performance in July 2024, the crypto industry made significant strides with the introduction of spot Ethereum exchange-traded products (ETPs).

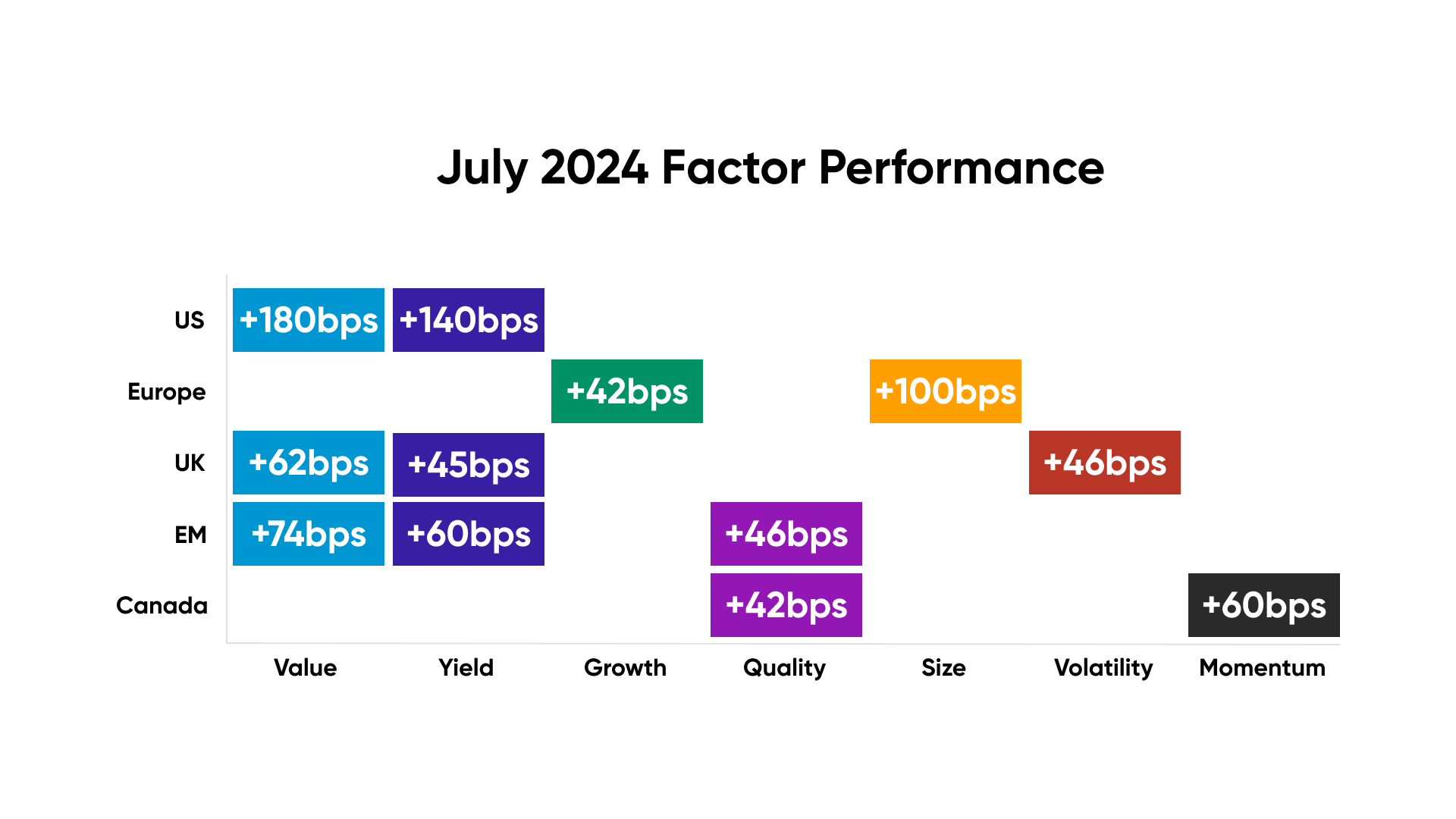

Factor Summary

- US Equities: Value and Yield outperformed

- Europe: Growth and Size outperformed

- UK: Value, Yield and Size outperformed

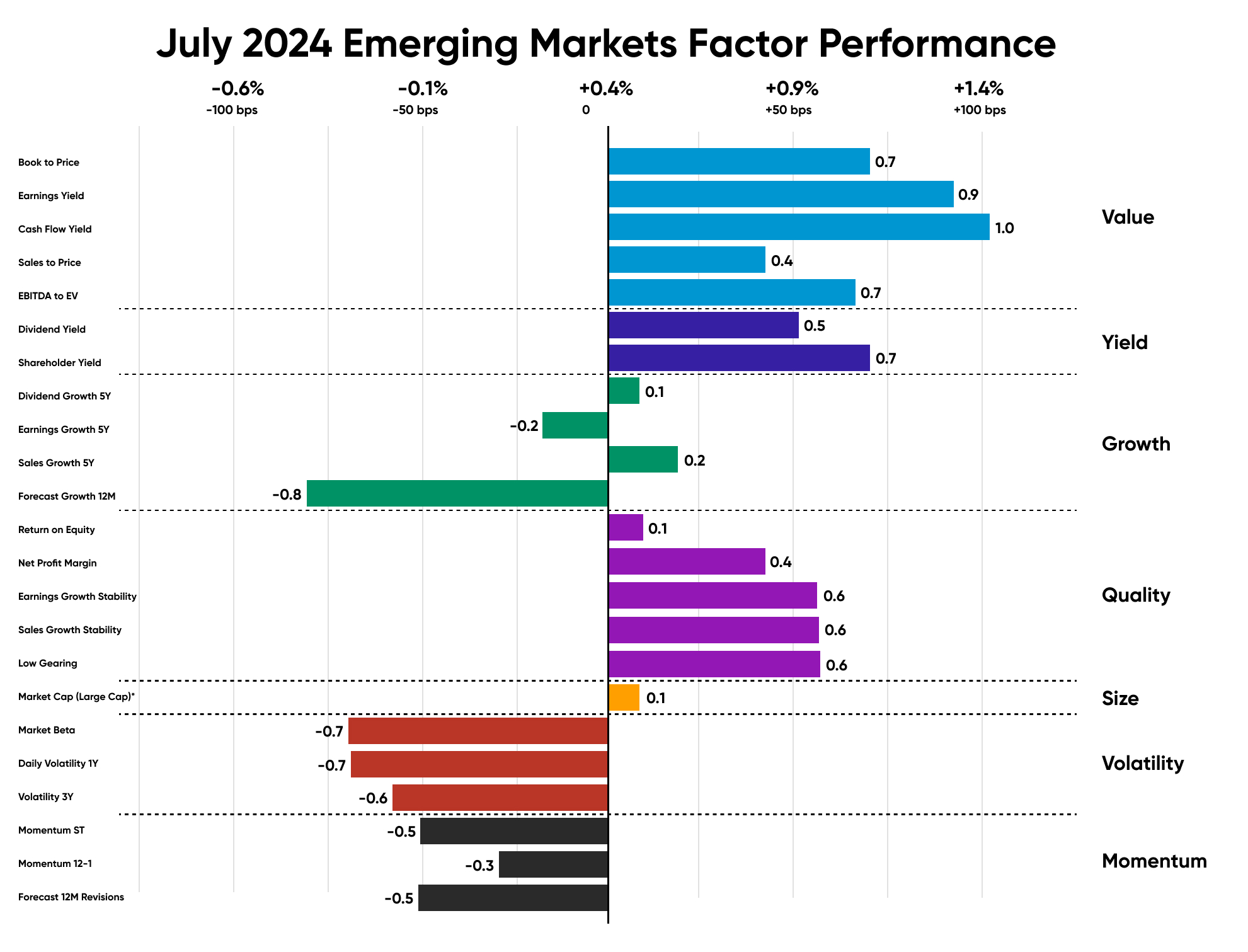

- Emerging Markets: Value, Yield and Quality outperformed

- Canada: Quality and Momentum outperformed

Figure 1: July 2024 Factor Performance (sector adjusted)

Source: Confluence Style Analytics

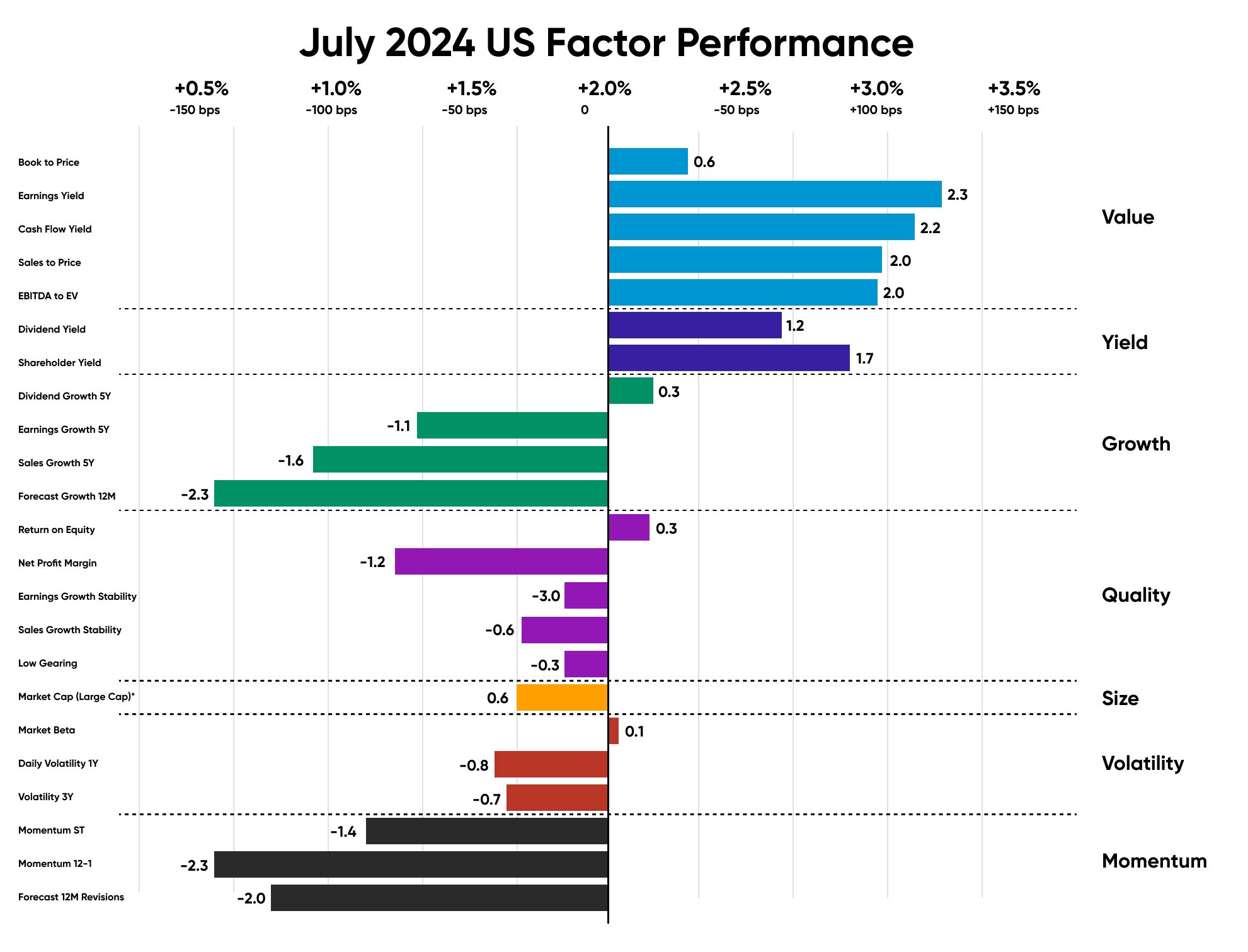

US Equities

The U.S. economy faced an unexpected setback in July, with a sharp decline in hiring and the unemployment rate increasing for the fourth consecutive month, intensifying concerns that the labour market was weakening, potentially leaving the economy vulnerable to a recession.

Stocks with steady earnings yield which contributed to the performance of US in July include the tech giants Apple (6% in July), and Meta Platforms (1.2% in July). Additionally, companies with high shareholder yield including industrials company General Electric (+7% in July) also contributed to the outperformance.

Source: Confluence Style Analytics

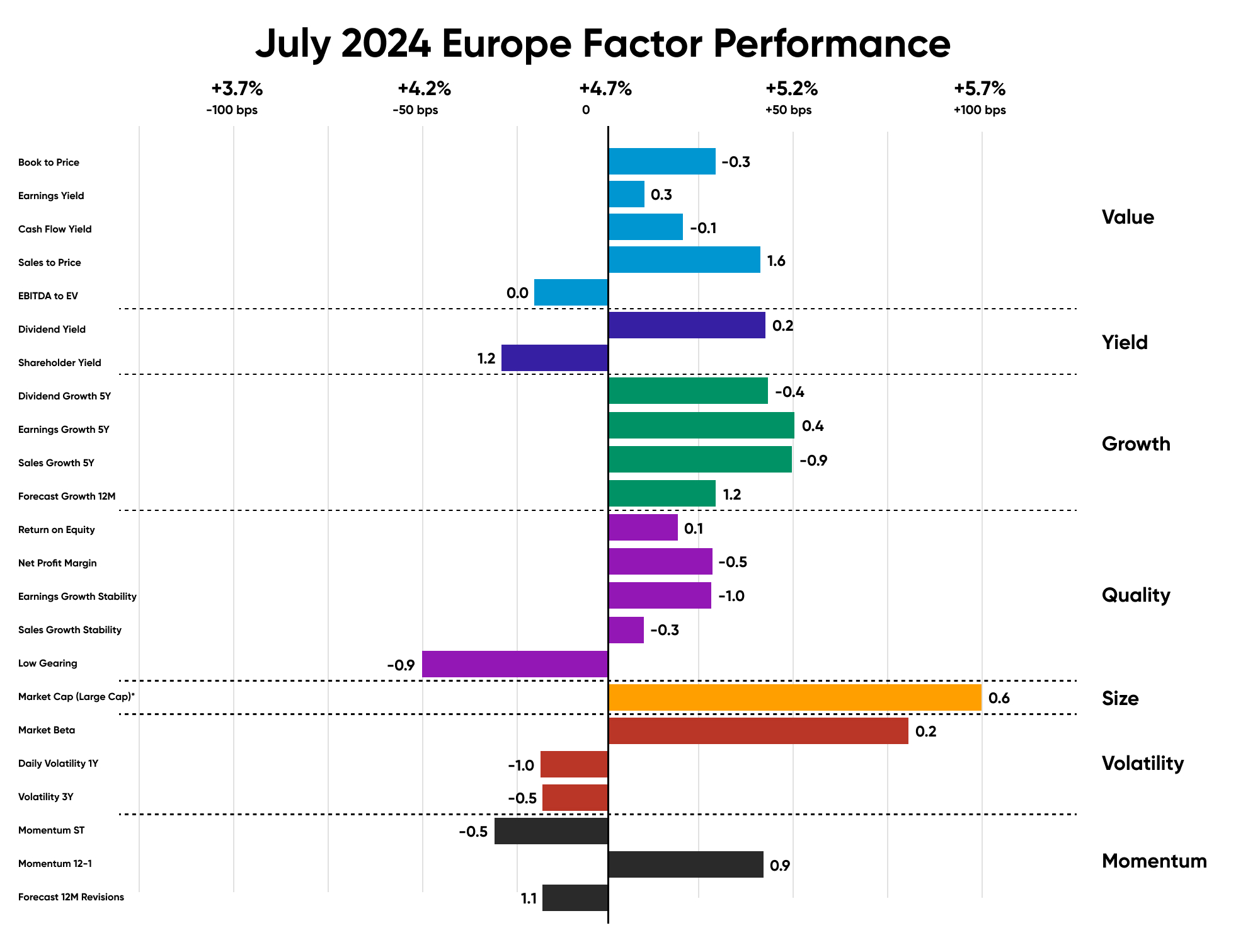

European Equities

A positive trend was noted in Growth subfactors, particularly in sales growth over 5 Years and earnings growth over 5 Years. Both subfactors outperformed the market by 50 bps.

Euro zone displayed a largely stable economic sentiment in July, with service sector production rebounding to a new record high while industrial production declining. The Eurozone unemployment report remained unchanged from the previous month, while the Headline inflation in the euro zone unexpectedly rose to 2.6% in July.

Key drivers of high-Value European stocks with positive market beta in the month of July include comm services company Spotify (+11% in July), financials company Unicredit SPA (+10% in July), and utilities company Enel (+6% in July).

Companies with large market cap that contributed to the outperformance of Euro Zone include Italian financials company Intesa (+9% in July), and French healthcare company Sanofi (+7% in July).

Figure 3: July 2024 Europe Factor Performance (country and sector adjusted)

Source: Confluence Style Analytics

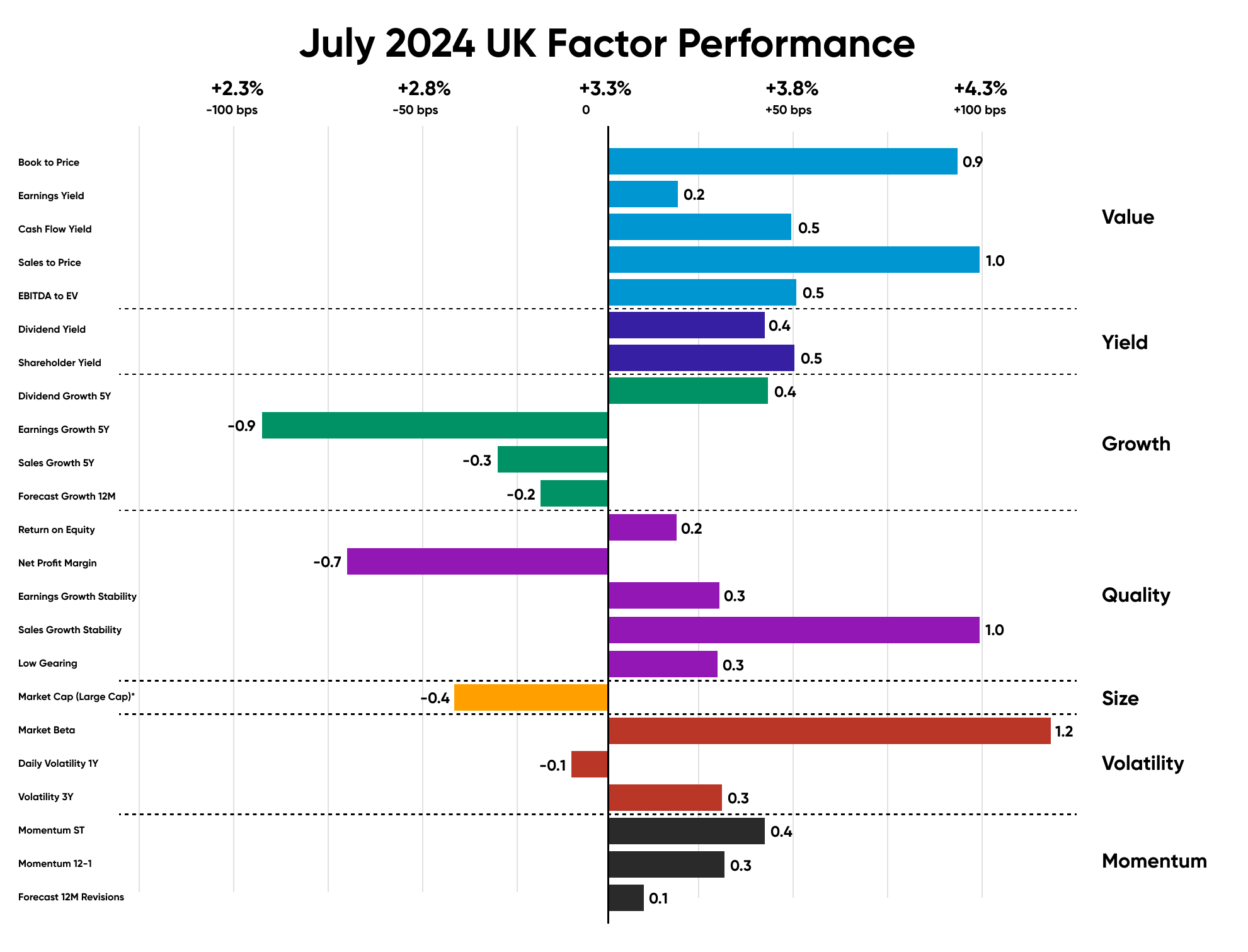

UK Equities

Despite the UK’s purchasing managers index (PMI) reaching a two-month high due to growth in new business, uncertainty persists regarding the BoE’s decision. This month’s labor market figures indicate a continued gradual cooling, with the number of vacancies declining and unemployment increasing.

British stocks with a strong Market Beta that outperformed this month include financials company Barclays (+14% in July); consumer staples company Haleon PLc (+10% in July), healthcare company Samith and Nephew PLC (+16% in July.)

Source: Confluence Style Analytics

Emerging Market Equities

In emerging markets, recent policy divergences underscore the need to manage the risks associated with currency and capital flow volatility, as many central banks in these economies remain cautious about lowering rates.

Emerging Markets equities that outperformed in the month of July, captured by the cashflow yield subfactor, include a Chinese Consumer Discretionary company Alibaba Group Holding (+10.0% in July), Chinese financials company China Construction Bank Corp (+8.5% in July), Chinese financials company Industrial and Commercial Bank of China (+8.5% in July).

Source: Confluence Style Analytics

Canadian Equities

Unlike June, Canada saw a significant trend in Quality subfactors this month, with most subfactors outperforming the market, except for low gearing.

For the second consecutive month, Canadian employment remained largely unchanged, falling short of expectations. The unemployment rate held steady at 6.4%, as a slight decrease in the labor force offset job losses. This reduction in the labour force occurred despite ongoing population growth.

Stocks in Canada that outperformed with a strong sales-to-price include companies like consumer staples company Loblaw Companies Ltd (+6% in July), info tech company Constellation Software Inc. (+9% in July), and financials company Canadian Imperial Bank of Commerce (+9% in July).

Key companies driving the earnings growth performance in July were financials company Brookfield Corp (+17% in July), and materials company Agnico Eagle Mines Ltd (+18% in July).

Source: Confluence Style Analytics

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values, relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The information provided in this document is for informational purposes only and does not constitute legal, financial, accounting, compliance, or any other professional advice. Confluence makes no representations or warranties as to the accuracy, completeness, or suitability of this information for any purpose. Recipients of this document are solely responsible for ensuring their compliance with applicable laws and regulations. Confluence disclaims any liability for actions taken based on the information provided herein.

About Confluence

For more information, visit confluence.com