January 2026

Factor Performance Analysis

Momentum and Volatility Make a Comeback

February 13, 2026

Prepared by:

Market background

In January 2026, global equity markets delivered mixed performance, with Emerging Markets leading the way and the U.S. lagging behind as the weakest performer. Across regions, market movements were primarily driven by Momentum and Volatility factors, which dominated returns as investors responded to sector trends, macroeconomic signals, and market uncertainty. These factor dynamics underpinned much of the month’s performance, highlighting the continued influence of trending stocks and market swings on global equity outcomes.

Crude oil prices climbed to $63 per barrel by the end of January, triggering a decline in the first week of February. By the end of January, the closing price of gold was approximately $4,865 per ounce. This represented a notable rise over the month, with gold finishing up about 12.4 % for January.

In January 2026, Bitcoin traded with significant volatility, initially rallying toward key resistance levels but ultimately weakening after failing to sustain higher prices and breaking below key support levels, contributing to a broad crypto market pullback.

Factor summary

- US Equities: Momentum and Volatility outperformed.

- European Equities: Momentum and Volatility outperformed.

- UK Equities: Momentum and Volatility outperformed.

- Emerging Markets Equities: Momentum and Volatility outperformed.

- Canadian Equities: Momentum and Volatility outperformed.

Figure 1: Regional relative factor performance (country and sector adjusted) for January 2026

Source: Confluence® Style Analytics®US equities

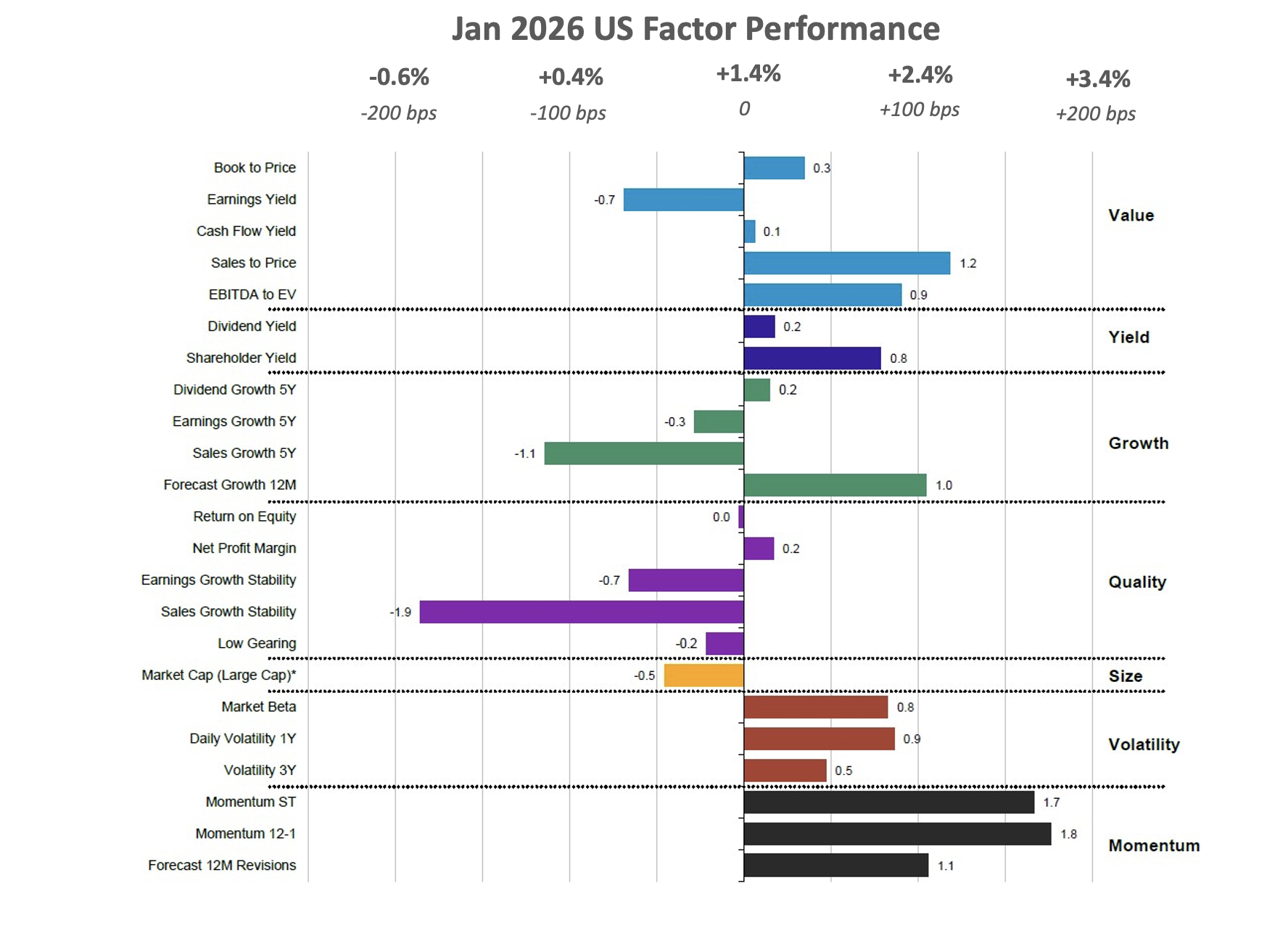

In January 2026, U.S. equity markets posted modest gains overall but lagged many global peers, largely due to weaker performance among large-cap technology stocks. During the month, investors shifted allocations away from U.S. equities toward international markets, resulting in relative rather than absolute underperformance for the U.S. market.

Similar to January of the previous year, the factors that outperformed in the region were Volatility and Momentum. In January 2026, increased market uncertainty and larger day-to-day price swings created a favorable environment for volatility strategies, as investors could benefit from sharp moves driven by policy concerns, geopolitical developments, and sector shifts. At the same time, momentum performed well because stocks that were already trending—particularly those outside the lagging mega-cap tech names—continued moving in the same direction, allowing momentum strategies to capture those sustained trends more effectively than the broader U.S. market. While Volatility continued to outperform, as it did in the previous month, the U.S. equity market experienced a shift within the Growth subfactors. Growth, which had been an outperforming factor the month before, showed mixed performance this month, primarily due to significant underperformance in the 5-year Sales Growth and 5-year Earnings Growth components. This underperformance was driven by weaker revenue and earnings trends and heightened uncertainty, which weighed on the Sales Growth and Earnings Growth 5Y measures relative to other market factors.

The U.S. annual inflation rate held steady at 2.7% in December 2025, unchanged from November and in line with market expectations. Meanwhile, the unemployment rate edged down to 4.3% in January 2026 from 4.4% in December. Manufacturing output also showed resilience, rising 0.2% month over month in December, surpassing expectations of a 0.2% decline.

Stocks with high momentum, which contributed to the performance of U.S. equities in Jan, include the information technology companies Alphabet Inc. (8% in Jan) and NVIDIA Corp (3% in Jan). Additionally, companies with high volatility include the communication services company Meta Platforms (+9% in Jan).

Figure 2: Jan 2026 US Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsEuropean equities

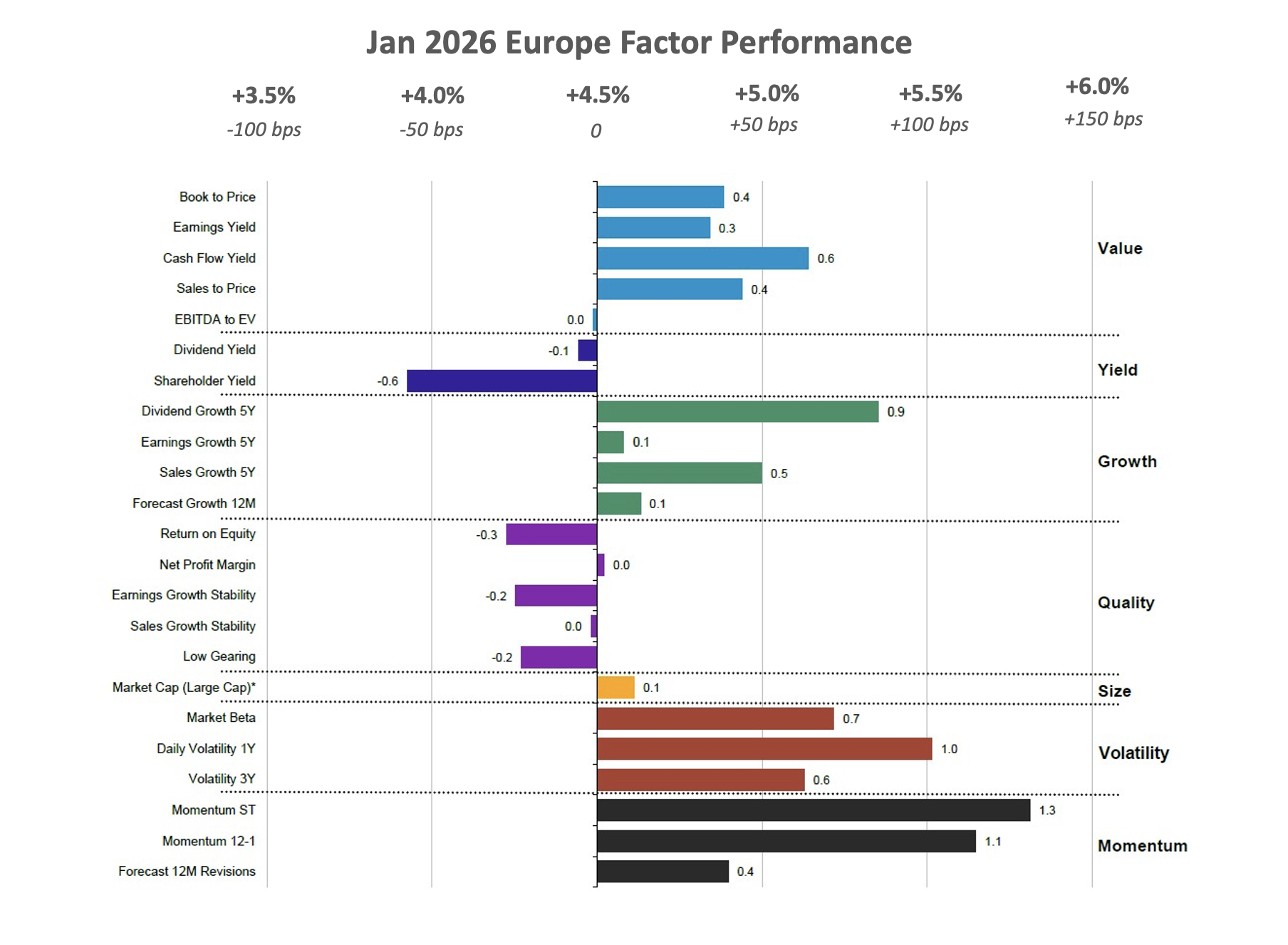

Similar to the U.S. market, European markets were primarily driven by Volatility and Momentum factors, with Value and Growth also contributing meaningfully to the region’s outperformance.

In Europe, Momentum and Volatility outperformed in January due to elevated market uncertainty and strong, persistent sector trends. Increased macroeconomic and geopolitical uncertainty led to wider price swings, benefiting volatility strategies, while clear leadership in sectors such as financials, industrials, and energy allowed momentum strategies to capture sustained performance trends more effectively than broad market indices. European markets outperformed the U.S. in January mainly due to more attractive valuation levels, which drew investor inflows, while currency movements further enhanced returns in dollar terms. In contrast, the U.S. market was pressured by weaker performance among large-cap technology stocks.

Inflation in the Euro Area eased to 1.7% in January, down from 2.0% in December 2025. The unemployment rate declined to 6.2% in December from 6.3% in November, while manufacturing production rose by 2.4% in November 2025.

Key European stocks with strong volatility that outperformed in January include Spanish financials company Banco Santander SA (+9% in Jan) and Industrials company Siemens Energy (22% in Jan). Leading the market through a strong momentum performance in the region include French consumer discretionary company Schneider Electric SE (5% in Jan) and Spanish financials Banco Bilbao Vizcaya Argentaria (8% in Jan).

Figure 3: Jan 2026 Europe Factor Performance (country and sector adjusted)

UK equities

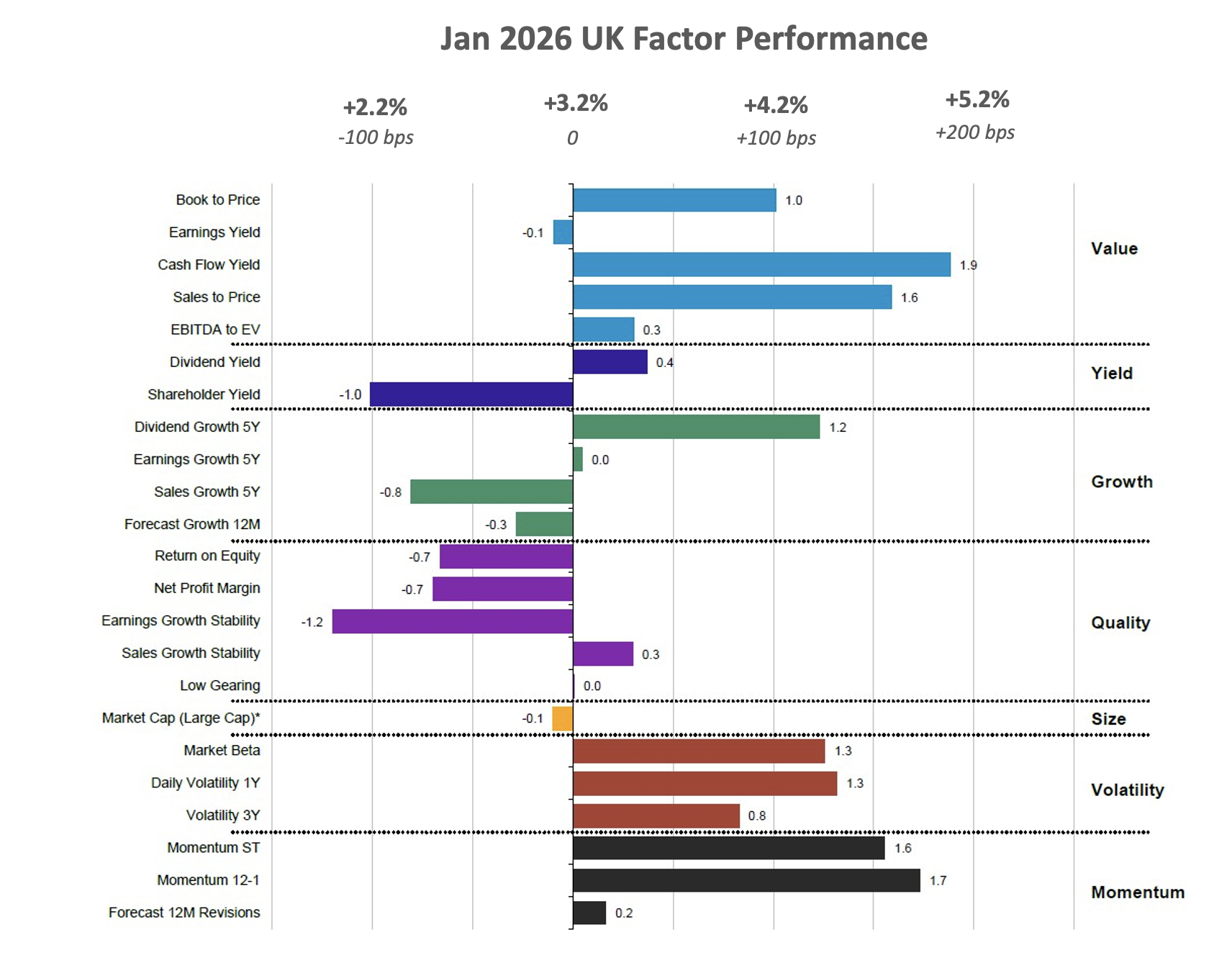

Although UK equity markets delivered solid returns in January 2026 and outperformed their U.S. counterparts, they lagged the broader European region. This relative underperformance was largely driven by more cautious growth expectations in the UK, reflecting weaker domestic economic signals and softer investor sentiment compared with continental Europe.

The factors that outperformed the region’s market in January were Volatility and Momentum, followed by Value. Compared to the previous month, Volatility rebounded to become one of the leading contributors to performance. This outperformance can largely be attributed to a shift in market conditions: December’s rally was relatively smooth and narrowly driven, favouring growth and directional factors, whereas January was characterized by heightened macro uncertainty, mixed economic data, and greater dispersion across sectors, creating a more supportive environment for volatility strategies.

UK consumer price inflation increased to 3.4% in December 2025, rising from November’s eight-month low of 3.2%. The unemployment rate was 5.1% in the three months to November 2025, while manufacturing production declined 0.5% month over month in December.

British stocks with strong momentum that outperformed this month include industrials company Rolls Royce Holdings Plc (+7% in Jan); consumer staples company British American Tobacco Plc (+6% in Jan), and energy company BP Plc (9% in Jan).

Figure 4: Jan 2026 Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsEmerging market equities

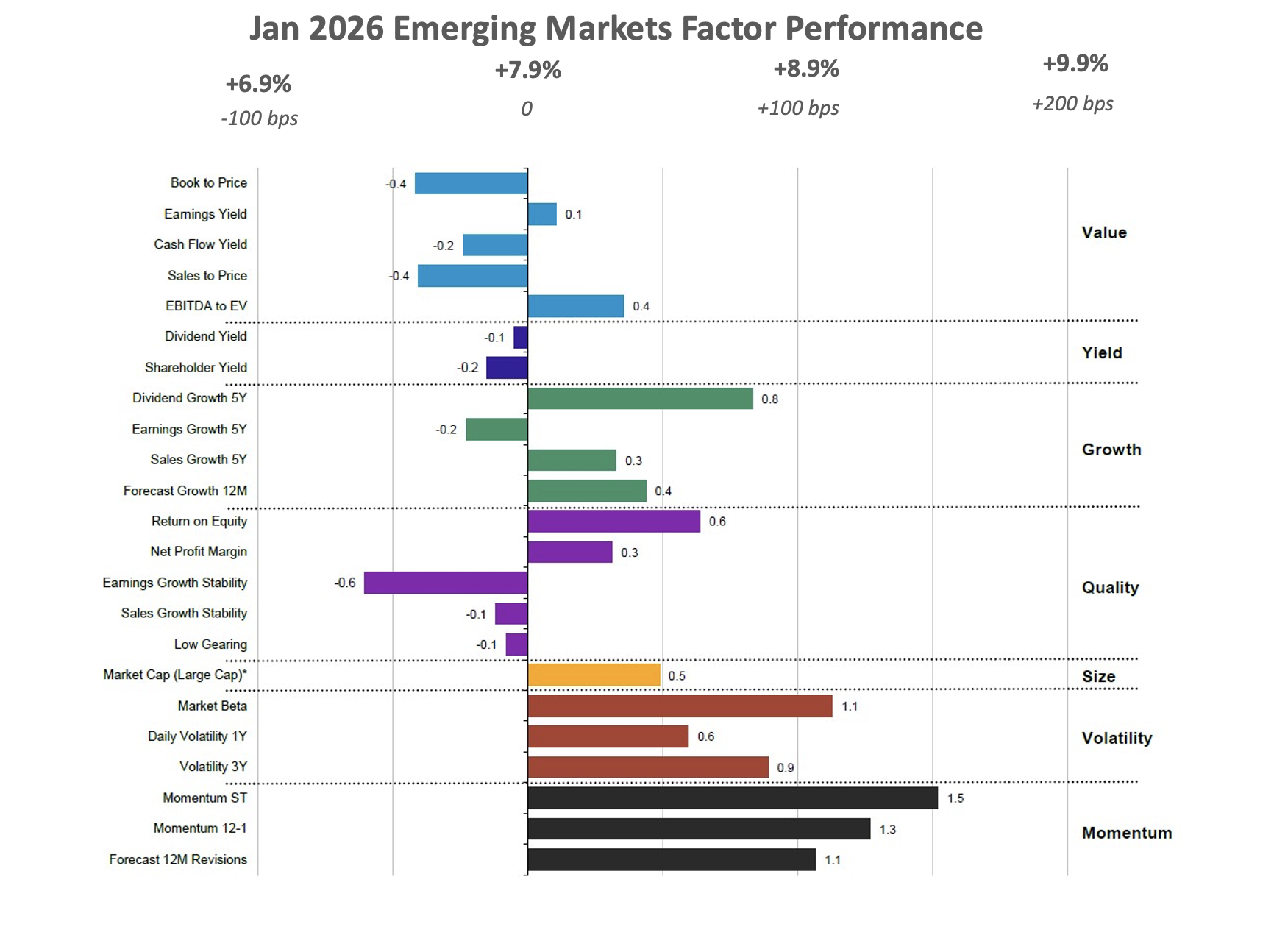

In January 2026, Emerging Markets outperformed developed markets, driven by stronger cyclical growth, and positive investor sentiment toward higher-risk assets. Resilient domestic demand and improving corporate earnings in these economies contrasted with headwinds in developed markets, including weaker tech performance and policy uncertainty, while a softer U.S. dollar further boosted local-currency returns.

Compared to the previous month, Emerging Market equities rebounded strongly, with outperformance rising from a modest 2.8% to an impressive 7.9% in January. This surge was largely driven by the outperformance of Volatility and Momentum, in line with trends seen across other global equity markets. Growth subfactors also contributed, following the strong performance of Volatility and Momentum.

China’s annual inflation slowed markedly to 0.2% in January 2026 from 0.8% the previous month, marking the lowest reading since October. Meanwhile, the surveyed urban unemployment rate stood at 5.1% in December 2025. Taiwan’s annual inflation rate eased to 0.69% in January 2026, down notably from 1.31% in December. Meanwhile, the seasonally adjusted unemployment rate held steady at 3.35% in December. India’s inflation rate increased to 2.75% in January 2026, exceeding market expectations of 2.4%. Meanwhile, the unemployment rate edged up to 4.8% in December 2025 from the series low of 4.7% recorded in the previous month.

Emerging Markets equities that outperformed in the month of Jan, captured by the Market Beta, include a Chinese consumer discretionary company Alibaba Group Holdings (19% in Jan); and Taiwanese Info Tech company Taiwan Semiconductor Manufacturing Company (14 % in Jan). Companies with progressing short-term momentum in this month include Chinese manufacturing company Zijin Minning Group Company Ltd (+27 % in Jan), Shandong Hongchuang Aluminium Industrials (27% in Jan).

Figure 5: Jan 2026 Emerging Factor Performance (country sector adjusted)

Source: Confluence Style AnalyticsCanadian equities

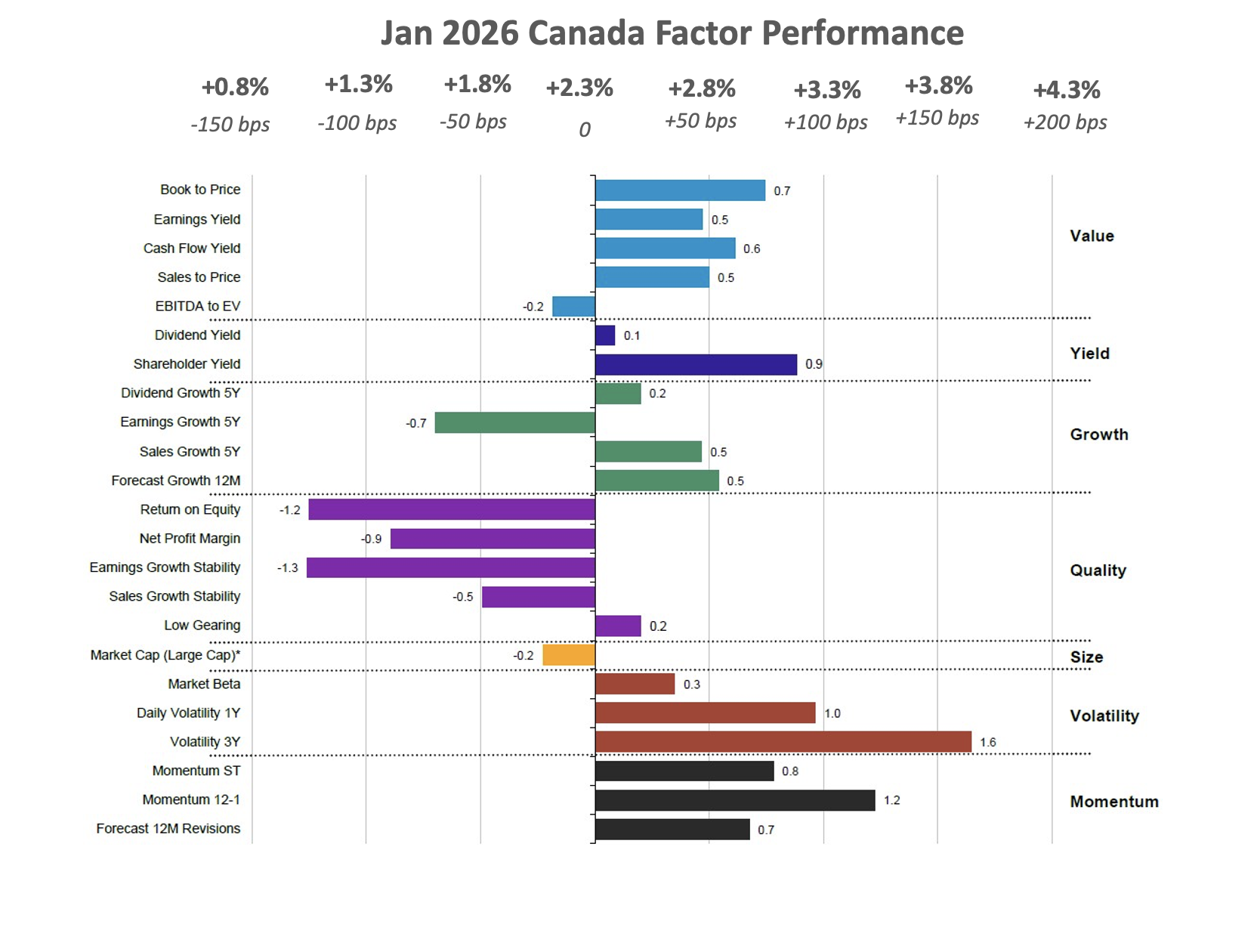

Following the U.S. market, Canadian equities recorded positive returns but lagged other global markets. The outperformance of global Momentum and Volatility factors, which favoured markets with stronger tech and cyclical sector leadership, contributed to Canada’s relative underperformance.

Value in Canada outperformed as undervalued or beaten-down stocks, particularly in energy, materials, and financials, rebounded amid investor rotation into attractively priced equities. At the same time, Volatility benefited from larger price swings across domestic sectors, with heightened market uncertainty and sector dispersion creating favourable opportunities.

Canada’s headline inflation rate increased to 2.4% in December 2025, up from 2.2% in the prior month. Manufacturing production declined by 5.66% year over year in November 2025. Meanwhile, the unemployment rate fell to 6.5% in January 2026 from 6.8% in the previous month.

Stocks with strong momentum in the region include financial companies Bank of Montreal (+6% in Jan) and energy company Suncor Energy Inc (+19% in Jan). High volatility 3Y stocks that contributed to the region’s performance include financial company Canadian Imperial Bank of Commerce (2% in Jan), energy company Cameco Corp (35% in Jan), and energy company Imperial Oil (17% in Jan).

Figure 6: Jan 2026 Canada Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsStyle Analytics

Style Analytics Fixed Income is now available globally. To learn more or request a demo, click on the link below.

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence® Technologies

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with over 700 employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com