January 2024

Q4 Preliminary Plan Universe Performance

by:

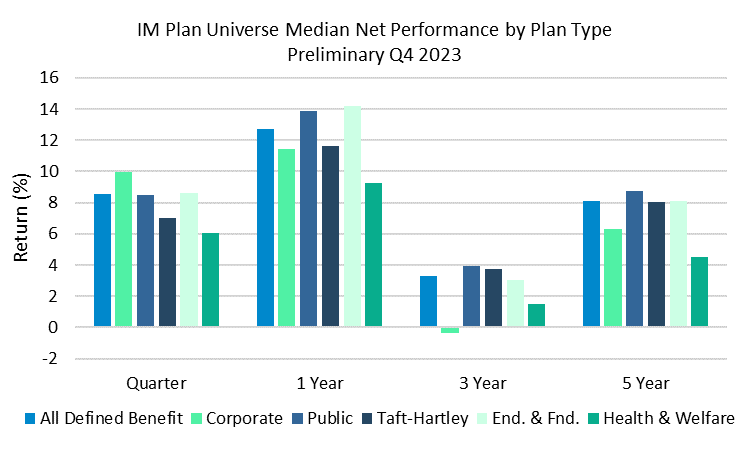

The Investment Metrics All Defined Benefit Plan Sponsor Universe posted a median net return of 8.55% for the fourth quarter and 12.69% for the year ending December 2023. For the quarter, corporate plans posted the strongest performance with a median return of 9.93%. This is a reversal from the last quarter in which corporate plans underperformed all other plan types. Robust performance in long bonds was significant as the Bloomberg U.S. Long Government/Credit index outperformed the Bloomberg U.S. Aggregate Index by more than 6%. Though plan performance was strong during the quarter, all plan types other than Corporates underperformed a traditional 60/40 benchmark return of 9.42%. (60% MSCI ACWI Index/ 40% Bloomberg Barclays U.S. Aggregate Index). For the calendar year 2023, endowments & foundations posted the strongest performance with a median return of 14.17 %.

All Defined Benefit: 667, Corporate: 153, Public: 274, Taft-Hartley: 158, End. & Fnd: 764, Health & Welfare: 132

Source: Investment Metrics, a Confluence company

Source: Investment Metrics, a Confluence company

Investment Metrics Plan Universe

The data includes 20+ years’ history on:

- Trust Funds, Corporates, Public Plans, Taft-Hartley, Endowments & Foundations, High Net Worth, Health & Welfare, and custom groups.

- Asset Allocations broken into equity (US, global, global ex-US), fixed income (US, global, and global ex-US), alternatives, real estate (public and private), multi-asset and cash. Emerging Markets allocations are available for equities and debt securities.

- Net and gross performances displayed by quartile with full percentiles via download.

- With all information aggregated by Plan Size.

Disclaimer

The information contained in this communication is for informational purposes only. Investment Metrics, a Confluence company, is not providing legal, financial, accounting, compliance or other similar services or advice through this communication. Recipients of this communication are responsible for understanding the regulatory and legal requirements applicable to their business.

About Confluence

including investment insights and research, Confluence invests in the latest technology to meet the evolving needs of asset managers, asset owners, asset services and asset allocators to provide best-of-breed solutions that deliver maximum scalability, speed and flexibility, while reducing risk and increasing efficiency. Headquartered in Pittsburgh, PA, with 900+ employees in 15 offices spanning across the United Kingdom, Europe, North America, South Africa, and Australia, Confluence services over 1000 clients in more than 40 countries.

For more information, visit confluence.com

In this article: