Institutional Client Reporting for Investment Consulting Firms and Advisors

Improve Your Investment Performance Reporting

Does your reporting:

- Require extensive resources to produce?

- Remain confined to Excel and PowerPoint, making it non-scalable?

- Lack the flexibility needed to serve your clients effectively?

- Make it difficult to manage index, custodial, and manager data?

PARis can help!

Enter your email to request a demo

We make reporting easier! Here is a sample of the reports you can use with PARis

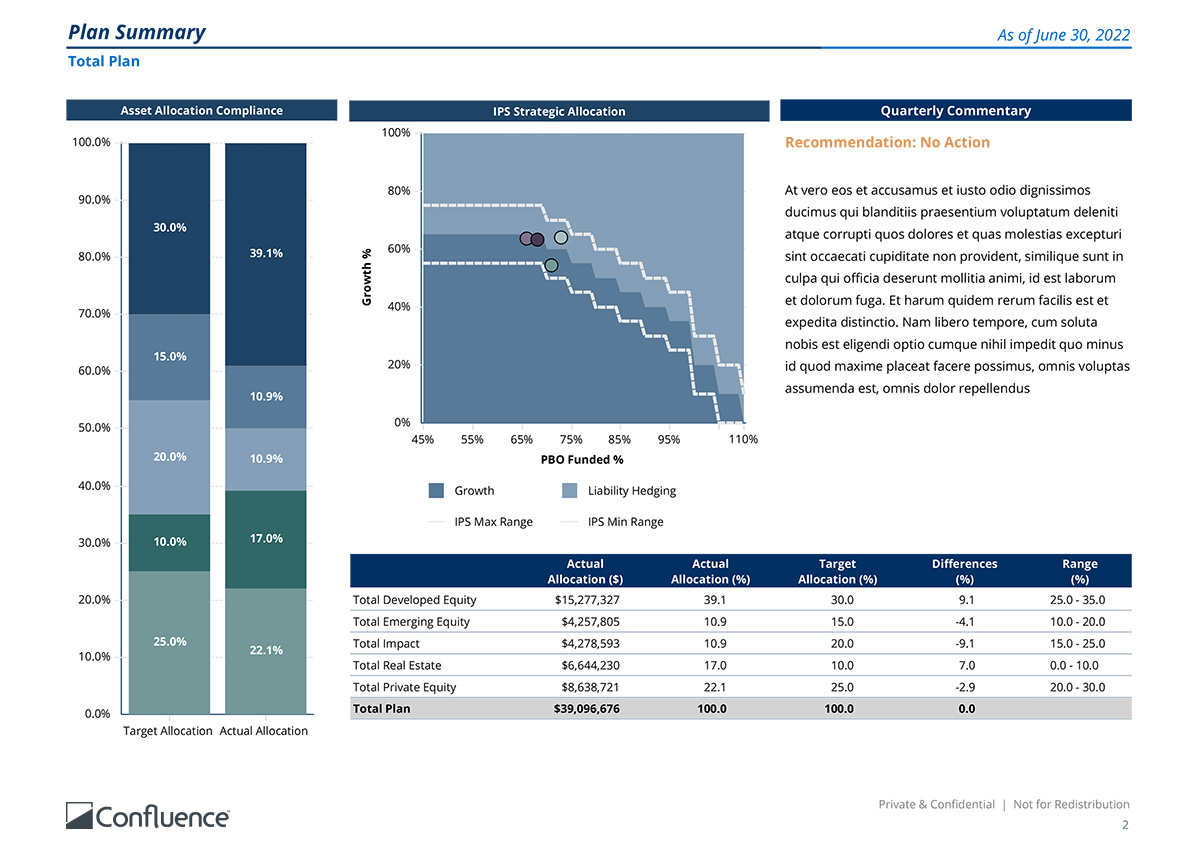

Total Plan Reports

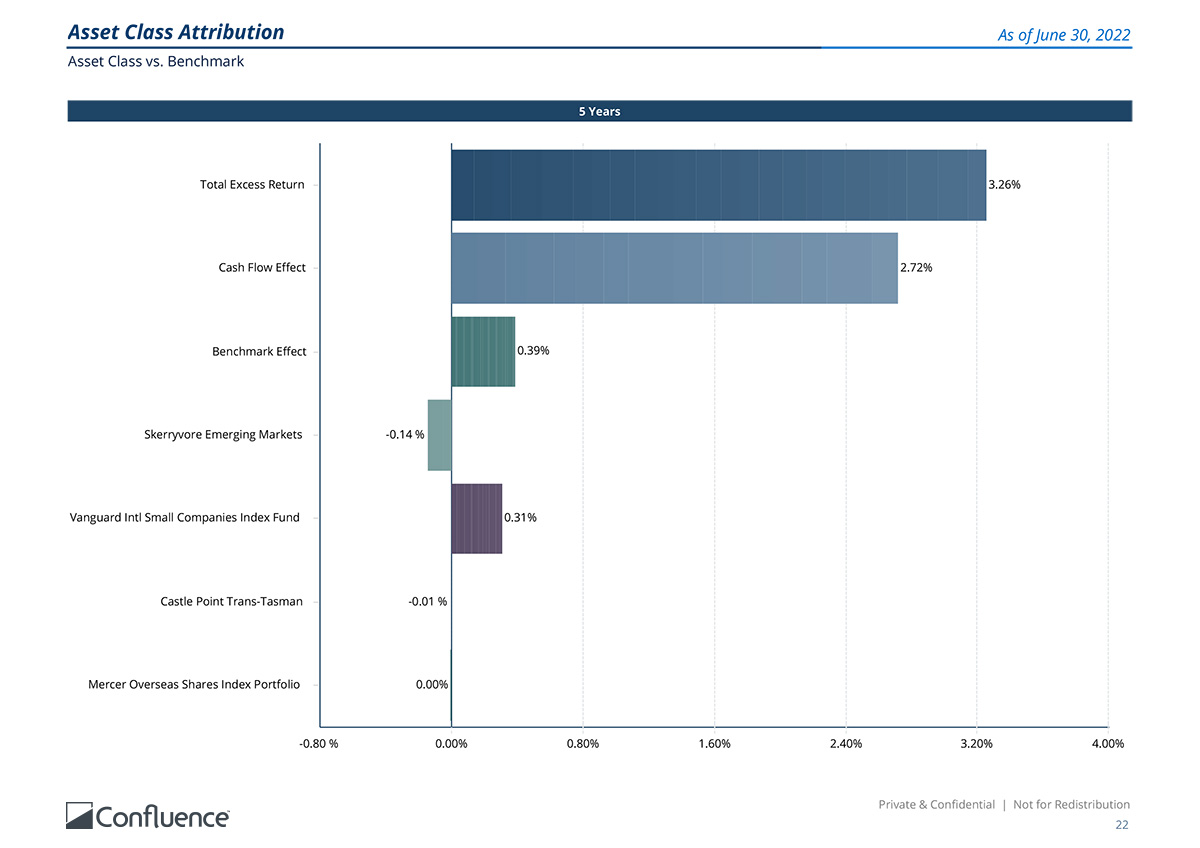

Asset Class Reports

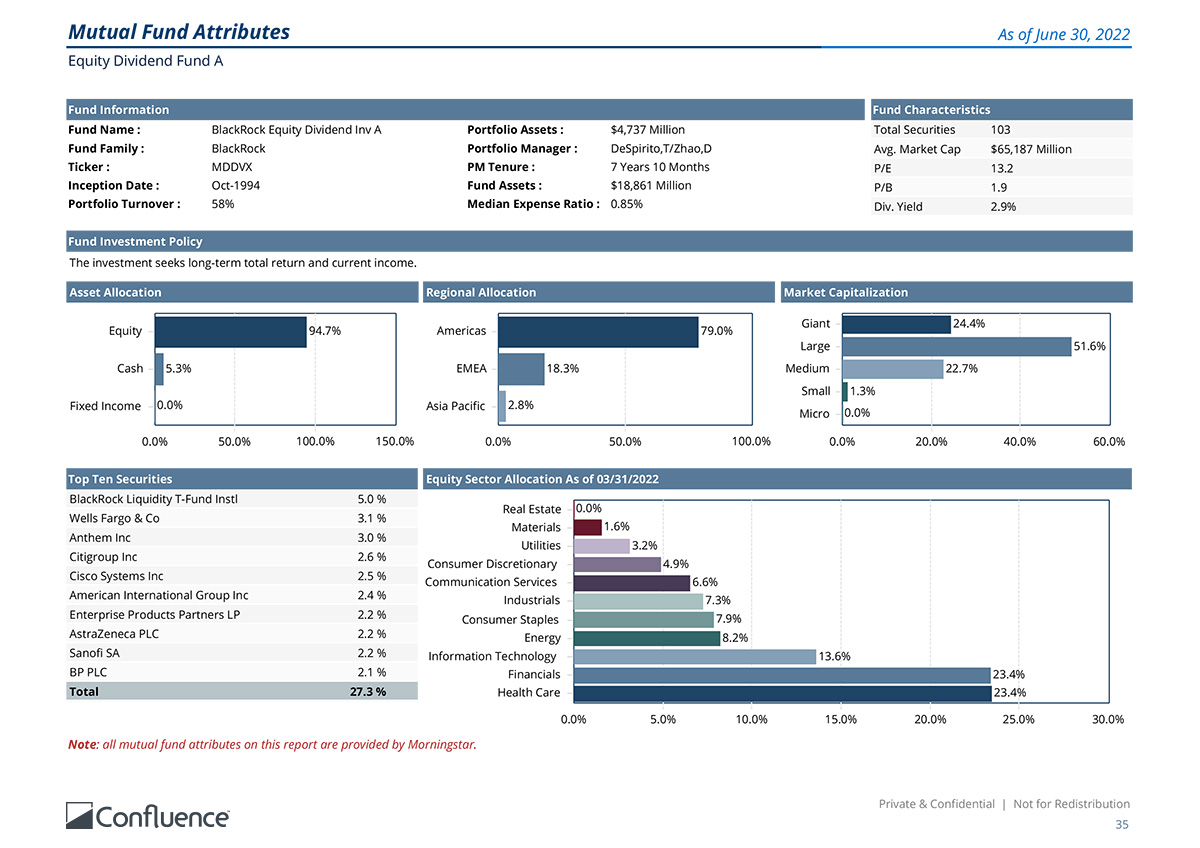

Manager/Fund Reports

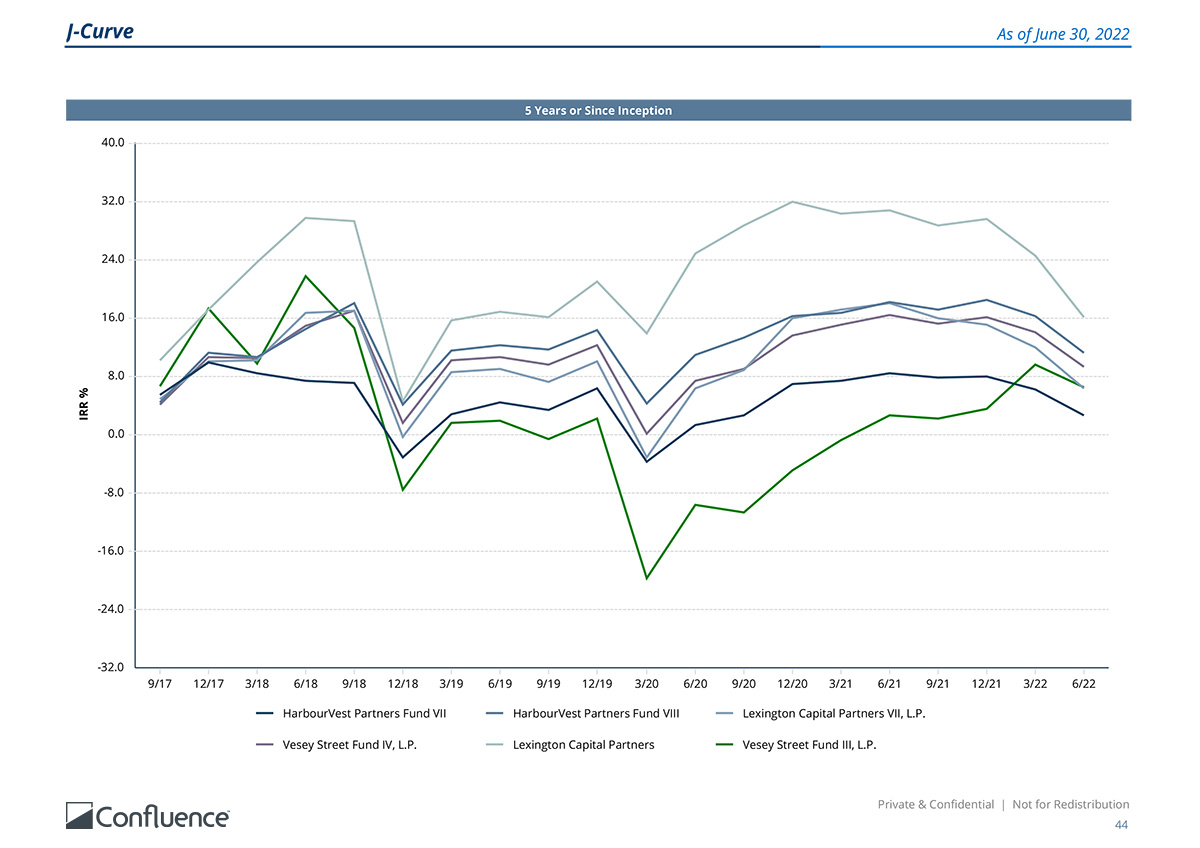

Private Equity Reports

PARis Portfolio Analytics and Reporting Platform provides:

- The largest plan and asset class comparative universes

- Robust, scalable reporting

- Support for DB, DC, E&F, and HNW, all on the same platform

- Fully integrated index, security, custody, record keeper, and manager data

- Multi-asset class, multi-currency, and multi-language capabilities

“Investment Metrics (PARis) allows us to provide value add for our clients. They understand our world, what we need to be successful, and it’s evident they are a partner who shares in our vision today – and our opportunities for tomorrow.”

Wendy Langowski

Head of Reporting ACG

"PARis is relied on by 16 of the top 20 investment consultants who advise on over 90% of AUA."

Rob Norcross

Product Manager, PARis Confluence

Articles and Reports

We think these articles will be of interest to UBS:

After the Alert – December 2025

November 2025 Factor Performance Analysis

Closing out 2025: A year of transition, transparency, and transformation

IntroductionThe scale of the challengeA focus on trading, post-trading, and asset managementPart of a wider simplification driveKey actions proposedGreater supervisory powers for ESMAWill this succeed where earlier CMU efforts fell short?How Confluence Technologies...