Inside the world of GARP investing

Prepared by:

Think of GARP — Growth at a Reasonable Price — like being a smart shopper or a savvy sports fan. You want quality, but you don’t want to overpay. Imagine you’re a baseball fan buying World Series tickets:

- Front-row seats? Incredible view, but pricey — that’s like pure growth investing: high excitement, high cost.

- Nosebleeds? Cheap, but you miss the action — that’s value investing: low price, limited upside.

- Mid-level seats with a great view at a fair price? That’s GARP — the sweet spot between quality and value.

GARP (Growth at a Reasonable Price) portfolios represent investment strategies that blend the key principles of both growth and value investing. These strategies target companies demonstrating steady, sustainable earnings growth while still being priced at reasonable valuations.

In the ever-shifting world of investing, trends swing between two poles: growth enthusiasts, who chase innovation and momentum, and value hunters, who dig for bargains. Somewhere between these camps lies a strategy that is often overlooked - yet quietly delivers through cycles: GARP, or Growth at a Reasonable Price.

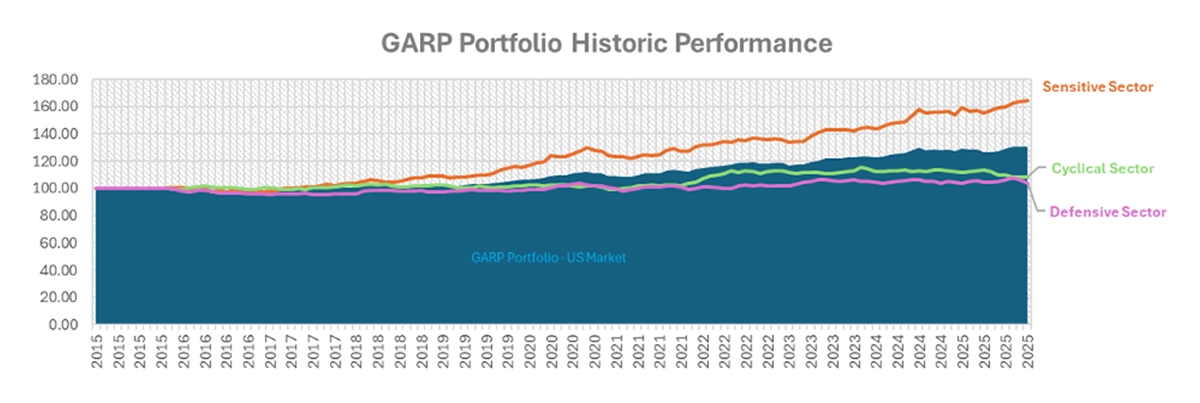

Figure 1: Source: Confluence Style Analytics

But when does this middle-ground approach really come into its own? Let’s unpack the environments where GARP portfolios tend to shine, stumble, and outperform.

When do GARP portfolios shine?

The sweet spot:

The goal of a GARP portfolio is to identify firms with above-average growth prospects without overpaying for them. In essence, GARP portfolios occupy the middle ground between the two investing extremes:

- They are less expensive and speculative than pure growth stocks.

- They offer stronger earnings potential than traditional value stocks.

In the mid-cycle market conditions, investors want exposure to companies that can grow earnings reliably, but they’re also wary of paying sky-high multiples for flashy names. GARP portfolios — focusing on firms with solid fundamentals, visible growth, and reasonable valuations — strike that perfect balance.

History has shown that during market storms — from the dot-com bust to the 2008 financial crisis, and even the COVID-19 selloff — GARP portfolios often held their ground better than pure growth or value strategies. In sectors sensitive to economic shocks, these “growth-at-a-reasonable-price” names tended to show more resilience and steadier returns, proving that a focus on fundamentals and valuation can pay off when volatility strikes.

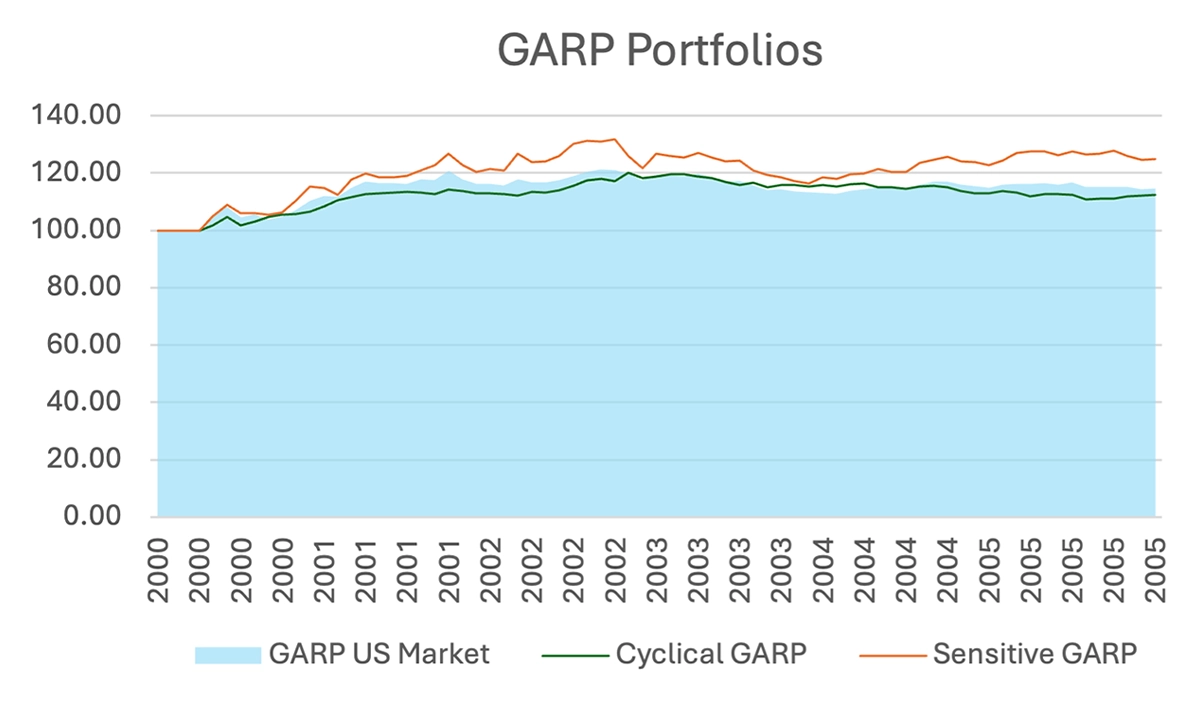

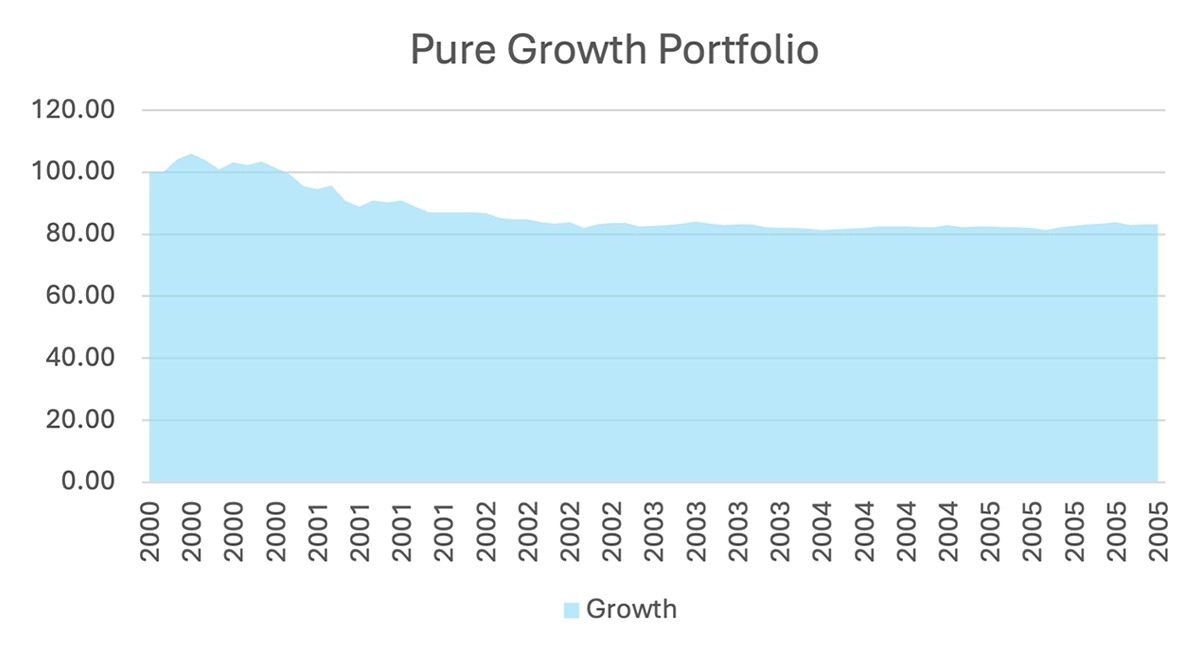

Dot-com crash: How GARP outlasted

pure growth

The year 2000 marked the end of one of the most euphoric market runs in history, the dot-com bubble burst. During the exuberance of the late 1990s, the internet’s potential seemed limitless. Investors poured into technology stocks, and growth portfolios swelled with companies boasting bold visions but fragile balance sheets. The excitement was contagious, even if the numbers didn’t quite match the narrative. This is where GARP investors quietly differentiated themselves. By design, GARP strategies avoided the excess — steering clear of companies whose prices had completely detached from fundamentals. Instead, they focused on businesses with proven earnings, sustainable growth, and reasonable valuations. To illustrate the impact of discipline, the charts below compare the performance of a GARP portfolio and a pure growth portfolio, both constructed using Style Analytics’ Markets Analyzer from 2000 to 2003.

Figure 2 & 3: Source: Confluence Style Analytics

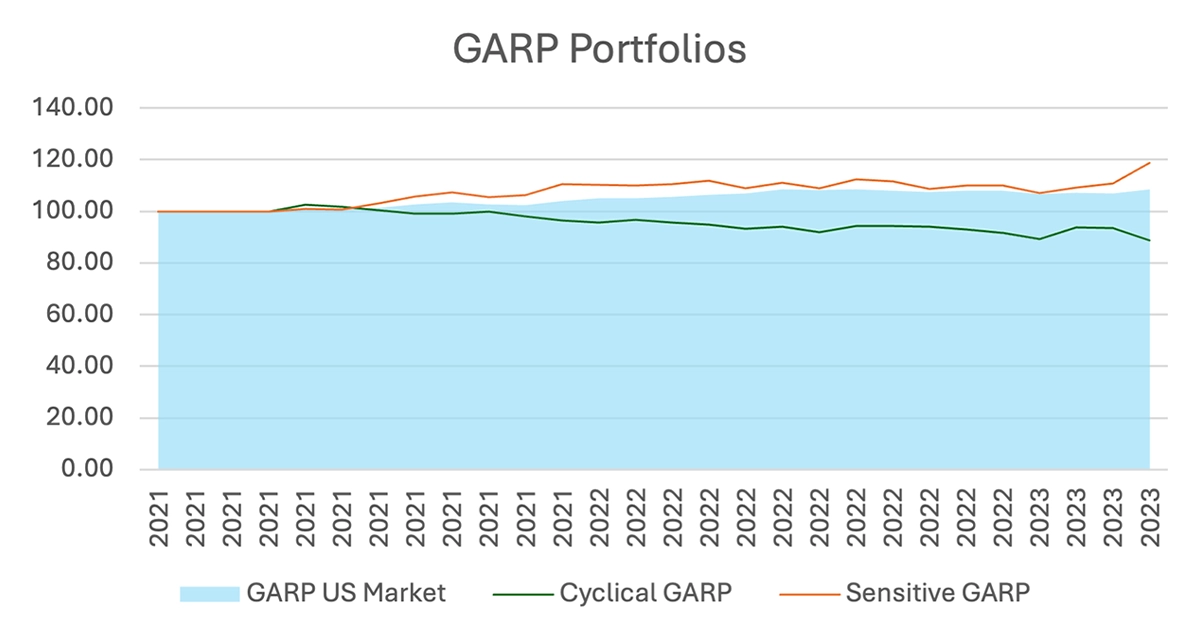

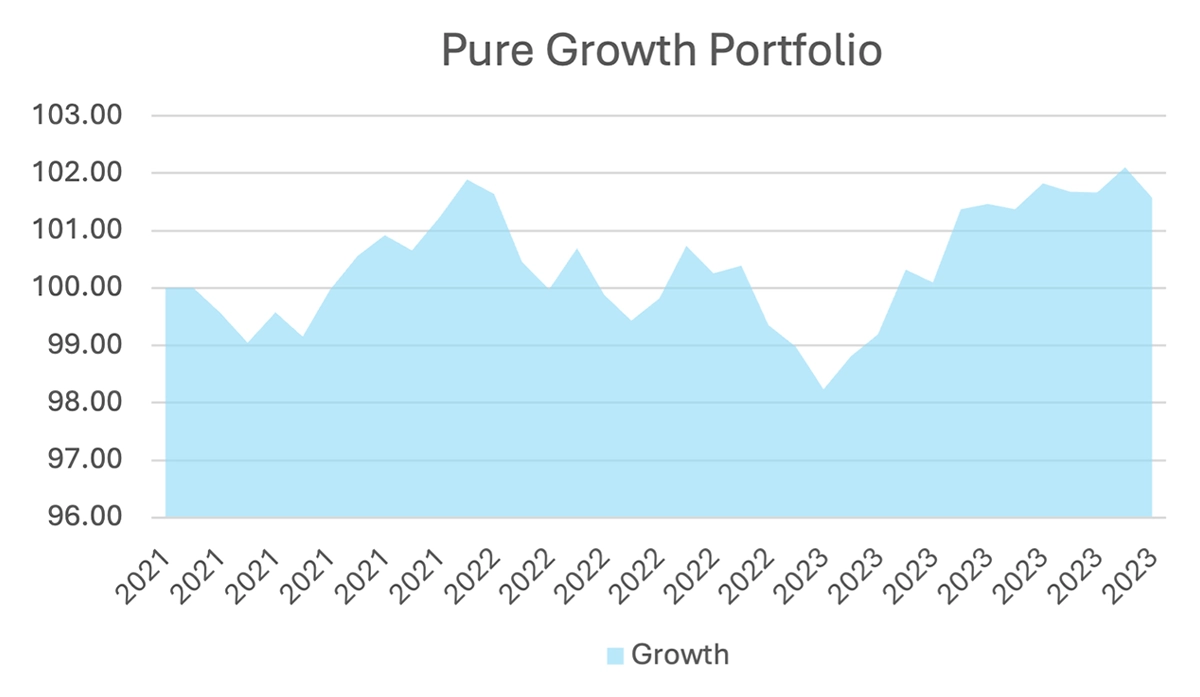

Post-pandemic lessons: How GARP found stability amid volatility

The years following the COVID-19 pandemic brought a new kind of market turbulence. Between 2021 and 2023, growth investing became a rollercoaster ride, driven by rapid shifts in interest rates, persistent inflation pressures, and changing investor sentiment. While pure growth portfolios experienced wide swings - soaring when optimism returned, then falling sharply as inflation fears and rate hikes dominated the headlines- in this volatile environment, GARP investing offered a steadier path. By combining strong earnings growth with valuation discipline, GARP portfolios sidestepped much of the excessive risk that plagued high-flying growth names. The approach provided balance, defensiveness, and consistent performance through a period of macroeconomic instability and valuation resets.

Ultimately, as seen in the charts below, while overvalued and volatile stocks weighed down aggressive growth portfolios, GARP strategies quietly outperformed, proving once again that measured optimism often fares better than unchecked exuberance.

Figure 4 & 5: Source: Confluence Style Analytics

Conclusion: GARP’s role during

market downturns

Markets are always changing, but one pattern keeps repeating - in every major downturn, from the dot-com bust to the COVID-19 selloff, GARP strategies tend to shine when uncertainty rises and exuberance fades. In volatile environments marked by rate hikes, inflation, or shifting sentiment, GARP portfolios stand out by focusing on sustainable earnings, credible growth, and valuation discipline.

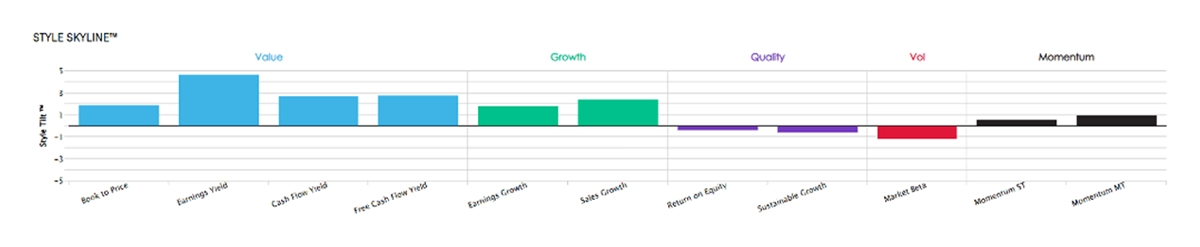

To see GARP in action, the skyline chart below helps explore and compare factor investing and tilts in portfolios, offering a hands-on way to understand why balance and valuation matter during periods of uncertainty.

Figure 6: Source: Confluence Style Analytics

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with 700+ employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com

You may also like: