The Financial Services Authority (FSA), specifically in the UK, although there are similar bodies in North America, Europe and Asia, have recently recognized that the relationship between those parties responsible for the oversight of a fund and the fund manager is a lot more complex than first anticipated.

Where larger organizations often have an internal department responsible for oversight, investor interests can compete with scenarios that are argued to be “for the good of the entire company”. In cases where oversight is outsourced to an independent third party, the fund manager is in fact a client to that third party. This means there will always be a risk that more priority is placed on satisfying the wants and needs of a paying client at the expense of protecting the interest of investors.

Acknowledging that the regulatory system needs refinement is a step in the right direction. Coming up with a workable solution that enables firms to effectively protect investors’ interests without bringing the entire investment industry to a crashing halt will be a bit more of a work in progress. There is no simple hard and fast solution but there are tools available that can assist an ACD, ManCo, Director or anyone responsible for the oversight of funds with the host of challenges and problems they experience whilst trying to enforce it. This blog explores a few of those challenges and we’ve made a few suggestions as to how technology can help.

Read: New Insights for Asset Managers: How Technology Can Drive the Most Effective Middle Offices

The need for independent verifiable information

At the moment anyone responsible for oversight is reliant on the fund manager to tell them what’s going on. The fund manager in turn relies on whatever information sources he’s got available to him; Bloomberg, Reuters or Factset are just a few examples. As you’d expect each firm has different tools available and every fund manager has their own preference so anyone responsible for the oversight of more than one fund will be exposed to information from a variety of different sources each with their own variances in how they report and present information.

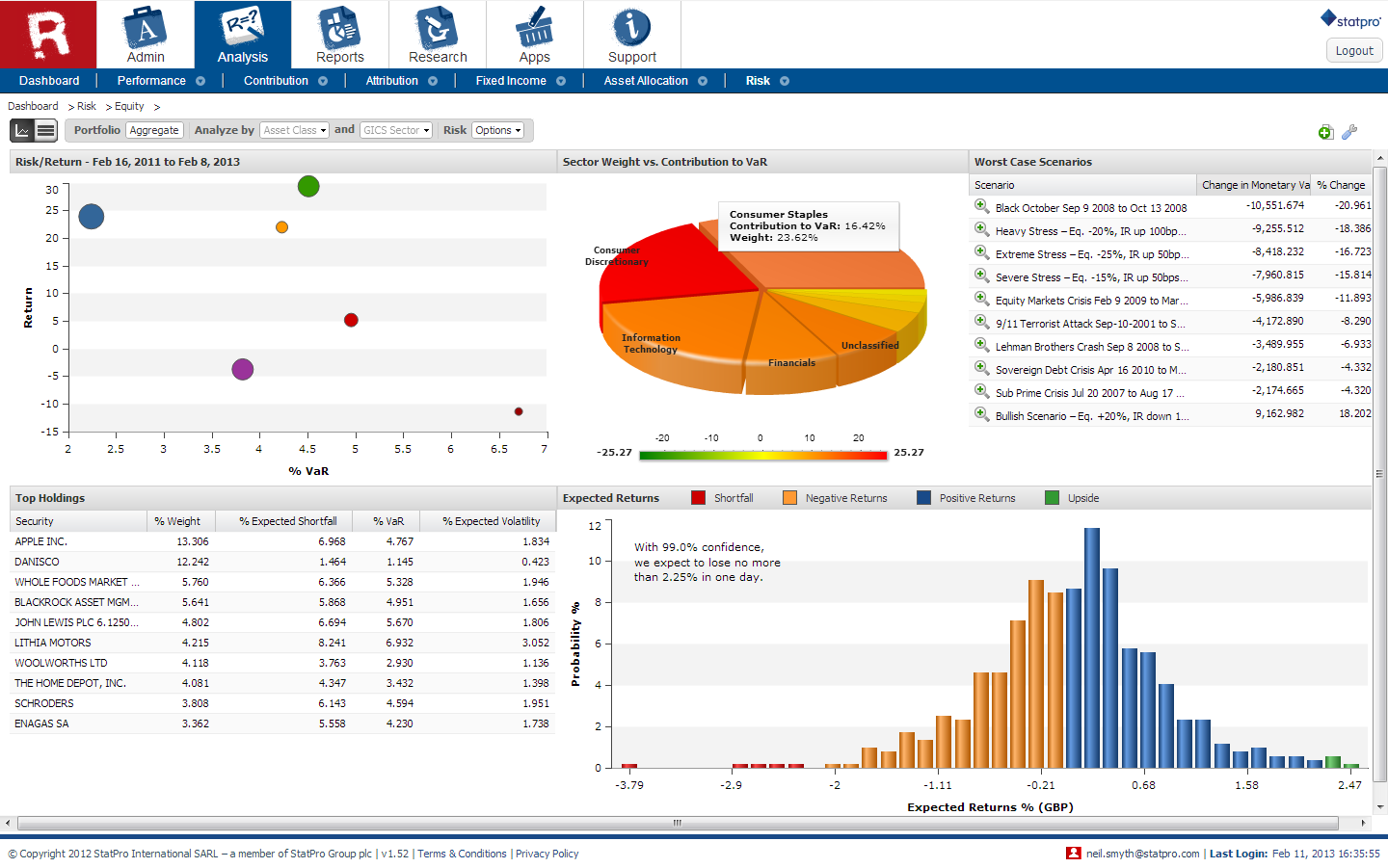

Knowing the information a fund’s ACD, Board of Directors or ManCo is interrogating is the same information the fund manager has available to him, makes working together to get to the bottom of any discrepancies within a fund, much easier. StatPro Revolution uses the official book of records, the fund accounting system sitting within the fund administrator that the asset manager has outsourced the fund administration to. Anyone responsible for oversight using StatPro Revolution can be assured that they are using an independent source of data that reconciles with the net asset value (NAV). What’s more, because StatPro Revolution is a cloud-based solution it allows you to share reports and information with anyone you choose to quickly and securely. It is also timely data. Available from anywhere, people responsible for oversight can access portfolio analysis data and see what happened right up to yesterday. No more waiting until a week into the following month to read paper based reports all coming from several different systems.

Transparency doesn’t have to occur at the expense of intellectual property or investment strategies

One problem that comes hand in hand with the need for visibility of your aggregated exposure is that no up-to-date daily look through transparency exists. It’s not uncommon for one fund to own another fund as part of its portfolio. In fact it happens all the time with fund of funds and it means that a significant amount of fee extraction could take place at the expense of the customer – something the FSA and other bodies around the world are beginning to focus their attention on.

The challenge around transparency occurs as a fund manager would need to disclose the details of the securities making up the fund, something they consider to be their intellectual property. It’s argued that disclosing this information could enable competitors to gauge a fund manager’s position, know the stock and front run them. Finding a solution to this challenge is really about finding a level of transparency that’s acceptable to all parties and stakeholders, and having the ability to control it.

Transparency between suppliers and stakeholders is very important if you want to really understand the risks you’re exposed to. Consider that without transparency a fund of funds could suddenly find it owns 25% of an illiquid stock because it didn’t realize the stock was evident in both its fund of fund portfolio and the portfolio of one of the funds it owned.

Finding and controlling an appropriate level of transparency is something StatPro Revolution can help with. Being a cloud-based portfolio analytics tool means that stakeholders can share information and give one another visibility of the stocks and shares in their portfolio securely. For example, the ACD for a fund of funds that owns a part of fund B could ask fund B for a StatPro Revolution login in order to have a helicopter view of what was happening within the fund. If the fund of funds were also using StatPro Revolution they could choose to aggregate all those different logins within StatPro Revolution to see the portfolios and get an aggregated exposure to all the securities.

Handling historical conflicts of interest

Another area the FSA and other regulatory bodies are beginning to take notice of is where the investor has suffered a loss because of conflicted trading interests by the fund manager. Examples of such incidences include where investors have incurred inappropriate costs; unequal access between investors to all suitable investment opportunities; failing to allocate trades between different customers in an equitable manner; being unable to show that cross trading between customers is in the interests of both customers and where firms don’t have appropriate policies in place on the acceptance of gifts which could be seen to impact a fund manager’s objectivity when they manage more than one fund.

With the FSA and other regulatory bodies taking enforcement action against firms in breach of the rules, questions arise on how a firm can begin to investigate whether a conflict of interest trade has occurred before they are forced to take on an expensive and time consuming investor detriment report.

StatPro Revolution enables you to quickly investigate any concerns that arise because it allows you to identify a specific security within a portfolio and then to strip out the transactions in the portfolio that pertain to it. This means you can quickly get a handle on the situation knowing that the data you are working with will reconcile with the official book of records and the NAV calculation. As to whether that investor has suffered or not it depends on when they bought the security and the circumstances surrounding the portfolio during the time they held that security.

Close

In summary, there really must be a balance. Internally, Directors need to be confident in challenging internal money managers in the same way an independent ACD would challenge an independent manager. It’s a no-brainer that analysis using an independent verifiable source of data enables transparency. The only final question is the solution that will enable you to perform sophisticated and trusted oversight.

StatPro Revolution is the first cloud-based portfolio analytics solution that combines performance measurement, contribution, attribution, asset allocation and risk analysis. For more information click here.

Learn more at our webinar ‘Portfolio oversight from StatPro’ on Wednesday 17 April 2013.