How OTC Data Gaps are

Hiding Massive Risks and

Blocking Fiduciary Duties

Prepared by:

Over-the-Counter Securities Without Terms = Risk Without Insight. The second post in a multi-part series on Fixed Income Transparency. Read more about the industry’s data double standard.

Over-the-Counter (OTC) Contracts

Active Fixed Income Managers use a range of instruments to hedge or express views, from exchange-traded derivatives to Over-the-Counter (OTC) contracts. Each OTC is governed by detailed terms and conditions (T&Cs) that define its risks and payoff structure. These T&Cs are essential inputs for internal risk models yet are rarely included in downstream holdings data. Without them, independent, bottom-up portfolio analysis becomes impossible for investors, consultants, FinTechs, and even regulators - and history has shown us how dangerous that opacity can be.

In addition to being central players in past financial crises, opaque OTCs directly cost investors today by preventing them from understanding what risks they actually hold.

Imagine you lead fixed income investments for a defined contribution pension fund invested in a Global Credit SMA. Your manager holds a mix of exchange-traded financials and hedges parts of that exposure using Credit Default Swaps (CDSs), a common, table-stakes tactic in fixed income. The terms of these CDSs reference an underlying entity or index, such as a specific bank or a regional financial credit index.

Then, news breaks about weakness in the European banking sector due to distressed commercial real estate exposure. You may know how much of the fund is in Europe, and how much is in financials. But you probably don’t see the intersection of the two, and without OTC T&Cs embedded in an independent risk system, you definitely won’t know whether those CDSs are mitigating the blow or amplifying it.

You’re left waiting on a portfolio manager call while markets move. That gap in transparency can lead to misinformed de-risking decisions, delayed response times, and, in some cases, millions in preventable losses for the retirees you have fiduciary responsibility for.

The good news is that the OTC data exists; the bad news is that it only flows to a subset of systems, for a subset of the assets under management (AUM), and to a privileged subset of clients.

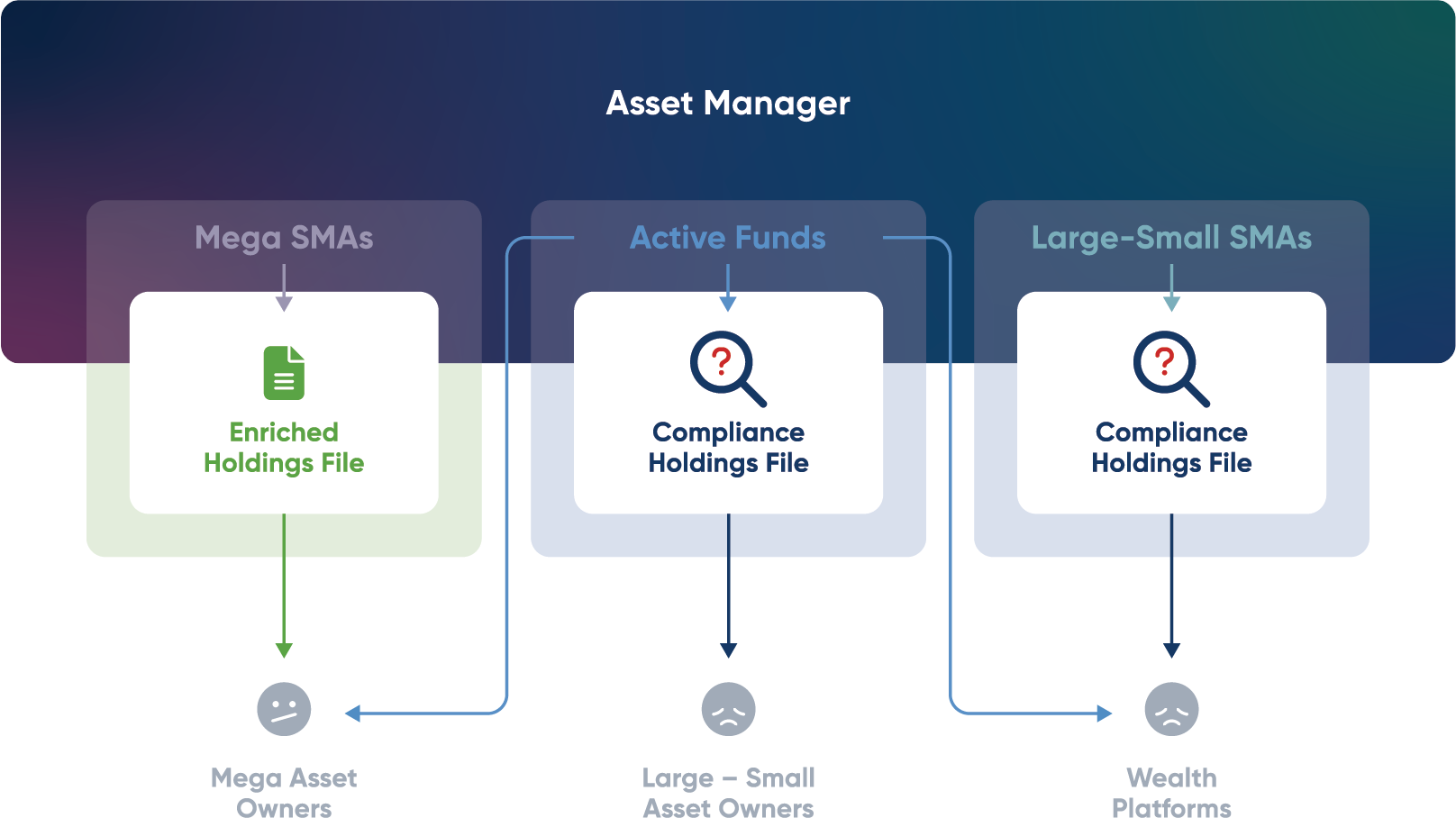

Figure 1: The enriched Holdings file is better than the Compliance Holdings file and allows for accurate analysis using Confluence Style Analytics.

Transparency for SMAs, Blind Spots for Funds

Despite major regulatory reforms since the 2008 crisis, including the OTC-specific ones documented by SIFMA, the vast majority of OTC derivatives remain opaque at the holdings level for most investors. Mega Asset Owners (AOs) can negotiate custom transparency into their SMA mandates, often backed by high-cost platforms such as PORT or Aladdin and fed with bespoke, enriched data feeds.

But transparency stops at the pooled fund wall. The same manager who provides full OTC detail in an SMA won’t offer it for a mutual fund. They gain access to OTC data in SMAs but lose visibility in pooled fund structures. Unless they run full SMA portfolios (which very few do), they must choose between cost and clarity.

This creates a two-tier transparency system, where the top few can demand clarity if they go full SMA on fixed income, and everyone else, institutional and wealth, lacks sufficient transparency. But fiduciary responsibility doesn’t scale with fee size; it’s the same set of duties from high net worth to CALPERs.

The current solution? Fixed income managers typically hand out a glossy factsheet for optics, a flat holdings file for compliance, and a custom Excel file that subjectively explains the exposures at the segment level if you're big enough.

Figure 2: Although the mega asset owners receive transparency for their SMAs, they still typically invest in funds that don’t provide transparency. The rest of the market receives zero transparency, but all share the same fiduciary responsibilities.

It’s Time for a Fiduciary Book of Record

In building Style Analytics Fixed Income, we’ve spoken with dozens of fund selectors all trying to perform manual, error-prone Excel portfolio analysis using incomplete data. It’s inefficient, inaccurate, unsustainable, and leads to limited fiduciary care.

The trouble with T&Cs is multi-layered, but at its core, it’s a failure of transparency. Investors must start demanding from their managers the data they need to fulfill their fiduciary obligations, and need independent portfolio analysis systems to handle it. Because when investors can see what’s really inside the portfolio, they make better decisions, ask smarter questions, and trust the manager more deeply.

It’s time for a new standard: the Fiduciary Book of Record (FBOR). We’ll write more about this in the coming weeks. Follow us on LinkedIn to stay in the loop.

In developing Style Analytics Fixed Income, we’ve also spoken with dozens of managers about enriched T&C data feeds. While the industry-wide fix remains complex, we’ve used our front-to-back office expertise and a novel data collection approach to bring new levels of transparency to fixed income portfolios. Want to learn more? Let’s talk.

Read the first post on Fixed Income Transparency here: Investors Need a Stronger Fixed Income Analytics Framework.

Figure 3: It’s time for a new standard: the Fiduciary Book of Record (FBOR)

Want to learn more? Let’s talk.

To stay in the loop for up-and-coming- new solutions from the Style Analytics team at Confluence.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with 700+ employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com

You may also like: