Whatever your feelings are on hedge funds and their practices, they’re almost certainly part of your retirement fund.

More and more institutional investors are allocating assets to hedge funds as they search for returns and diversification. This is placing new pressures on the hedge fund industry as it matures and starts to accept institutional money and the pressures for greater transparency, risk management and regulation.

A brief history

Hedge funds have been around longer than you think. Harvard graduate Alfred Winslow Jones is credited with starting the first hedge fund back in 1948. He raised $60,000 from investors and along with $40,000 of his own money, started minimising his risk in long term stock positions by short selling others. He also used leverage to enhance his returns and in 1952 Jones added that classic hedge fund trait, a 20% incentive fee based on performance. He also converted his fund from a general partnership to a limited partnership therefore limiting the investor’s exposure to the money they put in. So, with short selling, leverage, shared risk and a performance related incentive scheme for the manager, Alfred Jones got hedge fund industry started. Things didn’t really kick off until 1966 when an article in Fortune magazine highlighted an investment that outperformed every single mutual fund by double digit figures over the past 12 months and by even more over the last five years. By 1968 there were 160 hedge funds in operation.

The market today and beyond

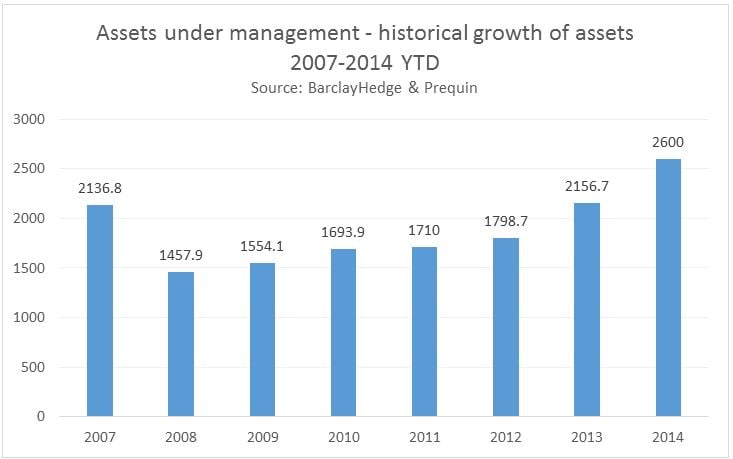

So what about the industry today? The general perception of hedge funds is still fairly negative. Famous fund collapses live long in the memory and the idea of a bunch of fat cats making highly speculative gambles with investor’s money to push returns to unsustainable levels still remains in many people’s minds. Surely this is the last thing you want in your pension fund? The industry is attracting capital at an ever increasing rate. Global hedge fund assets under management have grown every year since the financial crisis in 2008. In 2013 they passed their 2007 high of $2.13 trillion and year to date in 2014, AUM stands at an all-time high of $2.6 trillion.

Read: New Insights for Asset Managers: How Technology Can Drive the Most Effective Middle Offices

The pension fund factor

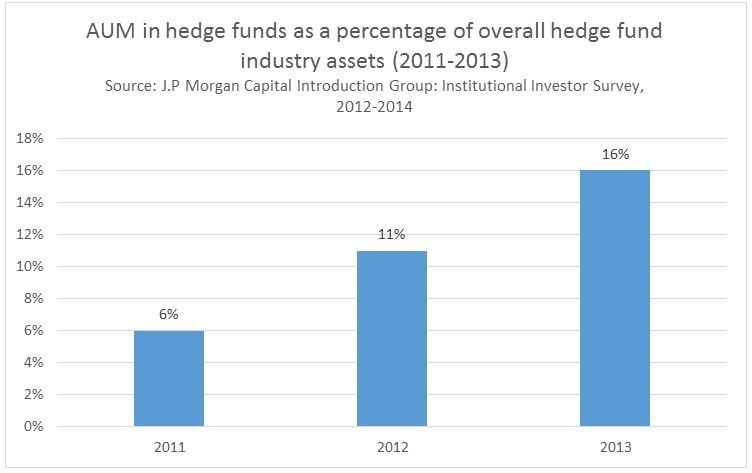

What impact has the pension fund market had on this recent growth? A report released in March 2014 by J.P Morgan’s Capital Introduction Group found that 97% of the institutional investors who participated in the survey (almost 300 of the leading institutional investors) indicated their plans to maintain or increase the number of their hedge fund investments in 2014. The group found that pensions are the fastest growing investor segment and it is the largest contributor to the growth of the hedge fund industry. As of September 30th, 2013, the amount of assets invested by defined benefit plans in hedge funds increased faster than any other investment class.

The 200 largest pension funds in the United States have $150 billion combined total direct investments in hedge funds and hedge fund-of-funds. This was 10.3% higher from the previous year.

Desire to manage risk and diversify

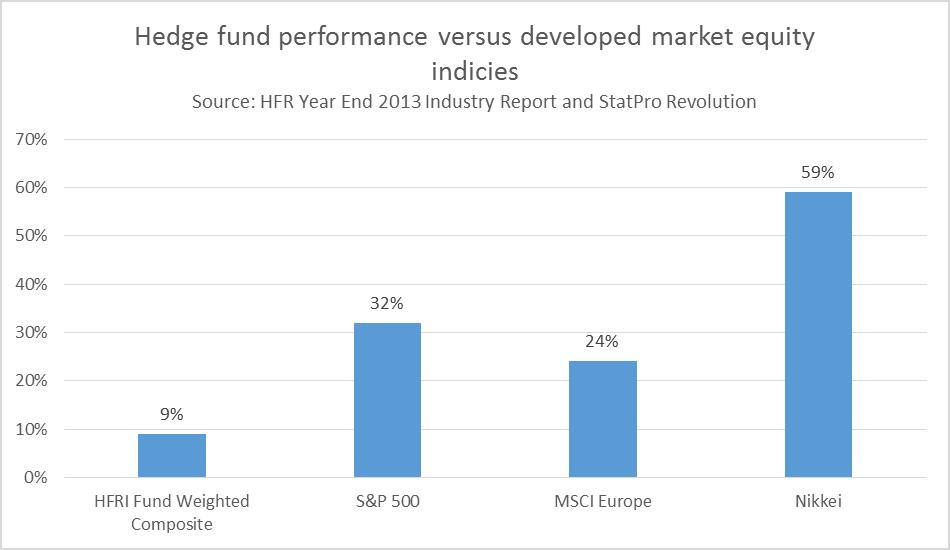

So you would think that hedge funds produced some fantastic returns recently if so much money is being allocated to them. You’d be wrong. While hedge fund managers delivered a better performance in 2013 compared to previous years, their relative performance to other markets was poor as you can see in the chart below. This suggests there must be other reasons pension funds are investing in alternative investment vehicles such as hedge funds.

Diversification is one reason. Over the last 10 years we have seen many pension funds move away from a traditional long only equity strategy. The initial move was to allocate more funds to bonds with many believing that pension liabilities are ‘bond like’ so switching to bonds was a good way to match these liabilities. In fact, while pension liabilities may be ‘bond like’, they are not properly matched by bonds at all. Pension funds are constantly looking to outperform their liabilities and a bond portfolio, even with corporate bonds (which still carry a default risk) is not going to achieve this. Even if switching to bonds is purely a driver for reducing overall risk, there are better ways to do this. Hedge funds and alternative assets may be the answer. Pure equity allocation cannot be relied upon to deliver sufficient, consistent returns to match or outperform pension liabilities. If the returns required are more than bond yields, then it is essential to hold non bond assets. Alternative assets are beneficial to pension funds because of they are not highly correlated with equities or bonds. This is where hedge funds can help a pension fund manage downside risk while still providing an opportunity to meet performance criteria.

Keeping an eye on things – the need for transparency

If pension funds are going to branch out into the brave new world of alternative assets in search for more active risk management and the need to meet more demanding performance targets, they need to have insight into these new investments and the individual assets that make up their fund. Hedge Funds are not known for the openness and transparency. They constantly fear that open reporting will expose what may be a proprietary methodology that adds value. Why should the portfolio holdings be known to anyone?! Most institutions do not want to invest in a black box, they want to know what is in the fund and what the risk characteristics are. How can hedge funds provide this transparency requirement while keeping their intellectual property safe? It’s a problem that is essential to solve if hedge funds want to win institutional money. Technology is the answer. Having the right technology to be able to analyse your investment strategy is crucial, but it’s also crucial to be able to report on that to clients. Hedge funds are famous for not wanting any infrastructure to manage, they want to focus on managing the money and keeping costs down (and rightly so). Investing in large technology projects is a non-starter for any hedge fund. This puts cloud-based software as a service (SaaS) providers to the top of list when evaluating technology solutions for the hedge fund market. Granular control of the analysis output and how this data is shared to clients is essential to manage the balancing act between transparency and privacy. It is clear that the pension fund market is allocating more money to hedge funds in order to diversify and to seek out new sources of return. Love them or hate them, this trend doesn’t look like slowing down, so in a competitive market, it is essential that hedge funds have the right technology in place to service their clients demands.

Find out more about the changing hedge fund environment with our Hedge Fund Technology resource page.