What are FANG stocks?

The term “FANG” was coined in 2013 by CNBC host Jim Cramer as an acronym for the four highest performing, high volume, technology growth stocks: Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google Alphabet (GOOG).  Facebook’s user growth has slowed recently, but their advertising-based business model can however reach over two billion daily users. Amazon has seen success expanding into business areas where they can see short-term profitability, for example Amazon Web Services, Twitch.tv, and Whole Foods. Netflix has capitalized on the cord-cutting trend in television, becoming the market leader in subscription-based content. They have added users quickly and expanded original programming, with both approaches spurring growth. Google, similar to Facebook, capitalizes on advertisement via their leading search platform. Combined they have enjoyed a tremendous run in the recent bull market, up 44% in 2017 which outpaces the S&P 500’s otherwise unbelievable performance of 21.7% over the same period. The four FANG stocks contributed about 2.7% of the S&P 500’s total performance in 2017.

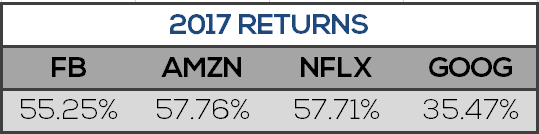

Facebook’s user growth has slowed recently, but their advertising-based business model can however reach over two billion daily users. Amazon has seen success expanding into business areas where they can see short-term profitability, for example Amazon Web Services, Twitch.tv, and Whole Foods. Netflix has capitalized on the cord-cutting trend in television, becoming the market leader in subscription-based content. They have added users quickly and expanded original programming, with both approaches spurring growth. Google, similar to Facebook, capitalizes on advertisement via their leading search platform. Combined they have enjoyed a tremendous run in the recent bull market, up 44% in 2017 which outpaces the S&P 500’s otherwise unbelievable performance of 21.7% over the same period. The four FANG stocks contributed about 2.7% of the S&P 500’s total performance in 2017.

Fig. 1: 2017 returns for the four original FANG stocks

Fig. 1: 2017 returns for the four original FANG stocks

How do FANG stocks affect our portfolio?

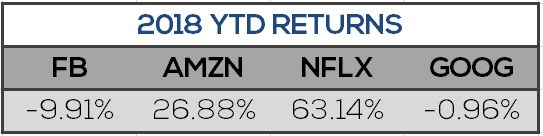

The four FANG stocks have had a significant impact on the US equity market when looked at as a whole. Together, they account for nearly 8% of the S&P 500, and that number will rise if the market cap of these giants continues to increase. So what happens when the hottest trade starts to unwind? The short volatility trade unwound sharply in February 2018 but that was a case of a broad market shift across the entire equity market. The FANG trade is unique in that if any one of these four names begins to shows signs of slowing growth, there is potential for meaningful losses in US equities. Over the recent few months this culprit has been Facebook.

Fig. 2: 2018 YTD returns highlighting Facebook drawdown

Fig. 2: 2018 YTD returns highlighting Facebook drawdown

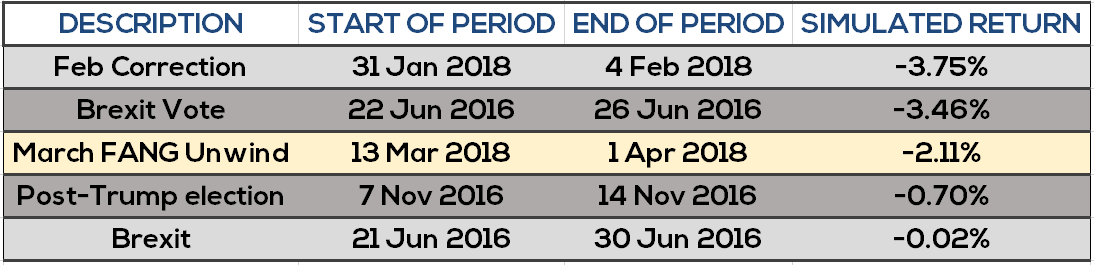

Over the period from March 13 to April 1, Facebook was entrenched in a data scandal, coinciding with a general pullback in the tech sector. To measure how well StatPro Revolution’s Alpha module could have predicted the impact to our Global Risk Outlook portfolio, we use the NYSE FANG+ Index as representative of growth tech stocks. The FANG+ is an expanded list of ten constituents: Facebook, Amazon, Netflix, and Google, as well as Apple, Alibaba, Baidu, NVIDIA, Tesla, and Twitter. March 13 was also the 52-week high for the FANG+ index, creating a window of interest around which we will run our historical scenario analysis:

Fig. 3: Simulated portfolio return over FANG+ pullback

Fig. 3: Simulated portfolio return over FANG+ pullback

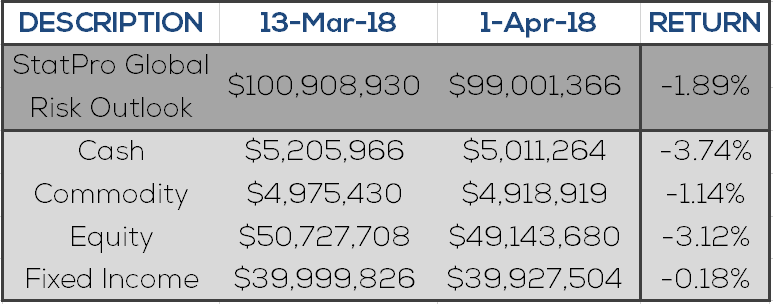

In the scenarios tool, we use the FANG+ index to create a correlated stress test which replays the drawdown period of March 13 to April 1 on our Global Risk Outlook portfolio. This results in a simulated loss of -2.11%, which was near the actual loss to the Global Risk Outlook portfolio of -1.89% in the same period. We see that this was driven by the -3.12% loss to the equity book, the portfolio’s largest asset class allocation.

Fig. 4: Actual portfolio returns, March 13 to April 1

Fig. 4: Actual portfolio returns, March 13 to April 1

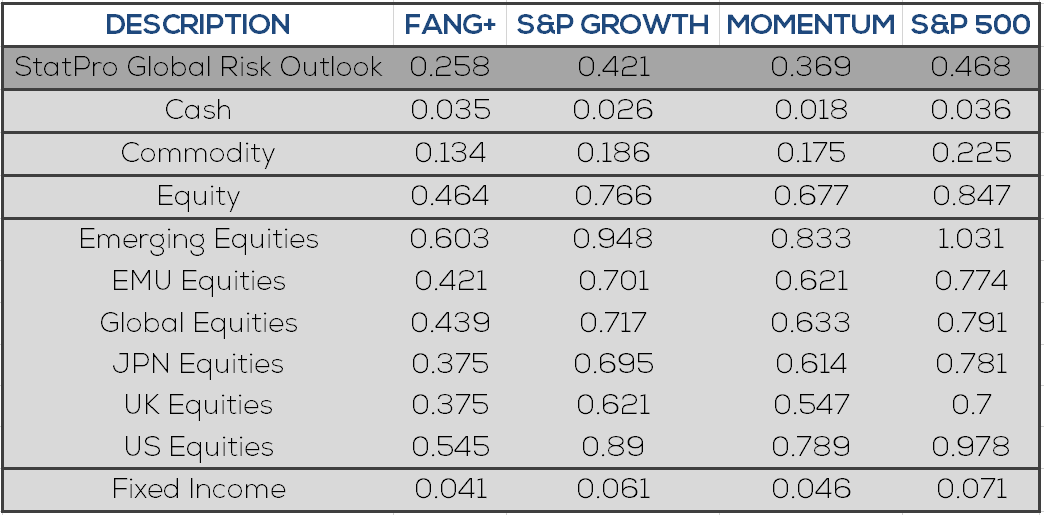

The impact the FANG stocks can have on our portfolio is real – even in a globally diversified asset manager. Whereas we know that changes in the S&P will move our portfolio in a significant way, we must also understand the constituents within the S&P and how they may affect the portfolio in turn. We can approach this analysis in our Global Risk Outlook portfolio by reviewing beta sensitivities for all equity holdings to the FANG+ stocks as well as other equity indices of interest.

Fig. 5: Betas to FANG+ and similar equity factors

Fig. 5: Betas to FANG+ and similar equity factors

Where do the FANGs go from here?

The term FANG has become synonymous with the exponential growth observed in consumer-facing technology stocks in recent years. As these companies reach the peaks of their growth and begin transitions to more mature dividend paying companies, similar to Microsoft (MSFT) and Apple (AAPL), investors will reassess their pricing in the market. While undoubtedly these stocks will all play significant roles in the market in years to come, investors should monitor for potential changes in the FANG growth regime.

{{cta(‘f543e487-b4d2-495c-a07a-cfa4a233f17e’)}}