In our 2018 FTF Performance Measurement Europe Conference recap blog we highlighted the impact of passive investment and fee compression on asset managers. As active managers move towards adding passive investment options, let us take a closer look at the middle ground: factor investing.

An active manager’s mandate is to generate alpha, or returns greater than the broader market. There are many methods and investment strategies which consistently boil down to a perceived informational advantage that the manager has over market participants on the other side of the trade. Passive investments are primarily index products that are bought and held. Risk decisions are made using long term historical data on industries, asset classes and market regimes.

Factor investment combines the benefits of active investment, market outperformance and targeted alpha generation, and passive investment, low fees and transparency. The difference is that instead of relying on a perceived informational advantage, factor investing targets known sources of outperformance in equity markets.

Factor investment combines the benefits of active investment, market outperformance and targeted alpha generation, and passive investment, low fees and transparency. The difference is that instead of relying on a perceived informational advantage, factor investing targets known sources of outperformance in equity markets.

Before implementing factor investments

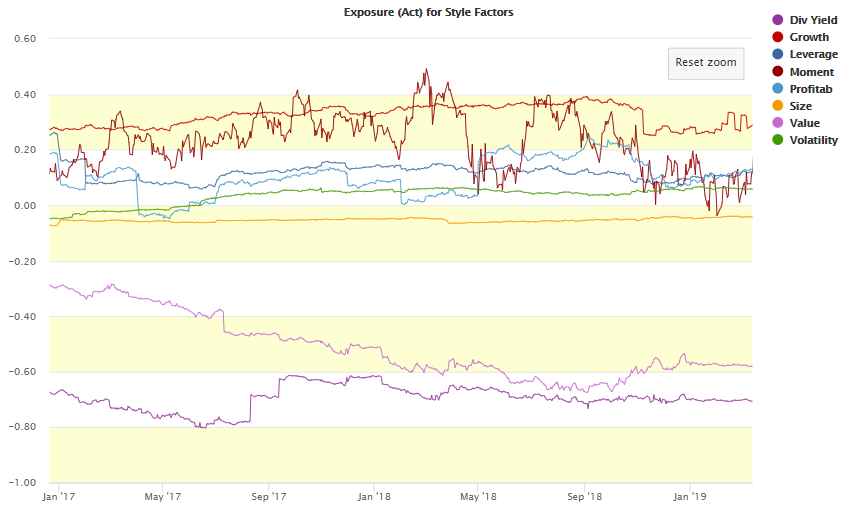

It is important to understand that there is not a magic allocation strategy for capturing returns. The allocation and implementation are unique to each situation; family offices, hedge funds and pension funds will target different allocations and factors. The commonality is first understanding the factor exposure of the current portfolio versus the desired exposure. In the figure below you can see the exposures of a sample portfolio to each fundamental factor over time produced using the fundamental factor model within StatPro Revolution. The portfolio’s active (difference between portfolio and benchmark) exposure has a positive exposure tilt toward growth and momentum and a negative exposure to size and dividend yield. If the desired strategy is, for example, equally weighted factor exposure to growth, value, and momentum, then adding value exposure, as well as size and dividend yield exposure in order to bring those factor exposures closer to zero, would be a solution. The portfolio’s changing exposure to the momentum factor is an example illustrating the importance of monitoring and potentially managing factor exposures over time. Factors can be cyclical and a stock’s exposure to each factor can change significantly over time.

Fig 1. Portfolio Exposure to Fundamental Factors – StatPro Alpha

Monitoring factor investments

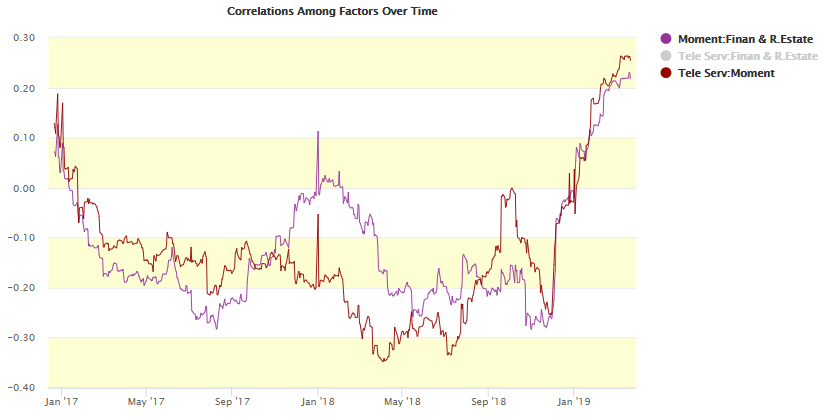

Once an investment strategy which includes factors is implemented, it is also important to monitor correlations between factors. For example, investment in the momentum factor can be a source of alpha and diversification to other portfolio factors. However, other fundamental factors also contain some premia attributed to momentum – known as factor momentum, which can cause moves in correlations and less diversification1. One example, as seen in figure 2 below, is the increase in correlations between momentum and the industry sectors Telecommunication Services and Financials & Real Estate from end 2018 to date.

Fig 2. Correlation between Fundamental and Industry Factors – StatPro Alpha

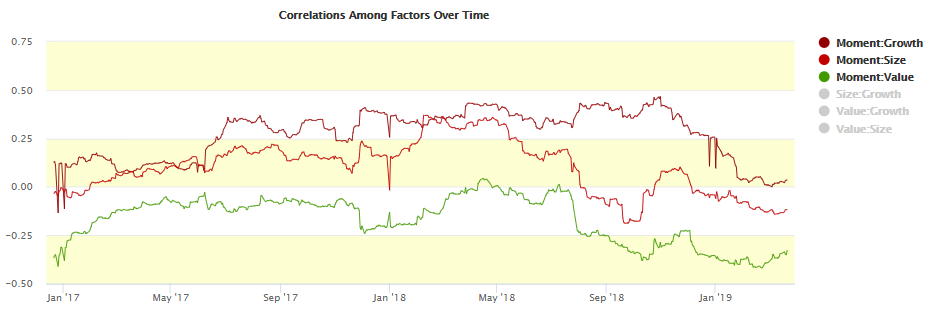

In most cases, achieving exposure to a factor comes bundled with that of other factors. For example, momentum exposure can come paired with exposure to another factor such as value, to which it is negatively correlated. In figure 3 we note global momentum and value historically have a negative correlation but throughout 2017 Momentum: Value starts to move closer to 0.0 with a reversal back to the -0.25 range in Q3 2018. Monitoring the correlations between key factor pairs, as well as factor pairs to areas of exposure concentration across industries is vital to the risk management process made easier by the Alpha factor model tools.

The power to monitor correlations and exposures to active investment in factors gives managers the tools needed to capture alpha. In cases where institutional investors are allocated to multiple funds, monitoring factor correlations can help avoid surprises that can arise when factor correlations shift. Take for example the case of two funds targeting momentum and growth respectively. If correlations between those factors increase and both funds have similar active exposures to those factors, the institutional investor is able to adjust allocation to the more profitable fund or diversify to another fund.

Fig 3. Fundamental Factor Correlations over time – StatPro Alpha

Conclusion

In a market where active managers are being squeezed to produce alpha despite fee compression, having the proper tools to understand portfolio factor exposures is key. It is vitally important to understand where the portfolio is positioned before proceeding with a targeted factors strategy. It’s equally important to monitoring the correlations between portfolio factors with significant active exposure. The Revolution Alpha tool uses industry standard methodology combined with the user friendly risk tools needed to assess active exposures, factor correlations, and factor performance over time.

1. Ehsani, Sina and Linnainmaa, Juhani T., Factor Momentum and the Momentum Factor (February 5, 2019). Available at SSRN: https://ssrn.com/abstract=3014521 or http://dx.doi.org/10.2139/ssrn.3014521

{{cta(’34dd9c3c-d412-43a6-85ea-ebafef0591a6′)}}